Famous Project Finance Training in Bangkok – Riverstone Training

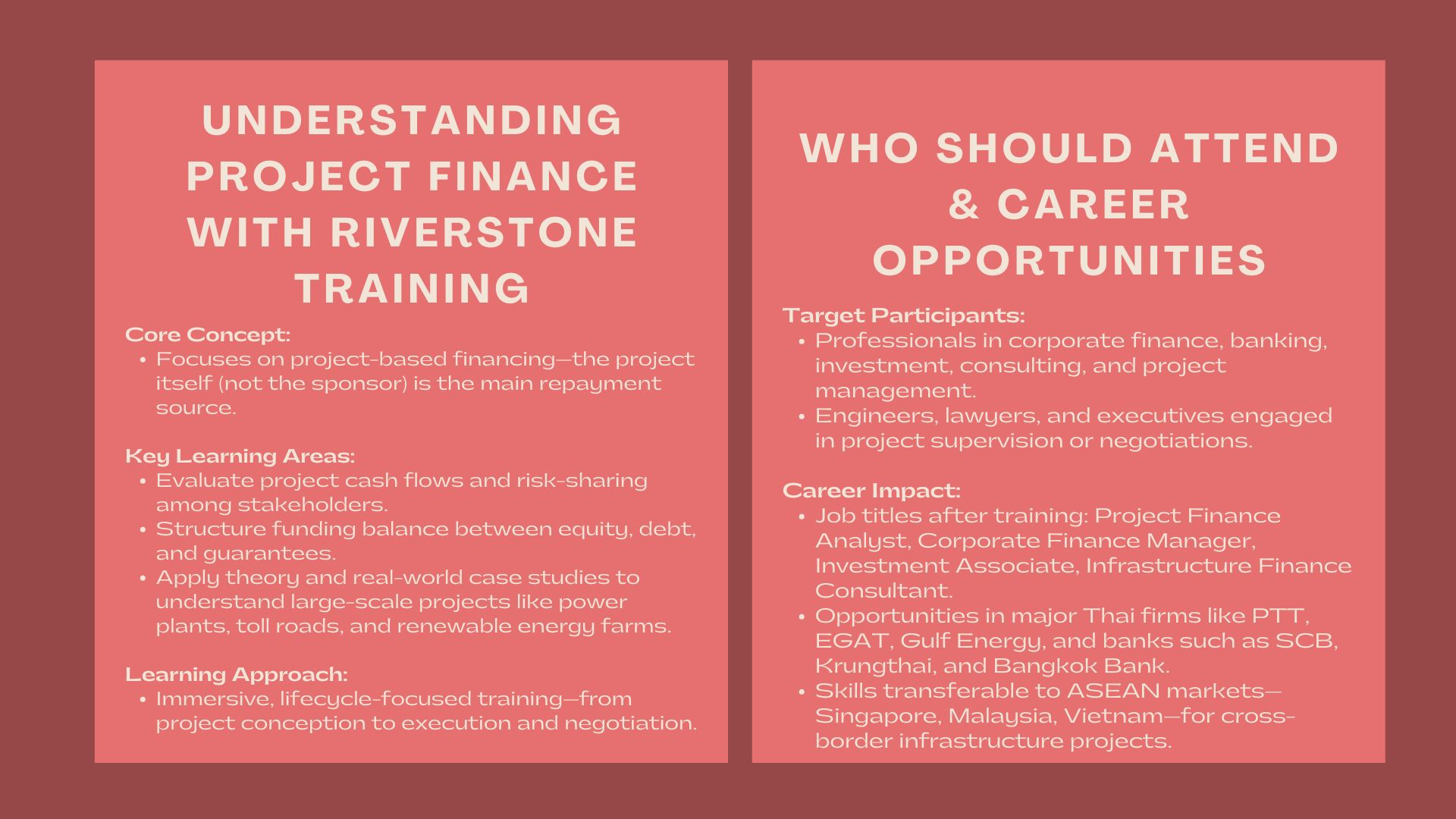

The training center’s unique feature is project financing, in which the project itself, but no longer the sponsor, is the main source of repayment. Participants are taught to evaluate project cash flows, spread risks among stakeholders and to create funding structures that achieve a balance of equity, debt and guarantees. The course is based on integrating theory and practical case studies in order to grasp a big picture of how is it possible to fund and manage large projects, such as power plants and toll road construction, as well as renewable energy farm development.

