Advanced Financial Modeling for Banking, PE, and VC Training Programs

Introduction to Professional Banking Financial Modeling Course

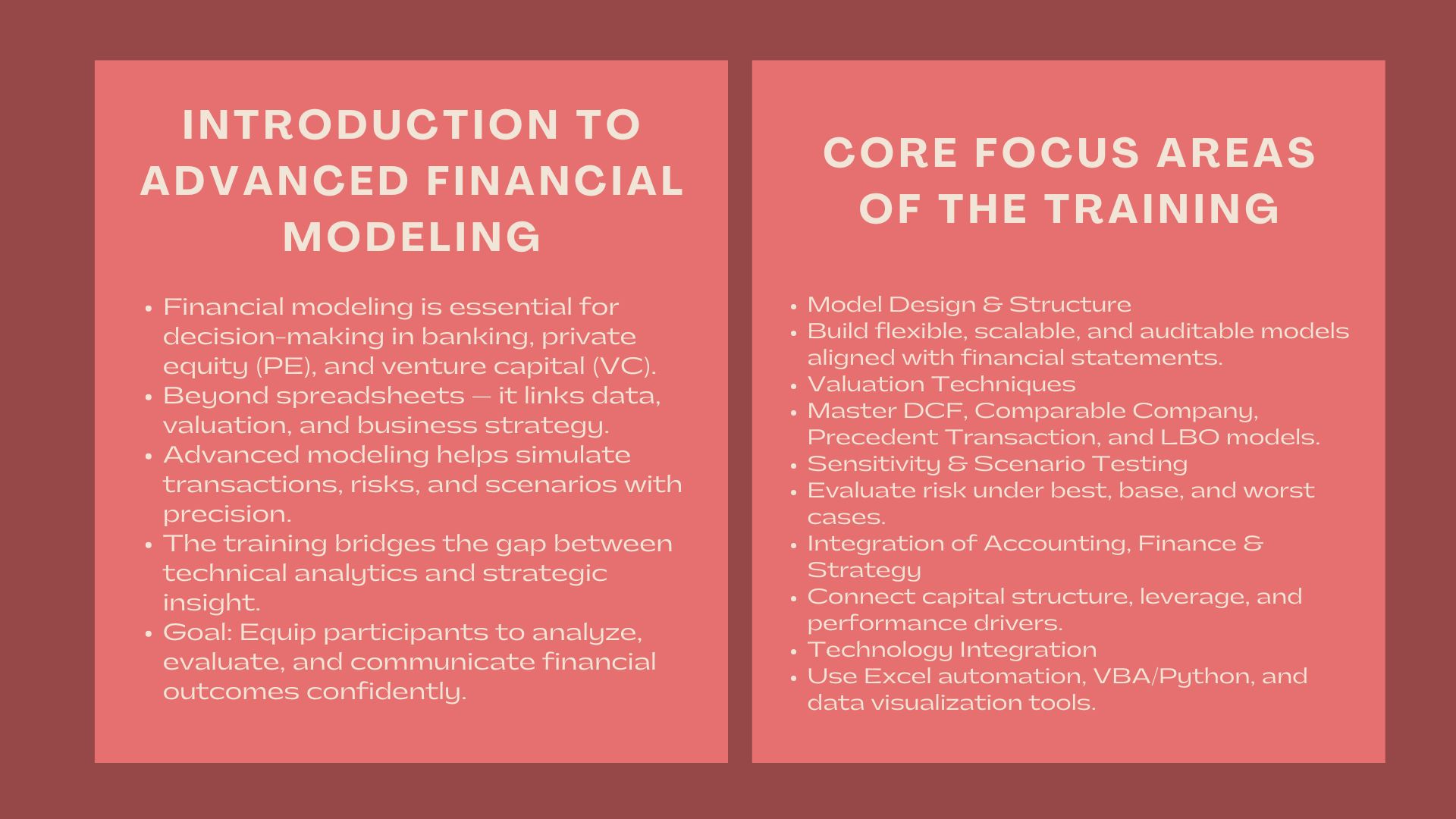

The skill of constructing correct and vibrant financial models cannot be neglected in the fast-paced financial world. It does not matter whether it is leveraged buyout, price venture capital investments, or predicting how bank portfolios will perform; professionals make decisions based on advanced modeling techniques. The need of technical modeling skills among the analysts and associates in the banking, private equity (PE), and venture capital (VC) is steadily increasing as the financial markets are becoming more intricate.

