Structuring Cash Flow and Liquidity Workshops for Financial Institutions

Introduction to Professional Cash Flow Structuring Certification

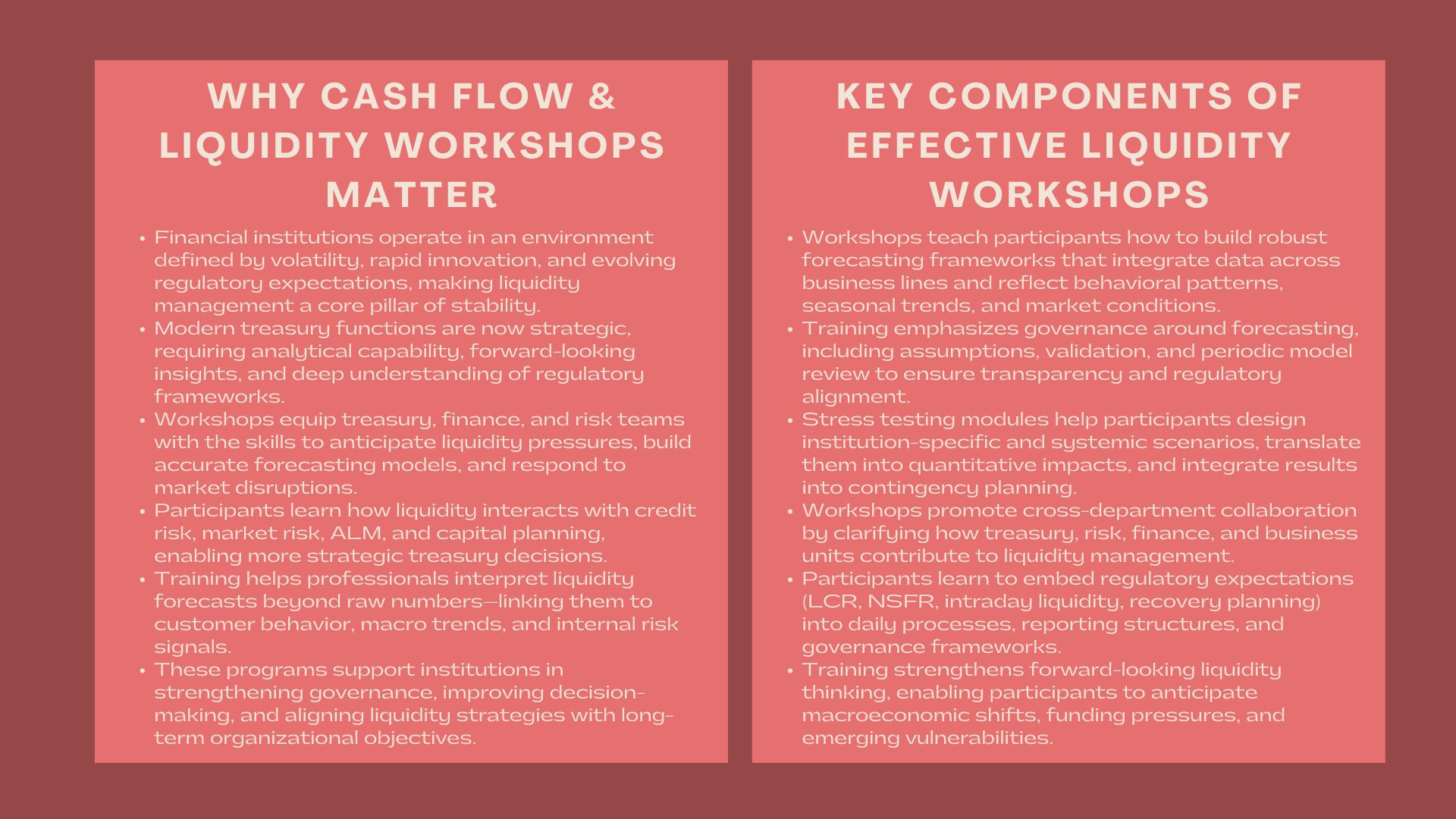

Modern financial institutions exist in an environment that is characterized by increased market volatility, accelerated technological change, and changing regulatory requirements. Liquidity management has since become a key component of financial stability and affects everything from treasury day-to-day transactions to balance sheet long-term strategies. In such an environment, the capacity to anticipate liquidity pressures, develop accurate cash flow forecasts, and move within regulatory frameworks is critical to help institutions retain their institutional resilience.

The growing complexity of financial markets has resulted in liquidity management not being a simple support function, but rather a strategic discipline with deep analytical capability needed. This is the reason why structured workshops related to cash flow forecasting and liquidity management have become indispensable for institutions in every sector of the banking industry, as well as Fintech and non-bank financial entities.

As the risks become more interconnected and the regulations require more, the need for advanced cash flow forecasting and liquidity management training for banks continues to grow. These workshops give treasury teams, finance professionals and risk officers the knowledge and frameworks with the tools they need to build strong liquidity practices to cope with stress events and aid strategic decision-making.

