Top Risk Management and Treasury in Surabaya – Riverstone Training

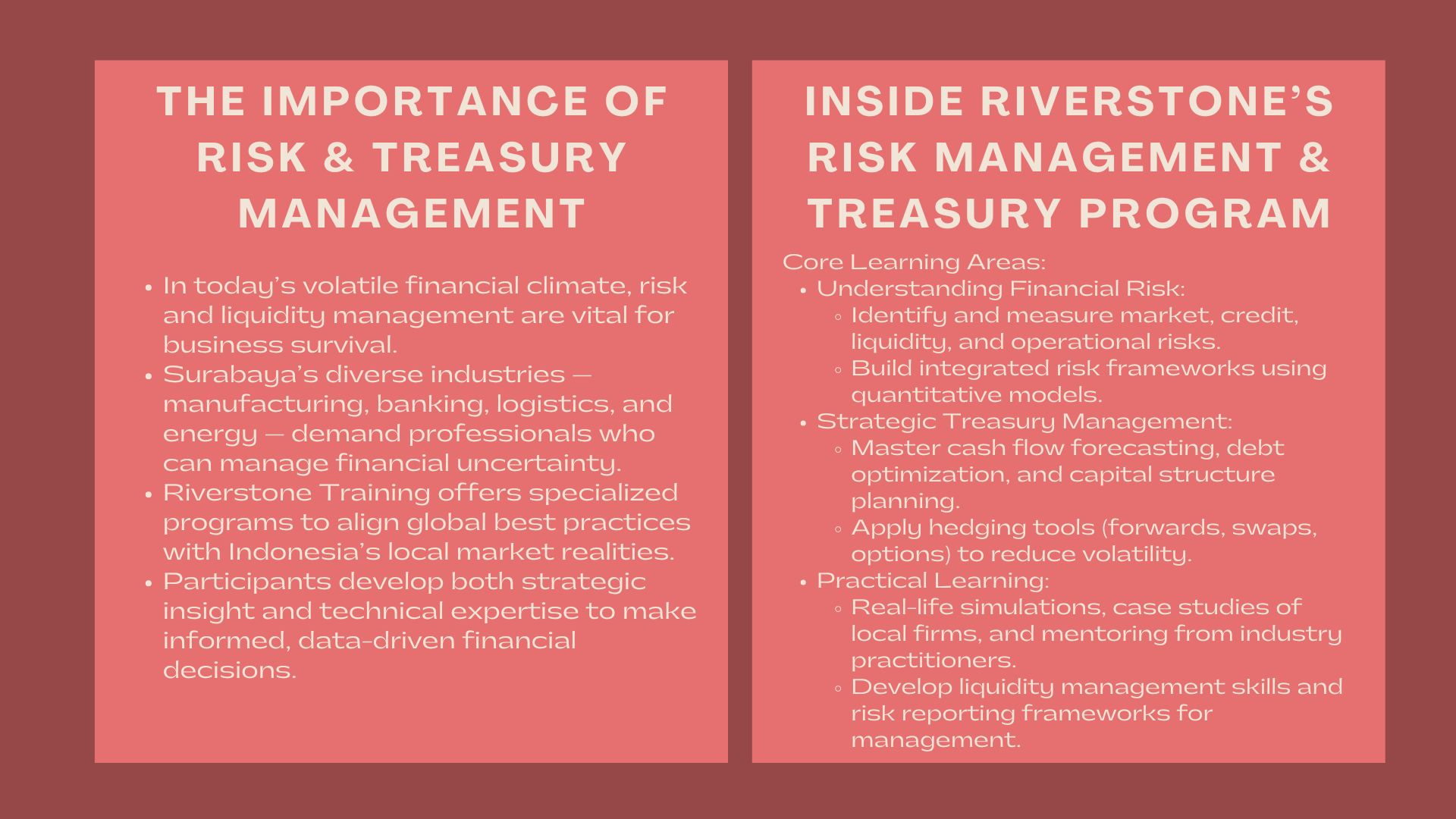

Living in an environment where financial unpredictability and regulatory demands are ever changing, risk and liquidity management has become an identifying competence of the finance practitioners. Treasury and risk management has become top pillars of financial stability to companies in the vibrant economic landscape of Surabaya, whether it is manufacturing and logistics, banking and energy.

