Highly Rated Private Equity Masterclass in Kuala Lumpur – Riverstone Training

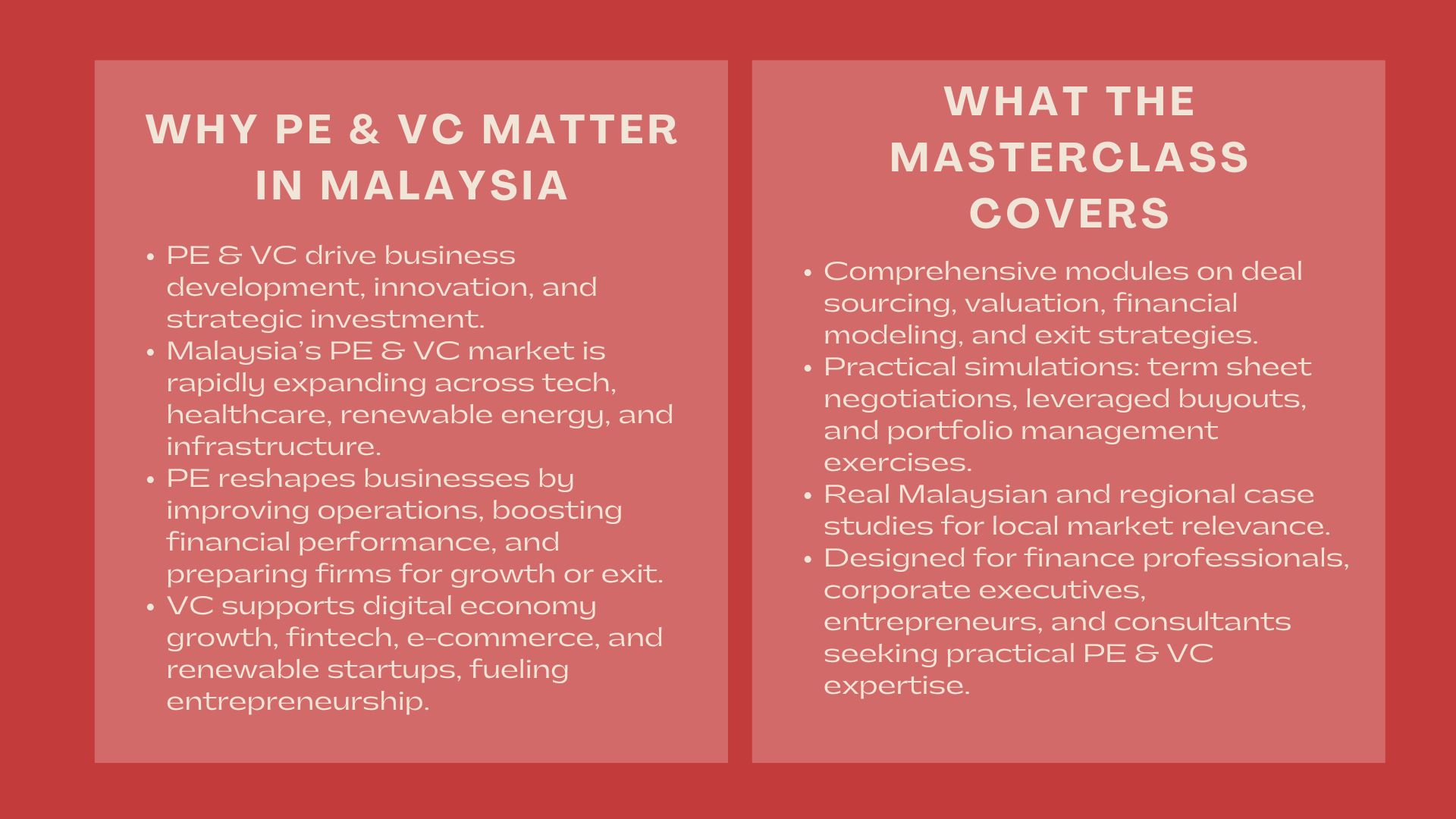

PE and VC are critical towards business development, financing innovation, and strategic investment in Southeast Asia. PE and VC industry in Malaysia has been expanding exponentially with the international investors and local funds investing in the industry like technology start-ups to massive infrastructural projects. To equip the professionals to refine their skills, there is need to have a specialized program to understand the sophistications of deal-making, portfolio management, and exit strategies.

Riverstone training has gained a reputable status as a professional finance educator in Kuala Lumpur and its Masterclass in Private Equity has been well received by the industry players. The program is designed in an interactive and practical style and provides the knowledge and tools that the participants can use to succeed in the growing PE and VC ecosystem in Malaysia. As an investment analyst, corporate strategist or entrepreneur, this masterclass will give you the success engineering in one of the most vibrant industries in the field of finance.

Why Private Equity and Venture Capital Matter

Knowing about the role of Private Equity in Business Development.

