Case Study: Personal Finance In-House Training Services Enhancing Financial Well-Being and Workforce Productivity

Background on Case Study Personal Finance In-House

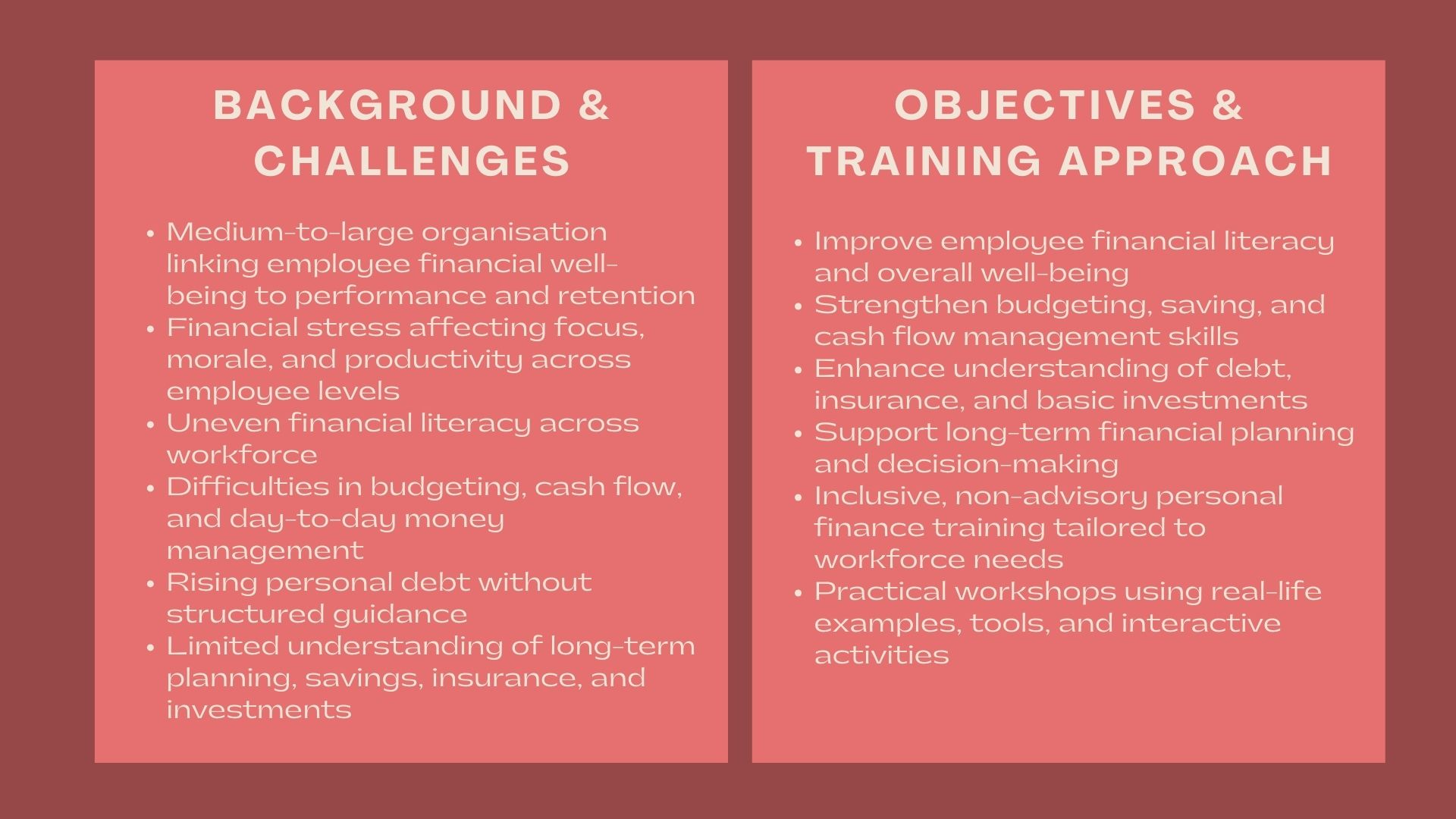

A medium-to-large organisation realised that employee financial well-being was becoming more and more connected to performance and engagement at work, as well as retention. There were personal financial problems among the employees in various positions and different levels of seniority that were being encountered in terms of budgeting, debt management, saving and long term financial planning.