The higher level of financial modeling training is aimed at changing analytical skills into strategic thinking. With the help of these programs, professionals will be able to do more than just use spreadsheets to analyze the results as they will be prepared to process them, evaluate the risks, and provide value-based recommendations. The roadmap is to equip the participants with actual world preparation so that they can simulate transactions, scenarios as well as convey financial information with accuracy and certainty.

The relevance of Advanced Financial Modeling Skills.

Closing the Gap between Analysis and Strategy.

Financial modeling is not merely a question of arithmetic but an instrument of business strategy that relates data to a business strategy. The model will allow a professional to estimate the possible investment, mergers, or financing options taking into consideration variables interest rate changes, economic conditions, and capital structures.

Modeling is used in investment banking to assist in the valuation and pricing of deals. In the case of private equity, it motivates the process of evaluation of the acquisitions and turnover. It is applied in venture capital to assist the investors in estimating the growth patterns and also to value high potential startups fairly. These disciplines during training would make sure that professionals are armed to read the dynamics of finances properly and match the suggestions with the goals of the institution.

The Increasing Deal Complexity.

The current operations deal with hybrid financing instruments, multi-stage investments, cross-border valuations that must be technically rigorous. Static templates or simple spread sheets are no longer effective. Sophisticated modeling skills, including but not limited to discounted cash flow (DCF) analysis, leveraged buyouts (LBO) and venture capital valuation are important in organizing deals with a balanced degree of risk/return.

Practitioners need to know how to combine assumptions in a dynamic way, automate sensitivity analysis, and make models understandable to the stakeholders. Such proficiency can only be achieved through systematic and practice-based learning programs which are set to fit in the real life uses of finance.

Basic Areas of Advanced Financial Modeling Training.

Techniques of Design and Structuring Models.

Designing flexible, scalable and easy-to-audit models is the basis of any modeling course. Participants are taught the best practices related to financial statement organization, the connection between assumptions and results, and consistency between integrated modules.

In an advanced financial modeling and valuation course for banking and private equity, professionals gain practical exposure to model architecture, error-checking frameworks, and the implementation of dynamic formulas that reflect real transaction environments. With the ability to master these principles, participants will be able to develop models that do not only predict financial outcomes but convey knowledge about the strategy, as well.

Transaction Modeling and Valuation.

Financial modeling is centered around valuation. The participants are subjected to various valuation techniques such as:

- Discounted cash Flow (DCF): It is used to estimate intrinsic value by using projected cash flows and discounting rates.

- Similar Company and Precedent Transaction Analysis: Comparing to market data to come up with the fair value range.

- Leveraged Buyout (LBO) Models: The effects of debt financing on returns and capital structure maximization.

These modules are a reflection of actual deal workflows and they enable the participants to experiment with various situations and assess the effect of assumptions on the results. At the program conclusion, trainees have known the role played by valuation models in supporting negotiation plans and investment choices.

Sensitivity testing and Scenario testing.

Actual investments are of a non-certain type. To control this, the professionals will have to test various outcomes on sensitivity analysis and scenario analysis. Training also focuses on approaches to assessing best-case, base-case, and worst-case situations by modifying some of the key drivers in the form of revenue growth, cost structure, or financing terms.

Using this process, the participants get to know how to measure risk, determine the strength of assumptions, and report the downside discussion to the decision-makers-capabilities that are essential in private equity due diligence and venture capital forecasting.

Combining Accounting, Finance, and Strategy.

Good modeling is necessitated by comprehensive knowledge of accounting principles, financial management and strategic planning. The participants are also taught how to balance the financial statements (income statement, balance sheet, and cash flow) with the underlying business strategies.

They also cover the correlation between capital structure and the results of valuation: the impact of leverage on returns, the impact of depreciation and amortization on cash flows, and the impact of non-cash changes on valuation indicators. The outcome is that the relationship between operational drivers and financial performance is fully comprehended.

Implementation in Banking, Private Equity and Venture Capital.

Investment Banking: Deal Valuation and M and A Advisory.

Models are employed by investment bankers to acquit mergers and acquisitions, initial public offerings (IPOs) and debt financing transactions. State-of-the-art training helps the bankers to develop deal-specific models that would reflect on the synergies, integration cost, and post-merger performance measures.

