Case Study: E-Learning Services on E-Commerce (Marketplace) Financial Modeling Enhancing Digital Business and Investment Decision-Making

Background on Case Study E-Commerce Financial Modeling

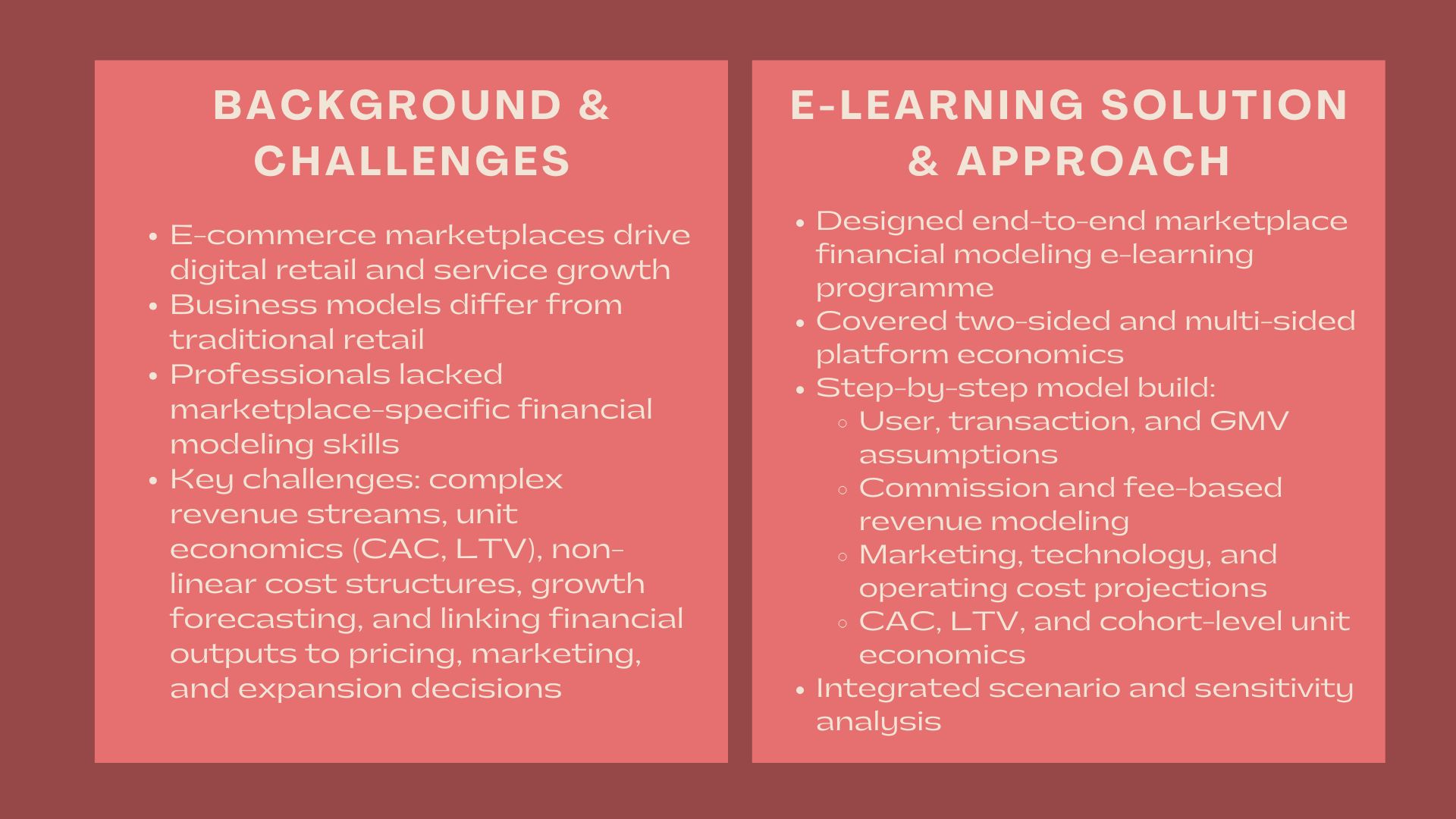

E-commerce marketplaces have emerged to be a strong line of operation in retail, service, and digital operations. Having evolved through B2C and C2C marketplaces, to vertical and niche businesses, these ones are substantially dependent on scalable technology, network effects, and data-driven decisions. With the increased competition, stakeholders are relying more on sound financial models to evaluate growth plans, unit economics, platform financials and long term valuation.

