Renewable Energy Finance and Investment in Phnom Penh – Riverstone Training

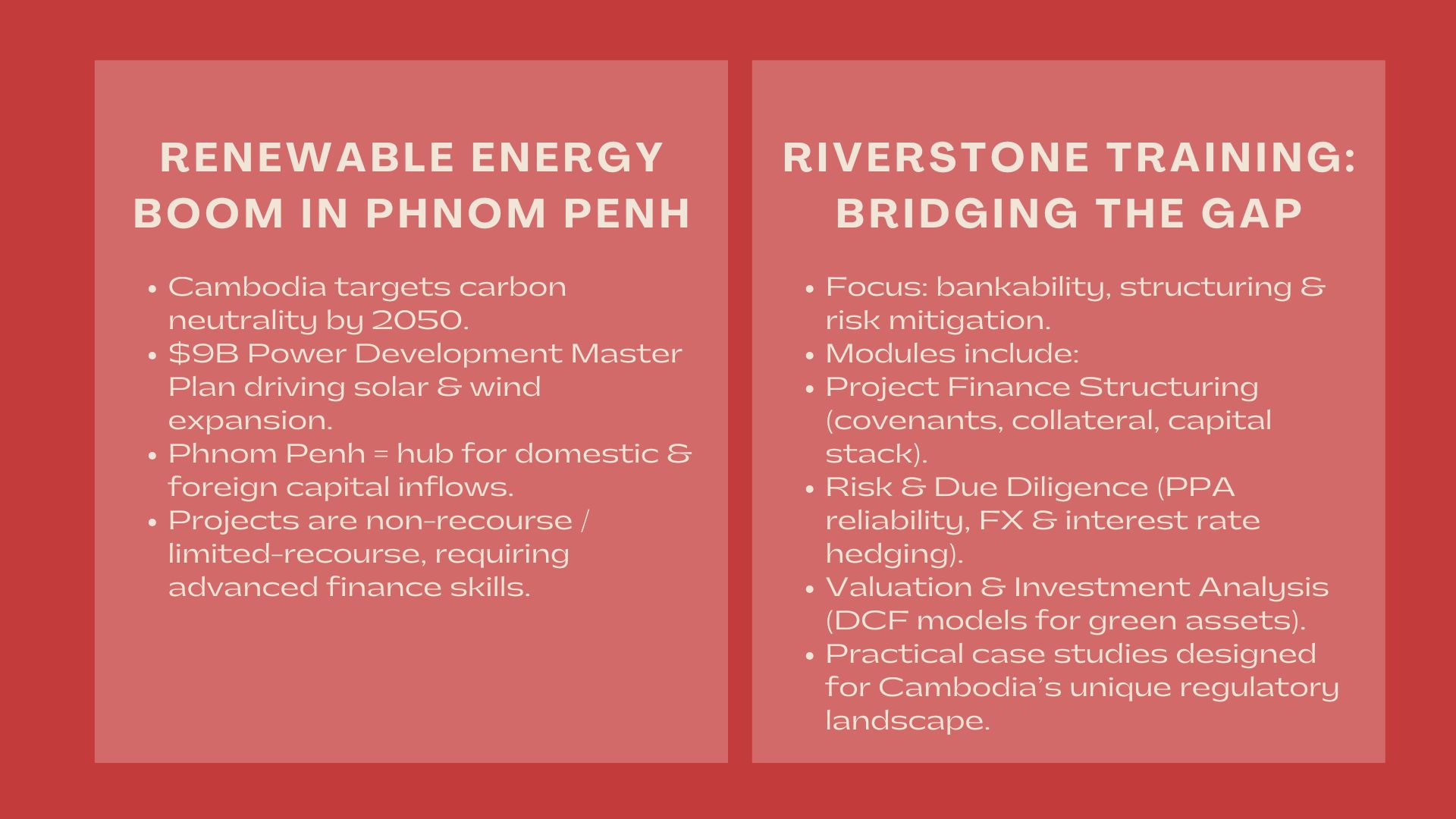

The fast developing capital of Cambodia, Phnom Penh, is seeing an unprecedented financial transformation. The city is emerging as the hub of major clean energy investments, due to both ambitious national ambitions to be carbon neutral by 2050 and a game-changing national national Power Development Master Plan of 9 billion dollars. As the government passes billions of new energy projects, mostly solar and wind, the market is opening up more rapidly than ever. It is this seismic shift towards fossil fuels that has given rise to a new breed of financial professional; professionals that are comfortable in structuring, valuing, and managing the complex financial risks of green infrastructure in a frontier market.

To an ambitious professional, be it an analyst at a commercial bank, a manager at a development firm or a strategist at a major local conglomerate, learning the financial language of sustainable power becomes the most important step in accelerating their careers. Riverstone Training provides specialisations in Phnom Penh, which aims to fill the knowledge gap between orthodox finance and the special needs of the new green energy industry. In this paper, we will describe how a graduate of our programs will be at the vanguard of the energy investment revolution in Cambodia, and explain the challenges and high-value skills you will acquire in this specialization, as well as the specific job positions this specialization will open to you.

Frontier Finance: The Unique Problems of Green Market in Cambodia.

Phnom Penh is the key spot where domestic and foreign capital is flowing to the green projects in Cambodia. These are frequently non-recourse or limited-recourse projects, which entail complicated transactions which would require a financial toolkit much more advanced than conventional corporate finance.

Organizing Deals in an Emerging Regulatory Landscape.

