Liquidity and Market Risk Management Training for Financial Institutions

Introduction: Certified Liquidity Risk Management Training

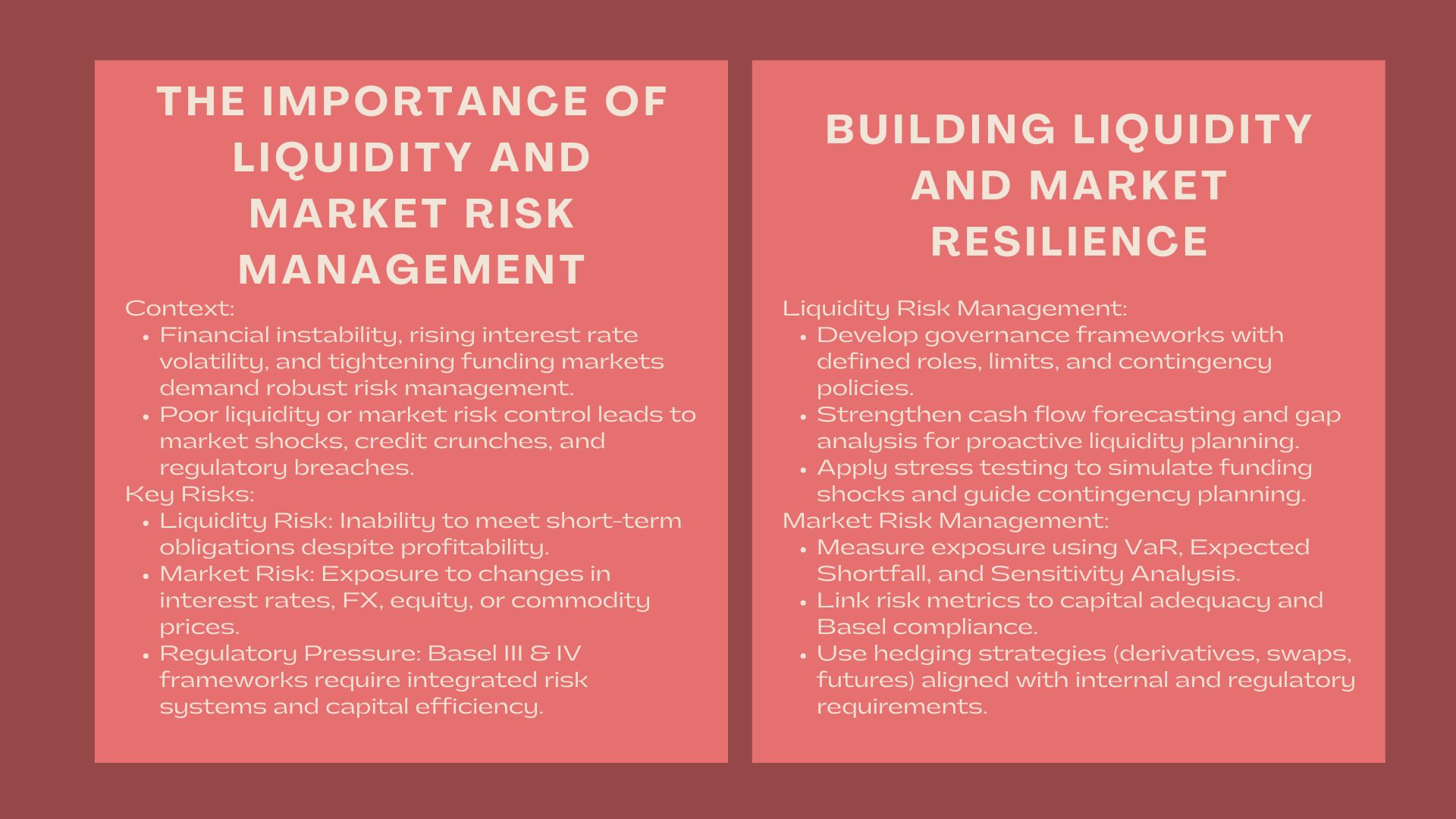

Today, risk management is not a choice anymore, but a must, as the world is facing a period of financial instability. Financial institutions are finding it to be more difficult to sustain liquidity and exposure to fluctuations in interest rates, market volatility and uncertainty in securing funding. Even the institutions that do not effectively control such risks are frequently exposed to market shocks, credit crunches and regulatory non-compliance.

To overcome these problems, the liquidity and market risk management training programs should be thorough. They assist banking practitioners, treasury managers, and financial executives in building the analytical, strategic, and technical capabilities needed to maintain the stability of the institutions, as well as manage capital optimally.

Risk Management and Its Significance to the Financial Institutions.

Liquidity and market risks are the main aspects to manage to keep investor confidence and to keep afloat, as well as stay in compliance with regulations. These risks are critical and understanding of the same can help financial institutions to maintain their profitability despite the turbulence in the market.

