Regulatory Compliance and Basel Guidelines Training for Banks

Introduction: Advanced Regulatory Compliance Certification

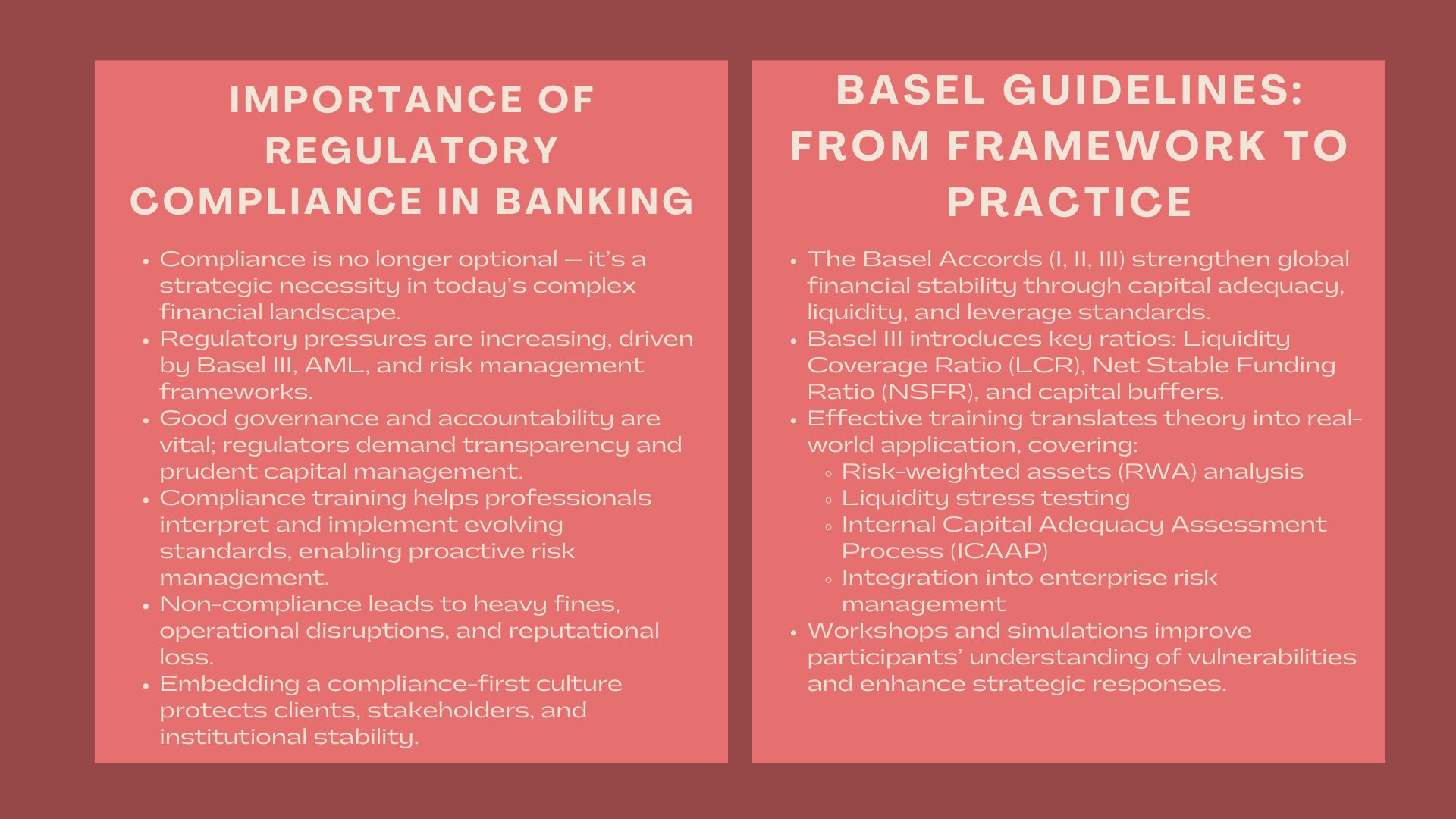

In this constantly-changing financial environment, it is no longer a choice to ensure that the financial organization is in compliance with the international banking regulations but a strategic requirement. The financial institutions are subjected to a growing regulatory scrutiny, fuelled by their guidelines like the Basel III, the anti-money laundering (AML) regulations, and risk management regulations. The banks have to invest in lifelong learning of their workforce in order to remain competitive and compliant. An expert training course on compliance with regulations and Basel guidelines equips professionals with the necessary knowledge and interpretation of these standards in order to use them successfully.

The Increased Significance of Regulatory Compliance in Banking.

Enhancing Governance and Accountability.

Banks are under increasing pressure to be transparent, prudent in the management of capital and to have good governance structures. Accountability on all levels of the organization is being prioritized by regulators all over the world, both on the board of directors and on day to day operations. Compliance training enables professionals to be informed of the most recent regulatory requirements and how they can take the initiative to uncover and eliminate risks.

A basel iii and regulatory compliance training for banking professionals enables participants to grasp capital adequacy requirements, liquidity ratios, and leverage limits under Basel norms. The knowledge of these elements will help guarantee that banks are able to maintain their operations despite being in stressful living conditions and yet retain the confidence of the market.

Securing Reputation and Stability of the Institutions.

Non-compliance has cost numerous institutions enormous amounts and loss of reputation. Through the breach of sanctions to the lack of adequate risk assessment systems, even the smallest lapses may lead to serious outcomes. Thus, well-developed training programs become important in instilling a culture of compliance first in all the tiers of a bank.