The management noticed that employee concentration, morale and productivity were not working well due to financial stress. Though the organisation was giving competitive compensation and benefits, there was not much organised support to enable employees to know and manage their personal finances effectively.

The organisation contracted our Personal Finance In-House Training Services to establish and implement a tangible, inclusive, and accessible financial education programme on the workforce to help deal with such challenges and promote holistic employee well-being.

Issues and Challenges

The organisation encountered a number of challenges that brought out the necessity of personal finance training.

Different financial literacy among the workforce was one of the main challenges. The number of employees of various educational and professional backgrounds caused a variety of knowledge of the fundamental financial concepts.

The other problem was day to day finances. A lot of financial strain and uncertainty were experienced as many employees reported that they had a hard time budgeting, monitoring expenses and cash flow management.

The management of debts was also an issue. Debts of all kinds, personal loans, credit cards, and mortgages were being acquired by employees, but there was no organized advice on how to pay their debt off and interest charges.

There were further problems with long-term financial planning. The workers did not know how to save, how to plan retirement, whether to get insured, as well as the basics of investments and thus planning their financial future became hard.

Lastly, the management wanted to make certain that whatever personal finance training was being offered was educational and not advisory in nature that would be neutral, inclusive and relevant throughout the organisation.

Objectives

The main aim of the engagement was to enhance the financial literacy and wellbeing of employees by introducing personal finance training in-house which was tailored.

Precisely, the organisation had the following intentions:

- Develop basic education about concepts of personal finance.

- Enhance budgeting, savings and management of cash flows.

- Improve knowledge on debt, insurance and basic investments.

- Planning and decision-making, long term.

- Lessen financial pressure and enhance employee welfare.

The training programme should have been practical, accessible to non-specialized, and befitted at various life stages of the employees.

How We Helped

We took a formal and non-elitist stance of personal finance in-house training which is based on the work force profile and well being agenda of the organisation.

We started with an individual assessment of my needs in personal finance training. We collaborated directly with HR and the management to learn about the demographics of the employees, typical financial issues, and learning styles they like.

On the basis of this evaluation we developed tailor-made training modules that address core issues of personal financial aspects. These were the basics of personal finance, budgeting and cash flow management, saving plan and debt management principles.

Other more long-term financial planning topics that we covered included the concepts of retirement planning, the general basics of insurance, and an introduction to investment. All the content was presented neutrally and educatively without advertising particular goods or vendors.

The practical application was highly relied on. The real life examples, straightforward calculations, and interaction activities were a part of training, which made the participants think about their personal financial habits and priorities.

The programme was designed in such a way that it was inclusive and non judgmental so as to make it relevant to all employees at various income brackets, career levels, and personal situations.

Workshops were used in the delivery of training with the combination of face-to-face and virtual training where warranted. Facilitators illustrated concepts using simple language and illustrations to simplify the understanding and application of concepts.

We also facilitated learning with practical resources like budgeting templates, financial planning checklists and reference guides which the participants could access in the aftermath of the training.

In the course of the engagement, we closely collaborated with the organisation to make sure that the training process did not contradict the goals of employee well-being and organisational values.

Value Delivered

This case study indicates that the financial well-being and the productivity of employees, in terms of productivity in the workplace, can be improved through professional Personal Finance In-House Training Services.

The engagement allowed enhancing financial awareness, developing confidence in personal financial decisions, and a healthier and more occupied workforce through structured and practical training.

The internal training system of personal finance that was developed by way of this engagement presented a modularised model of future financial education, staff assistance and long term organisational well being programs.