Case Study: Financial Modeling In-House Training Services Strengthening Analytical Capability and Decision Support

Background on Case Study Financial Modeling In-House

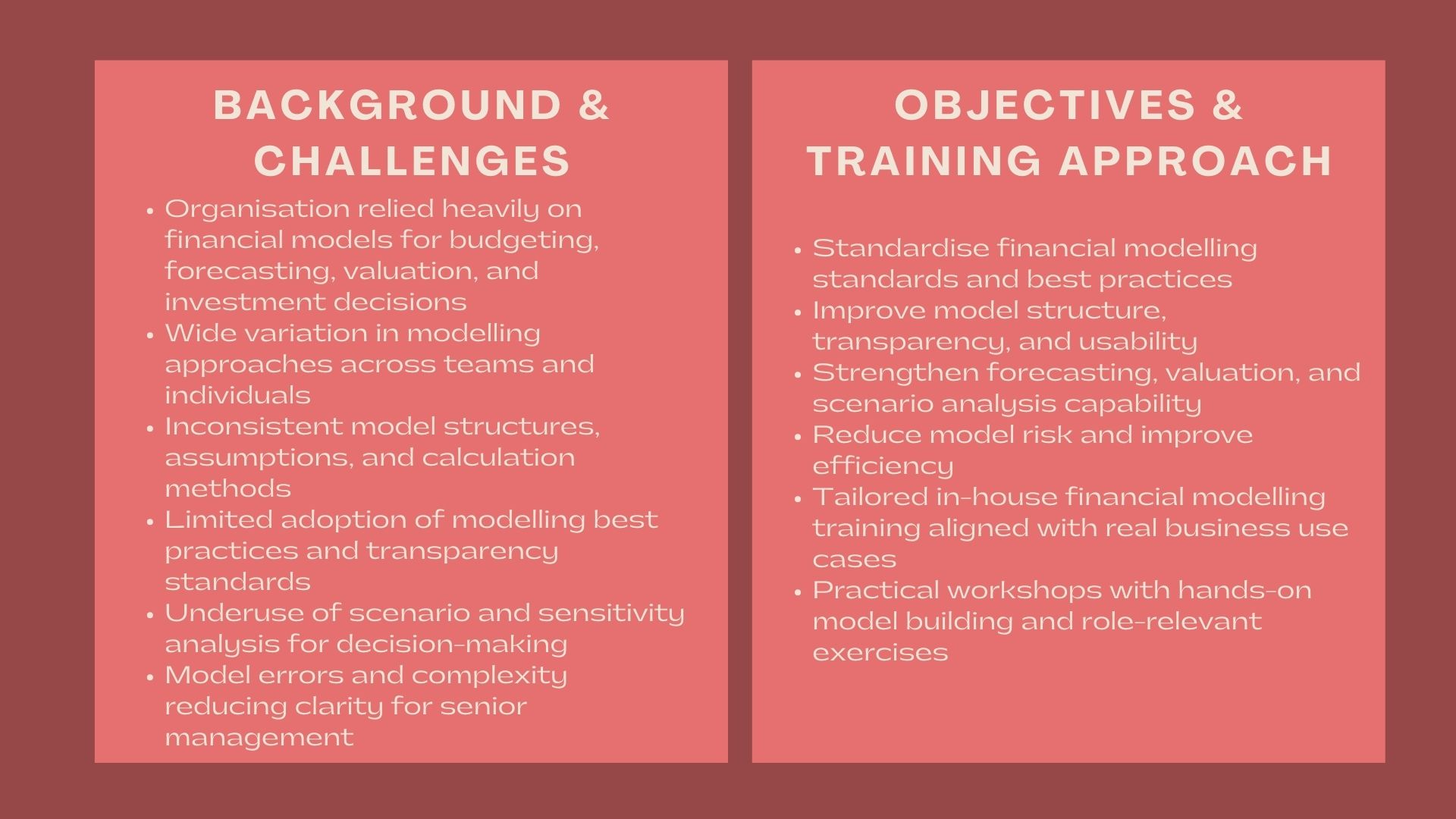

An expanding organisation conducting business in the corporate finance, investment and strategic planning business depended greatly on financial analysis to aid in management decision-making. Budgeting, forecasting, investment analysis, scenario analysis, valuation exercises were all done in teams with all the internal and external stakeholders.

