Structuring Audit Readiness Workshops for Multinational Organizations

Introduction to Certified Multinational Audit Readiness Training

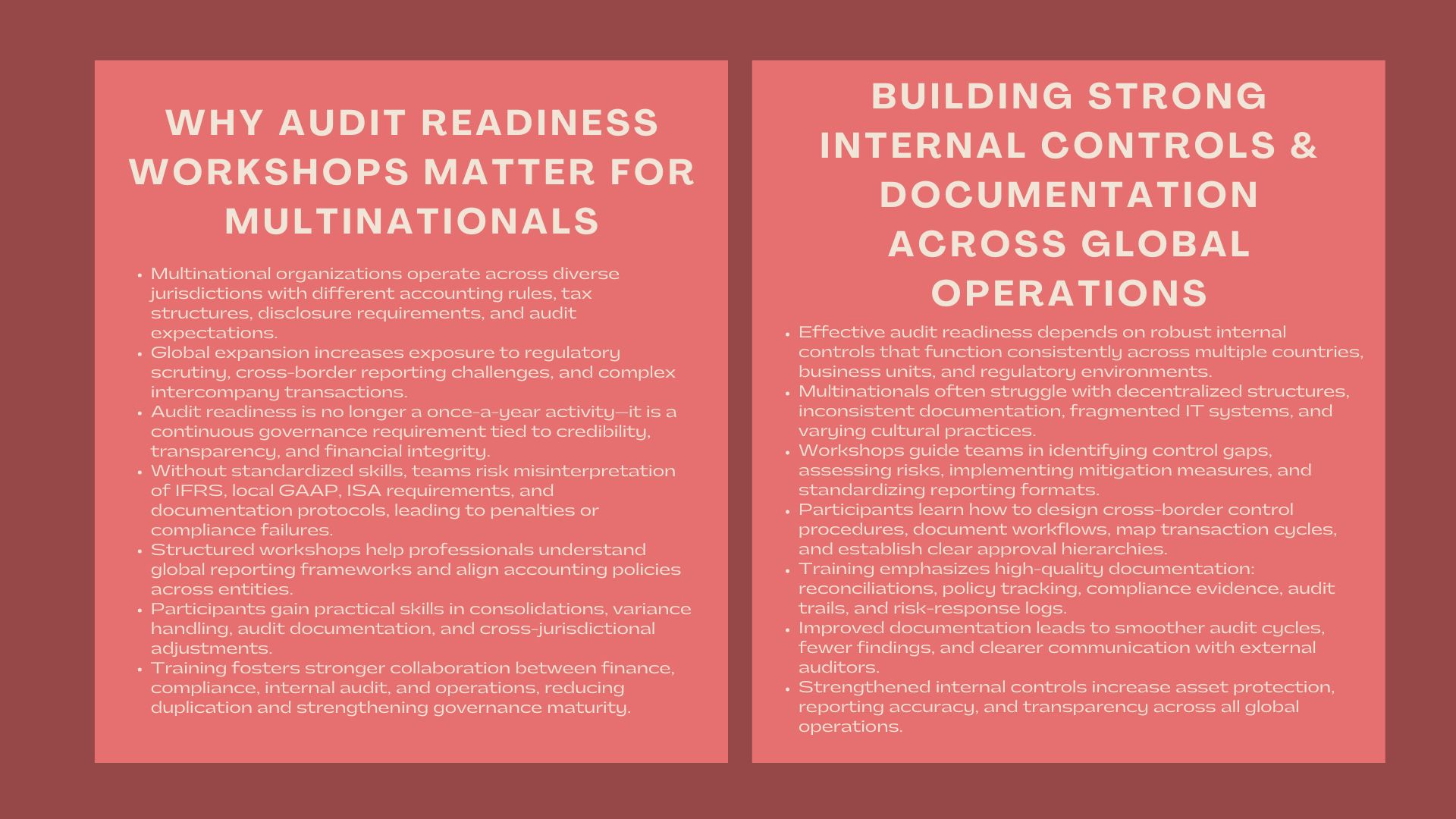

Multinational organizations are in an environment of multifaceted regulatory environments exposed to various jurisdictions, international reporting framework, overseas money transactions as well as increased examination by regulators, stakeholders, and external auditors. Audit readiness is an important element of organisational governance as the global business environments keep on changing. Companies should not just prove that they adhere to international accounting standards but also have an internal control system to enable them to effectively report the information and make appropriate disclosures and be accountable in their operations. Audit role is not considered as a non-routine task anymore; it is a strategic requirement that is continuously in place and portrays corporate credibility, financial integrity and risk discipline.

In order to address these requirements, multinational companies are increasingly putting funds into organized audit preparedness courses that enhance their in-house ability to prepare financial and operational audits. These programs equip the professionals with the frameworks, technical expertise and practical skills they require to manage the requirements of global reporting standards, complicated audit processes, as well as cross-border compliance issues. Both the specialized audit preparedness and compliance preparation training of multinationals and the demanding international audit preparation and reporting standards training equip organizations with the tools to enhance their audit preparedness and the internal control, and alignment to the expectations of various jurisdictions.

