Case Study: E-Learning Services on Financial Modeling in Excel Building Practical, Job-Ready Financial Skills at Scale

Background on Case Study Financial Modeling in Excel

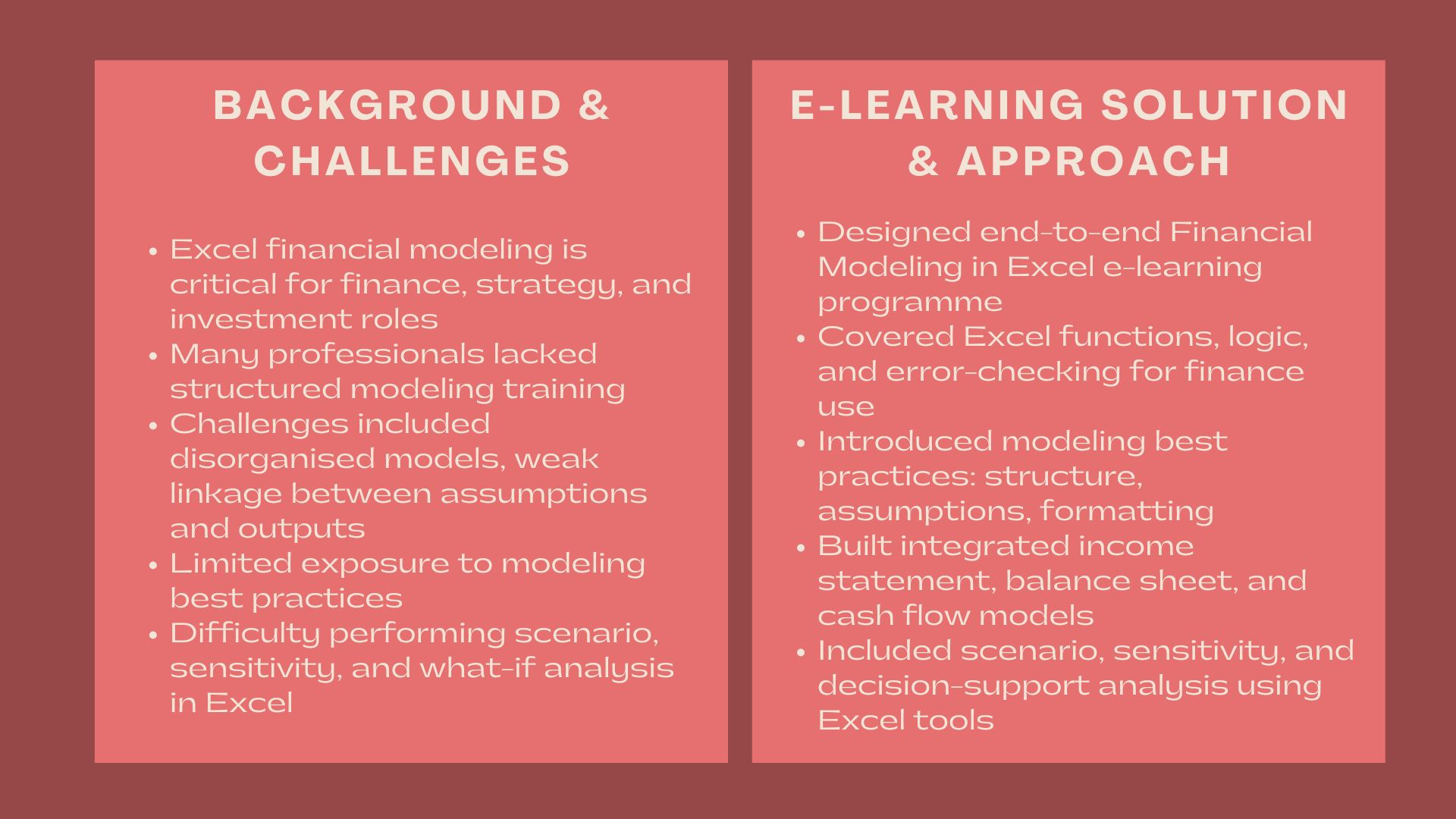

Excel financial modeling is an important skill in finance, investment, corporate strategy, consulting and entrepreneurial activities. Organisations are demanding a growing professionalism in developing strong financial models that aid in valuation, forecasting, budgeting, investment decisions as well as strategic planning.

