Case Study: ESG Investing In-House Training Services Integrating Sustainability into Investment Decision-Making

Background on Case Study ESG Investing In-House

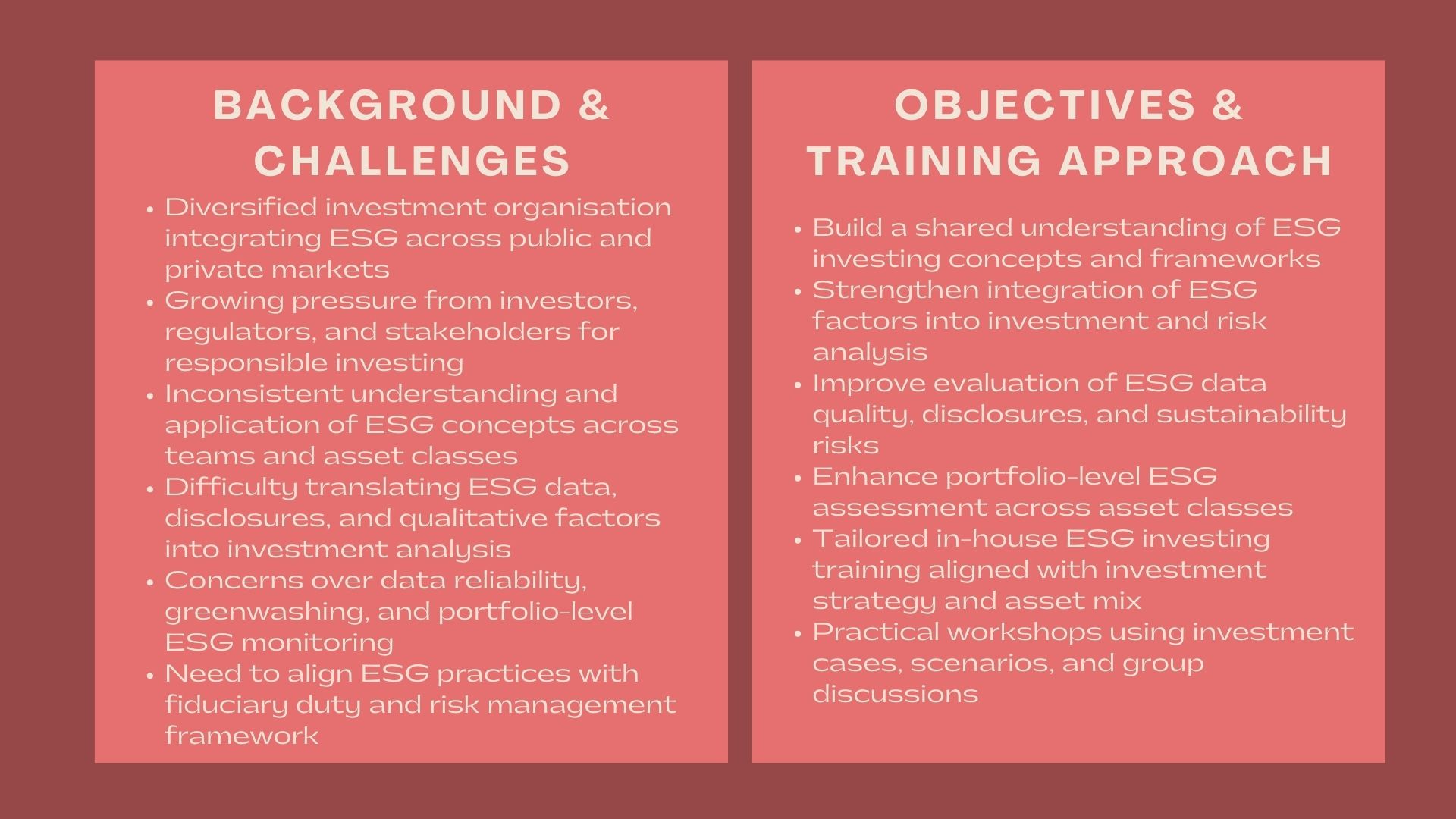

A diversified investment organisation, having both a public and a private market exposure, was becoming more and more oriented to the idea of implementing environmental, social and governance (ESG) issues into its investment policy. Responsible investing, transparency and long-term generation of value were being emphasized more by institutional investors, regulators, and stakeholders.

