Project Management Training for Finance, Banking, and Infrastructure Teams

Introduction to Certified Project Management Training

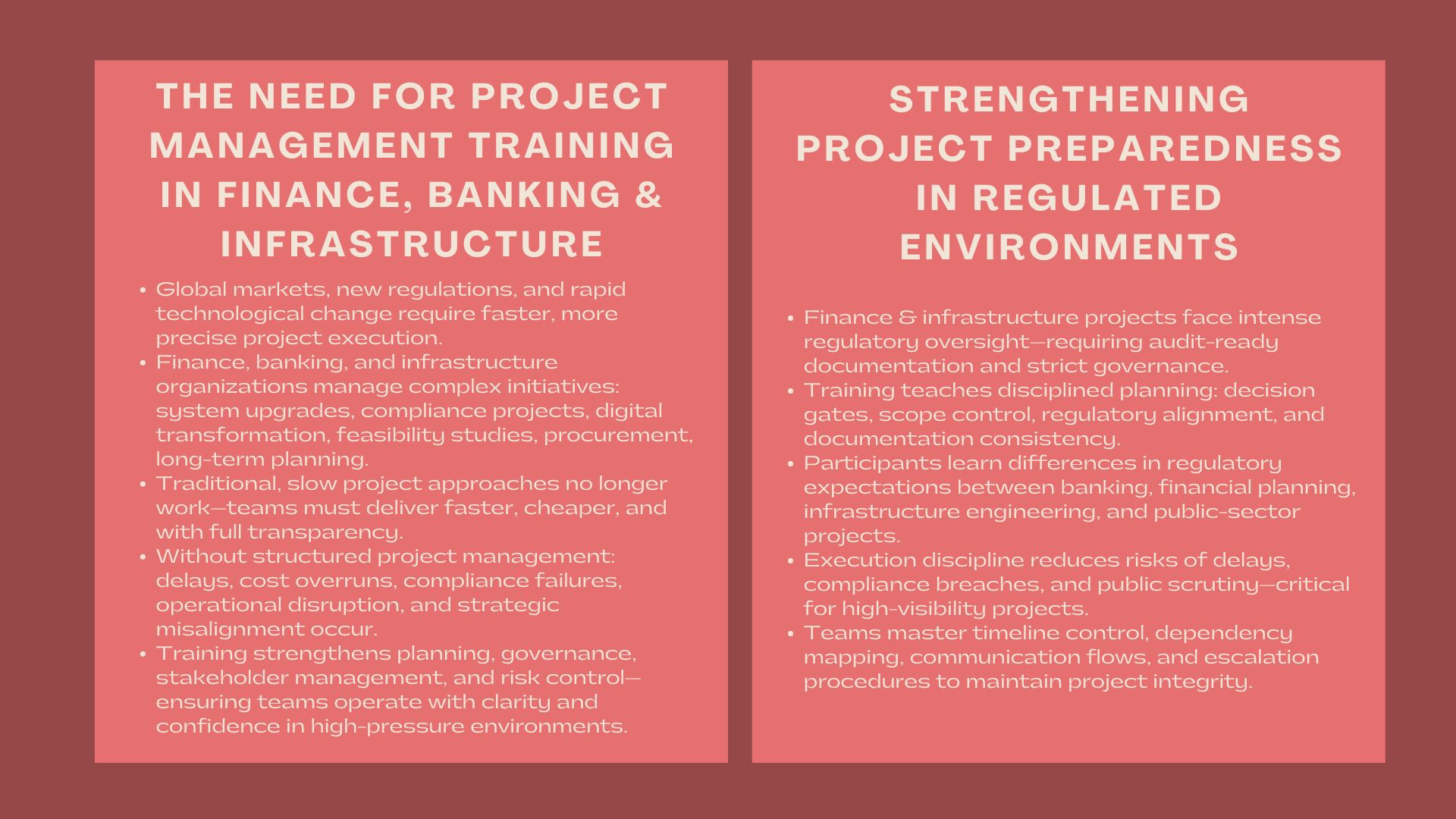

Organizations operating under the finance or banking industry as well as the infrastructure sector are in an ever connected international market characterized by the increase in regulatory demands and pressures, escalated technological advances, and the dynamism in the project delivery environment. The model of the past where projects were rolled out at slow speeds cannot take place.

