Private Equity Training Programs: Deal Structuring and Valuation Techniques

Introduction: Expert Course on PE Deal Techniques

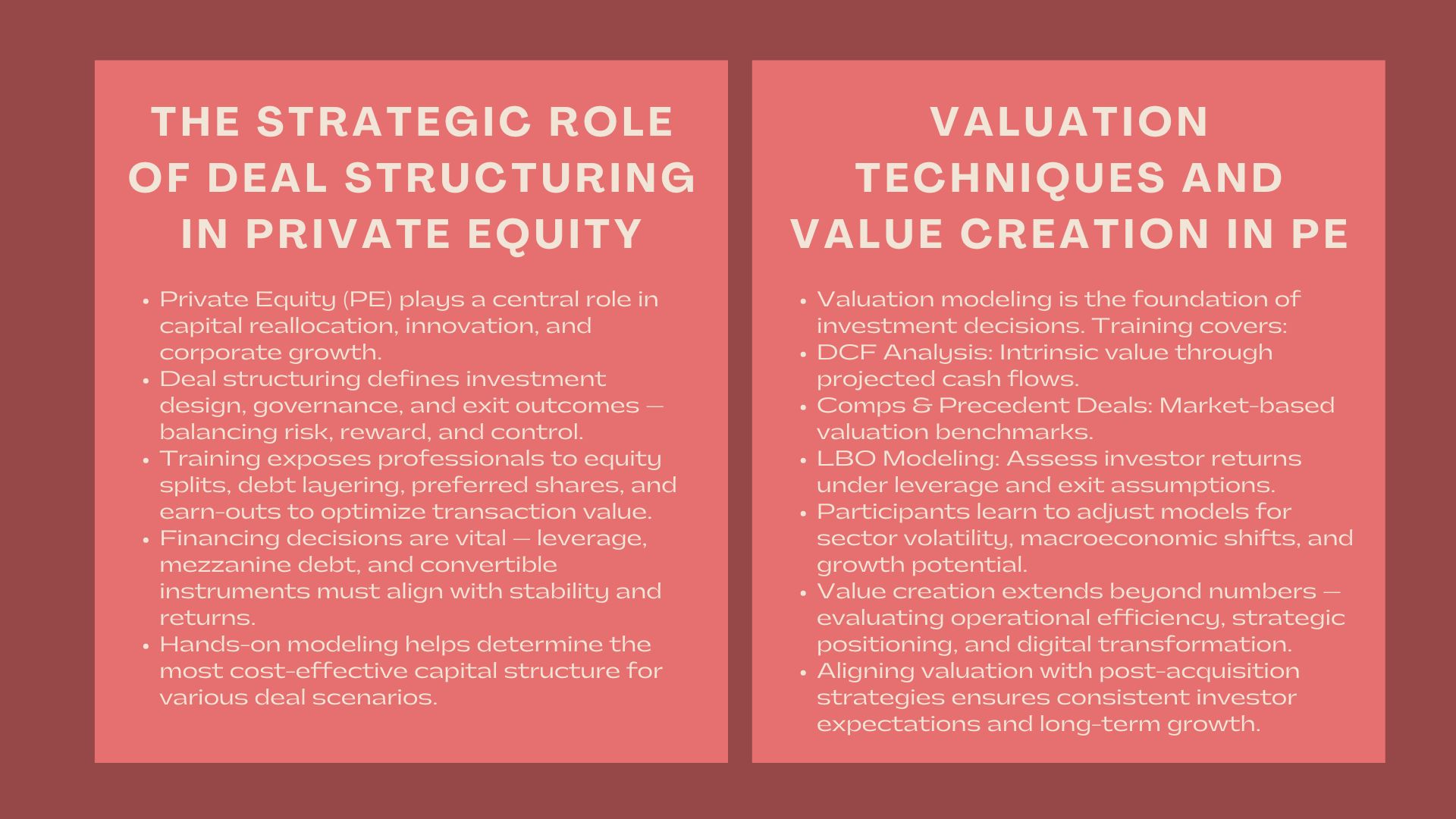

In the corporate growth, innovations as well as reallocation of capital, in the industries, the role of private equity (PE) remains central. The capability of structuring deals and appraising investments in the most accurate way to do so has become a hallmark of professionals in the field of finance as competition continues to increase. Thorough-going training programs in private equity include the skills that allow the individuals to negotiate the intricacies involved in deal structuring, valuation modelling and portfolio optimization.

As an aspiring associate or a veteran investment practitioner, these ideas are the ones you will study to gain the analytical and strategic knowledge that will make you your success in the private markets.

Strategic Role of Deal Structuring in Private Equity.

Developing the best transaction structures.

Deal structuring determines the manner in which investments are undertaken, financed as well as governed. It entails risk/benefit balancing, bargaining and coordinating the interests of both investors and management staff. During a training course to structure and model valuation of a unique deal in private equity, the professionals are exposed to the transaction design techniques such as equity splits, debt layering, preferred shares, and earn-out mechanisms.

The type of structure adopted directly affects the cash flows, control rights and exit results. Given the different structures like leveraged buyouts (LBOs), growth capital investments, and management buyouts (MBOs), the participants get to understand how to structure each transaction to maximize the value of the investor whilst addressing the risks present on the down side.

Capital and Financing Decision Management.

Funding is a deal success pillar. The decision of the amount of leverage that a target company can maintain without affecting its stability is one that should be evaluated by the professionals of the private equity. The training programs provide the participants with the deeper capital structure optimization techniques such as mezzanine financing, convertible instruments and subordinated debt.

