Case Study: Project Finance In-House Training Services Strengthening Structuring and Financial Evaluation Capabilities

Background on Case Study Project Finance In-House

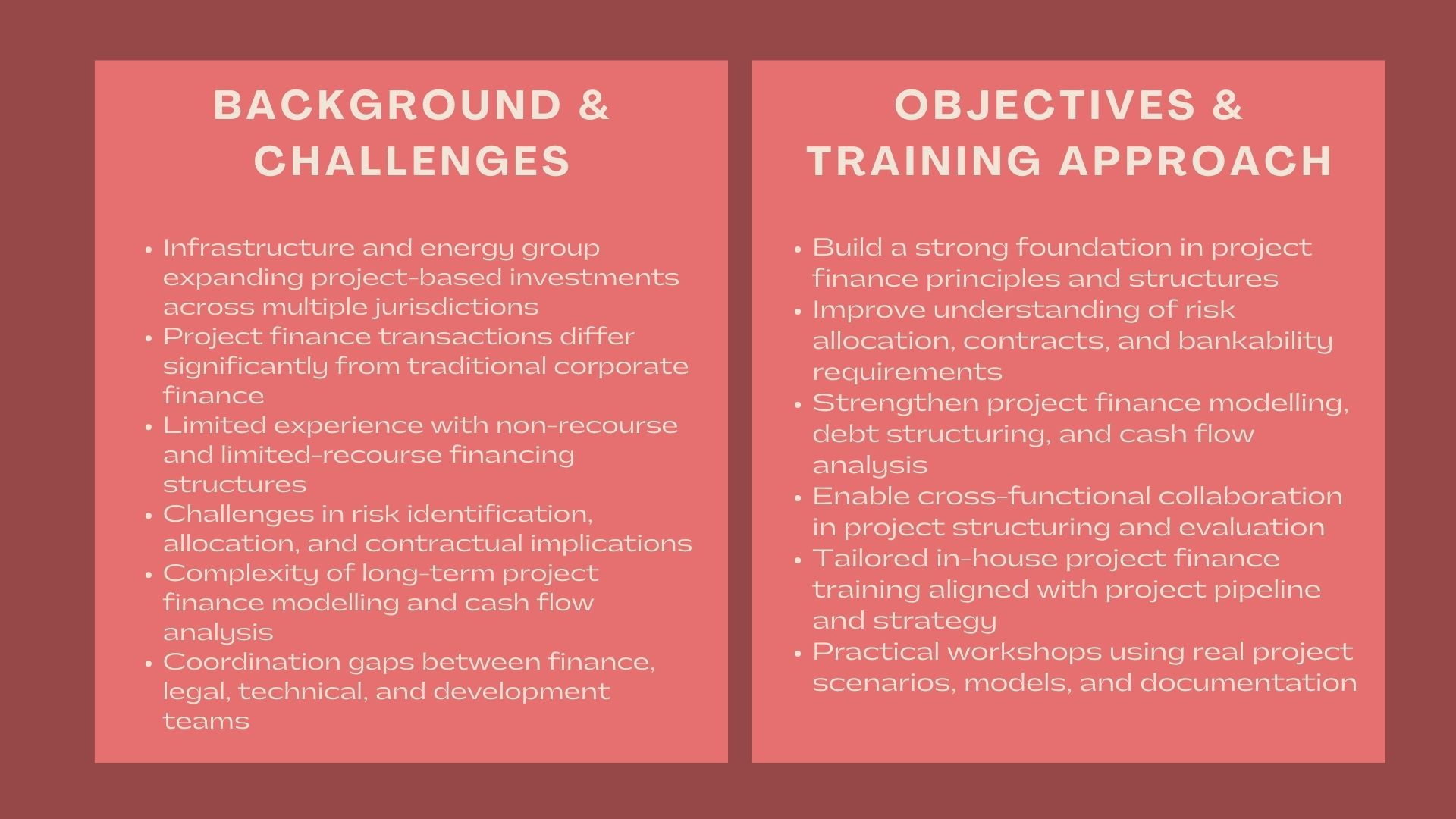

It is a corporate group that with vast experience in the infrastructure and energy industry as well as long-term investment capital projects was increasing its investment in project-based investment ventures across various jurisdictions. These projects were characterized by high initial capital investment, protracted development projects and complicated financing facilities with lenders, sponsors, contractors and government counterparties.

