Portfolio Monitoring and Performance Evaluation Training for Fund Managers

Introduction to Certified Portfolio Monitoring Course

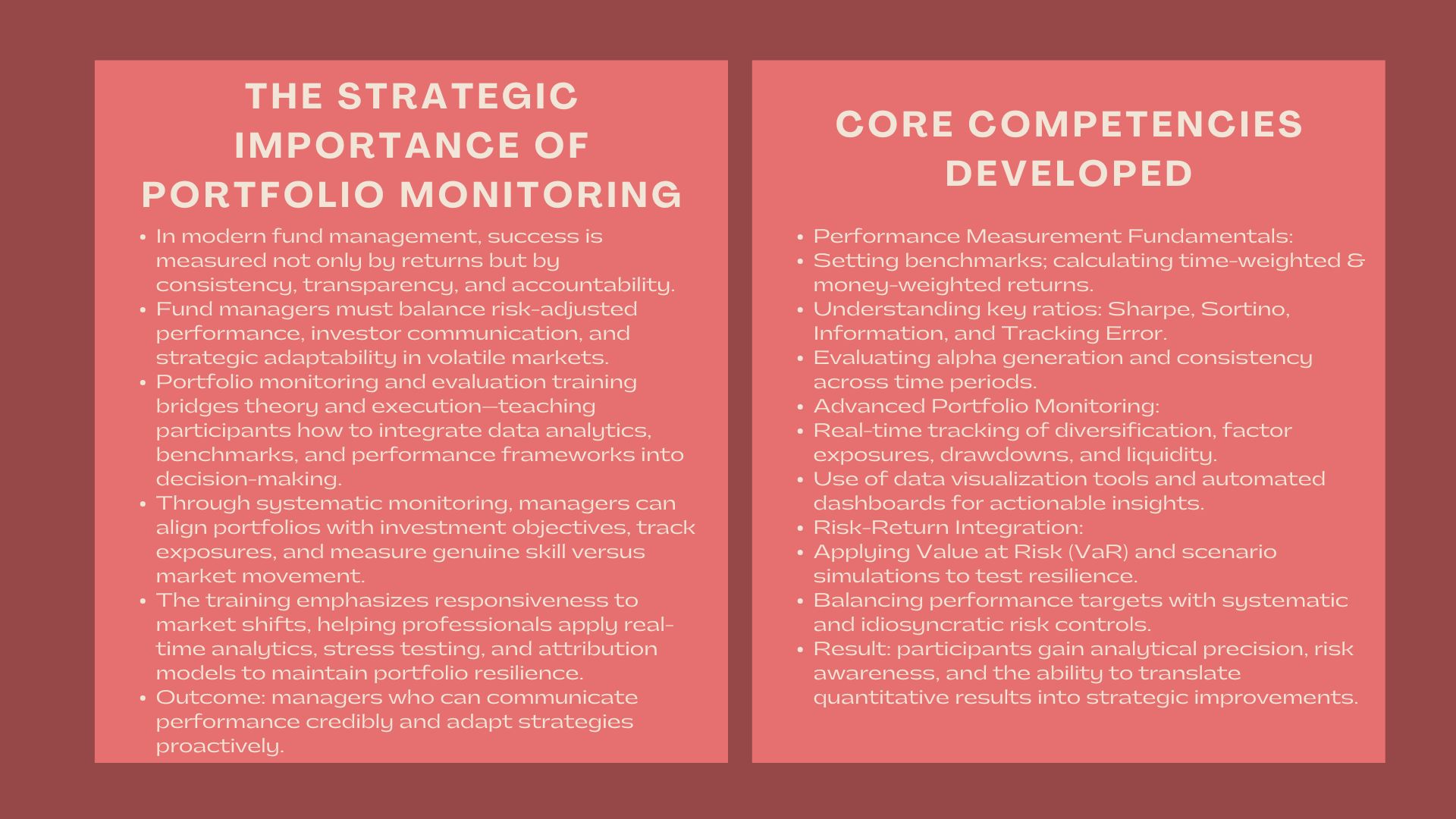

The keys of sustainable fund success in the competitive world of investment management are performance measurement and portfolio monitoring. In addition to making returns, fund managers are now required to create consistent performance, communicate effectively with the investors, and be flexible to changing situations in the market. This will involve a systematic system to monitor portfolio wellbeing, to measure risk-adjusted performance, and to reconcile outcomes and strategic investment objectives.