Rather, the institutions have to deal with the initiatives, which involve the adaptation of the new operational systems, the new compliance regulations, assimilation of the digital technologies, rebuilding of the internal workflows, and collaboration of different stakeholders concerning various jurisdictions. These circumstances make the project teams work on a certain amount of accuracy, strategy of thought and discipline of execution, which completely surpassed the conventional project management techniques.

The institutions of today, irrespective of their scale and industry, have a constant stress to execute projects quicker, economically and openly. This fact puts the capacity to manage projects in the centre of organization performance and resiliency. The introduction of new products, digitalization, cybersecurity, and regulatory remediation programs in the field of finance and banking demand the coordination of compliance, IT, risk management, and operations.

The organizations in the infrastructure environment are forced into a challenging journey through complicated feasibility studies, engineering deliberations, procurement and the long term capital planning. In the absence of organized project management systems, such high stake projects can become exposed to budget overruns, time overruns, failure to comply, operational hiccups and become exposed in competitive positions.

All these issues have made organized project management fundamentals for financial and infrastructure projects of organizational capacity building. Professional training programs assist people to comprehend the fundamentals of planning, governance, stakeholder relationships as well as risk management. They provide persons with the effective instruments that facilitate working clarity and enable teams to operate in stressful situations confidently.

Regardless of whether they are implemented as the project management principles toward the financial and infrastructure projects or as the banking and finance project planning and execution training, these initiatives enhance the ability that is necessary in the project delivery. In the time when institutions are relying on their capability to implement strategic change, project management training will also help keep the teams ready, focused, and working to propel the organizational concerns.

Strengthening Project Preparedness Across Financial and Infrastructure Environments

Developing Execution Discipline in Regulated and High-Visibility Projects

The finance and infrastructure industries are under the constant watch of regulators, auditors and other external reviewers. The projects within such industries cannot be based only on the working intuition or informal management style; the methodologies of such projects should be strict so as to guarantee the stability, transparency, and traceability. Implementation of the project should be stringent to the internal policies, supervisory rules, and compliance structures that will stipulate the extent to which decisions are recorded, how risks are identified, and how deliverables are handled.

This is a disciplined approach that is developed through training programs. The participants get to know how planned systematic planning structures help in regulatory alignment and how a decision in its initial stages affects the performance of the project over the long term. They discuss the reasons why financial and infrastructure projects should have more elaborate governance systems as compared to those that exist in industries with not-so strict regulation. With facilitated training, practitioners are taught to design decision gateways, to check the scope parameters and to guarantee the project documentation is audit compliant. Based on these lessons we can understand the value of precision and consistency in the delivery of a project.

It is also determined whether regulatory expectations in various types of projects differ. Banking projects related to new product development, system upgrades, risk model developments or banking and finance project planning and execution training compliance response projects are required to have approval steps that should conform with regulatory expectation. Where resource investment is heavily involved in infrastructure development, environmental review or as in the case of the public- private partnerships, the feasibility and transparency and effect on community are subject to scrutiny. These regulatory nuances enable the project teams to be aware of the constraints in advance, mitigation strategy planning and project stability throughout the execution cycle.

The discipline on execution is also enhanced by project management training as it equips those under it to have tools to control the timeline, tasks sequence, dependencies, and proper communication management. Disciplined project execution is necessary to the institutional credibility in high-visibility projects where regulatory investigation or public concern may be activated by project delays or errors. Learning in a structured manner gives the professionals a greater understanding of their roles and helps to enhance their capacity of producing projects that will satisfy the strategic and regulatory requirements.

Enhancing Institutional Capability in Multi-Dimensional Project Scenarios

Financial and infrastructural projects hardly go on alone. They entail different stakeholders, overlapping and complicated networks of interconnected activity. The new banking compliance initiative can involve all legal teams, IT developers, operational risk analysts, finance controllers, and external consultants working concurrently. The project of infrastructure extension might include engineering staff, procurement, ecological consultant, representatives of locality as well as project managers and money brokers. This multi dimensioned project environment demands a better level of internal capability which can hardly be supported by the traditional methods of management.