Riverstone Training is a company that introduces the global financial training to the people of Surabaya with the help of its specialization in Risk Management and Treasury, created to meet the demands of specialists who want to advance their skills, refine their financial decision making, and become leaders in the sphere of corporate finance. The program closes the gap between best practices in the world and the realities of local business in Indonesia and thus provides the participants with both theoretical knowledge and practical skills.

Importance of Leading Risk Management and Treasury Services in Surabaya

The Keystone to Financial Strength.

Corporate sustainability is centered on risk management and treasury activities. Companies in volatile markets are exposed to risks posed by the interest rates, foreign currency, liquidity and credit risks. Even the profitable companies may find themselves in a financial distress without a proper strategy.

Coming out as the masters of these fields, one may anticipate the occurrence of any form of risk and find the means of mitigation and alignment of financial policies to the long-term business objectives. This is complemented by treasury management which aims at ensuring that there is optimization of cash flow, funding and capital structures that are geared towards stability and growth.

Surabaya: An Emerging financial expertise center.

The emergence of Surabaya as a business destination in the region makes it a great place to be whether an individual wants to boost his or her financial skills. The growth of local and multinational businesses is creating a demand of the services of finance professionals who can ensure the security of company resources and find their way through the intricate market environment.

This need can be fulfilled through the program provided by Riverstone; the program can provide immersion training through the combination of financial theory, real-life simulations and case studies that are applicable to the economic climate in Indonesia. The participants do not only acquire technical expertise but also strategic thinking that can be used to make high stakes corporate decisions.

Inside Riverstone’s Risk Management and Treasury Training Program

1. Understanding the Financial Risk Landscape

Participants begin by exploring different types of financial risk—market, liquidity, credit, operational, and enterprise risk. Through the Advanced financial risk courses Surabaya, they learn how to measure exposure using quantitative models, interpret financial indicators, and create comprehensive risk frameworks aligned with corporate objectives.

It is a basis that enables professionals to evaluate the impact of external factors such as currency fluctuations, commodity prices changes or interest rate changes on their organizations. Through the combination of international principles and local market actualities, students gain a moderate view of dealing with uncertainty.

2. Building Strategic Treasury Management Skills

Treasury professionals are responsible for ensuring that organizations have the liquidity and capital required for smooth operations. The Risk and treasury management training Surabaya delves into cash flow forecasting, investment of surplus funds, debt management, and capital optimization.

The participants are presented with the real life models of treasury where they get to learn how to continue the flow of liquidity in case of economic crunch, how to evaluate the option of funding and how to operate the working capital efficiently. The teachings that the instructors at Riverstone give, given that they are professionals in treasury field, are practical lessons, taking into consideration the multinational treasury practice, which helps to fill the gap between the knowledge that the learners acquire and the practice that they employ in their daily lives.

Essential Learning Domains and Practice.

Liquidity Optimization and Treasury Operations.

An imperative feature of this program is liquidity management- making sure that organizations are able to fulfill short-term liabilities and still generate profits. Participants are also exposed to useful methods of managing cash positions, exploiting short-term investments, and using hedging methods.

Through the case studies of local companies, learners have the opportunity to learn how treasury departments predict the need to finance, create relationships with the banking institution, and use technology to streamline financial operations. This portion will highlight the direct impact of the strategic treasury activities on the corporate resilience and the shareholders value.

Risk Assessment and Hedging Strategies

Another major focus of the training is identifying and mitigating market risks through hedging instruments such as forwards, futures, swaps, and options. The Corporate treasury workshops for professionals Surabaya include exercises on how to design effective hedge portfolios that minimize volatility and protect profit margins.

The participants will have practical experience in preparing risk management reports, evaluating Value-at-Risk (VaR), and reporting the risks to senior management. This will make sure that they are not only knowledgeable about technical hedging mechanics but can also be capable of converting financial risk data into viable business advice.

Attendees and Reasons It is important.