Although the organisation had experience in conducting large scale projects, it realised that the project finance transactions were unique compared to the conventional corporate finance. The execution needed specificised knowledge on risk distribution, financing through the cash flows, additional structures of contract, and lender demands.

With increased project activity, the organisation has made use of our Project Finance In-House Training Services so as to enhance its internal capacity and to make sure that groups in finance, investment, legal, and project development have a uniform view of the principles and practices of project finance.

Issues and Challenges

A number of issues confronted the organisation that created the necessity of systematic project finance training.

Among non-specialized teams, one factor of limited experience with project finance structures was the biggest challenge. Most of the stakeholders were well versed in corporate finance but less conversant with non-recourse or limited-recourse arrangements of financing.

The other difficulty was the knowledge of the risk allocation. The construction, operational, market, and regulatory risks encountered in project finance involve appropriate identification and distribution of risks to various counterparties. It was not all the team members who were confident in determining the impact of the contractual terms and financing structures on the risk distribution.

Project finance financial modelling was also a problem. The project finance models consist of long-term cash flows projections, debt sculpturing, and covenant analysis, and these were unlike the common corporate models applied in the organisation.

There was another issue of stakeholder coordination. Close teamwork between technical, legal and financial teams was paramount, although occasionally the differences in the understanding of issues caused a mismatch or slowdown in the process of project structuring.

Lastly, the management tried to enhance internal decision-making process so that the teams could consider the project bankability, lender requirements and financing implication at the earlier stages of the project lifecycle.

Objectives

The main goal of the engagement was to enhance project finance capacity by in-house training on project finance which was specific.

To be specific, the organisation had to:

- Develop a solid project finance knowledge base.

- Enhance the knowledge on risk assignment and contracts.

- Master project finance modelling and cash flow analysis.

- Make project finance transactions more cross-functional.

- Informed investment and financing was supported.

The training programme had to be relevant, non-expert, and project-oriented in line with organisational project portfolio and strategic priorities.

How We Helped

We embraced an organized and participative method of in-house training project finance, based on the industry focus, project pipeline, and internal capabilities of the organisation.

Our interaction started with a project finance training needs analysis. We collaborated with finance, investment, project development, legal departments to get acquainted with the recent project finance exposure and major pitfalls.

On this evaluation, we developed tailor-made training modules on the basics of project finance. Such issues as project finance structures, the principles of non-recourse financing, and the position of sponsors, lenders, and other stakeholders were discussed.

One of the main aspects was risk sharing and contractual provisions. Along with the interaction between constructions contracts, offtake agreements, operating contracts, and financing documentation in order to aid project bankability, training sessions were held.

Another aspect that we covered was project finance and financial modelling. As part of the project, the participants were taken through the framework of project finance models, revenue prediction, operating cost assumptions, debt service coverage analysis, and debt sculpting techniques.

Practical application was put into a high value. Exercises during training were also based on project-related case studies, simplified case studies, and tours of common project finance documentation as an example of the case in practice.

The programme was designed in such a way that it included people representing various functions such as finance, engineering, legal and management. This made it relevant even as a common project finance framework was encouraged throughout the organisation.

The interactive workshops were used to deliver the training with physical and virtual presence being used in some cases. Creating open discussion and cross-functional dialogue was facilitated to explain project finance concepts.

We also used modelling templates, process guides, and reference materials to support the learning because the participants would be able to use them in future and current projects.

During the engagement, we collaborated with the organisation to tailor training content to particular types of projects and changing financing models.

Value Delivered

This case study shows that the In-House Training Services on professional Project Financing can enhance the structuring and financial assessment potential.

The interaction enabled the development of internal confidence in project finance analysis, enhanced coordination within project teams, and assisted in making more informed financing decisions through customised and practical training.

This engagement created the project finance in-house training framework which was a scalable base of future capability development, better execution of projects, and continued success in investment.