Case Study: E-Learning Services on Finance for Non-Finance Managers Empowering Better Business and Leadership Decisions

Background on Case Study Finance for Non-Finance Managers

In most organisations, operation, sales, marketing, human resources, engineering as well as technology functions managers have to make decisions with direct financial implications. Managerial tasks are now becoming more about budget ownership, cost control, pricing decisions and investment prioritisation, even to individuals who do not have formal finance training.

Although this is the case, not all non-finance managers are sure about reading financial data and seeing the impact their decisions have on the business performance. Financial reports may be considered to be complicated or scary to understand and most people are inclined to depend on the finance departments and have less involvement in financial debates.

In response to this issue, our company was contracted to develop and implement an end-to-end e-learning programme on Finance to Non-Finance Managers, which would allow the participants to develop relevant financial skills using a well-organized, convenient, and convenient digital learning tool.

Issues and Challenges

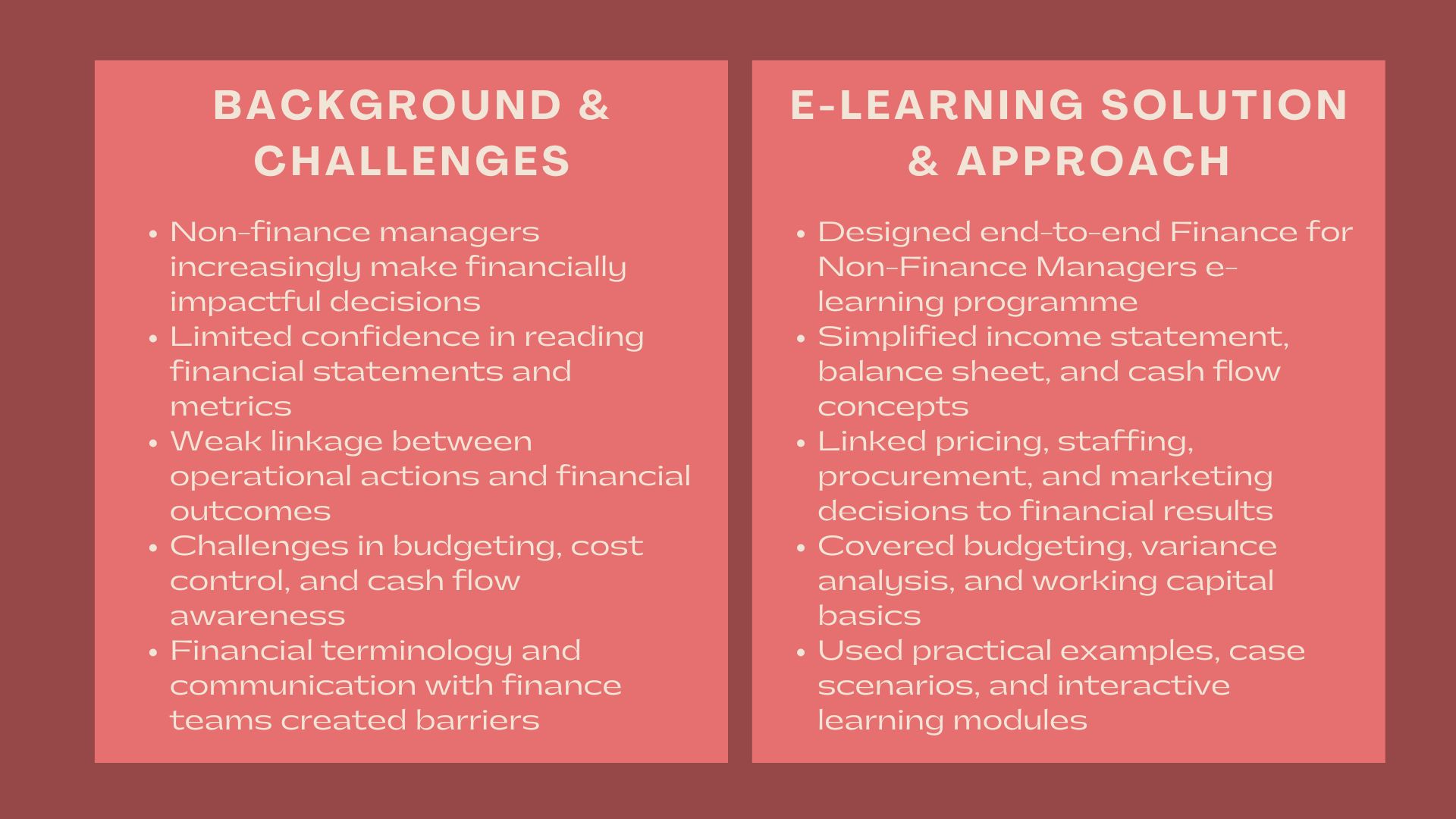

The respondents struggled with various challenges that made it clear that there is a need to focus on finance training among non-finance professionals.

Poor knowledge of financial statements was one of the challenges. Most of the managers had difficulties in interpreting income statements, balance sheets and cash flow statements as well as comprehending how such reporting indicates a business performance.

The other problem was a poor connection between operational decisions and financial performance. Managers tended to decide in areas of pricing, staffing, procurement or marketing without being aware of the cost implication, margin and cash flow implications.

The cost control and budgeting was a further challenge. The learners were not confident in making budgets, tracking variances, and control of departmental financial performance.

Terminologies and metrics of finance were also a hindrance. Gross margin, EBITDA, working capital, and return on investment are some of the terms that were consumed during meetings but not always comprehended.

Lastly, communication with finance departments, cross-functional interaction, and quality of decision-making were constrained, with many managers not being comfortable communicating with the finance departments or getting involved in financial decision-making with the top management.

Objectives

The main goal of the engagement was to create an e-learning course on Finance to Non-Finance Managers that might create financial competence and applied business knowledge.

Key objectives included:

- Demonstrating fundamental financial terms in understandable non-technical terms.

- Developing better knowledge of financial statements and measures.

- Connecting operational choices and financial performance.

- Increasing budgeting and cost control capacity.

- Offering self-managed flexible learning at all levels.

The programme had to be realistic, interactive and bring out the direct connection to the day-to-day managerial duties.

How We Helped

