The Anatomy of Weighted Average Cost.

In finance, the Weighted Average Cost method of inventory assessment customs a weighted average to regulate the volume that goes into inventory and COGS. The weighted average cost method boundaries the cost of products available for sale by the number of units accessible for sale.

Weighted Average Cost Formula

The formula for the weighted average cost is as follows:

The costs of goods available for sale are opening inventory value plus purchases, and units available for sale are the number of units a company can sell to its customer or clients.

Understanding Costs of Goods Available For Sale

The bundling of costs referred to as the cost of goods available for sale. The prices of products available for purchase are either allocated to COGS or ending inventory. Assigning the prices of products available for sale is mentioned as a cost flow statement.

There are numerous cost flow assumptions, such as:

Overview of Weighted Average cost

The weighted average method is castoff to allocate the average cost of production to a product. Weighted average costing is generally used in situations where:

- Inventory items are so intermixed that it is difficult to assign a specific cost to a separate unit.

- The accounting system is not adequately sophisticated to track FIFO or LIFO inventory layers.

- Inventory items are so commoditized that there is no other way to assign a cost to a separate unit.

The weighted average method divides the product’s value for sale by the number of units available for purchase, which yields the weighted average price per unit. In this calculation, the cost of products available for sale is the totality of launch inventory and total purchases. The then weighted-average figure to assign a value to both finish inventory and the cost of product sold.

Example of the WAC

At the starting of its financial period, Mr. Happy holds 300 units at the cost of $10 per unit. In the first quarter company made these entries:

- purchase of 100 units for $20 in January = $2,000

- purchase of 200 units at the cost of $15 in February = $3,000

Besides, the company made the following sales:

- January sales of 100 units

- March sales of 70 units

Under the inventory system, the company would determine the cost of products for sale and the units for sale at the end of the first quarter:

For the sale of 170 units on the quarterly sale period, allocate that $13.33 per unit sold.

The remaining stock would go to the ending inventory. So:

- 170 x 13.33 = $2,667 are the cost of goods sold

- 8000 – 2,667 = $5,733 is ending inventory

Under the continuous inventory system, we determine the cost before the sale of units.

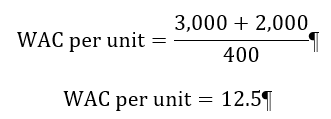

Therefore, before the sale of 100 units in January, our average would be:

For 100 units sale in January, the costs would be :

- 100 x 12.5 = $1,250 in Cost of goods sold

- 5,000 – 1,250 = $ 3,750 remaining inventory

Before the sale of 70 units in February, the company average will be:

For 70 units sale in March, the costs assigned as follows:

- 70 x $13.5 = $945 in cost of goods sold

- $6,750 – $945 = $5,805 in ending inventory

Conclusion

The Weighted Average Cost method of inventory assessment is the best tool to weighted average and determines COGS and inventory. It is helpful to understand the total yearly inventory and record precisely the amount of stock.