Case Study: Banking In-House Training Services Enhancing Capability and Regulatory Readiness

Background on Case Study Banking In-House Training

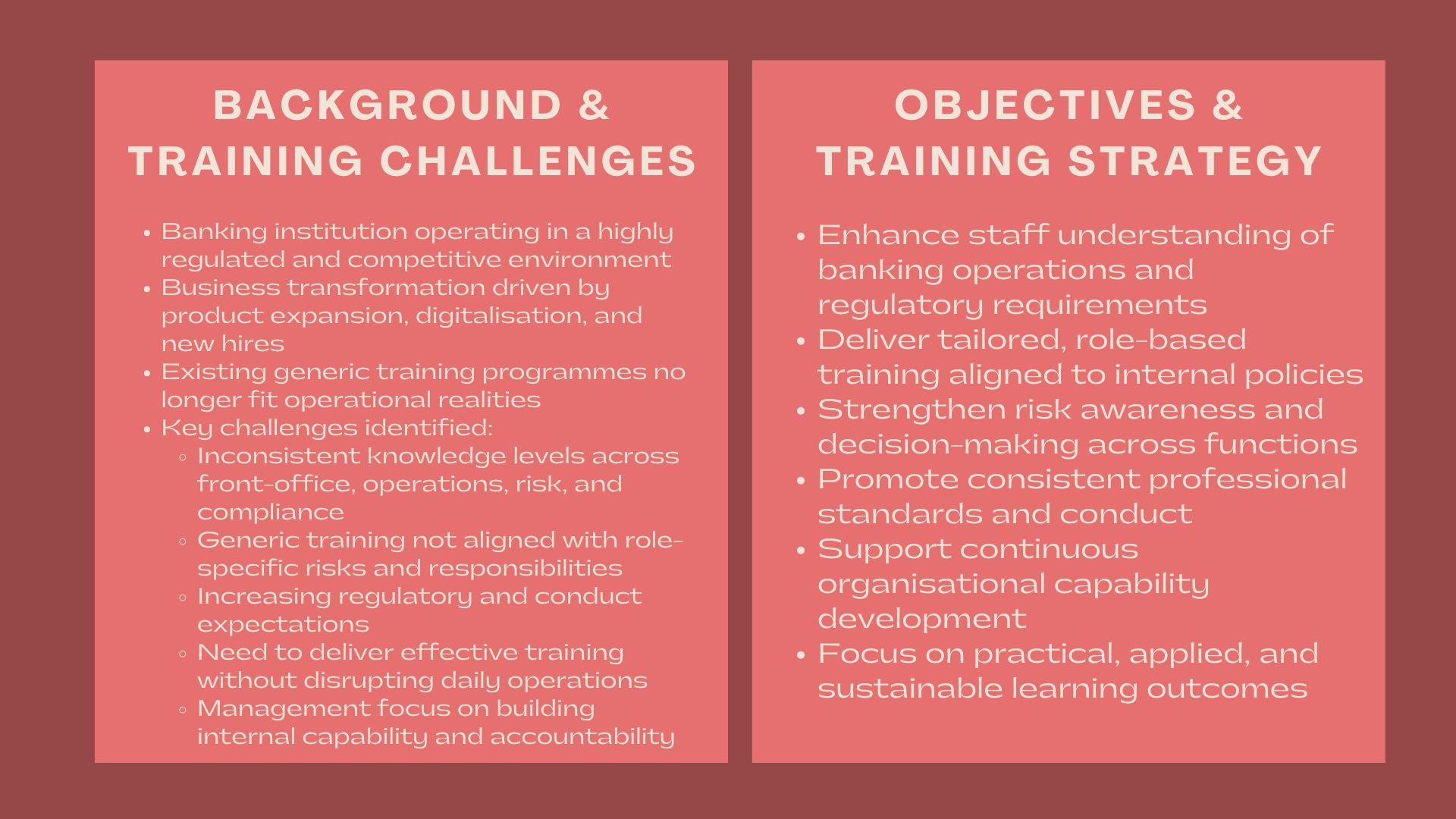

The hotel is a banking institution that is working in a highly regulated and competitive environment that is going through a transformational period. The bank was growing its product offerings, reinforcing digital operations, and recruiting new employees in front-office, operations, risk and compliance roles.