Formalised training in project management improves institutional capacity in that professionals get to know that project environments are interdependent. The participants are taught how to subdivide more complicated workflows into organized steps, stay in control throughout the series of tasks, and organize the work that involves the collaboration of various business units. These are competencies that would be needed in the prevention of project fragmentation, miscommunication, and inconsistencies that could hamper progress.

Another point of the training is that documentation is an essential requirement not only as an administrative process but also as a strategizing instrument that keeps teams on the same path. Governance is supported by accurate documentation, which helps in knowledge transfer, increases transparency, and projects do not get derailed even if staff members are another change in leadership. When the situations are multi-dimensional, the documentation can be used as the foundation of the team to be kept coherent and stable.

Project management workshops also enable participants to be aware of the warning signs that there are chances of the communication or coordination to stall. Professionals will be able to take remedial measures to avoid the problem by learning to detect such signals early. Such foresight provides an organization with a resilience and provides a focus to organizations to ensure that the integrity of projects is upheld during its lifetime.

Core Elements of Professional Project Management Development

Building Strategic Foundations for High-Complexity Project Environments

Project management is not just a matter of operational management but rather a process that starts with a strategic realization of the role of the projects in terms of supporting the goals of the institutions. This base is laid through workshops where the participants can be enabled to see how projects that are well-planned enhance organizational strategy. Projects that are not aligned with long term goals bring about inefficiencies and could deprive resources which could be used in important operations of the organization. In a well-organized training, the participants are taught to analyze the project proposals and determine their strategic appropriateness and whether they bring the desirable results.

This is a strategic understanding that becomes critical in a complex environment, such as in finance and infrastructure. Financial institutions need to coordinate the projects and risk appetite, regulatory commitments, and resources capacity and digital transformation priorities. The infrastructure organizations are required to assess the project feasibility, environmental demands, complexity in engineering and financial sustainability. The workshops make participants realize the effects of these strategic considerations on the planning decisions and how lack of appropriate alignment may cause unwarranted strain between the needs of operations and the strategic requirements.

The participants are also equipped to come up with effective governance frameworks that support the drive towards strategy. This involves learning how to formulate the oversight committees, setting up decision rights and forming reporting lines that will be accountable. Using strategic bases to make decisions in a project, organizations are able to provide consistency, eradicate duplication initiatives and stay on track throughout all the project portfolios.

Workshops serve the purpose of underpinning the significance of matching scope with strategic intent. The participants are taught how to prevent scope creep, control stakeholder expectations, and also uphold the project throughout the lifecycle. These are the strategic underpinning which allows project managers to go into complicated environments without hesitation or to assist the top leadership in fulfilling the long-term goals of an organization.

Developing Technical Competence in Planning, Monitoring, and Delivery

In addition to strategic insights, management of projects must have sophisticated technical dexterity which aids in planning, tracking and implementation. Workshops are used to train the participants on these competencies through intensive and systematic training. Professionals are taught on the way of creating realistic project timelines where they put into consideration the availability of resources, regulatory dates, and the cycle of operations. They also get to understand how to develop elaborate project plans where they assign the duties, sequences defined, outline the dependency and critical paths.

Technical competence, as applied in the financial and infrastructure circumstances, involves the capability to incorporate financial modeling in the planning of the project. The participants are taught on how to review the project budgets, cost structures, the projections of the returns on investment and make sound choices concerning the allocation of capital. The financial approach is necessary in an institution that is highly dependent on the long-term planning process and require an institution to showcase resource sound management.

Workshops also enhance monitoring skills of the participants. They get to be aware of how to put the performance indicators into perspective, monitor progress, detect delays compared to the expected time, and make use of situations that arise with unforeseen developments. Monitoring would also be a dynamic process, where members will be trained to intervene effectively, change plans of the project, and control the expectation of the team and the overall performance of the project.

