Case Study: Venture Capital In-House Training Services Strengthening Investment Capability and Decision-Making

Background on Case Study Venture Capital In-House

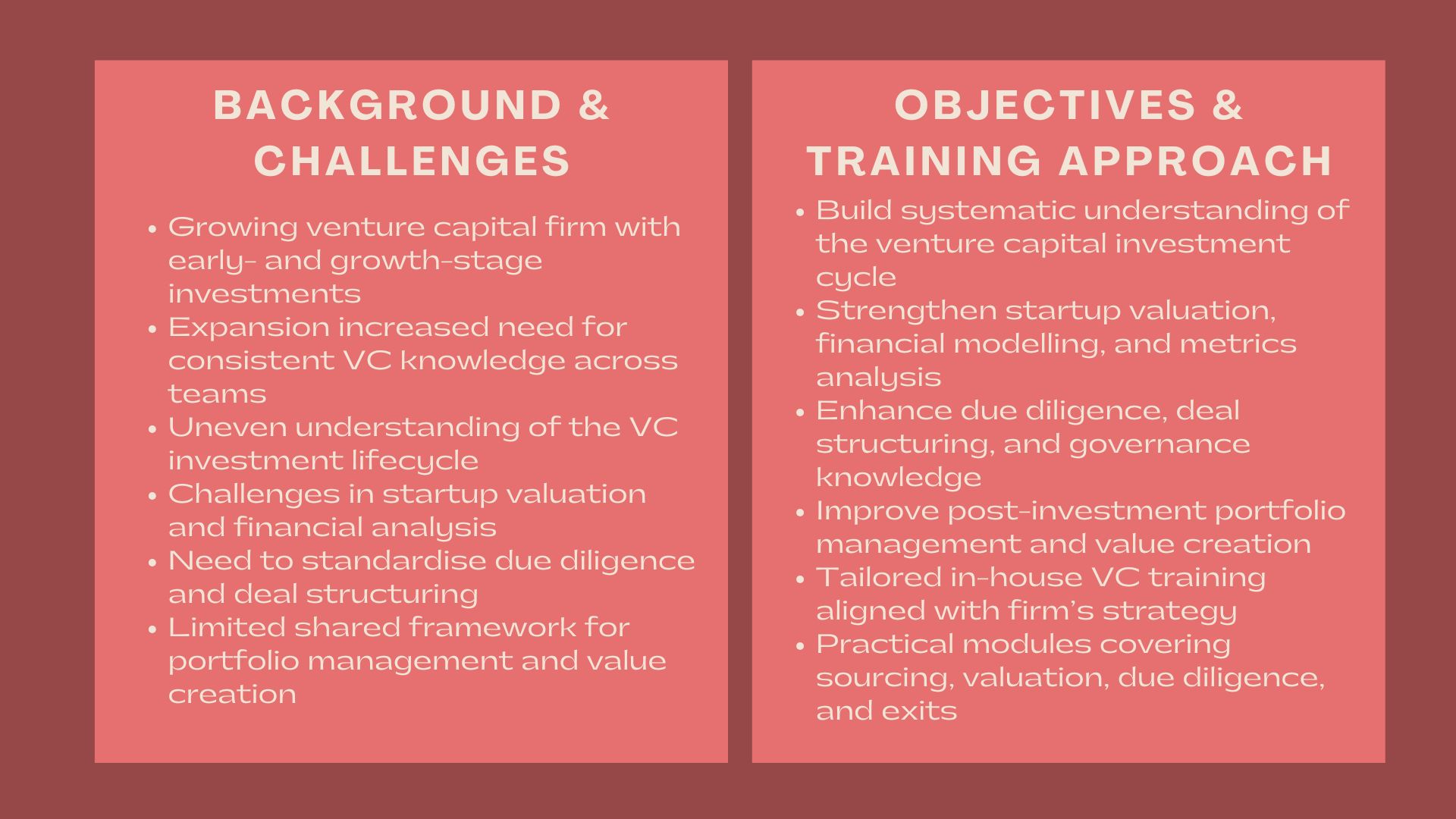

The venture capital firm experienced an increasing number of investment activities in the various sectors since it had a portfolio of early and growth stage investments. The strategy used by the firm was to identify the start-ups with high potential, nurture portfolio companies by actively engaging with them and creating long term value by successfully exiting them.

