Trusted Derivatives and Structured Products Training in Singapore – Riverstone Training

Singapore has gained an accolade as the reliable center of invention in the financial markets in Asia. The city-state has been successful in its banking and asset management industry and commodities and trade finance, with its success being based on its strength to attract capital and structure deals that can change the region. Some of the specialized abilities required by the current finance sector include the process of becoming proficient at derivatives and structured products; they are highly technical and also strategic.

Riverstone Training has established it as a market leader in the bridging of this skills gap. They offer not just a technical mastery, but also the strategic thinking required to use these tools responsibly and effectively with programs that make it specific to the needs of professionals in various industries, their derivatives and structured finance courses Singapore.

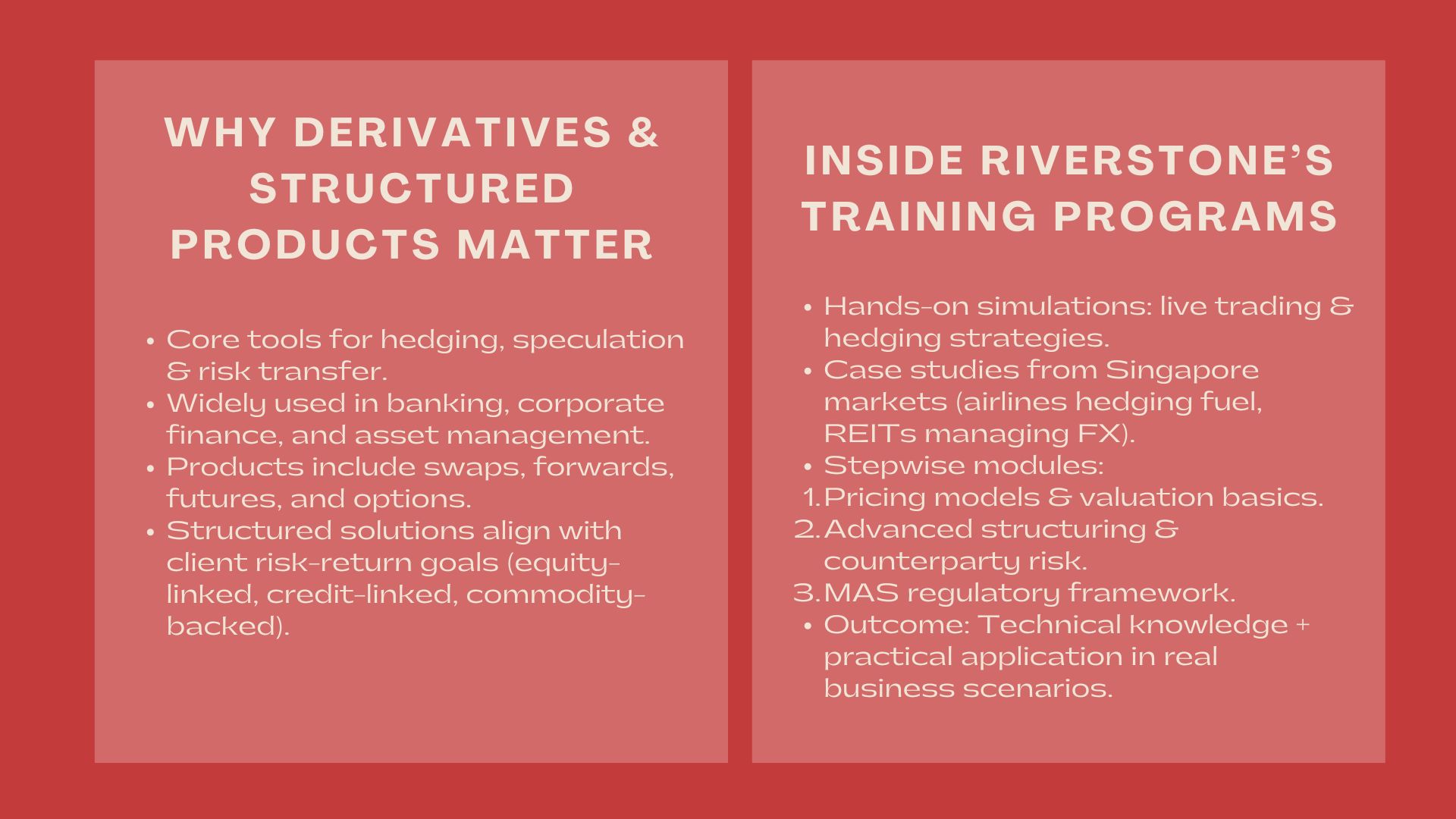

Why Trusted Derivatives and Structured Products Training in Singapore Matter?

Hedging, Speculation and Risk Transfer.

Derivatives have been erroneously perceived to be so complicated, yet they are not complex in the simple words of transferring risk. A corporate treasurer engages a currency swap to deal with the fluctuations of foreign exchange whereas an asset manager would buy options to hedge the portfolios in the case of a downturn in the market. These tools are vital in speculation and also hedging exposures that would otherwise destabilize a business.

