Best Private Equity & Venture Capital Training in Phnom Penh – Riverstone Training

Introduction to Top Private Equity VC Courses Phnom Penh

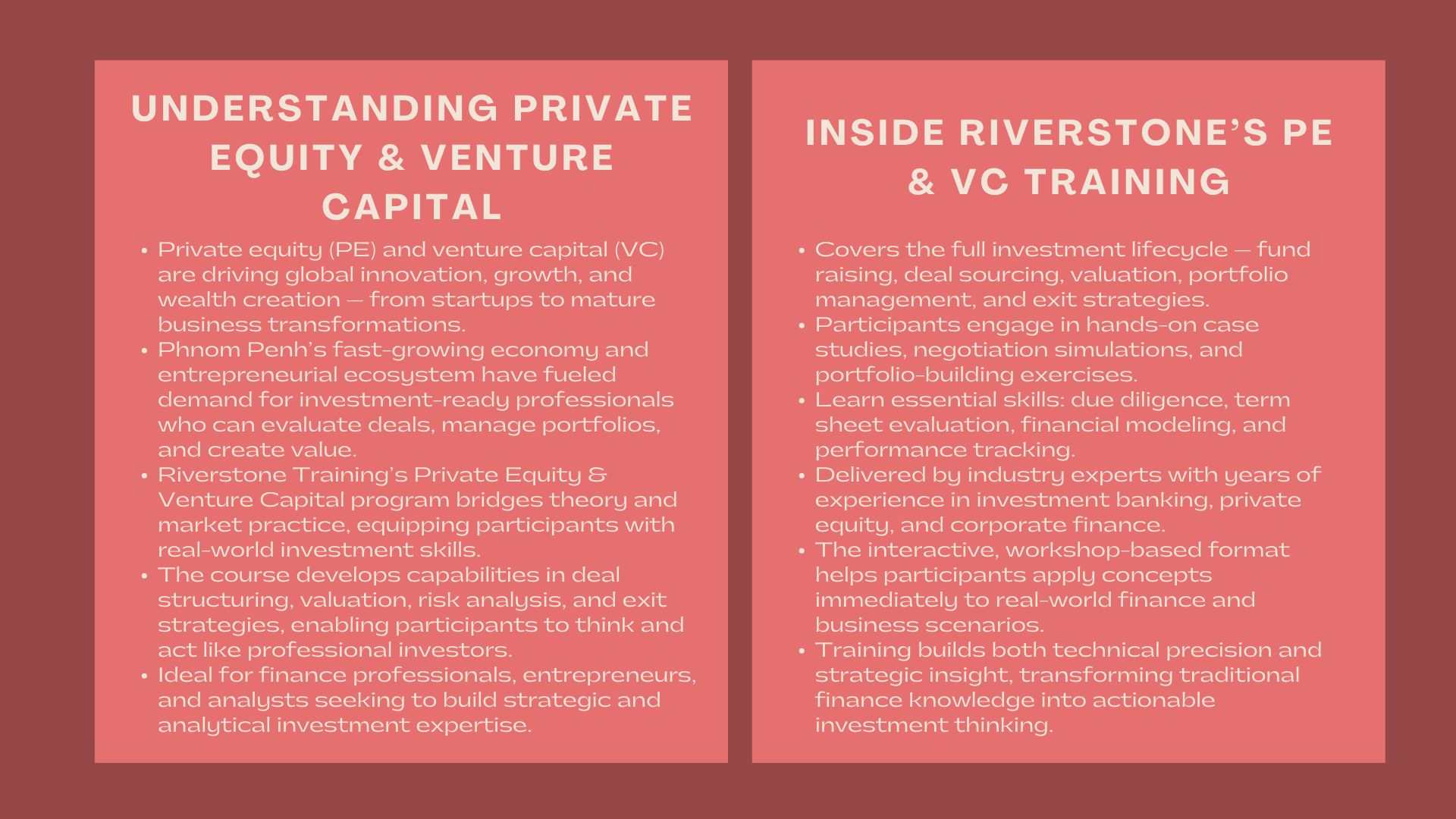

The world economy is experiencing innovation, growth and wealth creation that is being led by this debt financing sources: private equity (PE) and venture capital (VC). Since funds are being invested in startups with innovative ideas to the acquisition and transformation of mature businesses, people knowledgeable on how to deal with investments in the private markets are becoming more popular.

