Best Private Equity and Venture Capital Training in Manila – Riverstone Training

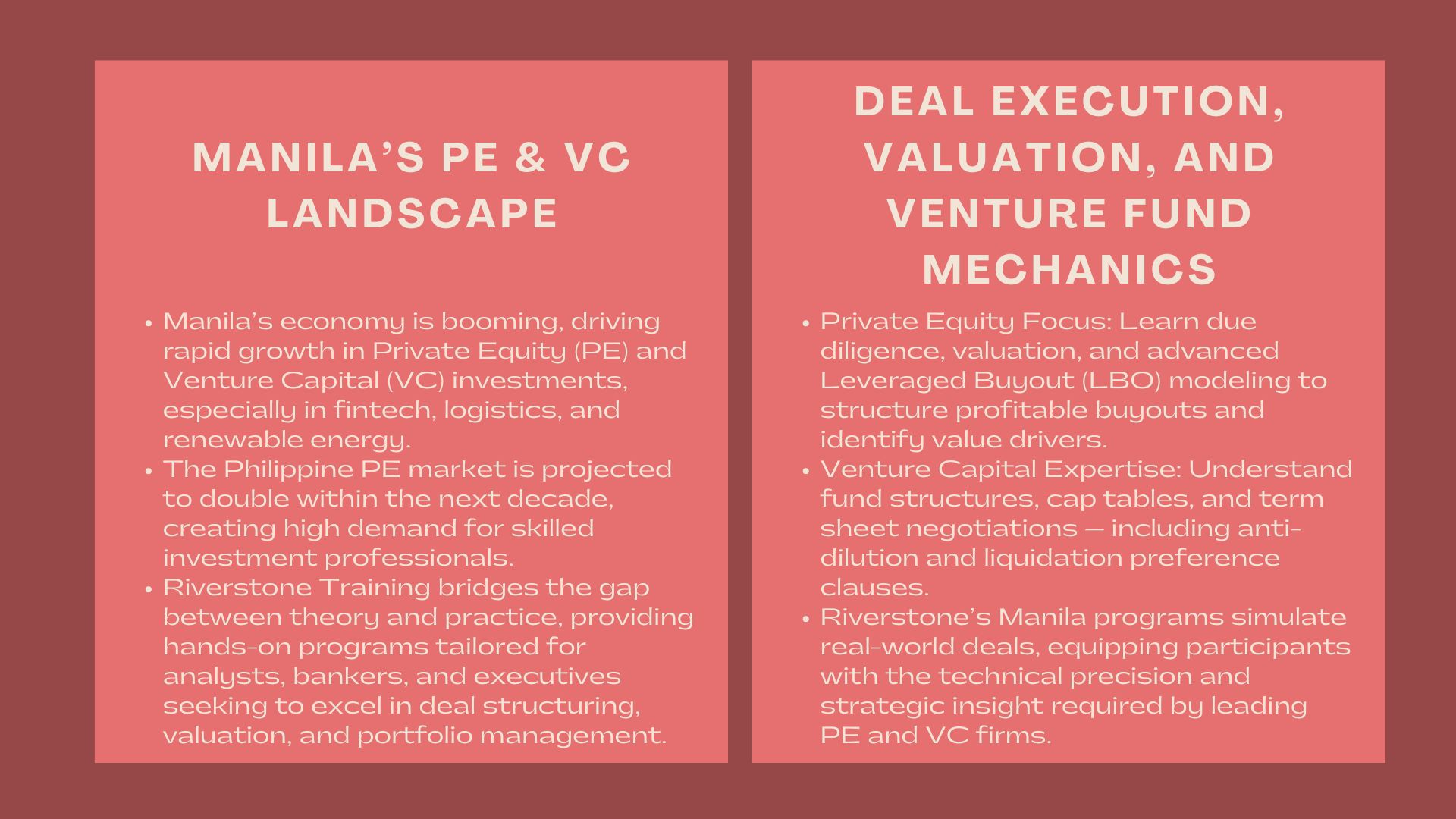

Investment in the city of Manila is experiencing an epic acceleration and it is fueled by a robust economy and an influx of funds into the mid-market and the thriving startup ecosystem. The need to find advanced investment professionals has never been greater with the Private Equity (PE) market in the Philippines estimated to grow twice over the next eleven years and with Venture Capital (VC) usage surging in the areas of fintech, logistics, and renewable energy. Strategic success in the industry does not solely involve financial modeling, it involves control over the whole investment life cycle; that includes diligent due diligence and deal structuring, value creation, and effective exit planning.

To financial analysts, investment bankers, and corporate strategy executives in Manila, achieving specialized knowledge in this asset class is the most obvious way to make it up the career ladder. Riverstone Training provides practitioner-based programs with intensive training tailored to fill the divide between the classroom learning and the complicated real world practice needed by the top firms in PE and VCs. This article shall outline how our training opens up executive level opportunities, with those specific skills required to operate deals, growth of the portfolio, and your role in the most profitable part of the Philippine financial market.

