Case Study: E-Learning Services on Road (Toll) Project Financial Modeling Building Infrastructure Finance and Investment Capability

Background on Case Study Road Toll Project Financial Modeling

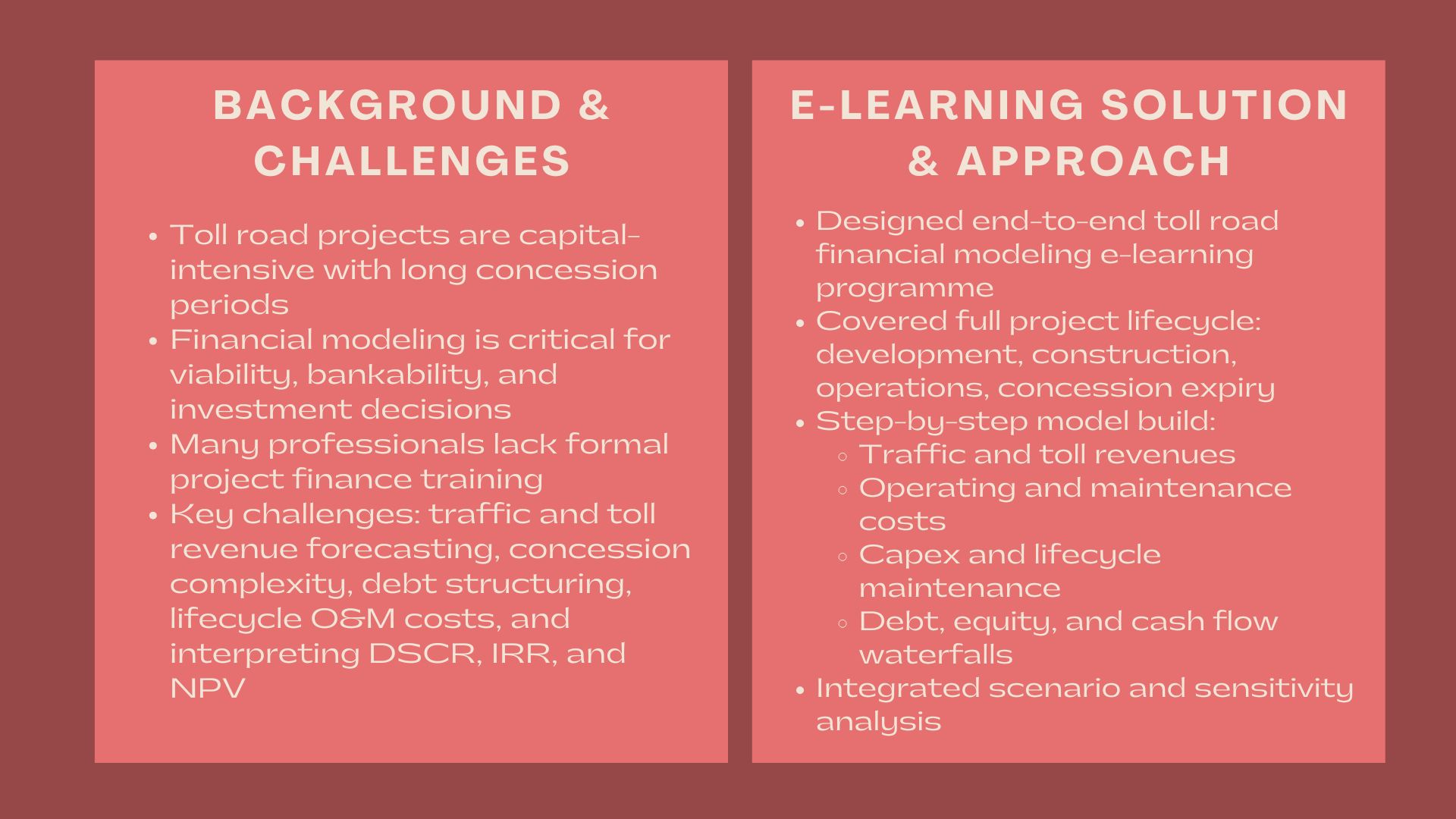

The roads and toll infrastructure projects are important in the economic development as it aids mobility, trade and regional connectivity. Toll road projects are assessed using detailed financial models to determine their viability, bankability and sustainability.

