Top Financial Modeling Courses in Bangkok – Riverstone Training

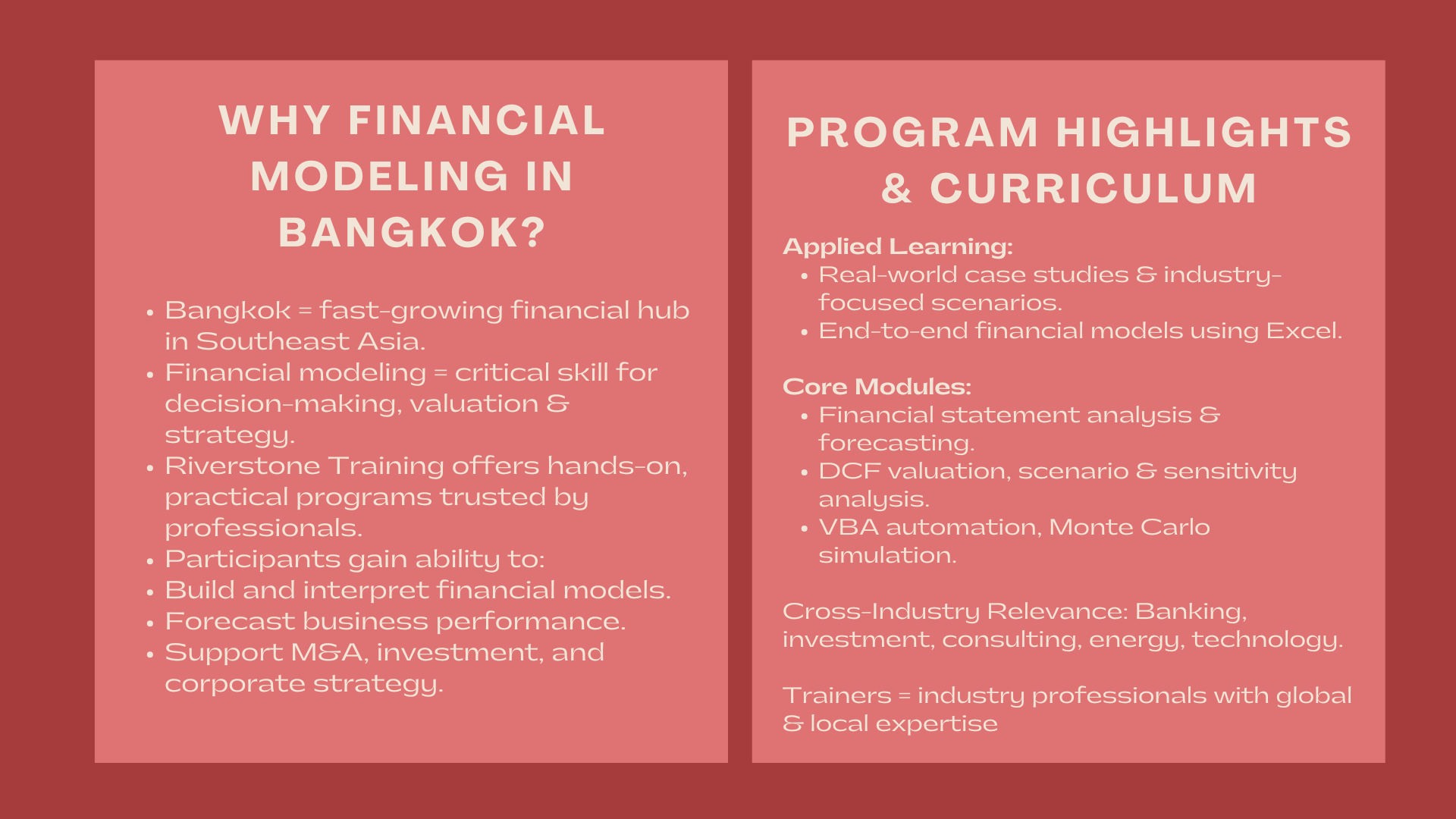

Financial modeling has become every finance professional and executive ideal in the fast-moving financial arena in the business world today. With business growth spurring in Southeast Asia the skills of developing, interpreting, and implementing financial models to inform strategy implementation are sought after.

Bangkok, a business and financial hub in the region, has experienced an influx of central business people who are at the peak of their careers and are in need of advanced training on financial processes and valuation. One of the best providers of the same programs in the city, Riverstone Training specializes in providing programs that combine a combination of practical training in financial analysis as well as practical modeling tools to achieve decision making excellence.

Empowering Professionals Through Technical Finance Mastery

Bridging Theory and Practice in Financial Analysis

Riverstone’s advanced financial modeling training Bangkok equips participants with the skills to transform complex financial data into actionable insights. The course does not just cover the formulae– it explains the principles of creating a solid, transparent, and dynamic model which reflects business issues in the real world.

The participants are taught to create models to use Excel to value, finance projects and forecast their business, which can strengthen the ability to justify corporate strategies, mergers and acquisitions and financial planning. They are given hands-on experiences to ensure that they have the confidence to implement financial modeling methods in any industry, including banking, manufacturing, technology, and energy.

Who to bring to it and why it is important.

The course is created to help finance professionals, investment analysts, accountants, business managers, and entrepreneurs to improve their analytical capabilities and mobility in their careers. Financial modeling skill can commonly be a distinction between job candidates in the competitive job market of Bangkok. The ability to convert business assumptions to numbers, analyze situations, and predict results is valued by employers and will direct employees toward success in the workplace.

The participants enjoy real life training sessions which sharpen their excel modelling and analytical mind. Pursuing a career in corporate finance, investment banking, or private equity? This course provides a path towards long term success in high-value finance positions.