The instructional design used was based on a structured approach in order to create a complete finance to non-finance managers e-learning programme.

The process has started with curriculum design. We designed the learning process in such a way that it progressively developed the financial understanding, beginning with simple concepts, and then moving to the practice.

Initial modules taught the learners about the role of finance in business and the basic financial terms. We dis-aggregated financial statements by dividing income statements, balance sheets and cash flow statements into easy to understand pieces.

The related modules were on the insights into profitability and cost frameworks. Students got to learn the relationship between revenue, fixed costs, variable costs, and margins in order to establish business performance.

The issues of budgeting and cost control were treated in essence. Modules took learners through the preparation of a budget, actual performance against a budget and the interpretation of financial variances.

Cash flow and working capital management were also touched in the programme. The learners were educated on how profitable businesses may still experience cash difficulties and they were also taught how the choices made by the business can affect the cash flow.

The e-learning material contained examples, simplified case scenarios, and real business situations to enhance learning. Students were to identify concepts in connection to their departments and roles.

Communication was given a high priority. The modules made the learners gain knowledge on how to pose the appropriate financial questions, management reports and interact with the finance teams with more confidence.

Everything was presented using a user-friendly e-learning system, which enabled the learners to study at their own pace. Materials, visual aids and reference guides were also supported to promote retention and real world use.

Learning Design and Delivery

The e-learning programme was to target adult learners who do not have formal background in finance.

The materials were presented in lesson modules that involved the combination of simple explanations, graphic representations, and real-life examples. Short questions and brief tests solidified knowledge and were not too many to give the participants.

The self-paced format enabled the managers to consider learning as part of the busy work schedule and therefore the programme was applicable to the work of an individual learner as well as the entire organisation.

The digital delivery model guaranteed homogeneity in training quality and scalability by the teams, locations and time zones.

Value Delivered

As identified in this case study, it has been established that E-Learning Services on Finance for Non-Finance Managers can enhance financial literacy, confidence and quality of decision-making substantially throughout an organisation.

The programme showed managers in a more practical, accessible way to learn about the financial implications of their decisions, work with finance teams more effectively and to be more productive participants in business performance conversations.

The scalable e-learning model will offer a sustainable approach to developing the financial capacity and aids in enhancing the leadership and cross-functional alignment.