Professional Finance for Non-Finance Managers in Ho Chi Minh City – Riverstone Training

Introduction to Ho Chi Minh Finance Manager Program

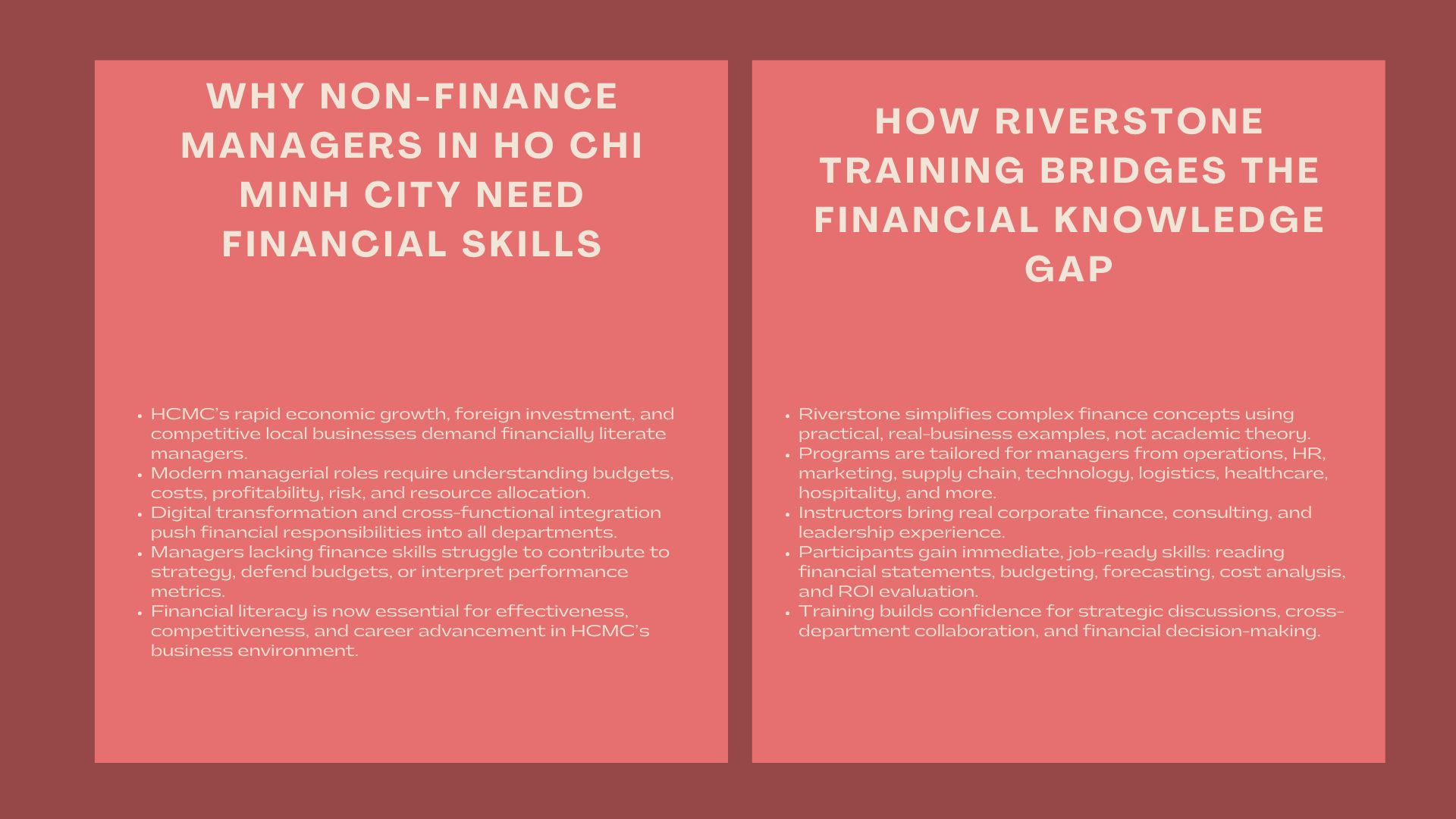

Ho Chi Minh City has become one of the most progressive business centers in Southeast Asia due to the acceleration in its economic growth, entry of multinational companies as well as emergence of local businesses which are competitive. As the business units grow and the managerial role is increasingly interdependent, the new professional expectation is presented before the modern manager: he or she needs to be versed in finance, irrespective of his or her department.

Managers with previous operations, marketing, human resources, supply chain, technology, or strategy as their sole emphasis are now to deal with budget, spend, evaluate financial consideration, expectancy of resources and participate in the conversation that touches on profitability, risk as well as business sustainability. Organizational integration and digital transformation have slowly transferred to the non-traditional departments of the company the financial related roles.

The trend has established an irrefutable fact that non-finance managers in Ho Chi Minh City have to become financially literate in order to be effective, competitive, and relevant. Firms are demanding leaders who are able to read financial reports, interpret business performance measures, business cost structure, and engage in strategic decisions that would entail a financial trade-off. The lack of finance knowledge is no longer a significant drawback; it is a direct limitation of professional development and undermines performance of managerial decision making.

