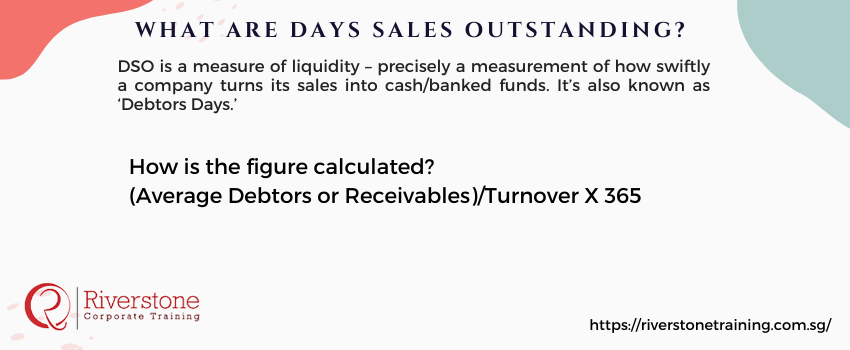

What are Days Sales Outstanding?

- DSO is a measure of liquidity – precisely a measurement of how swiftly a company turns its sales into cash/banked funds. It’s also known as ‘Debtors Days.’

- It should be a key focus for most businesses to make this process as efficient as possible. It’s slightly less relevant for a company that operates a retail-only sales channel. However, they still will have a time lag between sales and cleared cash in their bank accounts. Most debit/credit card sales result in the card operator collecting the funds from the customer initially and passing them onto the retailer after several days.

- The criticality here is that Debtor balances outstanding don’t pay the bills that are required to run a business – staff wages, creditors invoices, monthly payments can’t fail to be paid because ‘someone owes me money.’ Poor Debtor management can be one of the most significant reasons why a business fails.

How is the figure calculated?

(Average Debtors or Receivables)/Turnover*365

Debtors and Turnover figures available in the company accounts. serve as foundational inputs when learning how to calculate financial ratios accurately.

What does the figure indicate?

The calculation shows, on average, how many days’ credit provided to clients or customers or perhaps more appropriately put how many days on average Debtors are taking to pay.

Again an increasing number is an indication of the business’ practices worsening. It can also be an indication that the economy as a whole is slowing, or that the company has been choosing the wrong counterparts to do business.

What can be done to improve ‘Days Sales Outstanding’?

Several practices might help in collecting trade Debtors more smoothly;

- Establish a contact within the accounting department of each significant Debtor who is responsible for making payments. It’s often far more natural to talk to a person regarding what is causing a delay in a customer’s payments than to continue sending emails and letters

- Offer incentives for swift payment. Some companies will offer small financial discounts for an early fee – 1.5% off if you pay within 30 days for example —which can significantly improve cash flow projections, a concept emphasized in the best financial modelling training programs

- Understand if the goods or services that you provide to the customer are business-critical and act accordingly. If your products/services are vital to the running of the other party’s business, then cease providing them with such wares if they fall behind on agreed payment schedules. In fact, at some point, if the client is in arrears, you are going to have to decide whether to continue to supply the customer

- Try to improve on vetting customers if you offer credit terms to them – industry credit reports such as those provided by Dun and Bradstreet can be useful in assessing whether to give credit or how much to allocate to each customer.

Strategies for Reducing DSO in Singaporean Businesses:

Design the guide that will contain not the definition of DSO, but rather effective and practical ideas on how to optimize this indicator that would also be directly applicable to Singaporean organizational culture. This material may cover the following area of discussion effective credit vetting processes to local customer, efficient invoicing and payment terms, effective follow up processes, using technology to automate collections, and how to overcome typical payment issues in Singapore. You can gain businesses by providing useful local solutions because businesses are looking to seek ways to increase their cash flow and minimize their collection period on accounts receivable. You can gain businesses by providing useful local solutions because businesses are looking to seek ways to increase their cash flow, reduce days inventory outstanding Singapore, and minimize their collection period on accounts receivable—while also applying sound inventory accounting methods for Singapore businesses to better align financial health with operational efficiency.

Interactive DSO Calculator with Industry Benchmarking for Singapore:

Create an online calculator that is interactive and users can add their own information as the credit sales of your company and the average account receivables in order to calculate their DSO. More importantly, the tool must be able to provide some contextual rather than absolute views of the metric e.g. give an industry benchmark average for DSO (e.g. average DSO in retail in Singapore vs. DSO in professional services) or even enable comparison of calculated DSO with a desired future state. Not only does this practical tool have direct use to the visitors but also allows them to gain insight as to where the business resides compared to that of its rivals creating a more concrete and easily translatable to financial well being of their business in the Singaporean setting. Tools like this can supplement best practical finance courses in Singapore for professionals or support hands-on learning in a certified financial modeling course for investment analysts Singapore, giving learners both conceptual understanding and applied capabilities.

Conclusion:

Debtor collection is something vital to any ongoing business while it’s a necessary evil to provide credit terms; you should at least consider having an experienced and tenacious staff member in the role of Debtor management. It’s also worth considering establishing transparent processes and procedures for dealing with slow-paying trade debtors.