Corporate Valuation Training in Phnom Penh – Riverstone Training

The capital city of Cambodia, Phnom Penh, is a rapidly developing city that is on the verge of unparalleled economic change. It used to be a forgotten market but now it is greatly invested in foreign direct investment, it is also the birthplace of swelling local businesses, and its experience of consistent growth of M&A activity. The skill to clearly, transparently, and defensibly identify the actual worth of a business in this thrilling, yet frequently veil of darkness, environment is not simply an analysis game–it is the foundation of prudent investment choices and a requirement of the reduction of financial risk.

To the ambitious individuals in Phnom Penh who would like to traverse this frontier market and climb the financial ladder, corporate valuation is the right key to unlock the career ladder and shape the Cambodian economic trend. With its extensive experience of operations in Southeast Asia, Riverstone Training is a specialized training facility suited to the dynamics of the Cambodian market, right here in Phnom Penh. We have designed our curriculum to help you become an expert in analyzing and to make sure that you are in the middle of the new investment and business-related finance business in Cambodia.

In this article, we are going to discuss how the acquisition of expertise with our programs opens unprecedented career opportunities. We will elaborate in particular the overall curriculum, who our targeted audience will be, the practical benefits you will receive in the real world, and the particular roles and companies within the Cambodian market who are actively pursuing this type of elite education, as it relates directly to our training in order to establish your success.

The Economic Rise of Cambodia: The Valuation Requirement in a Frontier Market.

Managing the Ins and outs of Cambodian Business Valuation.

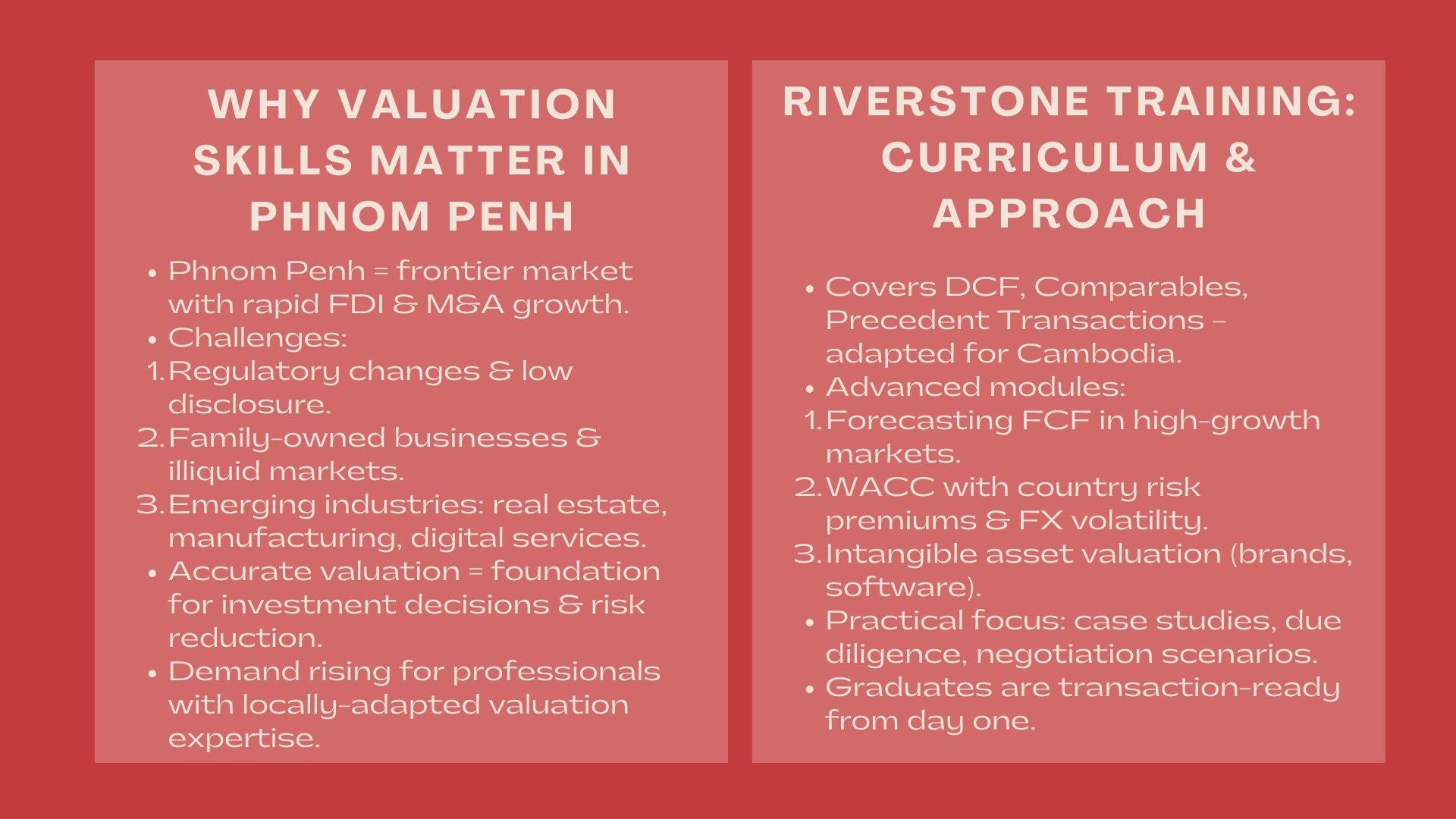

The market of Phnom Penh presents a number of unique challenges when it comes to valuing assets: the fast evolving regulatory framework, the differing degrees of corporate disclosure, and the local market peculiarities of ownership arrangements, frequently based on tightly-controlled family businesses. More than more established economies, Cambodia is often facing a context with very little information about the public market, a greater illiquidity of private businesses, and a certain concern over emerging sectors, like in real estate, manufacturing, and digital services.

