A Hacks For Petty Cash Accounting.

A Hacks For Petty Cash Accounting.

Petty cash is the small amount of money reserved on hand to repay for minor expenses, like reimbursements or office supplies. A petty cash fund will undertake periodic settlements, with transactions documented in the financial statements.

A petty cash fund can be a box with a minor amount in each section for larger organizations.

Petty cash transactions deliver convenience for small transactions for which issuing a check is unacceptable or irrational. The small amount of cash that a company deliberates petty cash will vary, with many companies keeping between a minimum of $100 to $10,000.

Examples of works that a petty cash fund used for are:

- Cards for clients

- Office provisions

- Paying for lunch for employees

- Repaying an employee for travel or meeting expenses

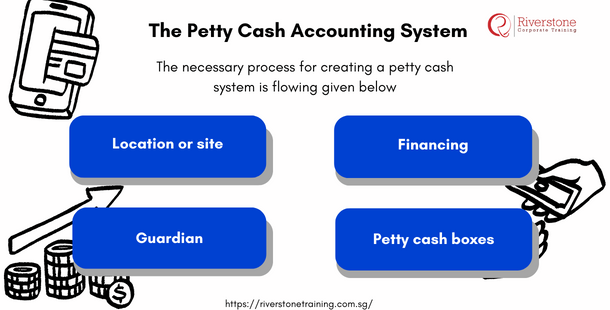

The Petty Cash Accounting System

A petty cash system is a system of procedures, controls, rules, and events that a company uses to distribute cash for various miscellaneous requirements, such as office provisions and facilities. The necessary process for creating a petty cash system is flowing given below:

- Location or site:

companies where petty cash funds are made decided upon the need and urgency. It will depend on organization policy; there may be a single organization or one per every department separately.

- Guardian:

These are generally administrative staff, who are working on Adhoc issues of the company regarding manage most of the day and have enough clerical skills to continue the essential record-keeping with a higher level of accuracy.

- Financing:

Financing will depend upon the size of the department as well as the petty cash funds. There is a high risk of theft of petty cash, so it is better not to create a sizeable petty cash fund. Smaller, little money is valuable and refilled more frequently. Professionals aiming to enhance their financial oversight and risk mitigation knowledge can benefit from advanced finance skills training Singapore courses that focus on internal control, budgeting, and cash management.

- Petty cash boxes:

Company set up safe petty cash boxes with a supply of petty cash vouchers.

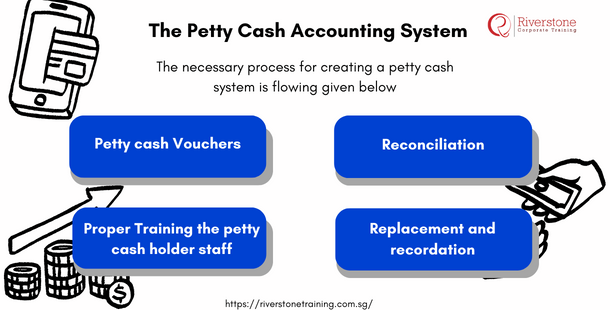

- Petty cash Vouchers:

Staff can purchase petty cash vouchers from the office supply store according to department needs.

- Proper Training the petty cash holder staff:

petty cash guardians should be adequately trained, estimate requirements for releasing petty cash, how to fill out vouchers correctly in exchange for cash payments, and when to appeal additional money when cash in hand is low.

- Reconciliation:

The accountant periodically inspects the cash in hand and creates receipts in each petty cash box to examine if the total amount matches the original amount of funds customary for the table and reconcile any modifications.

- Replacement and recordation:

Endorse is when the cashier refills the amount of cash in the petty cash box, as demanded by the petty cash guardians. That involves summarizing and recording all expenses in the general ledger.

Your Key to Tight Petty Cash Control and Easy Reconciliation

Although this is convenient, petty cash should be well controlled to avoid any loopholes and possible abuse. In this article, attention would be paid to the Imprest System, which is the most efficient and frequently used strategy used in the management of petty cash funds in businesses in Singapore. We will disassemble this system: how to set a set amount of this fund and how necessary are documented payments, as well as the most important step of returning funds to their initial value. Knowing the imprest system and using it allows you to know that your petty cash is always balanced, facilitates your reconciliation and your internal controls against fraud are solid and will make your audit a breeze. For those looking to build stronger control practices and financial oversight, joining a finance skills development program Singapore professionals trust can provide essential knowledge for better decision-making and compliance.

Essential Internal Controls to Prevent Petty Cash Fraud

By definition, petty cash is prone to misuse in case it is not managed correctly. The information would explore the pragmatic internal controls towards protecting petty cash funds of businesses in Singapore through the implementation of such controls to deter fraud. Our major lines of defense will be including a trusted custodian, establish a limit on the amount of money that can be spent in one transaction, demand a full receipt on all the disbursements and have regular and unexpected reconciliation by an outsider. These solid control procedures that are important to good governance hold people in check and safeguard the assets of your company and provides you with a sound night sleep whilst allowing your operations to be flexible. Understanding how to use managerial accounting effectively can further strengthen your internal control environment by linking spending habits to budgeting and oversight systems that align with broader financial goals.

Example of Petty Cash Accounting:

Company ‘XYZ’ formed a petty cash fund of $1000 on Jan 1, 2021. The journal entry will be:

| Petty Cash | 1000 | |

| Cash at Bank | 1000 |

In January 2021, the following payments made from the petty cash box:

| Office general Supplies | $400 |

| Highway toll tax | 40 |

| Postage fee | 40 |

| Freight-In | $250 |

The entries to record the about expenditures from petty cash is on the journal are:

| Office general Supplies | 400 | |

| Highway Toll tax | 40 | |

| Postage fee | 40 | |

| Freight-In | 250 | |

| Petty Cash | 730 |

The company refilled the fund $730. The journal entry will be:

| Petty Cash | 730 | |

| Cash at Bank | 730 |

Conclusion:

Petty cash is one of the essential needs of a company to perform a day-to-day activity. An organization must integrate satisfactory control to lessen the risks of stolen petty cash or improper reimbursement. To reinforce internal controls and employee training, many firms now invest in custom elearning course development Singapore providers to deliver tailored training modules that reduce misuse and improve financial accountability.

A Hacks For Petty Cash Accounting.

A Hacks For Petty Cash Accounting.