Following the expansion of the business, the management realised that they needed to enhance internal investment capability at the organisational level. Though the senior investment professionals had good experience in deals, junior team members as well as the support functions needed systematic training to develop consistent knowledge on venture capital concepts, processes, and best practices.

Moreover, the company was working more and more with founders, co-financiers, and institutional investors that demanded high professionalism and analytical rigour. To ensure sound growth and the quality of decision making in the investment, the firm contracted our Venture Capital In-House Training Services.

Issues and Challenges

The company had a number of difficulties that brought out the need to have venture capital training.

Lack of uniform knowledge on the lifecycle of the venture capital investment was one of the key challenges. The members of the team were exposed to different degrees of sourcing, screening, due diligence, deal structuring, portfolio monitoring and exit planning.

The other issue was the problem of startup valuation and financial analysis. Valuation and projection were more complicated as early-stage companies were not always well-established in terms of financial history. Not everyone on the team was confident in the usage of proper valuation techniques or a start up financial metrics.

Another area of concern was due diligence processes. Although the firm was undertaking due diligence of investments, it was necessary to standardise methodology of commercial, financial, operational and ESG-related due diligence.

There were more problems in portfolio management and value creation. The team members needed a better insight into the way the venture capital firms assist the portfolio companies after investing in them such as governance, monitoring their performance, and strategic direction.

Lastly, the company aimed to reinforce internal communication and alignment whereby investment decisions and the portfolio strategies would be always comprehended by the whole organisation.

Objectives

The main aim of the engagement was to enhance venture capital power by undertaking venture capital in-house training on a customised basis.

In particular, the company was to:

- Develop a systematic knowledge of the venture capital investment cycle.

- Enhance startup valuation and financial analysis competency.

- Increase due diligence and deal structuring abilities.

- Enhance the management and creation of values in portfolios.

- Create repeat venture capital knowledge.

The training programme had to be realistic, pertinent to the investment strategy of the firm and relevant to different participants who had different experiences in venture capital.

How We Helped

We used an organized and participatory approach to in-house venture capital training, which was designed to support the investment focus, portfolio make-up and internal capability of the firm.

Our activity started with a training requirement analysis. We were also very close with the partners, investment professionals and support teams in order to learn about the firm’s investment strategy, industry focus and the current processes.

It is on the basis of this evaluation that we have developed tailored training modules on the entire venture capital lifecycle. Some of the topics covered venture capital basics, deal sourcing tactics, startup screening and investment committee workflow.

The programme included startup valuation and financial analysis. Valuation methods that are applicable to early-stage and growth-stage start-ups, financial modelling, unit economics and key performance indicators applied in venture capital investing were discussed during training sessions.

Due diligence and deal structuring was also discussed. They were also taken through the financial, commercial, operational, and ESG due diligence factors, typical term sheet structures, investor rights, and governance systems.

Portfolio management and value creation were highlighted to make the participants have knowledge of post-investment responsibilities. Themes were board participation, monitoring performance, engagement of the founders, and how to prepare the portfolio companies to follow-on fund or exit.

The practical application was given a high priority. Real life scenarios, simplified case discussions, and role based exercises were included in the training sessions to assist the participants in putting the concepts into the real life or recent investment situations.

The programme was designed in such a way that it could handle the participants who belong to various positions such as partners, investment analysts, associates, and operational support staff. This saw to it that there was wide involvement besides encouraging a common language and framework of venture capital.

The delivery of training was done via interactive workshops, which incorporated both face-to-face and virtual training where necessary. Guided discussions helped the participants to provide experiences and converge on the investment practices.

As a reinforcement to the learning, we gave out practical tools, templates, and reference materials that the participants could make reference to as they continued with the investment analysis and managing portfolios.

During the engagement, we liaised well with the firm in order to localize content to changing investment priorities and market conditions.

Value Delivered

This case study shows how In-House training services by professional Venture Capital can help reinforce investment capabilities and assist in making disciplined decisions.

The involvement enabled the development of confidence in the process of venture capital analysis, more consistency in due diligence practices and valuation practices, and better coordination among investment teams through customised and practical training.

This engagement enabled the venture capital in-house training structure to be a scalable base of continuing capability building, portfolio value creation, and long-term investment success.