A specialized fund portfolio performance monitoring and reporting training helps professionals bridge the gap between portfolio management theory and real-world execution. These programs are a blend of quantitative approaches, analytical tools and performance reporting methods that allow fund managers to make decision that are data driven and manage the expectations of investors and ensure that they remain on track with world performance standards.

The Emerging Significance of Portfolio Management in Contemporary Fund Management.

Between Generation Return and Generation Accountability and Transparency.

Fund management is no longer measured on returns alone-it is also measured on consistency, transparency as well as accountability. Investors are now in need of information regarding the manner in which the results are attained, the risks involved and whether performance is in accordance with the mandated performance.

Portfolio monitoring and evaluation training helps managers to approach portfolio exposures, benchmark tracking, and reporting results in a systematic manner that reflects the actual skill involved in making investment decisions and not market fortuity.

Adjusting to the Unstable Market environments.

Investments around the globe are uncertain like never before- geopolitical bursts, inflationary trends and interest rates may ruin even well thought out portfolios. Through an asset management and fund performance evaluation workshop, participants learn to integrate real-time analytics, scenario testing, and attribution modeling to anticipate risks and adapt strategies swiftly.Monitoring key performance indicators (KPIs) enables managers to ensure portfolio resilience to ensure that the capital of investors is not lost by market fluctuations.

Basic Competencies Gained during the training in Portfolio Monitoring and Evaluation.

Creating a Strong Performance Measuring Framework.

The participants start with learning the basics of portfolio analysis- knowing what it takes to have truly generated alpha and what is meant by isolating skill and market exposure. Training modules normally involve:

- Planning benchmarks and the right performance measurement.

- Computing time-weighted and money-weighted returns.

- Knowing tracking error, information ratio and Sharpe ratio.

- Evaluation of consistency of performance across time periods.

These competencies are the foundation of successful fund management and they assist managers share valuable performance information with stakeholders.

Installation of Advanced Portfolio Monitoring Systems.

As financial instruments and asset classes grow more complicated, they have become a requirement to monitor them in real-time. Training programs instruct the participants on the design of systems to monitor:

- Diversification and asset allocation ratios.

- Exposure to factors and portfolio beta.

- Drawdowns, volatility and liquidity profiles.

- Meeting investment requirements and risk tolerance.

Using technology and data visualization, the fund managers are able to turn the raw data on performance to actionable intelligence which will help in making both strategic and operational decisions.

Associating Performance and Investment Decisions.

On top of measurement, the training of evaluation focuses on interpretation. The participants are taught to relate the results of performance to particular decisions of investment and to see what was good, what was not, and why.

This model enables managers to optimize investment procedures, modify portfolio weights, and enhance decision-making in the future with the help of constant feedback loops- data analysis will be turned into real performance enhancement.

Combining Risk Management and Performance Monitoring.

Finding the Balance between Return and Risk Objectives.

The management of risk is as important to good portfolio monitoring as the search after returns. Training assists professionals in evaluating risk-adjusted performance where different measures like Sortino ratio, VaR (Value at risk) and beta-adjusted returns have been utilized.

Fund managers are taught how to measure the exposure to systematic and idiosyncratic risks to keep the portfolio within their investment goals and risk tolerance.

Testing Stress and Simulation of the Scenario.

Scenario analysis is also a part of workshops, to investigate portfolios in relation to economic shocks or changes in policies. The ability to simulate adverse conditions enables managers to determine the drawdowns, rebalancing strategies, and the effectiveness of hedging to be tested in advance when the crisis has not yet happened.

Such proactive strategy reinforces the portfolio resilience and confidence of the investors.

The Importance of Level of Technology in the Evaluation of Modern Portfolios.

Information Synergizing and Automation.