Nevertheless, not all professionals have a systematized training on the use of Excel-based financial modeling. They might be conversant with simple spreadsheet operations, but they usually find it very difficult to transfer business assumptions into integrated financial statements, scenario analysis, or subject to accurate, flexible, and decision-ready models.

To resolve this skills gap, our firm was contacted to design and implement a rigorous e-learning course on Financial Modeling in Excel, which would allow the learners to acquire practical skills in modeling using a well-structured and self-paced online learning course.

Issues and Challenges

There are a number of challenges that learners had before the engagement that curtailed their efficiency in financial analysis and decision support.

Disjointed knowledge was one of the problems. Most of the learners had mastered the concepts of Excel and finance in isolation without the knowledge on how to combine assumptions, calculations and outputs into a coherent financial model.

There was a major challenge in model structure and design. The spreadsheets were usually disorganised, hard to audit and subject to errors and as such, they could not be trusted to make good decisions.

Exposure to best practices was another problem. The learners did not understand the common financial modeling rules of separating inputs, computations and outputs, using consistent formatting and constructing scalable models.

Weaknesses were also on scenario and sensitivity analysis. Students found it difficult to be able to test assumptions, assess risks, and compare possible business results with the help of Excel.

Lastly, flexible learning was required. Conventional classroom training could not be scaled and a lot of learners needed to be able to study at their own pace and still keep on with their work commitments.

Objectives

The engagement strategic goal was to design an e-learning solution on Financing Modeling in Excel that would build work ready modeling skills.

Key objectives included:

- Establishing solid bases in Excel in the field of financial modeling.

- Educating model design best practice models.

- Integrated Financial Statement Models: Development.

- Facilitating scenario, sensitivity and what-if analysis.

- Offering practical education using practical examples.

The programme had to be realistic, advanced and appropriate to suit learners with different backgrounds in prior finance and Excel background.

How We Helped

Our e-learning Financial Modeling in Excel programme was a comprehensive course that integrated financial theory, excel methods, and practice.

The programme has started with fundamental Excel skills required in model making which includes logical functions, financial functions, lookup formulas and error checking methods. The learners received instructions on how to be efficient and accurate when using Excel in a financial situation.

Then we presented the principles and the best practices of financial modeling. The model structure, layout design, assumption management and formatting standards were included in modules to provide clarity, transparency and auditability.

It was then accompanied by the development of a comprehensive financial model by learners. They were trained step by step on how to convert business drivers to revenue forecasts, cost structure, capital expenditure and working capital assumptions.

Through the programme, the flow of these assumptions into complete integrated income statements, balance sheets and cash flow statements was shown. It was stressed that the logic of every single link should be known, and not that it should be acted like a formula.

High level modules in decision support and scenario analysis. Students learned how to create a flexible model that will enable users to experiment with various assumptions, compare various cases of base, upside and downside and evaluate financial consequences on the basis of Excel tools like data tables and scenario analysis.

In order to strengthen the learning process, the programme contained guided modeling activities, practical illustrations, and downloadable Excel templates. The learners were also challenged to construct models as they learned which helped them put the ideas into practice.

The entire learning was provided through an easier e-learning platform and learners were able to work at their pace and still have a structured learning experience.

Learning Design and Delivery

The e-learning programme helped in supporting the skills transfer and experience.

The lessons were structured into brief, intensive modules that included instructional videos and step-by-step demonstrations and exercises. The explanations of the concepts were understandable, and there were visual aids and organized work processes to accommodate the learners with different technical backgrounds.

The programme had knowledge checks and modeling checkpoints to strengthen the knowledge and minimize errors.

The self-paced tutorial enabled the learners to re-visit the complicated areas, practice on modeling methods and gain confidence in the long run. The digital delivery has also promoted success in the training in terms of uniformity of training across teams and geographies.

Value Delivered

This case study illustrates how E-Learning Services on Financial Modeling in Excel have been effective in acquiring industry-related skills in practice.

Students were able to learn to create clear, transparent financial models which help in forecasting, valuation, budgeting, and analysing investments. Better experience with Excel and financial logic empowered learners to provide more value to the business planning and decision making processes.

At organisational level, the e-learning solution offered a scalable and cost-effective method of standardisation of financial modelling capability, decrease spreadsheet risk, and enhance financial analysis quality.

The programme provided by blending financial knowledge with Excel best practices brought in long term benefits with better analysis and more informed business choices.