The use of documentation is of key importance in project monitoring. The workshops show the participants how to come up with systematic documents that meet internal governing requirements as well as external regulatory requirements. It is imperative that in industries where documentation is among the audit trails, regulatory reviews, and risk reviews, records of high quality should also be kept to ensure accountability by the organization.

Through these technical offices, practitioners will be in position to cope up with projects of various stress levels, and every endeavor would be accomplished with accuracy, openness, and uniformity.

Applying Project Management Across Banking, Finance, and Infrastructure Sectors

Adapting Methodologies to Industry-Specific Structural Realities

There are major differences in project environments in banking, finance and infrastructure industries. Every industry has got its own working structures, regulation requirements and expectations of its stakeholders. These differences lead to the conclusion that successful training of project managers needs to be unique and based on industry peculiarities.

Within the banking industry, the project teams have to make sure that they are in tandem with compliance requirements, risk management model, and supervisory reporting aspects. Digital transformation, customer onboarding improvement, anti-money laundering system upgrades, or new product development projects need systematic approaches, which incorporate regulatory checkpoints and audit traceability.

The projects handled by the finance teams are model validation, capital planning, investment evaluation, and enhancement of the treasury system. These programs require the use of analytical accuracy and they should conform to the issue of risk appetite, policy and accountability models. Training programs also respond to these needs by educating the participants on the suitable way of incorporating financial modelling, risk assessment, and performance analytics within project planning and implementation.

The infrastructure organizations have different issues that are related to engineering solutions, environmental control, purchasing procedures, and social consequences insight. A project manager should have the ability to achieve balance between technical requirements and long-term planning, on one hand, and design, construction, and implementation, on the other hand, according to the regulations and budget limitation. Workshops enable the participants to get to know how to negotiate these complexities without altering the project stability and reducing the level of interference during operation.

Customised content will also make sure that every field receives training that best fits in its challenges. This personalization increases the applicability of the instruction and enables a subject to use specifics educationally in his or her own setting. The workshops on project management through working on industry-specific real facts enhance the institutional competence and the chances of favorable project outcomes are raised.

Strengthening Interdisciplinary Collaboration in High-Stake Projects

Massive projects require smooth coordination between the departments, the functional unit, the external partners of the company and the regulatory office holders. Without proper interdisciplinary communication, there is the risk that the projects will end up being disjointed, inconsistent or even out of sync with the organization goals.

Project management workshops encourage the value of interdisciplinary teamwork by educating the individuals in the workshop on how to collaborate across the functional lines. The participants get to know how to perceive the operational functions of other commercial departments, determine the cross-functional constraints, and synchronize the project time systems to reinforce common plans. This knowledge would eliminate tension and make teams operate as a team instead of operating in isolation.

Seminars emphasize the importance of good communication in improving quality of execution. Participants discuss issues such as frequent updates, proper documentation, clear escalation processes, and clear decision-making to minimize ambiguity and thus encourage clarity. Professionals also get to understand the behavior of handling conflict positively and engaging in talks that will enable the collaboration process towards a shared objective.

Even in high-stakes settings such as finance, banking and infrastructure interdisciplinary collaboration is not an option it is a necessity. Multi-stakeholder projects need to have proper communication channels and cohesive strategies of planning. Formed training presupposes the fact that professionals should acquire interpersonal intelligence and organizational consciousness required to function in cross-functional teams.

Conclusion

Project management training has been a strategic requirement in finance and banking institutions and infrastructure institutions aiming at providing initiative with accuracy, uniformity, and alignment. These programs provide professionals with the strategic awareness, technical skills and teamwork expertise on how to cope with a complex project environment. Through a course in the basic project management in financial and infrastructure projects, the teams are assisted to formulate the basic knowledge of planning, governance, and feasibility tests.

In the meantime, a developed banking and finance project design and implementation training initiative enhances the ability to execute and to be sure that groups are able to handle multi-stakeholder set-ups without hesitation. Through organized training, it is created that the organizations advanced project governance training for financial and infrastructure teams have strong project teams that can deliver transformational projects that can ensure the organization grows, maintain its regulatory stability, and acquire operational excellence in the fast-changing global environment.