Building a Strong Foundation for Strategic Thinking

Unlike short seminars, Riverstone’s programs focus on comprehensive learning. The Professional Excel and modeling courses Bangkok teach participants how to use Excel as a strategic financial tool—creating automated dashboards, applying scenario analysis, and stress-testing assumptions. The training focuses on creation of flexible models that could be adapted to various circumstances in business thus job ready on completion of their training.

The program design combines financial theory, business strategy, and technology, an integration critical to the contemporary finance professional. Not only do the participants know about the numbers, they interpret them in order to achieve better business results.

Transforming Career Potential Through Applied Learning

Course Curriculum and Learning Objectives

The Financial modeling workshops for professionals Bangkok offer a deep dive into valuation, corporate finance, and forecasting. The course content includes financial statement analysis, discounted cash flow (DCF) valuation, sensitivity analysis and scenario building.

Students are also exposed to more advanced Excel features and modeling techniques like VBA automation and Monte Carlo simulation. The outcome is the capacity to examine investment projects, assess financial performance, and construct engaged financial models to help them in decision-making.

At the conclusion of the workshop, participants will be able to generate models independently that simulates realistic business environments, which is greatly desired by employers in the banking, consulting and corporate sectors.

Applicability to the Thai and Regional Labor Market.

The financial industry in Bangkok is very dynamic with several large banks, consulting companies as well as investment companies in search of people who can analyze financial information accurately. Financial modeling experience is actively sought after and employed by employers like Bangkok bank, SCB, Deloitte Thailand, PwC, KPMG and Kasikornbank.

Financial analyst, investment associate, project finance consultant, and corporate strategy executive demand skills in creating and operating models that analyze projects, investments, and business plans. Graduates of Riverstone programs are distinguished by their technical expertise and applied financial skills-qualities that open career opportunities in all fields.

Divisions and Profiles.

All participants of the course can select jobs in the different departments which include:

- Corporate Finance and Strategy: Preeminent capital budgeting and planning investment.

- Investment Banking: Facilitating M&A transactions by valuation and transaction analysis.

- Financial Planning and Analysis (FP&A): Budgets, forecasts, and the appraisal of performance.

- Private Equity and Venture Capital: The evaluation of startup valuation and investment terms.

- Consulting and Advisory: Offering clients data-based information and expertise in valuations.

Financial modeling skills are important in these departments to help assess risks, to maximize financial decisions, and to drive value.

Building Future-Ready Financial Professionals

Practical Benefits to those involved.

A major strength of the training provided by Riverstone is emphasizing practical uses. Students solve problems that are industry-based and they build the end-to-end models similar to those applied in work settings. They are trained to work with actual financial data, to use assumptions that make sense, and to communicate their results in a clear manner-skills which increase not only confidence but also credibility in the workplace.

Graduates frequently note that their performance in analyzing company performance, making investment decisions, and reporting financial results to senior management has greatly improved. The program will enable them to be not only analysts but also decision-makers who can help shape financial strategies.

Firms that employ Financial Modeling Professionals.

Many companies in Thailand and ASEAN region are increasingly employing individuals with high modeling abilities. Other than large Thai banks and consulting companies, there are also multinational companies, such as Unilever, CP Group, Siemens, and Grab Thailand, that require candidates with expertise in using Excel as a financial analysis tool.

Today, job market websites like JobStreet, LinkedIn, and Indeed regularly advertise job opportunities in financial analysts, investment officers, and business consultants in which financial modeling skills are a mandatory requirement. Candidates who have received advanced training in modeling have a clear edge because employers are more interested in candidates who can create and analyze financial models on their own.

Professional Development and Income.

Successful completion of an organized modeling program may result in a faster climb up the hierarchy. Within two to three years, entry-level analysts have the option to become senior analysts or finance managers, and mid-level professionals will become strategic finance or investment professionals.

Financial modeling specialists are likely to find very attractive remuneration package in Bangkok as the city has a large demand of analytical skills. In addition to financial benefits, learning to model can also allow the professional to assume leadership responsibilities that require strategic decision-making processes.

The Edge of Riverstone, Experience, Expertise and Excellence.

Professional-Based Instruction and Customized Education.

The programs in Riverstone Training are facilitated by experienced industry professionals with a background in investment banking, private equity and corporate finance. This makes each session not only academically rigorous, but also market-relevant. Trainers introduce real case studies of the vibrant financial markets in Southeast Asia to enable the participants to easily connect theory with practice.

The structure of the classes promotes active engagement, learning among peers, and individual mentorship- so that each member can get the best out of the course irrespective of their experience.

Local Irrelevance and Unending Learning.

The regional approach is what is unique with Riverstone. The training integrates market experiences in Asia, where there exist variations in investment approaches, valuation principles and financial standards. The participants obtain a wider perspective into the application of financial modeling principles across the borders which is a necessary benefit in the modern business environment of globalization.

Also, Riverstone offers post-training support and updates, refresher courses and lifelong learning to keep professionals abreast with the changing market practice and technology.

Conclusion: Top Financial Modeling Courses in Bangkok

The presence of Bangkok as a financial centre in the region continues to grow and there is a dire shortage of professionals who possess the highest levels of analytical and modelling skills. The Financial Modeling Courses offered by Riverstone Training enable members to gain the necessary technical skills, strategic outlook and confidence to survive in this competitive world.

Using relevant, expertly crafted learning experiences, participants will acquire an arsenal of tools to turn data into strategy, analysis into insight, and ambition into concrete career advancement. As a budding analyst, a corporate manager, as an executive in a financial firm, learning how to do financial models in Bangkok is an investment that would pay professional lifetime returns.