The program does not just impart formulas or templates. It leverages participants into the life cycle of project finance- conception and feasibility, negotiation and execution- enabling them to pursue real world deals with confidence and understanding.

Mastering Financial Structures for Large-Scale Projects

Understanding the Core of Project Finance

The project finance courses for professionals Bangkok offered by Riverstone Training are crafted for those seeking to strengthen their analytical and decision-making capabilities in financing long-term infrastructure and energy projects. The training center’s unique feature is project financing, in which the project itself, but no longer the sponsor, is the main source of repayment.

Participants are taught to evaluate project cash flows, spread risks among stakeholders and to create funding structures that achieve a balance of equity, debt and guarantees. The course is based on integrating theory and practical case studies in order to grasp a big picture of how is it possible to fund and manage large projects, such as power plants and toll road construction, as well as renewable energy farm development.

The program does not just impart formulas or templates. It leverages participants into the life cycle of project finance- conception and feasibility, negotiation and execution- enabling them to pursue real world deals with confidence and understanding.

Who Should Attend and Why It Matters

Riverstone’s advanced project finance training Bangkok is tailored for professionals working in corporate finance, banking, project management, investment analysis, and consulting. It is also useful to engineers, lawyers or executives who may have engaged in project negotiations or supervision but wish to learn more about financial structuring.

In the modern business environment, human resources are placing greater emphasis on individuals with the ability to combine technical expertise in projects with financial skills. This education will be helpful whether you work as a financial analyst at a bank, a project manager in the energy sector, or a corporate executive analysis, or a project that has a billion-baht impact.

Project Finance Application to the Thais Economic Scenario.

Areas Spurring Expertise.

Thailand has an accelerated rate of infrastructure development that is centered in Bangkok. The expansion of mega projects such as Eastern Economic Corridor (EEC), mass rapid transit systems, airport expansions, renewable energy plants, etc are contributing to the necessity of professionals with project finance skills.

Participants in Riverstone’s program are exposed to practical case studies from sectors such as energy, transportation, telecommunications, and water management—industries where financing structures can determine the success or failure of projects. The corporate project finance workshops Bangkok also highlight the growing importance of public-private partnerships (PPPs) in Thailand, where understanding risk sharing, cash flow forecasting, and financial modeling is vital.

Understanding of these concepts takes professionals well positioned to work in both the public and private sectors. The uses of project finance training are varied and valuable, including structuring renewable energy transactions as well as advising infrastructural investments.

Actual businesses that are recruiting Project Finance Professionals.

An analysis of the job boards like JobStreet, LinkedIn and JobsDB shows that project finance experts are in demand in Bangkok. Financial institutions such as Bangkok Bank, Krungthai Bank, Kasikornbank and SCB are periodically listing analysts, associates and vice presidents positions in the project and infrastructure finance divisions.

Mega companies like PTT, EGAT, CP Group, B.Grimm Power, and Gulf Energy also employ project finance executives to assess capital projects and fund energy and industrial project development. Meanwhile, international consultancy firms, such as EY, Deloitte, and PwC Thailand are always seeking individuals with the modeling and transaction advisory background.

This business trend is evidence of how a project finance degree can create new opportunities in the market–not just in standard finance programs, finances programs, but also in planning and operation oriented posts in large companies.

Developing a Powerful Professional Relationship.

Key Learning Outcomes

Riverstone project finance programs focus on practical approach to financial modeling, scenario analysis and assessment of risks. This course teaches participants to create dynamic Excel models that model the financial performance of a project, including debt schedules, interest coverage ratios, and sensitivity analysis.

