Case Study: Compliance In-House Training Services Strengthening Regulatory Awareness and Organisational Integrity

Background on Case Study Compliance In-House

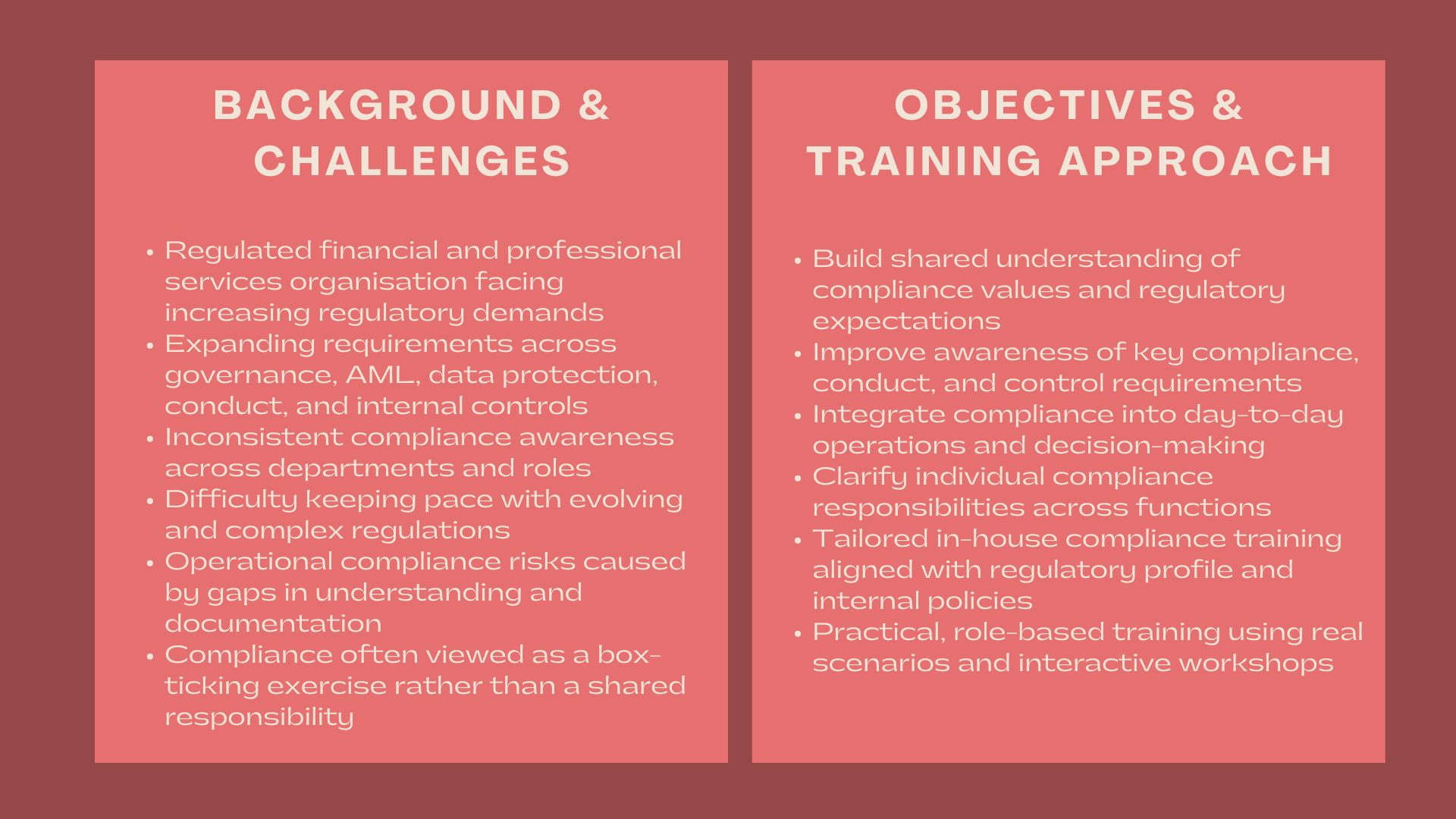

The organisation in the financial services sector and professional services industry was regulated and presently undergoing tougher regulation due to the growth in its operations. The organisation has been exposed to various regulatory demands that relate to governance, conduct, anti-money laundering, data protection, and internal controls. The regulatory requirements were changing and the management realised that compliance was no longer a functional duty.

