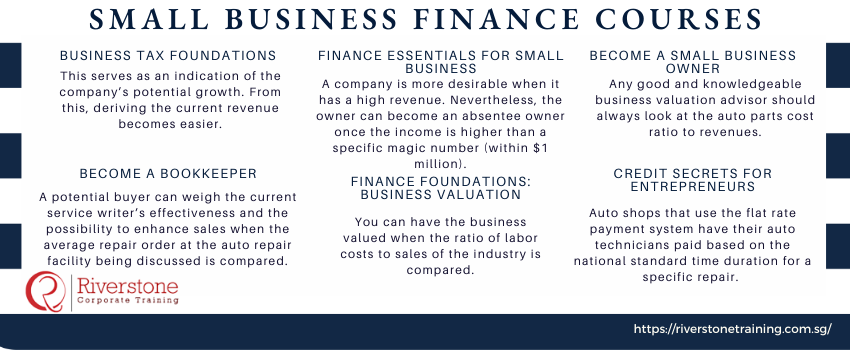

Small Business Finance Courses

Introduction

Small business finance refers to the raising and managing of funds by business organizations. Much of the day-to-day work of business finance is conducted by lower-level staff; their work includes handling cash receipts and disbursements, borrowing from commercial banks on a regular and continuing basis, and formulating cash budgets. If you’re looking to enhance your skills in this area, consider enrolling in a practical finance training course with certification Singapore to gain hands-on knowledge and improve your financial decision-making for small businesses. Here are courses that are related to small business finance:

Business Tax Foundations

Whether you are a professional accountant or a manager at a small-sized firm, navigating business taxes can be intimidating. Business taxes are an ongoing process for most businesses, with multiple due dates throughout the year. This course was designed to unlock the mystery around these forms and deadlines. Join professor Michael McDonald as he dives into the foundations of business taxes, detailing what needs to be submitted to the IRS when it needs to be submitted, and the essentials of completing these tax forms. In addition to covering key filing procedures, the course touches on critical financial metrics like earnings before tax vs EBITDA vs profit after tax, helping participants understand how tax obligations interact with different stages of income reporting. Upon completing this course, you’ll have a deeper understanding of the government’s rules and requirements, as well as how to save time and funds when filing business taxes.

The skills covered in this course are;

- Accounting

- Small business finance management

Finance Essentials For Small Business

Manage your small business successfully with these finance essentials from accounting professors Jim and Kay Stice. They explain the five reasons so many small businesses fail and outline strategies such as tracking your accounting, managing your operating cycle, and forecasting cash flow that will help you manage your small business better. They also provide valuable perspectives on pricing strategies and the dangers of fast growth. Additionally, they highlight the importance of financial statements for small businesses, emphasizing how accurate financial reporting can support better decision-making and long-term sustainability.

The skills covered in this course are;

- Financial Literacy

- Small business finance management

Become a Small Business Owner

Start your own business and get it right the first time. Learn everything you need to become a small business owner, from understanding the responsibilities of entrepreneurship to figuring out the legal, financial, and operational aspects of your future business.

- Learn what it takes to start a business alone or with family and friends.

- Build your business model and develop your business plan.

- Establish your business as a legitimate legal entity.

Become a Bookkeeper

Are you ready to begin a career in finance? Bookkeepers are essential to the success of small businesses. This path will help you build a strong foundation in accounting and small business finance as well as QuickBooks, and the best practices of bookkeeping.

- Master the fundamentals of bookkeeping, accounting, and finance.

- Create sample company files and records in QuickBooks.

- Learn from industry experts on how to run a profitable business.

Finance Foundations: Business Valuation

Do you know the value of your business? Business valuation is critical when selling a small business, bringing on a partner, seeking additional debt or equity financing, establishing the share valuation in an initial public offering (IPO), or buying another company. In this business valuation training course Singapore, accounting professors Jim and Kay Stice provide an introduction to the most important business valuation methods. This course is also suitable as a basic finance course for beginners Singapore, offering foundational insights into financial analysis and valuation.

They proceed from the valuation of individual assets and liabilities to the valuation of entire businesses. The course includes practice with simple valuation models, such as the use of multiples and price-to-earnings ratios, as well as the more complicated “discounted cash flow” valuation model. As part of the best company valuation course Singapore with certification, learners will also learn how to value a company in Singapore using real-world data and hands-on methods. The final chapters include fun and practical examination of the value of one very real business—McDonald’s—and some parting words of advice.

Credit Secrets for Entrepreneurs

If you have strong credit, then you can borrow money to start or grow the business of your dreams. But getting lenders to trust you is not always easy. This course details what you need to know to build your business’s credit score (and reputation) so you can start leveraging serious credit. Get step-by-step instructions on how to find and access your company’s credit report; take steps to boost your score; gain access to the funding you need; navigate special credit issues, such as a lack of data for determining if your business has proper credit reporting; and more. The skills covered in this course are;

- Entrepreneurship

- Credit management

- Small business finance management