The structured workshops further help the organizations to foresee the changes of the regulatory environment, control the complicated process of operations and develop audit documentation which is resistant to any elaborate inspection. They also provide practical abilities to finance and operating departments in order to manage multinational reporting, intercompany dealings as well audit readiness and compliance preparation training for multinationals as regulatory variances. With the worldwide operation being increased, these systematic trainings create a very fundamental basis of maintaining transparency, enhancing governance and aiding the future advancement. Those companies that consistently invest in preparation of audits are at a better stand to avoid the punishment, keep the stakeholders’ confidence, and keep global practice of financial management.

Why Audit Readiness Workshops Are Essential

Strengthening Global Compliance Competencies

The multinational nature of operations has also made audit preparedness even more difficult in terms of the variety in regulations. Organizations are faced with tax structures, accounting policies, disclosure policies and now internal control expectations in different countries across different countries. The differences in the financial reporting frameworks, levels of regulation enforcement, and audit processes compel internal audit teams to have advanced technical competencies, flexibility and that capacity to make judgement given uncertainty.

In the absence of a uniform interpretation of the international audit standards, there are high risks of misinterpretations, lapses of controls, and gaps in the compliance that could trigger financial fines, loss of reputation, or can even prevent the entities from performing operations in some regions. To help resolution of these challenges is organized audit readiness workshops which help professional professionals to have a clear vision of the global standards, such as IFRS, local GAAP regional requirements, international standards of auditing and international documentation protocols.

The participants are also taught the theory behind these structures in addition to having a practical experience in aligning the accounting policies among entities, consolidating accounting reporting processes and addressing the discrepancies brought about by jurisdictional differences. Case studies Save the real-world examples assist in making the attendees aware of pitfalls that could occur in their daily operations, formation of corrective action plan, and a feasible solution to improve global compliance.

In addition to technical congruence, workshops enhance internal teamwork by making sure that financial departments, compliance departments, internal audit teams and business departments have a common sense about what is expected during an audit. Organizations are also more efficient as coordinated processes diminish duplication of effort as well as enhance governance maturity within the global structure of the organization.

Building Robust Internal Controls and Documentation Practices

Audit readiness is based upon internal control systems. Multinational organizations have to set up controls which operate effectively across geographical borders alongside being able to fit-in jurisdiction-specific operation needs. These controls should be so strong that they are able to identify irregularities, provide proper reporting and protect the assets of the organization.

Nonetheless, the issues that are encountered in the implementation of standardized controls by many multinational firms include the existence of decentralized operations, disparity in IT systems, cultural differences, and irregular documentation procedures of organisations. Audit preparedness workshops assist organizations in facing these difficulties since professionals working with organizations are guided on how to develop, strengthen and prove the internal controls systems. The participants get to understand how they can be able to recognize control gaps, assess risk exposures, and put into place effective mitigation mechanisms as well as standardizing reporting among different locations.

Workshops underscore the need to have comprehensive documentation, which provides audit evidence, cross-border communication and transparency. This involves recording of procedures, flow of transactions, reconciliation, approval hierarchy, risk response and compliance processes. Through better documentation and internal control designs, organizations are able to increase the quality of their audit trail and provide the auditors with the right and complete information. This contributes to the process of smooth audit cycles, the improvement of governance and the trust in the financial report in all its operations all over the globe.

Key Components of Effective Audit Readiness Workshop Design

Curriculum Aligned With International Standards

An audit readiness workshop should be designed so that the curriculum that is used should be based on the international reporting frameworks and audit methodologies. The participants should be knowledgeable of the format and standards of IFRS, domestic changes of GAAP and international standards on auditing that regulate the process of external review.

Some of the concepts covered in the curriculum include financial statement representation and presentation, recognition of revenue, measurement of fair value, classification and consolidation procedures. It also looks into the role played by audit procedures in evaluating these accounting applications in risk assessment, substantial testing, internal control assessment and analytical review. The participants get to understand the structure of audit cycles, the impact of risk assessment on audit scope, and the impact of materiality judgments on requirements of documentation.

Members are expected to learn what is expected to be done in audit evidence through the use of sample audit findings, analysis of substantive testing methods, and reviewing of working papers international audit process and reporting standards workshop through a detailed case-based learning. An international audit process and reporting standards workshop is a comprehensive exposing of the roles and the responsibilities of the auditors, the management and internal stakeholders within the audit process. T

hese principles make the members of the profession aware of what the auditors seek and how organizations can be equipped to meet these demands, which makes the curriculum grounded. This knowledge enhances harmony among internal auditors and external auditors, lessens the follow-ups, and boosts the efficiency of the audit.

Enhancing Analytical and Interpretive Capabilities

Audit readiness involves practitioners to analyze financial information, control environments, and dissatisfaction of such that can possibly go wrong in the auditing process. The workshops focus on the training of analytical skills that are necessary to evaluate the balances of accounts, identify the anomalies, reconcile and verify the assumptions made based on reported figures.

