What is Amortization?

Amortization is the process of distributing the cost of an intangible asset over a certain period, which is usually the duration of the useful life of that intangible asset. Patents, trademarks, and copyrights are examples of valuable intangible assets that a company may acquire by incurring an expense.

How to Calculate the Amortization of an Asset

If a company acquires the exclusive rights for ten years to manufacture a new product from the patent holder by paying $10 million to the inventor, this expense should be amortized over the ten years. The straight-line method of amortization leads to the company having an amortization expense of $1 million per year to be recorded in the company’s income statement. This scenario is a great example for those understanding income statements for beginners Singapore, as it shows how long-term intangible assets like patents impact annual expenses and net income reporting.

The same calculation method is used to amortize expense if a pharmaceutical company acquires the exclusive rights to manufacture a patented drug newly approved by the Food and Drug Administration, aligning closely with how the cost of goods manufactured explained in pharmaceutical production accounting.

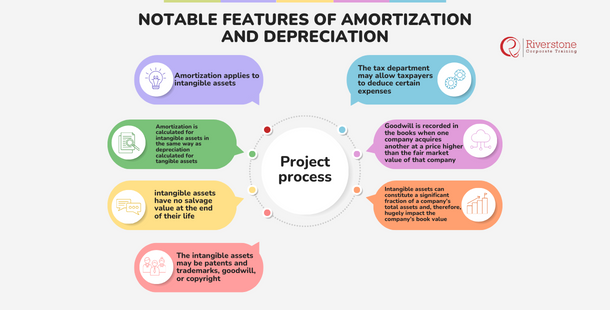

Notable Features of Amortization and Depreciation Difference

Notable Features of Amortization and Depreciation Difference

- Amortization applies to intangible assets, whereas depreciation applies to tangible or physical assets and understanding the depreciation methods for businesses is crucial for accurately representing asset value over time.

- Amortization is calculated for intangible assets in the same way as depreciation calculated for tangible assets.

- However, unlike tangible assets, intangible assets have no salvage value at the end of their life.

- The intangible assets may be patents and trademarks, goodwill, or copyright. Other intangible assets that amortized include franchise agreements, proprietary or copyrighted manufacturing processes, and patented designs — all of which can be better understood and applied in learning modules developed by professional e-learning developers for training.

- The tax department may allow taxpayers to deduce certain expenses, including expenditures on intangibles like goodwill, patents, copyrights, and trademarks.

- Goodwill is recorded in the books when one company acquires another at a price higher than the fair market value of that company. However, goodwill itself cannot be bought or sold. It is challenging to value goodwill. Hence, a company may overvalue the goodwill component of a company it is acquiring. The net assets of such an acquired company may fall in value forcing the acquiring company to write down those assets in a process called impairment. Impairment charges are a part of the income statement and negatively affect a company’s earnings per share (EPS) and stock price.

- Intangible assets can constitute a significant fraction of a company’s total assets and, therefore, hugely impact the company’s book value. While calculating the book value of a company, most analysts will only include the intangible assets that can be sold independent of the company – patents and copyrights are examples of such intangible assets, but goodwill is not.

In the new tech economy, the value and importance of intangible assets continue to rise.

Consider the immense amount of an ‘intangible’ asset like ‘Google’ or ‘iPhone.’ But intangible assets can disappear as quickly as they appear. Think ‘AOL’ or ‘Yahoo.’ Some intangible assets pre-date the ‘FAANG’ companies though – think ‘Coca Cola’ or ‘Gilette.’

Amortization in Singapore: From Intangible Assets to Property Loans:

The creation of an overarching solution that delineates the various applications of amortization, in particular the demonstration of accounting treatment of the softwares development cost (intangible asset) prima facie, along with the amortization of financial instruments such as business loans or property loan in Singapore would be necessary. This material may involve fictional situations or simplified case studies on how amortization is reflected on the financial statements of a firm (in case of intangible assets) or loan repayment schedule of an individual (in the case of mortgages) so that they can experience the abstract concept and relate it to the local financial systems. For businesses managing intellectual property, access to intangible asset valuation services in Singapore can enhance the accuracy of financial reporting. Additionally, using custom e-learning modules for companies Singapore ensures that finance teams clearly understand how amortization affects both intangible assets and liabilities across the local regulatory context.

Interactive Amortization of Assets Calculation:

Create a software that people can use online and do calculations in the form of amortization. In loan amortization, the user was able to enter the amount of loan, interest rate and the loan period to get a simple table that listed principal and interest repayment amount against the period. In the case of intangible assets amortization, users were allowed to enter asset cost, useful life, and residual value to assume the annual amortization expense. Adding alternative amortization possibilities (e.g. straight-line) would further increase interest, likewise, tabulating the results in graphic form. It is an instant-value resource that teaches those using it how amortization works and acts as the sticky resource when in need of dealing with loans intangible assets, or even exploring practical examples of biological assets accounting in Singapore.

Notable Features of Amortization and Depreciation Difference

Notable Features of Amortization and Depreciation Difference