Portfolio management in the digital age is very dependent on automation. The participants get to know how to combine various sources of data, such as custodians, brokers, and pricing services, into central monitoring systems.

Automation does not only increase accuracy, but also allows time to be used in more sophisticated analysis and planning. Portfolio data is kept up-to-date and can be audited by using real-time dashboards, APIs, and reporting tools.

Innovative Analytics and artificial intelligence.

State-of-the-art programs expose the participants to predictive analytics and machine learning as performance evaluation methods. These tools assist in the detection of the obscure correlations, predicting the performance trends, and the signs of the early warnings of underperformance or the concentration risk.

Fund managers have a better insight into the management of complex portfolios by using human judgment together with quantitative analysis.

Performance Reporting Turning Data into Investor Insight.

Writing Clean and Shareholder-Oriented Reports.

Reports on performance are not just documents of compliance, they are a form of communication that builds investor confidence. Training focuses on developing the reports, which are well structured in articulating strategy, results, and future prospects.

Professionals are taught the best practices when it comes to the manner to present the performance attribution, benchmark comparisons and portfolio changes in a manner that will be appealing to the institutional investors and LPs.

Realigning Reporting and Global Standards.

Some of the frameworks that are discussed by participants include Global Investment Performance Standards (GIPS) and best practices in the industry in regard to disclosure and ethics. Knowledge of such guidelines also makes reports accurate but comparable and credible across markets.

Storytelling Using Performance Data.

Numbers do not give the whole picture. Training highlights the performance storytelling which is the art of explaining the results of investments in the context of market movements, strategic decision, and prospective outlook.

This narrative approach will enable fund managers to build relationships with investors and stand out in an otherwise competitive market.

Uses in Sectors of Investments.

Mutual Funds and Institutional Portfolio.

Portfolio monitoring systems are used to assist mutual fund managers to maintain the consistency of the benchmark, to gain control over the tracking error, and to ensure that the investment restrictions are adhered to. Meanwhile, institutional investors use the same tools to assess external management, and compare the performance of funds across mandates.

Investing in the Alternative and Private Equity.

Performance analysis on alternative assets looks at internal rate of return (IRR), cash flow analysis and timing of distribution. Training assists the professionals to standardize the reporting practices, and bring the metrics in line with the investor expectations, which is essential to drawing and keeping capital.

ESG Sustainable Investment Funds.

As the sustainability metrics become more and more significant, there are training courses on the integration of ESG data into the portfolio overview as well. The participants get trained to assess not only the financial performance but also on environmental and social impact performance- holistic evaluation of funds.

The major advantages of Training in Portfolio Monitoring and Evaluation.

Enhancing Analytical Rigor

The participants would be well equipped with the techniques of quantitative performance as well as the qualitative evaluation in order to make a decision as well as optimize the portfolios based on data.

Developing Investor Trust.

Open, dependable and regular reporting develop confidence in the clients and investors- the secret of long term relationships and fundraising.

Enhancing Strategic Management.

With constant checks and feedbacks, fund managers are able to notice the shifts in performance at an early stage, change the strategies in time, and maintain the competitive advantage in a rapidly changing market.

Who Needs to enroll into these programs.

The training will be needed among:

- Investment managers and investment funds aiming at enhancing supervision.

- Risk officers and performance analysts that are related to reporting and attribution.

- External fund managers are assessed by institutional investors.

- Data accuracy and reporting standards compliance and the work of operations teams.

In addition to the experienced professionals, new fund managers enjoy the advantages of getting structured frameworks and sophisticated tools to bring their performance management practices to a new level.

Conclusion

Portfolio monitoring and performance evaluation are no longer an option in an investment environment characterized by volatility, transparency, and data abundance but it is a necessity to the success of a fund. Having learned the schemes and instruments discussed in a fund portfolio performance monitoring and reporting training, professionals will have an opportunity to quantify the executions accurately, communicate, and initiate strategic enhancement.

Fund managers, through an asset management and fund performance evaluation workshop, do not only get to know how to read the results, but also how to make sense of the insights and move them into action – to make numbers stories and performance progress.