Ideal Participants

The program caters to the needs of the finance managers, accountants, treasury analysts, corporate bankers and risk professionals who want to take their careers to the next level. It is also useful to entrepreneurs and executives in charge of financial management and give them the means of predicting financial challenges and acting decisively.

This program will be of importance to all people in charge of the finances and investment portfolio of the company or any other financing decision a company faces, regardless of the industry, to enhance their technical and strategic performance.

Professional Benefits

Riverstone graduates of its program are able to:

- Develop a detailed risk management system.

- Assess liquidity requirements and work out capital policies.

- Apply derivatives effectively to hedge.

- Provide a clear explanation of complicated financial matters to the stakeholders.

- Decision under uncertainty based on data.

Skills can be directly used in a position of Treasury Manager, Risk Analyst, Financial Controller, and Corporate Finance Specialist.

Career Opportunities in Risk and Treasury

Increasing Demand in all the industries.

In Surabaya and the whole of Indonesia, employers are demanding financial management professionals who are of advanced skills. Banks and manufacturing, as well as energy markets, in particular, demand professionals who are capable of negotiating financial risks and capital structure optimization.

In the brief review of the main job boards, it is possible to see that such jobs as Treasury Specialist, Risk Management Officer, Corporate Finance Manager, and Treasury Analyst are highly demanded. In HSBC Indonesia, Bank Mandiri, Pertamina, and Unilever Indonesia, the employers frequently include risk management experience as well and treasury modeling as desirable qualifications.

Long-Term Career Growth

The increased international attention given to governance, compliance and financial transparency implies that treasury and risk managerial functions are growing at a very high rate. Those who pass through Riverstone program will graduate as professionals who later become leaders in their areas like Head of Treasury, Chief Risk Officer, or Finance Director.

The range of strategic risk professionals has never been as extensive as it is currently due to the growing implication of environmental, social, and governance (ESG) factors in the financial decision-making process. By having the training provided by Riverstone, the individuals charged with it have the confidence and credibility to handle both the traditional financial risks as well as the new challenges associated with sustainability.

Learning Philosophy at Riverstone.

Interactive and Experiential Approach.

The unique feature of the programs provided by Riverstone is the design of the experiential learning. Rather than entirely depending on lectures, the participants participate in interactive programs, live simulations, and solving problems in groups. This will make sure that learners do not only learn the theoretical concepts, but also put them into real world business situations.

The industry practitioners guide each of the sessions and possess decades of experience in treasury operations and risk management. Their mentorship also enables them to acquire knowledge beyond the textbooks that of knowing how global trends, technological changes and policy change affect the financial approach of corporations.

Local and Global Viewpoints.

The course combines the best practices of the world with those of Indonesia in terms of regulatory structure and economic environment. The participants discuss the effects of local currency risks, local trade patterns and local financing instruments on risk and treasury operations.

This bilateral orientation is designed to equip learners to work effectively in the local and cross-border business contexts which is a major strength of professionals in Surabaya, a city that is being increasingly integrated into the expanding financial landscape of Southeast Asia.

Turning Competencies into Strategic Strength.

The participants do not only leave the program with increased technical know-how but with a new attitude. They are taught to perceive risk not as a threat only, but a strategic opportunity, and in the case it is handled intelligently, it can produce competitive advantages.

Training at Riverstone enables professionals to build the confidence to prescribe the capital strategies, spearhead financial transformation, and recommend to the management on risk-informed business planning. The combination of the hands-on activities, case studies, and mentoring will guarantee that each attendee becomes not only competent but also clear when handling financial problems.

Conclusion

Organizations require finance experts that are able to think on their feet and make quick decisions in the world that can be unpredictable and quick changing. The Surabaya Riverstone Training Risk Management and Treasury Program equips its participants with the ability to master the art of financial control- creating balance between risk, liquidity and profitability with accuracy.

To achieve their career objectives and to become powerful forces in serving their organizations, aspiring professionals hoping to succeed in their career paths require this program to offer them the skills, the confidence, and appreciation needed to succeed in the modern intricate financial environment. The world-class strategy of Riverstone enables the participants to not only learn the methods to safeguard corporate value, but to also generate it.