Other key topics included during the training are loan structuring, negotiating contracts, and analysis of cash flow waterfall-important skills easily practiced in the corporate and investment banking setting. The curriculum is aligned with the international demands but localized to the South East of Asia so that those who have gone through it are likely to use their knowledge in local as well as regional markets.

At the conclusion of the course, individuals will be able to design and interpret financial models on their own, make project proposals to stakeholders, and negotiate with lenders and investors.

Career Growth and Job Roles

Riverstone professionals who undertake project finance training usually experience considerable improvement in their careers. Common job titles are: Project Finance Analyst, Investment Associate, Corporate Finance Manager, Treasury Officer, or, Infrastructure Finance Consultant.

With increasing experience, participants will be able to rise to senior positions like Head of Project Finance, Director of Investments, or Chief Financial Officer. As Thailand persistently focus on its renewable energy and infrastructure spending, the career path of trained professionals is gaining faster pace.

In addition, project finance finance can be transferred internationally. There is a demand in adjacent markets, like Singapore, Malaysia and Vietnam, to take advantage of cross-border projects that demand particular financial knowledge, which graduates of Riverstones programs in Bangkok tend to have.

Practical Use and Federal Benefits.

Experience and Industry.

The case-based, immersive method is a strong point of Riverstone Training. Collaborative modeling activities and simulations that simulate the actual project financing situations are used as an alternative to traditional lectures. The sessions promote critical problem-solving, collaboration, and interaction – essential attributes of professionals in complex transactions.

Hands on training is provided as participants are exposed to assessing risk matrices, structuring tests on debt service coverage, and software optimization on funding mixes. This is a hands on exposure that they are sure to use their knowledge directly in their workplace; negotiating with investors or even preparing financial statements to the senior management.

Riverstone course project finance graduates have regular feedback about the practical values of their training. Most of those surveyed claim enhanced job performance, accelerated promotions, and a professional network of associates greater in the banking, energy, and corporate industries.

View of Employers and Industry Independence.

In Thailand, Riverstone Training is a recognized employer in providing professional development in finance. The practicality of the outcomes achieved by the institution guarantee that participants are ready to resume their respective organizations to work on strategic projects.

The focus on financial modeling, risk assessment, and financing strategic approach is valued by the companies because financial models, risk-assessment, and strategy financing are key elements of the modern competitive market. Some organizations go those steps and will themselves send employees to Riverstone to take the course, considering the program as a long term investment in developing internal financial capability.

Planning the Future of Sustainable Project Finance.

Green or renewable energy is an emerging field of opportunity.

Sustainability in Thailand has contributed to an explosion in investments in renewable energy. With an increasing number of companies transitioning to green finance, experts in the structuring of these projects and the environmental finance are sought after.

Riverstone projects finance programs incorporate courses on renewable energy project estimation and sustainable finance solutions, equipping students to participate in the new energy infrastructure generation. This is exactly what the country is moving towards in its quest to achieve carbon neutrality and the global shift to clean energy.

Widening the Career Horizons in ASEAN.

Bangkok Riverstone graduates tend to broaden their careers within the Southeast Asian region. International development banks, regional investment funds and consultancy firms have an interest in hiring professionals with experience in cross-border project finance.

By learning to model all the financial and deal structure participants can not only become more employable but also become a major player in terms of infrastructure development and economic growth throughout the region.

Conclusion: Famous Project Finance Training in Bangkok

In an economically dynamic society such as in Thailand, a strong competitive advantage is given to professionals who can manoeuvre the intricacies of financing major projects. Project Finance Courses in Bangkok at Riverstone Training equip students with the skills, tools and the confidence that they can be successful in this challenging profession.

Participants acquire the ability to appraise, design and execute high value projects through application of modeling, case-based learning and exposure to real world financial configuration. You may have plans to go further as a corporate finance practitioner, work in a major investment bank, become the head of infrastructure development projects, but Riverstone Training offers you a path deeper to long-term professional development and success.