Riverstone Training realized this change at an early stage and it has turned into a powerhouse in finance training for non-finance managers HCMC providing hands-on financial skills to non-finance professionals. Its programs are made to reach finance to its attainment, comprehension and practical application. Riverstone offers transformational learning programmes through its training in finance to non-finance managers HCMC, corporate finance to non-finance professionals HCMC, and practical courses in finance to managers HCMC which enhance leadership performance in industries.

The defining complexity of the current business environments in the contemporary world renders this training not just priceless, but necessary. In the present day, intuition and functional expertise cannot be the only basis of the managers. They need to use financial thinking in both the strategic decision making and operational decisions. The programs offered by Riverstone give the gap between non-financial backgrounds and actual financial capability so that the professionals could join the role that needed clarity, accuracy, and knowledgeable business decisions.

Why Finance Skills Are Becoming Essential for Non-Finance Managers in Ho Chi Minh City

The Rise of Data-Driven Management

The present day organizations work in the environment where decisions have to be supported with quantitative facts. The use of financial data by managers is expected to uphold operational plans, scrutinize an option as well as maximising the performance of their department. This is expected in all fields, both in retail and manufacturing, technology, logistics, hospitality, healthcare, property, and education.

In a highly competitive market of Ho Chi Minh City, the managers who are unable to make sense of the financial results may fail to contribute appropriately to the strategic discussions. Non-finance manager finance training HCMC assists in filling this knowledge gap and allows the professionals to understand the budgets, variance reports, cost projections, and performance metrics well.

Organizational Integration and Cross-Functional Collaboration

Interdepartmental collaboration increases with the increase in the size of the organizations. The choices being made in a department may affect the other department financially. Marketing programs make a difference in revenue forecasts, human resource management, operational choices, cash flow, and capital budgeting is needed because of technology investments.

The non-finance managers should then be aware of the impacts of their decisions on the company in terms of finances. The programs of Riverstone target this need, as they enable managers to relate their daily tasks with larger corporate financial returns.

Increasing Accountability for Departmental Financial Performance

Finance teams do not excel in controlling budgets of most businesses in Ho Chi Minh City. The managers are beginning to be given direct responsibility towards the financial performance of their department in terms of cost optimization, resource planning, expenditure control, and determination of ROI.

Due to such increasing duties healthcare professionals in the field without financial knowledge tend to make poor decisions. Corporate Finance Non-Financer Corp prevents the company managing the financial aspects with great and high level of confidence and success.

Professional Advancement and Leadership Development

Financially, litter managers have much more chances of becoming senior leaders. This is so because executives will always be required to make evaluation of investments, risk assessments, analyze financial statements, and make decisions related to the allocation of resources. The non-finance managers tend to restrict their career progress without the knowledge of finance.

Managerial practical finance classes HCMC provide the managers with the financial fluency that they need in upper level positions. It is giving them the strength to take part in the executive meetings, make decisions on strategic direction, and accept greater responsibilities.

Riverstone Training: Bridging the Financial Knowledge Gap for Non-Finance Leaders

A Practical, Accessible Approach to Finance Training

There are a lot of non-finance managers who are frightened with financial concepts due to the rather technical or abstract teaching methods that have been used. Riverstone heads this obstacle by simplifying the complicated ideas into straightforward descriptions surrounded by actual business illustrations. The programs are more practical in use, as opposed to academic rules, because they are concerned with how managers can apply finance instantly in their daily efforts.

It is not about transforming the participants into accountants but giving them the financial knowledge and understanding that will assist them make better decisions, communicate their business corporate finance for non-finance professionals HCMC effectively with finance departments as well as support the organizational objectives.

Instructors With Real Corporate and Managerial Experience

The trainers of Riverstone worked as corporate finance, consulting, business leadership and financial strategy graduates. They apply the real life examples, cases and decision making processes which are representative of the struggles that the managers have to deal with. This will make sure that the participants are taught not only the theory but also the attitude of putting my mind into the financial questions.

The educators know how to teach finance to non-finance students, the problem being that they need to explain things step by step, in simple terms and make them relevant more than complex.

Immediate Application to Non-Financial Job Functions

The respondents also complain that they use their new financial knowledge the same day or within a week. They are either working on the departmental plans, suppliers evaluation, analysis on performance measures or they are defending budgets, either way, Riverstone training enables them to have tools which bring immediate effects.

Understanding the Foundation: What Non-Finance Managers Need to Know

The Language of Business: Financial Statements

Financial outcomes are eventually traced to all business decisions. The programs of Riverstone educate managers on the methods of reading and interpreting the income statements, balance sheets and cash flow statements. The financial reports indicate the performance of the company, its financial status and efficiency of operations.

Managers get to know how to uncover what generates revenue, what undermines profitability, what makes financial positioning, and what indicates a risk. This knowledge assists the participants to interact better with the finance departments and executives.

