Case Study: Credit In-House Training Services Strengthening Credit Assessment and Risk Awareness

Background on Case Study Credit In-House

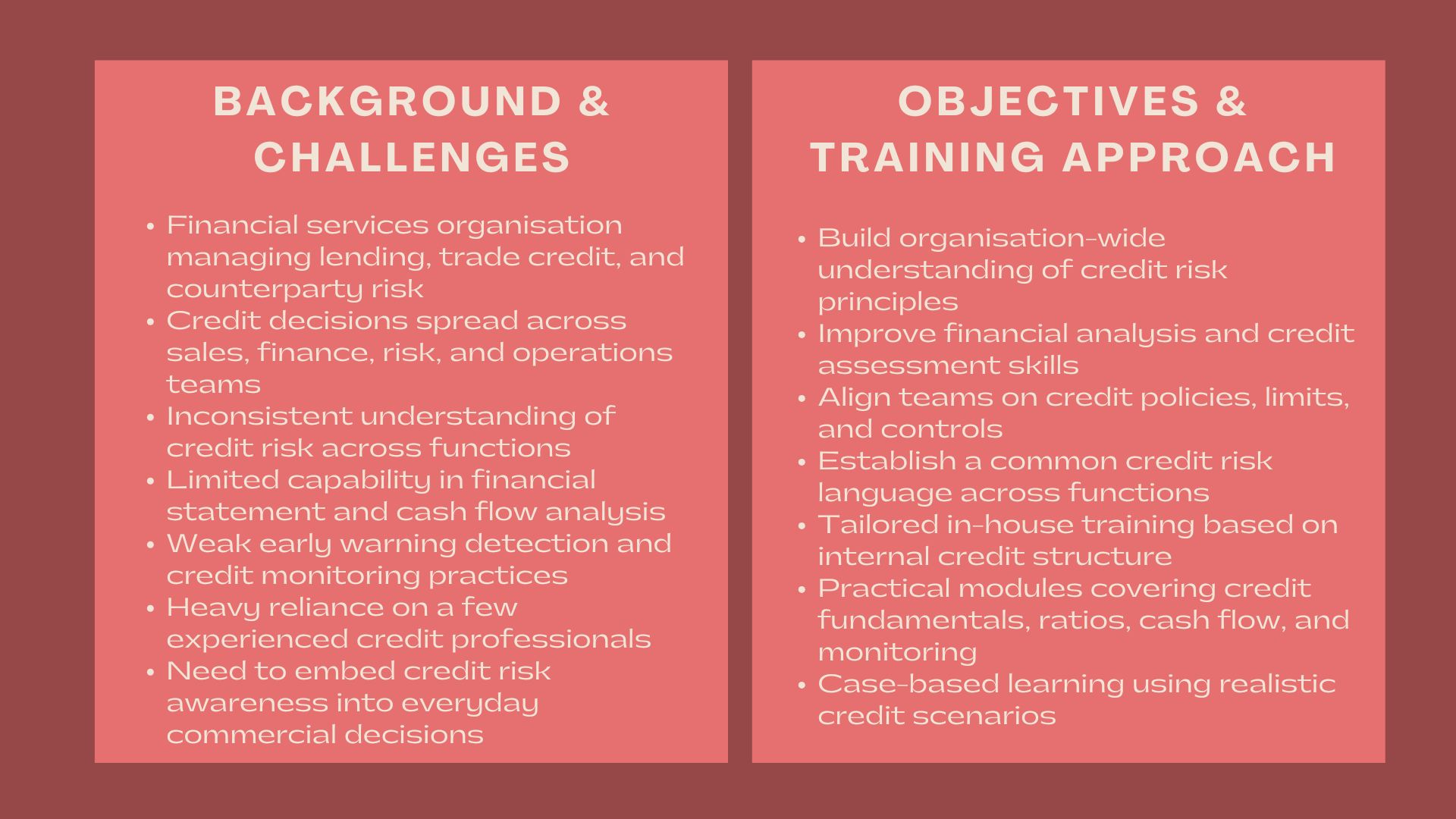

An organisation whose operations are related to financial services and subjected to lending, trade credit, and counterparties risk management was witnessing growing complexity of its credit-related operations. The credit decision-making of the organisation occurred across various functions whereby sales, finance, risk management and operations functions were all involved in the evaluation of credit exposure and management of credit.