Interpretive skills are also very important in the preparation of an audit. As a professional, it needs to learn how auditors perceive risk signs, the way the auditing sampling works, and this component determines how auditing judgments determine the results of reviews. The workshops equip the participants with skills on how to expect areas of concern, prepare straightforward documentation, and react to the audit questions fully.

With the creation of analytical and interpretive capabilities, organizations decrease the level of uncertainties linked to the audit cycles and achieve a higher degree of trust in the audit findings. Such competencies promote transparency, help to comply with the regulations and contribute to better governance practices throughout the multinational environment.

Implementing Audit Readiness Across Global Operations

Tailoring Workshops to Multijurisdictional Requirements

The audit ready training that multinational organizations need is that which is based on the realities of global expansion operation. The tax systems are found to be varied, reporting dates varied, accounting practices varied and documentation requirements varied depending on the local regulations. In the absence of custom training, international teams might have problems coping with the workflow with the audit demands, which will cause inefficiencies, mistakes, and inconsistency.

Through effective audit preparation workshops, there are considerations of the region that are included in the curriculum. The participants learn about the ways in which local GAAP plays with IFRS, and the ways in which reporting has to be affected by jurisdictional tax regulations and the ways in which cross-border transactions have to be backed up with special documentation. The complicated aspects of transfer pricing arrangements, intercompany transactions, foreign currency translations, and international compliance requirements are exposed during training programs.

With such sensibilities, the workshop will ensure that the participants are well-prepared to handle audit requirements in various jurisdictions with ease and accuracy. Personalized implementation also incorporates that the workshop contents will resonate with the practical obligations their participants have in the real world so that they can subsequently put into practice the findings they obtain in their area of operation. Such alignment enhances monitoring of the organization, minimizes reporting errors, and improves adherence to all the multinational organisations.

Promoting Cross-Functional Collaboration

The audit readiness is an inter-functional aspect that involves inter-functional cooperation in the audit among the finance unit, accounting, compliance, tax, legal, operations and internal audit department. Multinational organizations are known to have siloed processes that are not conducive to audit preparation and thus end up producing a disjointed documentation and no uniformity of communication with external auditors. The organized workshops indicate the need to utilize the silos that exist in a more effective manner of cross-functional cooperation.

The participants get to know how to arrange the auditing responses, exchange information among the departments and harmonize the documentation practices. Workshops provide the professionals with training on creating the integrated audit calendars, aligning timelines inside the organization, and facilitating the unified communication with the audit teams.

By improving collaboration, organizations will put an organized front when audits take place as close as possible to the auditors as they will be assured of finding similar and accurate information throughout their operations around the world. This cross-functional internationalization helps in enhancing audits preparedness, enhances control, and makes multinational organizations have a coherent structure in their audit approach. Through enhancing teamwork, the workshop will ensure a continuation of compliance, minimize repetition of efforts, and efficiency.

Strengthening Professional Judgment and Strategic Insight

Developing Forward-Looking Audit Capabilities

The recent changes in markets, the development of regulatory standards and analysis, and the prevalence of digital systems are becoming new audit problems of multinational organizations. The professionals should learn to improve their ability to detect the audit risks, respond to the emerging compliance obligation, and the impact of technology change. The workshops invite the participants to have a futuristic approach that looks at the future impacts of global trends on audit expectations.

The participants will explore how the regulatory reforms, environmental reporting environment, data governing structures, technological changes, and geopolitical developments affect the process of audit. Through strategic thinking, practitioners would be in a better position to equip their organizations with future audit environments and also inform leadership on advisable decisions to make.

Enhancing Audit Communication and Reporting Skills

Effective communication is the critical success factor in multinational settings where auditing is to be performed successfully. The specialists need to be in a position to provide complex financial information in a conveyed manner, clarify the internal control structures as well as answer auditor questions in a clear manner. The workshops are aimed at empowering the communication side of the participants and the topic of the value of open communication, well-organized reporting, and minimal documentation.

Interviewees receive education on how to postulate audit findings, summarise the major risks and explain the justification of accounting decisions. Effective communication would facilitate effective audit cycles, minimize the potential of misunderstanding, as well as facilitate the establishment of trust between the external auditors and the organizations. It guarantees the flow of audit activities and provision of valid and valuable information to the stakeholders.

Conclusion

The importance of audit readiness workshops to multinational companies is to help them build better reporting frameworks, improve the accuracy of their reporting as well as maintain compliance in various jurisdictions. The structured training allows organizations to have internal capabilities, which drive effective audit preparation, robust environments of internal control, and enhanced global audit readiness training for multinational finance teams operation working collaboration.

Having a detailed audit preparedness and compliance training in relation to the multinationals will help the professionals to gain the skills to read the standards, control and prepare the correct documents. Similarly, an international audit process workshop and reporting standards workshop is more integrated, which improves cross functionality and aligns it with the international audit expectation. By investing in such training programs over a long period of time, the multinational organizations develop prolonged resilience, greater results in their audits, and develop the quality to act in a clear manner in a complicated global environment.