Through the use of advanced modeling models, bankers are able to describe the range of valuation, defend the price of transactions, and create materials client-ready, which present analytical credibility. The technical confidence acquired by advanced modeling improves the client trust as well as the speed of executing it.

Portfolio Management and Exit Planning: Private Equity.

The acquisition analysis, tracking of portfolio, and exit evaluation, are some of the areas that private equity professionals rely on modeling. LBO Modelling is useful to determine the effect of leverage, operating improvements and timing on internal rate of return (IRR) and multiple on invested capital (MOIC).

The presence of performance dashboards, dynamic cash flow schedules and waterfall distributions enable the professionals to visualize the returns and make strategic exit decisions. This real-time analysis facility allows funds to be responsive within the competitive deal environment.

Venture Capital Growth Projection and Valuation with Uncertainty.

Financial modeling is also distinctly problematic to venture capital analysts. There is no historic data in startups and assumptions regarding growth, customers acquisition, and burn rates are extremely important. In a professional financial modeling certification for vc and pe analysts, participants learn to handle incomplete data, design milestone-based valuation frameworks, and apply probability-adjusted cash flow models.

These methods can assist VC professionals to appreciate early-stage enterprises better and explain the reasoning behind investments to limited partners (LPs). The focus on progressive modeling means that the participants are able to respond to the business dynamics through the models.

Improving Strategic and Analytical Thinking.

Forming a Decision-Making Mental State.

In addition to technical ability, other high-level financial modeling courses enable students to critically evaluate information. It is not as much about the modeling process but about the sense of what the model is. Respondents interpret outcomes in the framework of strategic options- to make an acquisition, refinance or postpone an investment.

Such an attitude to decision making makes financial models dynamic tools of insight creation instead of a frozen spreadsheet. Strategic analysts become the treasure trove of their companies because they read numbers.

Enhancing Presentation and Communication skill.

The financial insights are insignificant in the event that they are not delivered expediently. Presentation modules are usually part of training programs and in this case participants are taught, how to take the complicated model results and to be able to produce outputs that are easily understood by the executive. They also train on summarising valuation reports, visual data and stating recommendations that are appealing to boards, investors or clients.

Good communication fills the gap between theoretical modelling and strategic implementation- a trait of the most successful finance professionals.

Integrating Technology and Automation.

Leveraging Excel and Beyond

Although Excel continues to be the foundation of financial modeling, technology is changing the way analysts operate. Automation tools, scenario dashboards and programming (VBA or Python in Finance) are now being used in training to automate repetitive modelling tasks.

The participants are taught how to create models which update automatically on the current market data to minimize errors and maximize the real-time decision-making process. This cyber literacy puts specialists at an advantage in an information-driven financial system.

Connecting with Data Analytics.

More advanced courses also deal with the interaction of financial modeling and business intelligence platforms and data visualization tools. Linking the models to analytical dashboard, the participants will be in a position to track the key performance indicators and dynamically modify the assumptions. The integration continuous portfolio evaluation and scenario testing in banking, PE and VC settings.

Advantages of Higher Level Financial Modeling Training.

Professional Mastery and Personal Growth.

Individuals who do advanced modeling courses have a rich technical background and so they are in high demand by employers. Knowledge in valuation, scenario analysis, and transaction modeling would increase the job readiness and speed career development in finance.

Agility Strategy in Complex Markets.

Participants also learn to create the skills of interpreting complex financial results within a short time and make effective and strategic decisions. This agility will be happier when it comes to stressful decision-making whether they are advising clients, handling funds, or negotiating deals.

Institutional Impact

In the case of organizations, high-level modeling training enhances excellence in analytics, minimizes modeling errors, and enhances the ability to execute deals. It also promotes the sharing of knowledge in-house, and this fosters a culture of rigor in the analytical departments.

Conclusion

In the contemporary world of finance, complex modeling is a quality that makes the difference between a great specialist and the lesser ones. Financial analysts, bankers, and investors can develop sufficient confidence to assess intricate transactions accurately and insightfully through an extensive, scenario-based learning and practical experience. With the help of a progressive financial modelling and valuation course in banking and private equity, professionals are deepening the technical aspect and strategic vision.

On the same note, professional certification of the vc and pe analysts in the field of financial modeling ensures that professionals in the field of venture and private equity are able to analyze investments accurately, communicate effectively with the stakeholders and make evidence based decisions that lead to the success of the portfolio on a long-term basis.