Although the organisation had started to include ESG considerations in some of its investment decisions, there were mixed practices across groups and asset categories. The investment people were more or less familiar with ESG frameworks, data sources, and methods of analysis. The management realised that ESG integration had to be done effectively through the structured training so that the consideration of ESG was done in a systematic manner and not in a haphazard manner.

The organisation used our ESG Investing In-House Training Services to build in-house capacity and match investment practices to emerging expectations of ESR.

Issues and Challenges

The organisation experienced a number of challenges, which indicated the necessity to train on ESG investing in a structured way.

Among the challenges was the lack of consistency in the interpretation of the concept of ESG. The concept of ESG was hotly debated, but its meaning was different among teams. As an outcome, the approaches to evaluation and integration of the ESG factors into investment analysis were different.

The other issue was the practical implementation of the ESG data. Investment professionals tended to be confused on how to take ESG scores, disclosures, and sustainability reports, or how to incorporate the qualitative aspects of ESG to the conventional financial analysis.

Other concerns were greenwashing and reliability of data. As ESG data became more readily available, the organisation was in need of advice on how to assess the quality of data, learn about the limitations, and stop being dependent on false signals.

ESG integration was also difficult at portfolio level. Teams needed a better conception of how ESG considerations might be implemented within any specific asset type and how the ESG risks and opportunities at the portfolio level could be tracked.

Lastly, the management was concerned with making sure that the ESG investing behaviours were in tandem with the fiduciary functions, investment purpose and risk management structure of the organisation.

Objectives

The engagement was mainly aimed at developing ESG investing capacity by training on ESG investing in-house.

In particular, the organisation also targeted:

- Develop shared knowledge of ESG investing concepts and models.

- Enhance the incorporation of ESG-factors in the analysis of investments.

- Enhance assessment of ESG information, reporting, and risks.

- Optimize portfolio level ESG evaluation and monitoring.

- Encourage the standardization of ESG investments.

The training programme should have been practical, investment oriented and should have been applicable in various asset classes and investment strategies.

How We Helped

We embraced a systematic and participatory model of in-house training on ESG investing, which is based on the organisational investment strategy, asset mix and level of the organisation maturity regarding ESG.

We have started with an ESG investing training needs assessment. We collaborated with investment, risk, and sustainability teams to get to know the existing ESG practices, information application, and major issues.

On this evaluation, we developed bespoke training programs on the basic of ESG investing. Among the issues were ESG concepts, responsible investing strategies and how ESG expectations in the investment sector had evolved.

Another area that we touched upon was ESG integration in investment analysis. The training sessions covered the application of ESG factors on financial performance, risk profile, and long-term value-creation with practical examples in terms of the investments of the organisation.

The analysis of data and disclosure was also a major point. The participants received information on how to evaluate ESG data sources, understand sustainability disclosures, and determine some of the possible red flags like greenwashing or incomplete reporting.

Essentially, the portfolio-level ESG factors were included to enable the participants to comprehend the ESG risks and opportunities monitoring at the portfolio, sector, and asset classes.

The focus was put on the practical application. The sessions of training were also focused on the introduction of ESG concepts to real investment choices by discussing scenario-based discussions, using investment case examples, and engaging in group exercises.

The programme was designed to suit the participants of various investment functions such as portfolio managers, analysts, risk as well as senior management. This guaranteed extensive engagement coupled with fostering a common ESG investing model.

The presentation of the training was in the form of interactive workshops including the elements of face-to-face and online training when necessary. Discussion forums empowered the parties to exchange views and converge on the strategies of integrating ESG.

In order to strengthen the learning process, we presented viable ESG integration frameworks, evaluation and reference materials that the participants can use in further investment analysis.

During the engagement, we collaborated with the organisation to customize content according to the changes in ESG rules and regulations, market dynamics, and internal investment priorities.

Value Delivered

This case study indicates that professional ESG Investing In-House Training Services could be helpful in assisting to implement sustainability in investment decision-making.

The engagement contributed to enhancing ESG awareness by means of tailored and practical training and increased the level of consistency in ESG analysis with embedding ESG considerations in the investment processes.

The in- house training framework on ESG investing that was devised in the course of this engagement offered a cost-effective basis of continuous capability building, responsible investment framework, and value creation in the long-term.