Such a setting requires financial practitioners able to develop strong financial structures that provide a proper accounting of these local factors, including increased discount rates which reflect the perceived market risk, and custom adjustments to the operational complexities. In the event of there being no intensive, locally-aware training, financial executives run the risk of under-pricing deals, causing expensive mistakes to the domestic investor as well as foreign capital. Consequently, firms are aggressively seeking candidates who can demonstrate practical competence in these areas, making our Business valuation courses Phnom Penh an essential foundation for serious career advancement in the nation’s financial heart.

From Data to Decisions: Empowering Strategic Influence

The ultimate gateway between unrefined financial information and corporate action is valuation expertise. Indeed, professionals capable of articulation and defense of a valuation opinion can be key areas of focus during a decision making process. They are the reliable counselors, who advise C-suite executives whether to purchase, sell, invest or reorganize assets. This professional expertise helps people who have worked in technical support services to be in the position that shapes the price of the corporate policy and investment in the region.

An example is an auditor who knows how to value can become a Transaction Services employee, whereas a Corporate Finance Analyst can quickly become a Corporate Development Manager and begin valuing mergers and acquisition targets and board capital structure directly. No better means than mastering valuation can be made to gain promotions and enter positions that can change major capitals movements in and out of the Phnom Penh economy.

Riverstone Strength: Niche Applications to a Unique Market.

Basic Methodologies Adapted to Cambodian situations.

Instead of operating on introductory concepts, our workshops are designed to master the three major pillars of corporate valuation the Discounted Cash Flow (DCF), Comparables and Precedent Transactions and condition entirely on the unique problems of the Cambodian market. The curriculum provides strategic use with technical profundity. The training also offers high-level training on such subjects as Advanced Discounted Cash Flow (DCF), and it necessitates an intensive study of forecasting Free Cash Flow (FCF) in high growth, new market companies and proper estimation of the Terminal Value with the help of sustainable long-term growth rates that are unique to the development stage of Cambodia.

In addition, we will also take into account a proper calculation of the Weighted Average Cost of Capital (WACC), taking the important step of adding Country Risk Premiums, and adjusting to the local currency and market volatility of Cambodia–a crucial step in any local or cross-border transaction. This practical instruction is a hallmark of our Advanced corporate valuation Phnom Penh programs, giving participants the real-world competence that sets them apart in deal negotiation and investment analysis.

Specialized Scenarios and Enhanced Due Diligence

The complex Cambodian economy needs the services of professionals who can manage highly specialized valuation problems that are not taught in the general degrees in finance. Because these high-value areas are so important in our training, it gives the specialist knowledge that opens the doors to elite careers. This involves learning how to Value Intangible Assets, which are brand names and software, that is essential in the increasing digital and consumer goods industries in Phnom Penh. In addition to this, we do Valuation to Private Equity and Venture Capital and learn methods to value early-stage companies and use scenario analysis to price equity rounds and valuation of exits of private investors.

The concentration on Transaction Due Diligence implies the direct incorporation of valuation results into the due diligence procedure, the financial red flags particular to emerging markets, and stability of the valuation under the pressure of the intensive negotiations and legal scrutiny. It is this strong preparation which is a major output of our Professional valuation workshops Phnom Penh which make sure that the graduates are ready to transact right after graduating.

The Job Market Benefit: Companies in need of Valuation Expert.

Firms in Phnom Penh in the finance, consulting sector and major corporate groups, are aggressively recruiting professionals whose resume show a demonstrated area of specialization in corporate valuation. Such competence is an indicator of the preparedness of a candidate to take up strategic positions and authoritative roles in the most influential economic players in defining the future of Cambodia.

Leading Employers and High-Demand Roles

Major players in the Cambodian economy are demanding specialized skills in valuation to handle their growth and risk management, and provide competitive compensation and career development opportunities. Capital raising and transaction advisory Investment Banks and Securities Firms such as ACLEDA Securities, RHB Indochina Bank, and an increasing number of local financial institutions are always seeking M&A associates and research analysts. Local and regional Private Equity/ Venture Capital Funds need valuation analysts to screen, price, and control their investment in Cambodia-based companies.

Transaction Services Managers have their presence increasingly in the Big Four Consulting Firms (PwC, KPMG, EY, and Deloitte), which are the key recruiters of managers to handle intricate financial reporting and PPA valuation in their varied client base. Lastly, Major Conglomerates such as Chip Mong Group and Prince Group require Corporate Development Executives to have internal oversight of their M&A and strategic alliances, usually leading to large-scale expansion. By mastering this new set of skill, you can not only enhance your technical competence but you are making it clear to the employers that you are prepared to take the next step into the strategic management.

Conclusion: Corporate Valuation Training in Phnom Penh

Phnom Penh is an exciting and competitive career place to be but only to individuals who have the targeted skills to handle its peculiarities. Corporate valuation expertise is the only valuable asset that a finance professional can have in a market where capital decisions are being made on a daily basis and M&A deals are becoming increasingly common. Riverstone Training gives you the ultimate, real-life channel to the process of gaining this knowledge, so that you can price accurately and successfully also be able to close a high-stakes deal. The final step of becoming not only a member of the process, but a leader of the future of the dynamic Cambodian economy is investing in state-of-the-art corporate valuation training today.

Those aiming to deepen their financial expertise can explore opportunities like the Corporate Valuation Training in Manila, designed for real-world application.