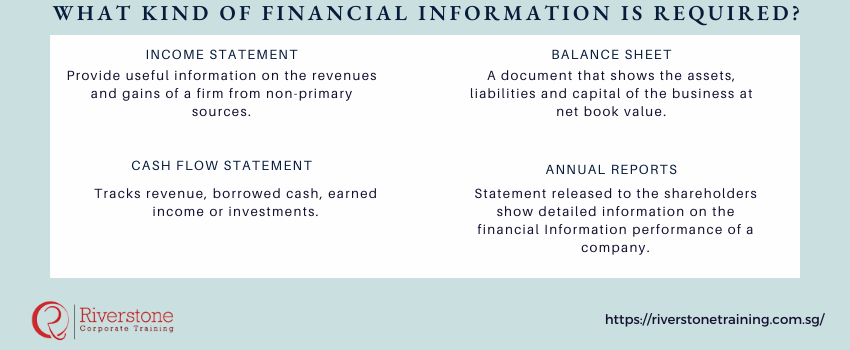

What Kind of Financial Information is Required?

There are various types of financial statements that one would require for financial analysis. In any analysis, you will find that you need at least one of the following data—highlighting the importance of financial analysis in Singapore and why financial analysis matters in business.

Financial Statements Information

The Income Statement or The Profit and Loss Statement

Provide useful information on the revenues and gains of a firm from non-primary sources—an essential part of understanding financial statements for business. The income statement, will usually show the net income which is arrived at after deducting expenses from the total revenue.

The Balance Sheet for Financial Statement

is a document that shows the assets, liabilities and capital of the business at net book value. Firms usually indicate the income and expenditure of a company over a given period, usually one year.

Cash Flow for Financial Statements

When there are changes in the balance sheet, income, cash, and cash equivalents, one would need the of a firm to see these changes. Such analysis is further broken down into operating, investing as well as financial Information activities. In simple terms, it is what comes into the business and leaves the company . It tracks revenue, borrowed cash, earned income or investments.

Annual Reports for Financial Statements

released to the shareholders show detailed information on the financial Information performance of a company. Sometimes the data may require further clarification, hence the use of notes to financial statements. The management decision and analysis or MD&A provides an overview of a company’s performance for the previous year.

Which Methods of Accounting do a Firm use?

The only way you can know is to look at the depreciation, deferred tax and leasing, if it is the depreciation for instance, you would need further to see if it is a straight line or reducing balance.

For accountability, a company should have its books audited in conformity with international standards. The Audit reports are essential as they provide material disclosures on the strengths and weaknesses in the financial Information books of accounts.

To plan for the future, a company needs to make future projections for the profits and revenues, among other variables spread over the years.

Lastly, a firm would need to compare industry standards to know how your firm’s operating results with the competitors. For your firm to be competitive and identify its strengths or weaknesses, you would need a competitor’s data. To master these evaluations and apply them effectively, professionals often turn to financial analysis techniques for professionals or enroll in a practical financial analysis course Singapore to gain hands-on skills.

Navigating Singapore’s Financial Reporting Landscape: A Guide to ACRA & IRAS Compliance

A bit lost in the maze of the Singapore financial regulations? You are not an only party! All the businesses both big and small, including the hawker stalls, here have to be able to interpret financial reporting to be on the right side of two regulatory bodies – ACRA (Accounting and Corporate Regulatory Authority) and IRAS (Inland Revenue Authority of Singapore). It is not only about avoiding fines but also establishing trust and working in an orthodox way. We will dismantle the basics: the mandatory obligation to provide a financial statement annually in XBRL format, the specificities of the requirements of the audit of small enterprises, so that the business is fully compliant with all the requirements of the legislation.

The Power Beyond Compliance: How Strategic Use of Financial Information Drives Growth in Singaporean SMEs

Although compliance is of huge importance, the real magic of financial information is its ability to drive your business towards success. And knowing your financial statements is not a burden to Singaporean SMEs but it is a competitive advantage. Just think how much it would help you to know which of your services are the most profitable to you, where you can save money, or when it is the best time to purchase new equipment. The profound understanding of your income statements, balance sheets and cash flow enables you to make smarter decisions, bid confident investors and gather superior financing. Make your financial data act as your guiding point that would steer your small or medium-sized business towards the sustainable development and dominance within the market. To unlock the full potential of your financial information and gain a true competitive edge, consider deepening your skills through a well-structured finance course for Singaporean professionals.

Understanding Your Audit Report in Singapore: Key Takeaways for Business Owners

Getting your annual audit report may seem like reading a mystery novel that is hard to solve. However, to Singaporean businessmen, this document can play a crucial role! Your audit audit report gives the surety that the financial statements of your company are true and fair to the stakeholders, which includes investors to banks. We will unmask critical areas such as the opinion given by the auditor (is it clean, qualified or adverse), what the note to financial statements actually tell and how an audit report builds the credibility of your company. Learn to read between the lines and use your audit report as a strong instrument to transparency and trust. For those seeking deeper expertise, enrolling in an advanced financial modeling training Singapore can sharpen your analytical edge, while the best financial modeling certification Singapore adds strong credibility to your professional profile.

Unlock clearer audit insights and build business credibility with a practical Malaysia compliance course designed for business owners in Malaysia.