Cost Structures and Profitability

Marketing managers, operations managers, HR managers, or technology managers tend to have a hand in the cost without having a complete understanding of the impact of the costs on the profitability of their companies. Riverstone discusses classification of costs, break-even study, contribution margin and variable costs and fixed costs behaviour.

The knowledge will assist managers in planning in a better way, setting realistic performance goals, as well as knowing how their decisions will affect the financial performance.

Budgeting and Forecasting Essentials

The finance training given by Riverstone to non-finance managers HCMC encompasses tips on how to create, defend and manage the budgets practically. The participants get to know how to predict the demands, determine the expenditures and predict the financial results. The ability increases accountability and provides greater contribution of a manager towards strategic planning.

Capital Investment and ROI Evaluation

A lot of managerial decisions require investments, training programs, new equipment, technology upgrade, marketing campaign, expansion project. Riverstone educates managers to compare the payback period, determine payback period, risk analysis, and make proposals and justify that with a straightforward financial rationale.

Corporate Finance for Non-Finance Professionals in HCMC

Understanding How Organizations Create Value

Corporate finance by non-finance Finance professionals HCMC is the process of creating value through investment, financing, and operations choices. Managers get to know how their efforts will lead to increase in revenue, cost effectiveness, use of assets, and financial stability.

The wider approach assists managers to ensure that they are acting in line with the corporate strategy and long-term objectives.

Risk Assessment and Decision-Making Under Uncertainty

In most cases managers take decisions without knowing the financial risks that will be incurred. Riverstone educates on the identification, measurement and analysis of various forms of risk; their market risk, operational risk, credit risk and strategic risk. Such knowledge leads to better, think-through decisions.

Cash Flow Management for Managers

Any business is made out of cash flow. Cash flow management is critical even to profitable companies that do not manage them effectively. Managers get to learn the implications of their choices on working capital, liquidity and through this they will know how to operate without problems in the organization.

Using Financial Information to Support Strategic Decisions

The training provided by Riverstone enables non-finance managers to turn out to be useful contributors to strategic discussions. Knowing the financial principles, managers may have a chance to justify proposals, present arguments in favor of investments, and define the aspects of improvement of performance.

Practical Finance Courses for Managers in HCMC

Real Business Scenarios, Not Textbook Simulations

Riverstone is of the opinion that managers are best trained where their training is based on real challenges in an organization. The managerial courses in practical finance HCMC contain case studies, scenario-based learning, exercises in data interpretation, guided financial thinking. These are ways of making the participants internalize some important concepts.

Cross-Departmental Relevance

The training is equal to HR technology, marketing, logistics, HR, operations, customer service, and product development. All of the previously mentioned departments end up touching on the financial performance of a company and this is what the curriculum of Riverstone echoes.

Improving Decision-Making Confidence

A lot of managers find it tough to speak when subjects of finances come up as they are afraid of making wrong assumptions. Riverstone is useful in overcoming this indecisiveness through instructing in a logical, regular process of financial reasoning. Glass perceives graduates as more confident, capable and credible participating as part of discussions involving money, numbers or measures of performance.

The Impact of Riverstone Finance Training on Organizations in Ho Chi Minh City

Greater Alignment Between Departments and Finance Teams

Communication is appropriate when the managers are conversant with finance. Misunderstandings decrease. Budget meetings are made more effective. The teams work more together in performance improvement programs.

Managers in organizations are able to speak the same language of finance which provides a relief and boosts their productivity.

Improved Financial Performance Across Departments

Managers who are trained in finance make superior choices when it comes to their costs, investments as well as resource allocation. They identify inefficiencies sooner, measure risks more appropriately and implement strategies that are more financially rational. This results in quantifiable changes in the performance of the departments.

Stronger Leadership Bench Strength

Firms that have managers that are financially literate do have a better succession of future leaders. The training of Riverstone assists organizations in discovering and developing high potential employees who could fill in the positions of the executives.

Better Use of Company Resources

Financial awareness allows managers to be more conscious about the effects of their actions and decisions on spending, profitability and health of the corporations. This results in responsible management and general financial discipline of the resources.

Conclusion

Riverstone Training has positioned itself as the best agency in offering financial education to the non-finance professionals in Vietnam. Riverstone prepares managers with the benchmarks of the data-driven and financially competitive business environment of today by training them, through its finance training to non-finance managers HCMC, corporate finance to non-finance professionals HCMC, and practical finance training to managers HCMC.

Managers who are knowledgeable in finance stand a definite edge set against competition that is practical finance courses for managers HCMC stiff and competition in the city where business decisions are getting complicated. They make superior decisions, manage more efficiently, can communicate more assertively and have a more significant contribution to the success of an organization.

The need to appoint financially literate managers will only rise as Ho Chi Minh City continues to develop into a business force in the region. Riverstone Training is on hand to equip the professionals to meet this new age- building on turning non-finance managers into leaders with the ability to manage their funds wisely, and in a strategic manner.