In a world where crises can arise in liquidity matters in a matter of hours instead of days, regrettably institutions can no longer depend on old forecasting tools or single-siloed processes. What they do need is a systematic training framework that takes them up a notch in terms of technical skills and brings in regulatory knowledge, analytical thinking and teamwork between departments. Structuring such workshops requires a good understanding of the function of the treasury and its regulatory requirements, behavioral modeling, stress testing, and technologies affecting the future of liquidity management.

The Relevance of Cash Flow and Liquidity Workshops

Bridging Analytical Capacity with Strategic Treasury Decisions

Liquidity management is no longer confined only to monitoring cash inflows and outflows on a day to day basis. Instead, it now includes huge array of strategic considerations like funding diversification, stress scenario planning, as well as optimizing the balance sheet. In the past, treasury functions was mainly operational, being the settlement activities and short-term funding. Nowadays, they are at the crossroads of risk, strategy and financial planning.

A comprehensive workshop in which the treasury professionals come to a clear understanding of how liquidity works with key areas of the institution’s operations, including credit risk, market risk, asset-liability management and capital planning. By learning how to incorporate these elements into forecasting models, participants learn how to think strategically and understand how to link technical modeling and broader organizational objectives. This shift is particularly important for organisations that want to improve risk governance, provide for long-term growth and respond proactively to market developments.

There is also the ability to interpret liquidity data in a more meaningful way given to participants through workshops. Instead of looking at forecasts as isolated numbers they can instead learn how forecasts reflect customer behaviour, macroeconomic trends, market liquidity state, as well as internal risk signals to the company. Ultimately, training helps treasury teams bring complex information to life in actionable insight which enhances decision making at the level of senior management and the board.

Increasing Complexity of Treasury and Liquidity Regulation

Regulatory frameworks such as Basel III have made managing liquidity a much more important area. Requirements like the Liquidity Coverage Ratio (LCR), Net Stable Funding Ratio (NSFR), intraday liquidity monitoring and recovery planning provide stringent requirements on how institutions measure, report and maintain liquidity buffers.

Given the ever-changing nature of these regulations, institutions need continued training to ensure they abide by supervisory regulations. A structured treasury liquidity risk and cash management workshop provides participants with an understanding of the role of regulators in assessing the liquidity frameworks, what are the critical data points considered by regulators and how institutions should respond to supervisory feedback.

Moreover, regulatory expectations are now beyond the compliance level. Regulators are paying more attention to the quality of governance, the design of the scenarios, contingency planning and then the readiness of the institution in dealing with a severe liquidity stress situation. Workshops assist in preparing institutions so they can avoid regulatory penalties, loss of operations, and loss of reputation.

Basic Areas of Cash Flow and Liquidity Workshop Design

Developing Forecasting Frameworks and Liquidity Models

Any efficient liquidity workshop is based on the development of forecasting frameworks. Forecasting cannot be equated to cash movement projections, but is a process in which a structured methodology of understanding how the business model of an institution creates liquidity requirements under different circumstances can be constructed.

An extensive workshop takes participants through the design of integrated forecasting systems based on the utilization of multiple business lines which are: retail banking, corporate banking, treasury operations and investment activities. The participants are educated on how the behavior of the customers impacts the change in liquidity flows, the pattern of customer behavior on seasons, and the impact of disruption in the market on the availability of funds.

Besides that, workshops provide the significance of instituting governance procedures of utilizing forecasting. This involves data verifying, scenario assumptions, model calibration and a review periodically. Liquidity strategies are not effective as the forecasts made by the institutions are not reliably based because they lack a well-structured governing body. The training assists the participants to establish forecasting structures that are predictable, traceable and adjusted to realities in the operations as well as regulatory submission.

Stress Testing and Scenario Development

Liquidity resilience is necessary to test through the stress test. Through workshops, the participants are taught to design the scenarios that demonstrate both institution-specific vulnerabilities and macroeconomic events. Examples of scenarios may be the unexpected decline in liquidity in the market, mass withdrawals of deposits, fueled credit, rating downgrade, or wholesale funding markets.

The participants are taught to transform qualitative stress occurrences into a quantitative effect on liquidity buffers, cash positions as well as the funding requirements. They are also educated to incorporate the outcomes of stress into contingency funds plans, early signs, and escalation. Through becoming skilled in scenario creation, participants enhance their skills to identify systems of liquidity strain at an initial stage and institute institutions against sudden irregularities.

Stress testing is neither a compliance exercise nor, is it an activity related to strategic preparedness. Training can also serve to educate the participants on the peculiarities of the interpretation of stress, and the impact of results on the risk appetite, funding plan and the decisions about the governance.

Implementation in Financial Institutions

Integrating Treasury Operations, Risk Functions, and Finance Teams

Liquidity management involves a high rate of coordination of the departments. To ensure the provision of relevant information and value truth, treasury, risk management, finance, internal audit even business units would have to collaborate. However, most institutions are faced with disintegrated processes, uneven approaches and lack of communication.