The bank had prior training programs but the management realised that generic or externally sponsored programmes could not be effective any longer. The various teams were facing different regulatory, operational and risk based challenges and there was an increasing demand for tailor made in-house banking training that clearly matched those of the bank policies, procedures and regulatory requirements.

In order to meet these needs and enhance organisational potentials, the bank approached our Banking In-House Training Services to design and present customised training programmes in various functions.

Issues and Challenges

The bank had a number of challenges that influenced the necessity to organize inside training.

Lack of uniformity in the levels of knowledge among teams was one of the issues. The personnel had a wide range of backgrounds and their experience in the banking and regulatory field was different, which made it hard to guarantee that there would be similar knowledge of the banking principles, internal processes and regulatory expectations.

A different difficulty was role relevance. Front-line staff, middle-office teams and control functions were exposed and liable to varying risks. These differences were not sufficiently reflected in generic training material and could not be used in practical implementation in day-to-day operations.

Complicated regulations also put pressure. Regulations, risk management expectations, and conduct standards were still developing, and the staff members had to keep on the cutting edge and be sure of their abilities in implementing the regulatory requirements in real-life situations.

There was also the issue of operational constraints which complicated the delivery of training. The bank had to have training programmes that would be effective to be delivered without interfering with the business activities, and yet must be comprehensive, interactive and effective to learn.

Lastly, the management tried to enhance internal capability and accountability. Internal training was regarded as one of the primary tools that would help to instill uniform standards, build up governance anticipations, and contribute to the long-term advancement of talent.

Objectives

The key goal of the engagement was to design and implement tailored banking in-house training programmes in accordance with the operating requirements and regulation of the bank.

In particular, the bank was to:

- Improve the knowledge of the staff about banking procedures and regulation requirements.

- Provide role-based and training that is practical based on internal policies.

- Enhance functional risk awareness and risk-making.

- Encourage uniformity and professional behaviour.

- Encourage continuous improvement of the organisation.

The interaction was aimed at applied knowledge learning and knowledge sustainability.

How We Helped

We have taken a systematic and team-based banking-in-house training that is based on the business model of operation, regulatory environment, and workforce composition of the bank.

The process that started with us was a training needs assessment. In generating priority areas of training, target audiences, and learning goals, we collaborated well with the top management and the heads of the various functions. This guaranteed that the content of training was aligned to business needs.

On the basis of this evaluation, we developed tailor-made training processes that addressed the major banking issues like banking essentials, credit and lending practices, risk management, regulatory requirements, standards of conduct and internal controls. The content was customized in such a way so that it reflected internal policies and procedures of the bank and actual working situations.

There was a high level of emphasis on implementation. Case studies, process walkthrough, scenario analysis and interactive discussions were part of the training sessions to ensure the participants related the theoretical concepts with their daily duties.

We facilitated the use of flexible formats of delivery, such as on-site workshops, virtual delivery, and blended learning. This has enabled the bank to coordinate operational schedules as well as ensuring that there is effective collaboration within teams.

We gave reference guides and training materials that were in line with external documentation to supplement training. These were the resources used during post training application and as a constant reference tool to staff.

During the interaction, we collaborated with the management and participants to answer questions, explain regulatory expectations, and make changes where needed. There was an introduction of feedback so that improvements were made continuously and relevant.

Value Delivered

This case study proves that professional Banking In-House Training Services may increase organisational capability, regulatory awareness, and consistency in operations.

The engagement enabled the bank to boost staff confidence by customising and role-specific training, enhancing their knowledge and knowledge of banking and regulatory requirements and ensuring that the staff operated under the same standards. The in-house training strategy helped to internalize alignment and capability building in the long term as well.

The banking training model that was created, as a result of this interaction offered a scalable basis to continuous employee growth, regulatory preparedness and sustainable operational efficiency.