Although the organisation had developed compliance policies and procedures, compliance knowledge in the day to day activities in the various departments was different. The employees were required to adhere to the regulatory provisions, but most of them had little exposure to the legal justifications of the regulatory provisions, as well as how they were applied in the day-to-day operations.

The senior management realised that there was a need to accelerate compliance awareness in the organisation and institute a better compliance culture. To do so, the organisation took the services of our Compliance In-House Training Services to plan and execute structured, practical, and role-relevant compliance training programmes.

Issues and Challenges

The organisation encountered a number of problems which brought to focus the necessity of organised compliance training.

Lack of uniform compliance awareness was one of the issues. Different functions had different degrees of knowledge on regulatory requirements and therefore inconsistent compliance procedures were applied by employees.

The other challenge was the issue of regulatory complexity. The organisation was subjected to various regulatory frameworks and employees could hardly cope with a change in regulations, shifting instructions and developing demands.

There were also risks of operational compliance. Violation incidents tended to have been linked to the lack of understanding of the processes, documentation habits, or escalation processes instead of deliberate misbehavior.

Another situation noted by the management was that compliance is sometimes viewed as a box-ticking exercise of ethical and professional behaviour, as opposed to being part of it. This restricted risk identification and issue escalation.

Lastly, the organisation aimed at having employees have a clear picture of their respective compliance responsibilities, such as the role their duties played in the overall compliance system of the organisation.

Objectives

The main aim of the engagement was to enhance the organisational compliance capability by tailor-made training on compliance in-house.

In particular, the organisation was to:

- Develop a shared knowledge on compliance values and regulation needs.

- Enhance awareness on major regulatory and conduct requirements.

- Integrate compliance elements into the day-to-day operations.

- Enforce responsibility and intensification of practice.

- Foster the culture of compliance (strong and sustainable).

The training programme was to be realistic and understandable by non-experts and should be consistent with the regulatory environment and internal policies of the organisation.

How We Helped

Our compliance in-house training was based on a systematic and joint method, which was designed in relation to the regulatory profile of the organisation, the business operations, and the structure of the workforce.

We started with a compliance training needs evaluation. To be acquainted with regulatory requirements, institutional policies and frequent compliance dilemmas among the employees, we collaborated with senior management, compliance, and risk departments.

On this evaluation, we developed specific training sessions on important areas of compliances. They were compliance fundamentals, regulatory expectations, conduct risk, internal controls and the significance of ethical behaviour.

Other areas of practical compliance that were addressed in relation to the organisation were anti-money laundering, conflict of interest management, data protection, and record-keeping practices. The regulatory requirements were described in the non-technical terms so that it will be accessible.

A heavy stress was laid upon application. Real world scenarios and role-based examples as well as interactive discussions were incorporated in the training sessions to get the participants to detect the compliance risks in their respective job roles.

The programme was designed in a way that allows the attendance of the participants who represent various functions, such as operations, finance, sales, compliance and management. This has guaranteed relevance as well as ensuring uniform compliance awareness within the organisation.

The delivery of training was done in interactive workshops and where necessary; it was a combination of both in-person and virtual training. Open discussion fell under the facilitators and they were free to ask questions and seek clarification on the regulations.

To support learning, we issued reference materials, compliance checklists and escalation guides that the participants could make reference to in their day to day activities.

During the engagement, we collaborated with the organisation to prepare training content for regulatory changes and new compliance risks.

Value Delivered

The case study illustrates that professional Compliance In-House Training Services could empower regulatory awareness and organisational integrity.

The engagement allowed the introduction of compliance into everyday operations, increased consistency of understanding of regulations and made the organisation more accountable, through structured and practical training.

The compliance in-house training program established as part of this engagement created a scalable base of continued compliance training, risk management, and long-lasting compliance with regulations.