Financial modeling of the businesses of e-commerce market places are however not similar to the traditional retail or service models. The complexity of the analytical task is revenue structures, cost dynamics, customer acquisition economics, and platform scalability to which many professionals are not trained.

In order to overcome this capability gap, our firm was contracted to provide design and delivery of a holistic e-learning programme on E-Commerce (Marketplace) Financial Modelling that would see optimistic learners develop their own platform specific modeling skills through scalable and flexible digital learning solutions.

Issues and Challenges

There were various challenges that the participants had to contend with and this showed why specialised marketplace financial modelling training is necessary.

Learning the revenue models of the market place was one of the challenges. In contrast to the conventional retailers, marketplaces earn commissions, transactions, subscriptions, advertisements, and value-added services, and thus cannot be modeled in the same way.

The other problem was the analysis of unit economics. Students had difficulties modelling customer acquisition cost (CAC), customer lifetime value (LTV), cohort behaviour and contribution margins.

The complexity of the cost structure was also problematic. The platform development expenses, payment processing expenses, marketing expenses, logistics coordination expenses and customer support overheads in marketplace businesses do not increase in line with revenue.

Another important problem was growth forecasting. The learners struggled to model the growth of users, transaction volumes, take rates and network effects in a systematic and realistic way.

Lastly, a significant proportion of the professionals were not confident in translating the financial outputs and connecting the marketplace measurements to the strategic choices of pricing, marketing spending optimization, as well as market and category expansion.

Objectives

The main aim of the engagement was to design an e-learning programme on E-Commerce (Marketplace) Financial Modeling that would be able to establish a robust analytical and decision-making capacity.

Key objectives included:

- Training in end-to-end marketplace financial modeling methods.

- Elaborating platform specific revenue and cost structure.

- Enhancing the knowledge of unit economics and scalability.

- Improving the ability of scenario and sensitivity analysis.

- Offering self-directed and flexible learning to the learner profiles.

The programme should have been practical, applicable in the real world market place business and accessible to finance professionals and non-finance professionals.

How We Helped

A systematic instructional design strategy was used to come up with an elaborate e-learning programme on financial modelling of an e-commerce market place.

The interaction started with curriculum design. Our learning experience was designed as a progressive experience beginning with marketplace business basics up to an advanced level of financial modeling and strategic analysis.

The first modules exposed the learner to the business models of the marketplace such as two-side and multi-sides platforms, revenue channels, and key performance indicators such as GMV, take rate, order frequency, and active user counts.

The essence of the programme involved the creation of a marketplace financial model step by step. The learners were taken through:

- Organizing assumptions of users, transaction, and growth.

- Predicting gross merchandise value (GMV) and platform revenue.

- Modeling commission on income and fee income.

- Projection of marketing, technology and operating costs.

- Integrating customer retention and acquisition dynamics.

This was followed by the introduction of unit economics and profitability analysis. Throughout the modules, I learned how to compute CAC, LTV, and contribution margins, and break-even points on cohort and platform levels.

The programme had scenario and sensitivity analysis. Students studied the relationship between profitability and valuation with alterations in take rates, marketing efficiency, user growth, and cost structure.

There was practical modeling practice as part of e-learning experience. Students were directed through simulation tours on realistic marketplace situations and were asked to make changes in assumptions so as to see the financial results.

Interpretation and communication was also stressed in the programme. Students were trained on how to convert financial outputs into straightforward meanings to founders, investors, management teams and board level deliberations.

Every content was provided via a user-friendly e-learning system and assistant instructions were supported in the form of instructional video clips, downloadable templates, and reference materials to be applied instantly.

Learning Design and Delivery

The e-learning programme would suit the financial, strategic, operations, technology, and entrepreneurial students.

The content was presented in a modular form of lesson where conceptual explanations were made, visual frameworks, and modeling exercises. Learning was supported by knowledge checks and applied tasks but kept the learner engaged.

The self-paced structure enabled the learners to fit the learning with the operations tasks which required a high speed; thus, the programme would be appropriate in one to one individual professionals, startups and even corporate digital teams.

The digital delivery model made it uniform, scalable and available in different regions and time zones.

Value Delivered

This case study represents a method to support the idea that E-Learning Services on E-Commerce (Marketplace) Financial Modeling will become an effective tool in managing financial literacy, strategic understanding, and decision-making skills in online platform business.

The programme, consisting of formal education and market place-specific modeling activities helped the learners to gain a deeper insight into platform economics, assess their growth strategies, and effectively disseminate financial risks.

The modular e-learning system offers a long-term capability building solution with the continuously changing business models of e-commerce, technologies and competitive forces.