An effective workshop will allow integration in that it will enable them to understand the flow of liquidity within the institution and how various stakeholders will assist in the entire liquidity management system. The participants can appreciate the reason why treasury needs risk function assumptions, why the business financing teams need the right projection of the liquidity, and a reason as to how the business lines can affect the concentration of funding and the stability of deposits.

The workshop establishes a common ground, develops continuity during interpretation and ascertaining that the liquidity decisions are taken in the holistic perspective of the institution operations and exposures to risks.

Embedding Regulatory and Supervisory Expectations

The concept of regulatory compliance should also belong to liquidity management. Workshops equip the participants with skills on how to interpret regulatory demands into effective methods, reporting systems, and governance procedures. The participants are taught to interpret the supervisory instructions, regulatory evaluation, and develop documentation that regulators deem as quality compliance.

Training is also useful in aligning members’ internal practices on supervisors expectations. This involves building liquidity governance frameworks, creation of risk appetite measures, developing sound documentation and also the creation of monitoring tools to aid in regulatory reporting. Well integrated institutions, which take into consideration these expectations, are in a good position to steer through examination by the regulatory authorities and good supervisor relations.

Improving Strategic and Analytical Thinking

Developing a Forward-Looking Liquidity Mindset

This is because the capacity to forecast upcoming liquidity constraint is what differentiates between strong and weak financial institutions. Workshops will advise the participants to move beyond being reactive in their liquidity management and look forward into the future perspective where they factor in the macroeconomic trends, market signals, and strategic objectives.

It educates the participants on the ways liquidity models indicate variations in the interest rates, monetary policy, geopolitical risks, customer behavior and the dynamics of the capital market. They come up with models of analysis utilizing which they can approximate the effect of these changes on liquid musts, financing policy and placement of balance sheets.

Such training enables the participants to make proactive decisions at the treasury including diversification of means of funds, asset-liability duration, and enhancement of liquidity cushions.

Strengthening Communication and Reporting Competence

Liquidity governance must rely on effective communication. Treasury teams should be able to communicate the liquidity positions in a manner that is convincing to the senior management, regulators, and internal stakeholders in an excellent manner. The participants of the workshops are trained to communicate complex liquidity metrics in a manner that would be amenable and practical.

The participants are being taught how to come up with reports that do not just show operation data but strategic interpretation as well. They enhance their skills to support assumptions, justify model results and clarify the liquidity patterns in an assertive and clear manner. This improves the effectiveness of governance and makes the leadership teams able to make the informed decisions in a fast and reliable way.

Integrating Technology and Automation

Using Digital Tools and Data Systems for Liquidity Management

Liquidity management in the modern world cannot be done without technology. Workshops will present the participants with digital systems that will consolidate the cash flows, track the intraday liquidity, and generate real-time dashboards.

The participants get to know how automation helps to promote accuracy, slow operations risk, as well as to increase transparency. They discuss the success of data integration in increasing the quality of forecasts and making institutions react swiftly to any emerging risk. Since the liquidity pressures might arise at short notice, the real-time monitoring will also give the institution immediate knowledge of the weak areas and enhance the ability to take decisive actions.

Enhancing Liquidity Models Through Data Analytics

The liquidity management is being transformed with the integration of advanced analytics. Workshops assist the participants to learn about how predictive analytics determines behavioral trends, how machine learning is more effective in scenario analysis, and how data visualization tools are effective in communication.

These methodologies also enable the participants to perfect their liquidity models and enhance stability analysis, as well as streamline their funding models. With the adoption of the digital transformation in institutions, such types of analytical capabilities will be a requisite to stay ahead of the pack.

Advantages of Structured Cash Flow and Liquidity Workshops

Strengthening Institutional Resilience

Liquidity training in institutions that are structured to a considerable degree boosts the resilience of the institution. The workshops provide the participants with the tools and approach to taking necessary strategic actions in order to overcome market shocks, financial volatility and regulatory strains. One of the roles of a resilient treasury function is to reinforce the image of the institution, drive long-term development and increase the confidence of stakeholders.

Enhancing Strategic Value and Treasury Performance

Workshops transform treasury as a transact-based operation to a strategic one. Respondents are taught about liquidity intelligence and the impact of liquidity on the balance sheet strategy, business planning, and maximizing revenues. They develop the ability of balancing between liquidity choices and organizational interests, which enhances performance of the business and strategic merit.

Conclusion

Formed workshops dealing with cash flow predictions and liquidity control are critical to financial institutions in need of enhancing stability, preparedness to take on regulations, and its growth towards strategic liquidity provisions. Those institutions that invest in cash flow forecasting and liquidity management training of banks prepare their teams with an understanding of the dynamics of liquidity and provide them with a higher degree and accuracy of interpretation. In like manner, a wide-ranging advanced liquidity risk management training for financial institutions and cash management workshop brings teams to adequate readiness to create a model, devise a stress test, communicate in an effective setting, and facilitate well-informed selections.

By a more uncertain financial times, the resilience of an institution to operations is more about the strength of its treasury and liquidity departments than its future standing with regard to competitiveness. Deep, structural, and strategic workshops are strategic and imperative to manoeuvre the liquidity management future.