Such projects are usually characterized by huge capital expenditure, lengthy concessions, intricate traffic projections and numerous parties. Although most experts working in infrastructure development have either engineering or operational backgrounds, some do not have the formal training of road (toll) project financial modeling.

As a solution to this capability gap, our company was contracted to design and provide an all-encompassing e-learning programme on Road (Toll) Project Financial Modeling that would allow the participants to acquire practical and project-finance-oriented modeling skills via a digital platform that is flexible.

Issues and Challenges

The participants had a number of issues, which highlighted a necessity in specialised training of toll road financial modeling.

The major challenge was the prediction of traffic and toll revenues. Students found it difficult to convert traffic analysis, expansion projections as well as toll increase plans into credible revenue projections.

The other issue was the research of concession structures. In many cases, Toll road projects are served on the basis of long-term concessions between the public and the private parties having certain rights, obligations, and risk-sharing agreements.

Complexity in debt structuring and financing were other challenges. Other financing structures that were not recourse to or limited recourse debt had to be modeled closely with debt service, covenants and cash flow waterfalls.

Forecasting of operating and maintenance cost also proved a problem especially when it comes to lifecycle maintenance modeling, major periodic repairs and cost escalation in extended concession periods.

Lastly, most professionals were not confident when interpreting the important project finance measures like the DSCR, LLCR, IRR and the NPV as applied to the toll road investments.

Objectives

The main aim of the engagement was to create an e-learning programme on Road (Toll) Project Financial Modeling that has the potential of creating infrastructure finance ability in a systematic and expandable fashion.

Key objectives included:

- End-to-end toll road project financial modeling.

- Describing revenue and cost structures based on concession.

- Enhancing knowledge in project finance and debt structuring.

- Improving the situational and sensitivity analysis.

- Offering self-paced learning that is flexible and not location-specific.

The programme should have provided an equilibrium between the technical and clarity and practical use.

How We Helped

Our choice of instructional design was structured, to make a full e-learning programme about the financial modeling of a road (toll) project.

The involvement commenced with curriculum design. Our learning process was in the form of a step-by-step process that involved the entire lifecycle of a toll road project including development, construction, operations and concession expiry.

Preliminary modules were used to familiarize learners with the basics of the toll road projects, which included the concession structure, stakeholder roles, and the main risk factors like the traffic demand, regulatory change and cost overruns.

The main idea of the programme was the development of a toll road financial model. The learners were directed through:

- Organising model schedules and building stages.

- Prediction of traffic and toll revenues.

- Estimating the cost of operating and maintenance.

- The factor of capital expenditure and lifecycle maintenance.

- Organizing debt, equity and cash flow waterfalls.

We then presented a project finance analysis and valuation model. Issues that were taught include cash flow forecasting, debt service modeling and the computation of project-level returns and coverage ratios.

Scenario and sensitivity analysis were incorporated in the programme. Students examined the relationship between variations in the growth of traffic, toll rates, operating expenses, and financing conditions and the viability of a project and the risk profiles.

This e-learning experience involved a lot of practical modeling practice. Students took guided tours based on real-life situations of a toll road project and manipulated assumptions to see the reflection of finances.

Interpretation and communication were also highlighted in the programme. The learners were trained on analyzing outputs of a model and reporting financial outcomes in an effective manner to investors, lenders and the stakeholders in the public sector.

Learning materials were all presented in an easy to use e-learning platform, assisted with instructional videos, templates that could be downloaded, and reference material.

Learning Design and Delivery

The e learning programme was to suit learners in the engineering, finance, investment and government background.

The content was presented in modular lessons that consisted of conceptual explanations, visual structure, and modeling practices. With checks and tasks, applied tasks helped enhance knowledge without overwhelming the participants.

The self-paced format gave the learners the opportunity to balance the learning with the project duties making the programme favourable to individual professionals as well as corporate infrastructure teams.

The online delivery system provided uniformity, extendability and portability amongst geographical areas.

Value Delivered

This case study illustrates that E-Learning Services on Road (Toll) Project Financial Modeling can increase the capacity of infrastructure financing and aid informed decision making in investment.

Through a mix of formal education and project-centric, models of practical exercises, the programme allowed the learners to comprehend the economics of a toll road more effectively and evaluate financial risks affecting such projects and assist in structuring bankable project frameworks.

The scalable e-learning can offer a long-term solution in terms of continuous skill enhancement as the infrastructure markets, financing systems, and regulatory landscapes keep on changing