Through advanced structured products training Singapore, participants learn how contracts like swaps, forwards, futures, and options are structured, priced, and applied in real markets. They also study how these products integrate into larger financial strategies, equipping them with insights relevant to banks, corporations, and institutional investors.

Financial Engineering Structured Products.

Structured products are a combination of derivatives and traditional assets to develop investment solutions that match the risk-return profile. They are also becoming common in wealth management, corporate finance, and deals involving trade in Singapore. Riverstone training programs involve real world illustrations, in which there are equity-linked notes, credit-linked instruments and commodity-backed structures, which allow professionals to develop products that achieve either client or organizational goals.

Inside Riverstone’s Training Programs

Learning Beyond Textbooks

Unlike conventional programs, Riverstone’s courses prioritize hands-on learning. Participants in corporate derivatives workshops Singapore engage in simulations of live trading scenarios, where they design hedging strategies for companies facing interest rate or commodity risks. Case studies based on the Singapore market including shipping companies hedging against bunker gas or REITs hedging against currency will bring the learning directly to the work of the participants.

Practical-value Designed Course Modules.

The training will be organized into modules that are focused where the basic will be taught first, followed by advanced modules. The initial sessions are a base in pricing models and valuation, and subsequent modules focus on the structuring of customised products, counterparty risk analysis and regulatory frameworks at Monetary Authority of Singapore (MAS). At the end of the program, the participants are not only aware on how these instruments operate, but also know how to utilize them in solving real business problems.

Applicability of Career in a variety of sectors.

Beyond the Banking Sector

Although the derivatives trading desks of the global investment banks continue to be large employers, the market in Singapore has expanded. The commodity futures and options help energy companies to stabilize the cost of inputs. The airlines such as Singapore Airlines have hedged the jet fuel using structured products. Huge companies like the Keppel Corporation and Wilmar use the services of treasury departments trained in derivatives to handle the risks of currency and commodities associated with international trade.

Professionals with expertise from derivatives and structured finance courses Singapore are therefore not limited to banking—they are highly employable across shipping, logistics, energy, agriculture, real estate, and consulting.

Profitable Roles and Departments.

There is a growing demand of derivatives expertise in the risk management, treasury and investment strategy departments. Derivatives Analyst, Treasury Manager, Risk Officer, Structured Products Specialist, and Portfolio Manager are usually provided. On the senior level, CFOs and Heads of Treasury acquire competitive advantage to know how structured instruments can help protect profits and encourage innovation in financing.

Trend in Hiring in Singaporean Job Market.

The Singapore job market has been pointing to high demand of derivatives expertise. A survey of the existing job opportunities reveals that DBS and UOB are in search of experts in interest rate derivatives and FX structuring. Citi and BNP Paribas have international banks looking to employ structured products desks. PwC and EY promote advisory positions, which involve the derivatives knowledge of structuring transactions.

Corporates are also prolific recruiters: Keppel Corporation, Wilmar and Olam International have posted job adverts seeking treasury and risk managers to manage commodity hedging policies. The asset managers such as BlackRock and Schroders are always advertising positions of product specialists who are capable of designing and running a portfolio based on derivatives.

For professionals aiming to stand out in this market, completing advanced structured products training Singapore signals readiness for high-responsibility roles.

Profitable Roles and Departments.

There is a growing demand of derivatives expertise in the risk management, treasury and investment strategy departments. Derivatives Analyst, Treasury Manager, Risk Officer, Structured Products Specialist, and Portfolio Manager are usually provided. On the senior level, CFOs and Heads of Treasury acquire competitive advantage to know how structured instruments can help protect profits and encourage innovation in financing.

Trend in Hiring in Singaporean Job Market.

The Singapore job market has been pointing to high demand of derivatives expertise. A survey of the existing job opportunities reveals that DBS and UOB are in search of experts in interest rate derivatives and FX structuring. Citi and BNP Paribas have international banks looking to employ structured products desks. PwC and EY promote advisory positions, which involve the derivatives knowledge of structuring transactions.

Corporates are also prolific recruiters: Keppel Corporation, Wilmar and Olam International have posted job adverts seeking treasury and risk managers to manage commodity hedging policies. The asset managers such as BlackRock and Schroders are always advertising positions of product specialists who are capable of designing and running a portfolio based on derivatives.

For those targeting such roles, Riverstone’s programs provide a direct competitive advantage. Enrolling in derivatives and structured finance courses Singapore builds the technical expertise employers demand, while corporate derivatives workshops Singapore enhance the strategic decision-making skills critical for leadership positions.

Conclusion

Structured products and derivatives are not merely financial instruments, but the foundation of risk management and innovation in investments in the modern world. With Singapore increasing its influence as the financial centre in Asia, the services of qualified professionals available to design, price and implement these tools will continue to increase.

The structured products training Singapore by riverstone training gives the highest tier training to the participants enabling them to acquire technical prowess and practical mastery of this dynamic field. These programs provide the vehicle to long-term success to the professionals who are willing to develop their careers, venture into different industries or place themselves at the front line of the global opportunities. Riverstone also complements this with Singapore Digital Finance and FinTech Training Programs designed to equip participants with future-ready skills.