Investment in renewable energy in Cambodia is a market where there is a high regulatory development and institutional capacity change. Financiers of the project have to contend with grid constraints, Power Purchase Agreements (PPAs) complexities with the national utility, and insufficient local data to make financial projections. Moreover, foreign financing usually involves adherence to strict Environmental, Social and Governance (ESG) requirements, which are being quickly fulfilled by local banks and developers, as witnessed by the attention of such institutions as the IFC and ADB.

The present context, where multilateral organizations and business green financing transactions are heavily financed, badly needs to have experts capable of developing advanced financial models capable of effectively quantifying these structural and regulatory risks. Therefore, companies are fiercely targeting individuals that can prove this practical ability. Our Renewable energy finance courses Phnom Penh provide precisely this focused, contextual expertise, transforming general finance knowledge into sector-specific mastery that addresses Cambodia’s unique investment landscape.

Cross-Sector Demand: Who is Hiring for Green Skills

The demand on the very well-trained professionals of green finance is general and cuts across all departments and all sectors of energy development and infrastructure. Credit Analysts and Project Finance Associates are required by the local commercial banks and other regional development banks to underwrite the tsunami of green loan applications and administer the issuance of green bonds, in line with the Cambodian Sustainable Finance Taxonomy initiative. Finance Managers and M&A Specialists are needed by Energy and Project Developers, including those working on the new wind and solar projects, to design bankable deals and raise capital in an efficient manner.

Further, through Government Bodies and International Development Organizations, there is a desperate need to find experts to assist in the implementation of green policies and capacity building programs. Lastly, there is the growth of Consulting and Advisory Firms that are expanding their staff to provide foreign investors with regulatory compliance and risk mitigation. The quickest method of becoming an invaluable and well-paying part of such fast-moving teams is to master green project finance.

Riverstone Focus: Bridging the Skill Gap to Project Bankability.

The approach taken by Riverstone Training is highly pragmatic, as it is based on highly sophisticated financial modeling and risk-assessment systems that apply directly to massive infrastructure and energy transactions in Cambodia. Our goal is to provide actionable high-value skills that can be used immediately by the participants.

Principles Training: Bankability to Risk Mitigation.

Our programs go beyond the standard finance theory and include technical nuances of green energy deals so that the entire range of skills required to make the project bankable is obtained. The training commences with Project Finance Structuring where candidates learn how to navigate the complexity of the non-recourse finance structure, such as covenants, collateral structures and capitals stack management unique to Cambodian solar and wind resources. This is very critical in the launch of projects and competitive financing.

Next, in our Sustainable energy investment workshops Phnom Penh, we focus heavily on Risk and Due Diligence, which involves quantifying and mitigating critical factors like market risks (e.g., PPA reliability, curtailment risk) and financial risks (e.g., interest rate and exchange rate hedging). This critical risk assessment capability is highly valued by lenders who require robust assurance before committing capital. Moreover, there is a fundamental course in Valuation and Investment Analysis of green assets, where participants are instructed in specialized DCF models to appropriately consider the life of the asset, regulatory subsidies and rates of technology degradation, which gives them the confidence to give advice on investment approach.

Career Acceleration: High-Value Job Titles

The specialized skills acquired through our rigorous Green energy project finance training Phnom Penh directly translate into executive-track roles with significantly higher earning potential and strategic influence. A Financial Analyst may become a Project Finance Manager where he or she will head the debt and equity capitalization of the major green projects. This financial savvy made an Engineer or Technical Developer a Business Development Manager, who can orchestrate new deals and be a good point of contact with local and foreign investors.

A Credit Analyst qualifies towards an Investment Director role in a Private Equity or Infrastructure Fund and evaluates the viability of projects and handles a portfolio of convoluted green assets. These positions are highly remunerated and professionals are at the heart of strategic growth decisions in Cambodia, which determines the future of energy in the country.

The Job Market Benefit: Employers in Search of Green Finance Professionals.

The job market of financial professionals in Phnom Penh is amazingly high with specialisation in energy, which points to an evident supply-demand gap. There is intense competition among companies and funds to access the few talented who can be able to put talent together in terms of structures of bankable green deals.

Employers Hiring Aggressively: Local and International Banks such as ACLEDA and local banks require Credit Analysts and Project Finance Associates that will underwrite the millions of renewable energy loans applications. Local and regional power developers need expert Finance Managers and M&A Specialists to make sure their portfolios are constantly being optimized and to bring in additional capital. In addition, Global and regional Private Equity and Infrastructure Funds are seeking out highly qualified Investment Analysts to source, conduct due diligence on and administer their clean energy portfolio.

Lastly, Consulting & Advisory Firms need the service of financial advisors to help their clients navigate the intricate PPA negotiations and regulatory requirements in this fast growing market. The art of renewable energy financing is not about following the trend; it is about being at the forefront of the capital investment trend that is setting the new chapter in the Cambodian economy.

Conclusion: Renewable Energy Finance and Investment in Phnom Penh

The opportunity of developing specialized skills in the fast developing green energy industry in Cambodia is available today. Phnom Penh is the financial hub of this national energy shift, which provides ambitious individuals with unsurpassed career development opportunities. The specialist valuation and project finance programs offered at Riverstone Training offer the exact high value skills that help in navigating this complex and high stakes market. Through renewable energy finance courses you will no longer be just watching what is going on in the market but will be financing and making the vital deals that will make Cambodia prosper and sustainable.

In Manila, the growing focus on clean energy has created demand for specialists who understand financing structures—something explored in detail in this Renewable Energy Finance and Investment in Manila.