By regulating the employees to the international best practices and ethical standards, institutions are able to minimize the exposure of them to both operational and financial risks, which protect the clients and stakeholders.

The Exposure to Basel Guidelines and their Practical Applicability.

Evolution of Basel Accords

The Basel Accords Basel I, II and III were introduced by the Basel Committee on Banking Supervision in order to enhance the stability of the banking system at the international level. These frames provide the basis of risk-weighted capital requirements and standards of liquidity management.

The latest and most inclusive framework is that of Basel III, which is aimed at the coverage of risk, the quality of capital, and the need to achieve a greater financial stability. It also presents the Liquidity Coverage Ratio (LCR), Net Stable Funding Ratio (NSFR) and countercyclical capital buffers.

Translating Basel III Principles to Practice.

It is one thing to learn theory and another to put it to practical use in the real-life banking operations. A feasible training program assists the professionals on how to turn the regulatory requirements into the effective internal policies and procedures. The participants get trained on how to:

- Risk-weighted assets (RWA) to measure capital adequacy.

- Introduce liquidity stress testing and monitoring.

- Grow internal capital adequacy assessment procedures (ICAAP).

- Embark on Basel principles in enterprise risk management structures.

This pragmatic approach makes compliance officers and risk managers capable of decoding the regulatory standards and implementing them to the specific setting in their institution.

Basel Training and the Core Element of Compliance.

The Basics of Risk Management.

Risk identification and measurement is one of the main parts of Basel-focused training. The participants discuss the three pillars of Basel III, which include the minimum capital requirements, supervisory review, and market discipline. They get to know how to assess credit, market and operational risks and also understand how to use the internal models to measure them.

Workshops are sometimes based on practical simulations, at which the balance sheet of a bank is being scrutinized by professionals, who impose stress factors, and assess the capital adequacy. This practice will help them improve their capacity to foresee its possible vulnerability and plan effective mitigation measures.

Regulatory Reporting and Disclosure Standards.

Regulator trust is important to be able to report accurately and in time. Regulatory disclosure training modules make participants learn data aggregation, reporting templates, and supervisory technology (SupTech).

The participants will be taken through usual hurdles, including inaccurate data, cross-border variations in regulations, and emerging disclosure regulations. Such sessions equip them to have reporting mechanisms that are in line with the local and international standards.

Compliance should be a part of the organizational culture.

Regulatory compliance is not a departmental issue but it has to be the DNA in the organization. The significance of ethical conduct, open communication, and risk identification are also highlighted in the workshops.

Training both managers and frontline employees will make the institutions have a compliance-oriented mind that transcends box-ticking. This would be a sustainable way of meeting the changing requirements of the regulations

Advantages of Basel and Compliance Training for Professionals

Elevating Technical and Analytical Expertise

A bank compliance and risk management certification workshops provides participants with an advanced understanding of how regulatory requirements intersect with financial performance. They get to know how to evaluate liquidity positions, capital buffers and credit exposures accurately.

Such analytical abilities help them make decisions which are more risk-adjusted, and hence the bank will continue being profitable without interfering with integrity of compliance.

Development of Career Opportunities.

As the demand of compliance and risk management experts grows, certification in the field contributes greatly to career opportunities. Basel and regulated professionals are in high demand in commercial banks, investment institutions and regulators.

Attaining accredited programs will show that a professional is dedicated towards industry standards and is up to date on all the regulations of the world-qualities that employers appreciate.

Financial Institutions Benefits.

Enhancements in Risk Resilience.

Basel and compliance framework institutions that focus on staff training build a better internal control framework and effective monitoring structure. This, in its turn, makes it less likely that there will be a regulatory violation or financial losses.

Moreover, highly trained teams may react quicker on any new regulatory changes and reduce the impact of any disruption on the operations, as well as increase the overall resilience.

Developing a Compliance-Based Culture.

The development of compliance-based environment is done through training programs. The better the employees know the reasoning behind the regulations, the more they will be inclined to observe the best practices over time. This change of attitude enables banks to be upright, transparent and sustainable in their growth.

Enhancing Stakeholder Faith.

Strong governance and risk management are preferred by investors, clients and regulators in institutions. Investing in employee education, the banks demonstrate their intentions to long-term financial stability, and this will markly increase the confidence of stakeholders and reputation in the market.

Selecting an Appropriate Compliance and Basel Training Program.

The professionals and institutions should keep in mind when assessing a regulatory compliance workshop:

- Background of the Instructor: Practical background (regulatory experience) The instructor should be an individual with a real-world perspective on it.

- Relevance to the Curriculum: The courses must comprise the most recent changes to Basel III reforms, ESG-related regulatory expectations, and digital compliance models

- Interactive Learning: Case studies, group projects and scenario analysis are included in the programs resulting in effective understanding and application.

- Accreditation: Registered qualifications enhances both professional qualifications and is an indicator of competence to both employers and regulators.

Choosing a well-crafted course and having knowledge that is comprehensive and practical will make sure the participants acquire a well-developed knowledge.

Conclusion

Financial institutions should also make sure that their staffs are equipped with knowledge to read and implement new banking standards, which are becoming more complex through regulatory changes. As well as increasing technical knowledge, Basel and compliance training also instill a culture of risk management proactivity.

Structured education of professionals will enable the banks to overcome the challenges posed by the regulatory environment without fear and at the same time ensure that the banks remain financially stable and trusted by the populace.