Capital is not all that the topic of private equity is about, but rather it is about changing businesses. PE investors collaborate with the management teams to reorganize the operations, enhance the financial results, and precondition the firms with the sustainable growth or successful exits. In Malaysia, PE is interested in such industries as healthcare, renewable energy, and manufacturing because of their potential of growth and adherence to regional priorities.

By attending private equity courses for professionals KL, participants learn how institutional investors identify high-potential companies, structure deals, and create value through active management. The program of Riverstone focuses on the entire lifecycle of investments, including finding opportunities and developing the exit strategy, which allows participants to acquire technical and strategic background.

The Increasing Applicability of Venture Capital.

Venture capital has become a pillar of investment to facilitate innovation in the successful technology and digital economy in Malaysia. As the government takes steps to promote entrepreneurs, fintech, e-commerce, and renewable energy startups are not only gaining popularity with VCs.

Riverstone Training’s venture capital training workshops KL introduce professionals to the nuances of early-stage investing. The participants inquire on how venture capitalists assess disruptive business models, gauge scalability, as well as risk management in high-growth settings. Other necessary skills include cap table organization, term sheet negotiation, and exit planning by either IPOs or acquirions- knowledge that is vital to anyone working the Malaysian ecosystem in the startup sector.

What the Masterclass Covers

Advanced Private Equity and Venture Capital Training

The advanced PE and VC training Malaysia program at Riverstone is designed for professionals who want to move beyond theory and gain actionable insights. Its curriculum has modules on deal sourcing, financial modeling, valuation techniques, and post acquisition value creation. Real Malaysian and regional deals case studies are also included to make sure that the participants have insights into the local market situation.

Another peculiarity of this program is the emphasis on practical simulations. The participants are involved in role-play activities where they negotiate term sheets, structure leveraged buyouts as well as assess exit strategies. These interactive sessions train the participants on the real world pressure of making investment decisions.

Who is to be present at the Masterclass?

The masterclass will be designed to suit a wide range of viewers in the field of finance professionals, corporate executives, and entrepreneurs. The training will be of invaluable value to investment analysts and associates working in the private equity or venture capital firm to fast track their career advancement. The knowledge can be used by corporate finance managers, business development executives and consultants to pursue M and A strategies and to analyze investment opportunities.

The entrepreneurs who need capital also gain as they learn to think, negotiate, and construct transactions as PE and VC firms. This understanding will enable them to match their business plans with the expectations of the investors, and this will eventually enhance their success in raising funds.

Benefits of Attending Riverstone’s Program

Market Opportunities and Career Benefits.

The masterclass is of great benefit in improving the marketability of a professional. The financial sector in Malaysia has seen its employers put more importance on candidates who have acquired high knowledge in the area of private equity and venture capital. The students of the program at Riverstone place themselves in positions of Investment Analyst, Private Equity Associate, Venture Capital Manager, or Corporate Development Director.

Multinationals, sovereign wealth funds, and local investors, such as Khazanah Nasional, Ekuinas, and Gobi Partners, also hire professionals who specialize in PE and VC on a regular basis. Through a specialized knowledge, the participants would be in line with the hiring requirements of some of the most influential investment organisations in Malaysia.

Application Skills to the Real World.

The best advantage of the program is that it focuses on the practical part of it. The participants do not just study technical instruments such as valuation modeling and risk analysis, but also acquire soft skills that can lead to the success of investment. The curriculum incorporates effective communication and negotiation as well as stakeholder management to equip professionals with the ability to perform well in the high-stakes deal environments.

Also, the participants are able to access a community of network of peers and trainers who have a wide industry experience. The network is an excellent resource to achieve collaboration, mentorship, and future career opportunities, which will be beneficial even after the completion of the program.

PE and VC Future in Malaysia.

Increasing Demand of Expert Professionals.

Since Malaysia is becoming a location of choice in Southeast Asia, where the private equity and venture capital is concerned, the need in the population of skilled professionals will only expand. As more funds are raised and more and more cross-border deals are being made, there is an opportunity available to those professionals at all stages of their career. It is the individuals who arm themselves with specialized trainings in the present that are likely to be the future heads of investment firms, advisory houses and corporate finance departments.

International Accessibility and Employability.

The competencies acquired in the masterclass of Riverstone are not confined to Malaysia. This makes the industry of private equity and venture capital worldwide and professionals that have good technical skills and experience in dealing are required within the Asian Pacific, Middle East region and other continents. Through the advanced training, the participants do not only enhance their career opportunities at the local level, but they are also able to move freely to seek opportunities abroad.

Conclusion

In a business environment that is more and more dominated by global ventures like private equity and venture capital, it is impossible to afford professionals to be left behind. The professional KL, venture capital training workshops KL and advanced PE and VC training Malaysia have offered the ideal environment to gain the skills, confidence and network required to be a success.

To practitioners in Kuala Lumpur and the rest of the world, this masterclass is more than an investment in education but a career-defining move. With the ability to handle the complexities of PE and VC, participants would be at the pinnacle of the investment future in Malaysia.