Why Liquidity Risk Matters

The liquidity risk is the risk of the inability of a financial institution to fulfill its immediate liabilities. Profitability does not guarantee a bank that will not go under in case of a squeeze of liquidity. This training will provide professionals with the structures and stress-testing models to assess the source of funds, track liquidity gaps and develop contingency plans.

The Increased Relatability of Market Risk.

Market risk is caused by fluctuations in the financial market variables, like interest rates, equity prices and the foreign exchange rates. As the world markets continue to change at a fast rate, the skill to model, measure, and mitigate the market risk has become an essential competence among financial professionals.

Regulatory Insistence on Risk Management.

Basel III and IV regulatory frameworks have increased the necessity of having liquidity and market risk management systems that are integrated. These rules are important in order to make sure that they are adhered to at the same time delivering optimal capital efficiency.

Building Liquidity Resilience Through Training

The liquidity risk management and stress testing training for banks module focuses on strengthening participants’ ability to identify vulnerabilities and establish liquidity risk buffers.

Creating Liquidity Governance Frameworks.

Properly designed liquidity governance framework will make sure that roles and responsibilities and limits are well defined. The participants of the training are taught to establish governance systems that would enable them to incorporate risk policies with the strategies of decision-making so that the management would respond promptly to disruptions in the market.

Amplifying the Cash Flow Forecasting and Gap Analysis.

Valid forecasting is of great importance in projecting liquidity positions and preventing shortages in funding. The course focuses on the analysis of scenarios, modeling of deposit behaviors, and liquidity gaps techniques that are in line with central bank and regulatory standards.

Adopting Effective Stress Testing.

The basis of liquidity preparedness is made up of stress testing. The participants will experiment with sophisticated ways of creating realistic stress situations, validating assumptions, and adding systemic risks. The training also explores the use of the stress test results in the liquidity contingency planning and strategic fund decisions.

Mastering Market Risk and Capital Management

The market risk measurement and capital management workshop for financial institutions offers deep insights into the mechanics of market exposure and the optimization of capital resources.

Knowing Market Risk Dynamics.

The participants are taught how to measure exposure to interest rate, equity risks, currency risks and commodity risks through the modern risk measures like Value at risk (VaR), Expected shortfall and sensitivity analysis. Training also emphasizes on back-testing and model validation methods which assure accuracy and regulation.

Association of Market risk and Capital Adequacy.

The critical thing with managing market risk is to know how it affects capital requirements. The program discusses the translation of risk metrics to capital planning required by the program such as risk-weighted asset allocation and optimization of capital buffers. The integration helps institutions to balance between profitability and prudential safety.

Both Hedging and Mitigation Strategies.

In order to minimize the effects of market volatility, professionals are instructed on the practical hedging measures by use of derivatives, swaps, as well as futures contracts. The module incorporates both accounting and regulatory views, as they enable participants to harmonize hedging strategies and internal risk appetite and external compliance expectations.

Combining Liquidity and Market Risk Frameworks.

Market risk and liquidity cannot be independent in present day finance. Risk management is an aid to ensure alignment in an integrated institutional framework.

Interaction and Correlation between Risk.

The training focusing on how the liquidity shocks may increase the market losses and vice versa. The participants will have the knowledge of systemic risk amplification, market contagion effects, and interdependencies that may pose a threat to balance sheet stability.

Developing a Cohesive Risk Dashboard.

A unified risk dashboard enables the management to track the liquidity exposures and market risk exposures in real time. The training shows the way to build reporting structures that can facilitate strategic decision-making, compliance reporting, and investor transparency.

Risk Management and Technology, Data Analytics.

The current risk management is becoming more data-oriented. The course will also enable them to get familiar with analytical tools and software platforms that can be used to aggregate data, stress model, and predictive analytics, which is allowing proactive as opposed to reactive decision-making.

Who Should Attend

The program of training should be recommended to:

- Bankers and other financial Risk management specialists.

- Liquidity and Treasury managers who will be in charge of short-term funding and optimization of the balance sheet.

- Capital adequacy and Basel controls by compliance and regulatory officers

- Investment and portfolio managers in need of knowing more about the exposure to market risks.

- The finance executives who want to enhance the enterprise risk governance frameworks.

Benefits of Attending

Participants will:

- Become well acquainted with the concepts of liquidity and market risk.

- Technical skill in quantitative risk assessment.

- Figure out how to design and implement the strong stress-testing systems.

- Be in a position to improve their capacity to address global regulatory expectations.

- Develop trust in funding crisis and capital adequacy issues.

The training fills the divide between theory and practice with case studies, simulations, and discussions based on scenarios. Practical cases assist the participants to generalize the complicated risk concepts into practical insights to be implemented in their respective institutions.

Conclusion

The financial industry is still in its dynamic stages, and the institutions that invest in the creation of effective liquidity and market risks management practices will be in the best position to achieve stability and growth in the long term. Risk anticipation, capital allocation and decision-making framework reinforcement are key issues that comprehensive training equips professionals with the power to make significant decisions.

With the help of special courses on liquidity management and market risk management, financial practitioners have the necessary instruments to find their way in uncertainty, resilience, and maintain trust in an ever-volatile global market.