Investment Lifecycle The High Stakes Deal Execution Skills.

The essence of the Private Equity / Venture Capital job is to create and capture value over multi-year periods. The professionals should have an all-inclusive skillset encompassing market intelligence, technical financial engineering, and operating strategy.

Learning how to perform Due Diligence and Valuation in Buyouts.

In the Private Equity arena, where companies are buying companies and conducting growth equity transactions, two fundamental capabilities are essential: valuation and due diligence. Standard DCF models no longer suffice, analysts have to learn how to do complex leveraged buyouts (LBO) modeling which involves complex debt structuring, capital waterfalls, and sensitivity analysis.

Such technical expertise is coupled with due diligence which entails being able to probe the financial statements, legal conformity and feasibility of operations of a target company- a process that cannot be compromised before committing huge amounts of money. Our targeted Private equity courses for professionals Manila focus intensely on simulating this entire process, ensuring participants can accurately price a deal and identify key value creation levers before the transaction is even closed. It is this control of the deal mechanics that makes a support analyst and a decision making associate different.

Venture capital Fund Mechanics and Term Sheet Negotiation.

The Venture Capital market is confronted with other challenges, which are high growth, technology disruption, and risk management. In this case, practitioners must have an advanced knowledge of fund structures, capital tables (cap tables), and complex legal terminology of term sheets. As a VC Associate, one should also possess expertise in applying the Venture Capital Method to the valuation of a pre-revenue start up and negotiating such terms as anti-dilution clauses and liquidation preference, which have a major part in fund payoffs.

Our specialized Venture capital training workshops Manila provide hands-on experience in these critical areas, teaching participants how to structure deals that protect the firm’s downside while maximizing its share of the upside upon exit. Given the Philippines’ thriving fintech and e-commerce startup ecosystem, this expertise is highly sought after by local and regional VC funds looking for talent to manage their rapidly growing portfolios.

Riverstone’s Edge: Operational Value Creation and Risk Management

Riverstone Training has a niche in that it pays attention not only to deal closing but to the post-acquisition process: operational value creation, and management of systematic risk, which are the primary returns drivers in current PE/VC.

Value Creation and Portfolio Management Strategies.

Most valuable professionals in the PE/VC industry are those who can make buildings improvements in the operations in portfolio companies. This is done through the establishment and tracking of key performance indicators (KPIs), financing and cash management approaches, and strategizing the company to someday exit, usually by an IPO or M&A sale. Our Advanced PE & VC training Manila programs delve into this portfolio management phase, teaching participants how to utilize operational benchmarking, apply governance frameworks, and align management incentives (e.g., stock options, earn-outs) to achieve the fund’s investment thesis. This value creation emphasis is pivotal, in that the professional is converted into more of hands-on operator and strategist and not merely a financier.

Quantifying Risk and Integrating ESG.

The trend in the world towards sustainable investment has deeply infiltrated the Philippine market in regard with investments in renewable energy and infrastructure. The current PE/VC practitioners are supposed to incorporate Environmental, Social, and Governance (ESG) in their investment process, and this is critical in soliciting capital with development finance organizations and huge pensions.

We fill this gap in our curriculum by learning how to quantify risk at a high level, demonstrating how to stress-test portfolio returns to geopolitical instability and currency fluctuations, and novel regulatory risks, which are crucial inputs to investment in the Philippine market. By having command of such a comprehensive view of risk and sustainability, our graduates are then uniquely competitive in obtaining high-level roles based on resilient, long-term investments.

The Job Market Advantage: How to get Elite jobs in Manila.

Riverstone Training has a technical expertise that is highly correlated with positions in the most prestigious financial institutions and investment firms in the Philippines.

Key Employers Proactively Hiring: The most sought-after jobs are with the large universal banks such as BDO and Metrobank, international firms that have Manila branches such as JPMorgan Chase, and companies in the region who manages global PE/VC clients such as Infinit-O and IQ-EQ. Moreover, local investment companies and big conglomerates such as Ayala Corporation and Filinvest Development are also regularly recruiting in their corporate development and internal funds.

Top-Paying Job Titles: Graduates will be placed into positions like Investment Analyst (PE/VC), Fund Accounting Associate ( Private Equity), Deal Specialist and Corporate Strategy Manager. These positions are able to provide fast track career growth where a person is exposed to some intricate transactions thereby getting them on the track to hold top positions in just a few years. Through such specialized training, the professionals will have a distinct set of skills known internationally and appreciated back at home.

Conclusion: Best Private Equity and Venture Capital Training in Manila

PE and VC sectors provide the most vibrant and lucrative career in Manila which spurs innovation and expansion within the Philippine economy. System expertise needs expertise, practice, which spreads not only through deal initiation, sophisticated financial modeling, and operational control. Riverstone Training has the advanced, expert based training required to succeed in this competitive industry. With our programs, you acquire skills, confidence, and credibility that will enable you to make deals with high stakes, and as your career progresses, so does the level of Investment in the Philippines.