With the increase in volumes of business and the dynamic market conditions, the management realised the need to establish better internal credit knowledge and harmonisation of credit assessment practices among teams. Though the credit professionals were available, they were also sharing the credit related duties with the non credit employees who needed to better understand the basics of credit and risk factor.

The organisation has hired our Credit In-House Training Services to design and implement a structured training programme in line with the credit policies, risk appetite and business climate to optimize the internal capability and make sound credit decisions.

Issues and Challenges

There were a number of challenges the organisation was facing that showed the need for formal credit training.

Poor cross-functional congruence in the definition of credit risk was one such challenge. There was a tendency of inconsistency in approaches and decision making among the employees who had different levels of familiarity with credit assessment principles, as was shown in customer onboarding, contract approval, and account management.

The other difficulty was financial statement analysis. Although financial data was on hand, not all the participants were sure about analysing financial reports to evaluate creditworthiness, liquidity and solvency.

There were also problems with credit monitoring and early warning detection. Not all teams were in agreement on the way of recognizing the signs of credit deterioration or escalating the potential issues in a timely fashion.

Credit judgement was also based on the few experienced individuals with the result of bottlenecks and operational risks where the experienced individuals were not available.

Lastly, the management aimed at instilling a greater credit risk culture, whereby, credit considerations were factored in commercial decisions, and not as a distinct service.

Objectives

The main aim of the engagement was to enhance credit capability in the whole organisation by tailor-made credit in-house training.

In particular, the organisation was to:

- Enhance knowledge on credit risk principles and measurement systems.

- Improve credit analysis (financial analysis) skills.

- Enhance awareness on credit policies, limits and controls.

- Enhance credit observation and risk exaggeration measures.

- Develop a common language of credit risk.

The training should have been feasible, available to non-credit professionals and should have been based on the internal credit structure of the organisation.

How We Helped

To provide effective credit in-house training, we used a formal and participative method based on the credit operations and risk profile of the organisation, and its internal operations.

The interaction started off with a credit training needs assessment. We collaborated with credit, finance and risk management teams to gain an insight into the process involved in credit and overall challenges and skill gaps among the functions.

On the basis of this evaluation, we developed tailor-made training units on core credit subjects. These were the fundamentals of credit, types of credit risk, financial statement analysis as the credit assessment, cash flow analysis, and the important credit ratios.

We also discussed credit approval procedures, credit limits, and monitoring habits, and we got in touch with participants learning how credit policies practice works in reality and whether adherence to internal controls is significant.

Good focus on practice was given. Real-life credit scenarios and simplified financial examples that were included in training sessions were accompanied by case-based discussions that enabled the participants to apply concepts to real-life situations.

The programme was designed in such a way that it could fit the participants of various positions, such as sales, operations, finance, and risk management. This provided accessibility as well as facilitating a level of consistency in credit understanding throughout the organisation.

The delivery of training was adaptable as it involved both face-to-face workshops and virtual training where necessary. The interactive discussions, question and answer sessions and the analysis of scenarios were employed to facilitate the engagement and understanding.

We used supporting material, credit assessment checklists and reference guides to reinforce the learning and the participants had the material available after the training to assist them in making the decisions that were related to credit.

During the engagement period we liaised closely with the participants to clarify, answer questions and tailor discussions to the particular credit setting of the organisation.

Value Delivered

In this case study, the professional Credit In-House Training Services can be enhanced to build stronger credit assessment capability and foster a culture of greater credit risk.

The involvement enabled through bespoke and useful training assisted in enhancing trust in credit appraisal, greater uniformity in credit-related judgments, and better management of credit exposure.

The credit in-house training model that emerged as a result of this interaction offered a sustainable basis of continuous capability building, better risk governance and strengthened credit management behavior.