In Cambodia where entrepreneurship and foreign investment are booming, the demand to finance professionals who can evaluate opportunities, organize deals, and handle portfolios has been on the rise. Riverstone Training has therefore launched its own Private Equity and Venture Capital Training in Phnom Penh a practical and broad based course that is geared towards allowing professionals to gain the knowledge required to succeed in the private investment markets.

The reasons why skills in the field of Private Equity and Venture Capital are important.

Next Generation of Investment Leaders Empowerment.

Modern financial strategy is centered on private equity and venture capital. They offer businesses growth capital, strategic direction and creation of long-term values. To the practitioners of finance, an insight into the working of PE and VC funds can provide a chance to be part of some of the most vibrant areas of the financial system of the world.

Riverstone’s private equity courses for professionals in Phnom Penh equip participants with the skills to analyze potential investments, conduct due diligence, and manage portfolio performance. The program will also focus on moving theory to practice with the aim of allowing the learners to understand how professional investors make decisions, structure deals, and provide returns.

Overcoming the Chasm between Market Practice and Finance Theory.

Typically, the strength of academic finance lies in corporate valuation and capital markets; meanwhile, private equity and venture capital demand more insight into business development, risk management and exit measures. The program by Riverstone assists professionals in converting the conventional finance knowledge into plausible investment choices.

Respondents discuss the way in which investors spot growth opportunities in startups, meet deal terms, oversee investments and develop value before eventual exits by way of IPOs or acquisitions. The course makes sure that the learners have not only heard the financial modeling and valuation but are also able to think like investors who can evaluate the opportunity and the risk.

Within the Private Equity/ Venture Capital Training at Riverstone.

All-Encompassing, Practical Curriculum.

The Private Equity and Venture Capital Training at Riverstone is inclusive of the entire investment lifecycle including raising funds and identifying deals to managing portfolios and exit strategy. Individual modules have been well designed to give practical information on the functioning of investment companies and the structuring of deals in actual business environments.

The venture capital training workshops in Phnom Penh incorporate real-world case studies drawn from successful funds and regional investment projects. In this step, participants get to know how to assess startups, conduct due diligence, and review important performance indicators. They also have an introduction to deal structuring, valuation methods and term sheets, which are essential tools to any professional in the area of private investments.

Application through Case Studies.

The philosophy of training in Riverstone is based on experiential learning. The program is not purely theoretical, but rather practical. The participants solve the issues based on real-life case studies including real investment transactions, make simulations related to negotiations, and develop portfolio development strategies.

The workshop-based interactive approach will make sure that learners will get a practical experience in the evaluation of investment opportunities and will learn how value can be created during various periods of the lifecycle of a company. It is not only about getting educated on finance, it is about education on how to think like an investor.

Led by Industry Experts

The training is provided by the trainers who have the vast experience in the field of private equity, venture capital and corporate finance. These experts are veterans of deal-making experience at investment banks, advisory firms, and private investment funds.

Their experience provides the participants with a realistic perspective of what they need to make it in this competitive industry – to finding viable opportunities and dealing with the investors. Through them, the participants are retained to level their technical competence and strategy required to the private markets.

Who Will Be Attended and What They Will Receive.

Perfect in the case of Future Investment Professionals.

Riverstone Institute Private Equity and Venture Capital Training is targeted at finance professionals, entrepreneurs, analysts, and executives, who wish to increase their knowledge of investments, or seek a career in either the area of the private equity sector, venture capital, or corporate development

Whether you work in banking, consulting, or a corporate finance department, understanding how private investors evaluate, fund, and manage companies provides a valuable strategic edge. The advanced PE & VC training in Phnom Penh equips participants with tools that are applicable across industries — from analyzing cash flows to assessing risk-adjusted returns.