Although financial models were popular throughout the organisation, there was a high level of difference in modelling practices, both at team and individual levels. There were models that were extremely detailed and incomprehensible, and there were those that did not have the appropriate structure and clarity. The senior management realised that incoherent modelling standards led to the tendency to have miscommunication and inefficient decision-making.

In order to develop greater analytical ability and consistency in the financial modelling practices, the organisation has contracted our Financial Modeling In-House Training Services to develop and provide a structured, practical and role-relevant training programme.

Issues and Challenges

The organisation had a number of challenges, which revealed the necessity of organised financial modelling training.

Inconsistency in model structure and design was one of the challenges. The models were commonly constructed with various assumptions, layouts, and calculation techniques, hence hard to review, revise or transfer amongst the members of the team.

The other issue was poor knowledge of the best practices in financial modeling. Although most employees knew how to use the spreadsheets, the understanding of the concepts like logical flow and separation of the inputs and outputs as well as model transparency were known by a lesser number of employees.

There was also underutilisation in the use of scenario and sensitivity analysis. The management needed models that could be used to assist in the decision making when faced by uncertainty, but not all the team members were assured of the ability to construct flexible models that would enable effective testing of the scenarios.

Mistakes and ineffectiveness were one more issue. The risk of poor design of formulas, absence of error checks, and inconsistent documentation higher the chances of error especially when making high stakes decisions based on the models.

Lastly, the organisation aimed to enhance communication between the technical analysts and senior decision-makers by making sure that models are straightforward, user-friendly and decision-oriented.

Objectives

The overall aim of the engagement was to enhance internal financial modelling capacity by means of in-house financial modelling training of their own.

In particular, the organisation was supposed to:

- Standardize financial modeling standards and best practices.

- Enhance model format, transparency, and consumption.

- Energize forecasting, valuation and scenario analysis.

- Eliminate model risk and enhance efficiency.

- Make better use of decision support with better financial models.

The training programme had to be viable and fit the personnel who had different degrees of exposure in modelling and fit into the cost analysis needs of the organisation.

How We Helped

Our in-house financial model training was structured and collaborative, and functional to the organisational use cases, level of technical skills and decision making requirements.

The introduction of our interaction was in the form of a financial modeling training needs assessment. We collaborated with the finance, investment, and strategy team to know how models were being utilized and where they were failing.

On this evaluation, we made tailor-made training modules to address the financial modelling basics and best practices. Among the topics covered there were principles of model design, logical structuring, and managing assumptions, and clear presentation of outputs.

Other applications of core financial modeling that we also covered included budgeting and forecasting models, discounted cash flow models, and integrated financial statements. Following building models were taken step by step but with emphasis on clarity and precision and not complexity.

The programme involved scenario and sensitivity analysis. The training reflected the process of constructing flexible models in which the user can test his assumptions, evaluate risks, and measure alternative outcomes.

There was a high level of practical application. Training would have involved practical exercises, model-building, and examples based on common business and investment situations encountered by the organisation.

The programme was designed in such a way that it accommodated the participants of various functions such as finance, investment, corporate development and management. This provided relevance and enhanced the use of a standard modeling language and standard.

The delivery of training was done by the interactive workshops which included both virtual and face-to-face versions where necessary. The participants were urged to pose questions, make assumptions to be tested, as well as refining the models during the sessions.

In order to enhance learning, we gave them modeling templates, best practice guidelines, and references which the participants could use in their normal working routine.

During the engagement, we collaborated closely with participants to overcome difficulties, develop methods, and match models to organisational expectations.

Value Delivered

This case study proves that professional Financial Modeling In-House Training Services may enhance the power of analysis and the ability to make appropriate decisions.

The engagement was through structured and practical training, which contributed to the creation of uniformity in financial models, minimisation of errors, and quality of financial analysis throughout the organisation.

The in-house training model of financial modeling that resulted under this engagement gave a platform that was scalable to continued skill development, better governance of financial models, and better decision support to the management.