Through the combination of financial modeling and strategic decision making, trainees are taught to determine the most cost-effective financing structure to be used in the various transaction situations.

Understanding Valuation Techniques in Private Equity

Fundamentals of Valuation Modeling

Valuation serves as the basis for investment decisions. In PE, valuation is not limited to static models—it requires flexibility, strategic foresight, and the ability to assess multiple exit scenarios. Workshops focused on advanced private equity investment and deal analysis workshop guide professionals through various valuation techniques such as:

- Discounted Cash Flow (DCF) Analysis: Intrinsic value estimation based on actual projections of the free cash flows and discount rate.

- Similar Company Analysis (Comps): Relative Valuation Multiple- The agreement of the other companies to determine the valuation multiple.

- Precedent Transaction Analysis: Use of the past deals to assess market trends and pricing standard.

- LBO Modeling: ascertainment of returns to investors as per various leverage and exit assumptions.

These are the models which support the analysis of deal and deal negotiation. The participants also get to know how to manipulate assumptions to suit the market conditions, volatility in the sector and macroeconomic risks.

Value Creation Strategies Incorporation.

The concept of valuation in the context of a private equity is not limited to financial measures, as it also incorporates the evaluation of operational efficiency, positioning, and growth opportunities. The participants are trained to recognize and measure the opportunities of creating value by reducing costs, transforming into digital, and increasing revenue.

This comprehensive strategy will allow professionals to make valuation outcomes consistent with post acquisition strategies and investor expectations.

Basic Elements of a Complete Program in Private Equity training.

Transaction Lifecycle Analysis.

There is an extensive training program, which deals with the entire range of the private equity investment process- sourcing of a deal to exit. Participants learn through case studies of the real world simulating the process of finding potential targets, doing due diligence, negotiating terms and closing deals.

Knowing each stage step by step, professionals will be able to have a full picture of the capital flow throughout the investment process and value creation at each stage.

Financial Scenario Simulation and Financial Modeling.

Real world modeling is a critical component of private equity education. The participants are taught to create dynamic Excel based models capable of evaluating the performance of investments under different assumptions. Sensitivity analysis, debt repayment schedules, and the projections of returns can be modules.

The scenario based exercises enable the participants to experiment with the effect of varying revenue, margins, or interest rates on the internal rate of return (IRR) and cash-on-cash multiples. This applied aspect assists in closing the divide between the theoretical knowledge and practical decision-making.

Risk Assessment and Due Diligence.

Prior to sealing every transaction, the private equity experts perform due diligence due diligence to access financial, legal, and operational risks. The training programs highlight the need to detect red flags at the earliest, capability in management, and confirmation of assumptions on the targets.

The participants also understand well-organized systems of due diligence reporting where all the possible risks are calculated and effectively reported to investment committees.

Skills and Competencies that are gained as a result of training.

Improving Analytical and Strategic Thinking.

It is the role of the private equity individuals to critically analyze data and decipher how they can be applied to create value. Training will help the participants to improve their correlation between financial results and strategy. Exercises and discussions help them to perfect their ability to spot investment opportunities, estimate risk-adjusted returns, and evaluate various exit strategies.

Improving Negotiation and Communication.

The deal structuring is usually a complicated negotiation with the management teams, lenders, and co-investors. These negotiations are replicated in training programs, which assist participants to acquire persuasive communication and strategic reasoning skills. One of the major results of such workshops is how to negotiate win-win situations without compromising the interests of the investors.

Building Confidence in Financial Decision-Making

A private equity deal structuring and valuation modeling training course builds confidence by reinforcing practical applications of financial modeling, valuation, and transaction analysis. Participants come out better to make decisions based on data to make investment decisions and to defend their suggestions to senior stakeholders.

Professional and institutional Benefits.

In the case of Individual Participants.

The training of the private equity also benefits professional credibility and career mobility to a great extent. Certified individuals are skilled persons with high levels of analysis, and a good knowledge of the basics of investments. These qualifications usually result in the investment banking, corporate development, and portfolio management.

For Investment Firms

The training programs equip firms with well equipped professionals who can effectively contribute to deal sourcing, analysis and execution process. Improved skill sets lead to improved risk management, quicker decision-making process and better deal outcomes. In addition, together with the standardized training, the quality of analysis is unified in teams.

New Trends that define training in the field of private equity.

Emphasis on ESG Integration

The environmental, social, and governance (ESG) factors are becoming more and more important in the decision-making of investments. Assessment of ESG risks, measurement of impact and incorporation of sustainability into valuation framework are now being included in training programs. When professionals are aware of these dimensions, they will be at a better place to deal with reputational risks and seize new opportunities.

Digital Investment Analysis Transformation.

The use of technological platforms like data analytics, AI-based valuation sites, and automated modeling is changing the face of the private equity industry. These innovations are brought about by modern workshops, where the participants can exploit technology to evaluate their deals faster and more accurately.

Internationalization of Private Equity Markets.

Due to the rising cross-border investments, professionals are required to know a variety of regulatory environments and market dynamics. Training programs in these complexities cover the complexities through deal structure and currency risk management strategies internationally.

Conclusion

The training programs of private equity are not simple to acquire technical knowledge, they can also be seen as a framework to make strategic decisions, handle risks, and create values. Deal structuring, valuation modeling, and investment analysis help the professionals make wise decisions that can lead to and generate high returns and long-term growth.

To individuals who want to develop their careers or to improve investment potential of their respective organization, specialized training is one of the best investments in the current competitive financial environment.