Building Investment Confidence and Analytical Skills

At the end of the program, participants have a good mastery of financial modeling, valuation, and investment assessment techniques. They are taught to build deal structures to accommodate investor and founder interests, negotiate equity positions and exit strategies.

These abilities do not only result in a higher level of analytical accuracy, but also in the development of trust in communication with stakeholders, such as investors, entrepreneurs, and members of the board of directors. The graduates are prepared to recognize good investment opportunities, eliminate riskiness, and become able to participate in high-stakes financial conversations.

Thinking Strategically, Out of Numbers.

Riverstone has one of their key strengths in assisting the participants in making strategic and commercial judgment. The training is not confined to spreadsheets and financial indicators, but it discusses how value can be created by enhancing operations, entering new markets, or being innovative.

The professionals are taught to see companies as an asset, as something that can be transformed into a living thing. This is the holistic view that is most essential in achieving success in private markets where the returns are not necessarily made by numbers but by strategy and management.

The reasons to attend Riverstone Training.

World Wide known Leadership in financial education.

Riverstone Training has established a high reputation in Asia and has been proven to provide professional training programs in finance using high academic standards but at the same time being practical. In Singapore and Bangkok, Riverstone is a recognized name in financial training when it comes to corporations, investment firms, and state organizations.

This has been carried on in its Private Equity and Venture Capital Training, which offers a global-quality based learning experience, but adjusted to regional market forces. The same standards of excellence that have established Riverstone as a household brand in the area of financial education are enjoyed by the participants.

Interactive and Flexible Learning Experience.

Knowing the hectic schedule of working adults, Riverstone provides various types of learning, such as the face-to-face learning in Phnom Penh, the online live classes, and the specially designed in-house business training workshops. All formats are equally deep and high quality, which guarantees a similar result of learning.

The course design is based on engagement, discussion and problem solving. The trainers will motivate participants to exchange experience, discuss strategies, and collaboratively solve case challenges, which will help build a learning environment that promotes the growth of skills as well as networking amongst their peers in finance.

Career-Enhancing Certification

On successful learning, they are given a Certificate of Achievement by Riverstone Training, which indicates that they are knowledgeable in the field of private equity and venture capital. This certification gives the professionals more credibility in their profession especially when they need to advance in their position in investment or when they want to move to other fields of finance.

Riverstone-trained professionals have an edge over their peers as they are able to think analytically, understand business, and have a practical understanding of how investment processes work. Graduates are unique thinkers prepared to infiltrate into growth, innovation and financial leadership.

Value of Expertise in the Private Markets.

The future of finance is being determined by private markets, which include both the private equity and the venture capital. The need of professionals who are well versed in such areas is still increasing as companies prefer to remain privately longer and as investors seek new resource to diversify.

This is a key prospect to the Cambodian professionals to engage in the vibrant regional investment ecosystem. The course offered by Riverstone Training enables the graduates with the instruments and knowledge to talk to an investor, evaluate business opportunities and become an integral part of this highly dynamic industry.

Conclusion

The next wave of financial leadership in Southeast Asia is the presence of private equity and venture capital. Given the ever changing business environment in Phnom Penh, business people who know how to discover, invest, and develop investment opportunities will have a competitive advantage in determining the future economy of the region.

The Best Private Equity & Venture Capital Training at Riverstone Training in Phnom Penh provides the knowledge, analytical, strategic and practical expertise required of those in the volatile sector. With a mix of professional education, practical training and the international benchmarks of greatness, Riverstone can enable aspiring people to turn their financial wisdom into practical investment achievement.

To the future professionals who have the desire to grow their careers and become a part of the new wave of growth and innovation, Riverstone Training is the partner that they can rely on in order to start the journey.