Case Study: E-Learning Services on Retail Business Financial Modeling Strengthening Commercial Insight and Financial Decision-Making

Background on Case Study Retail Business Financial Modeling

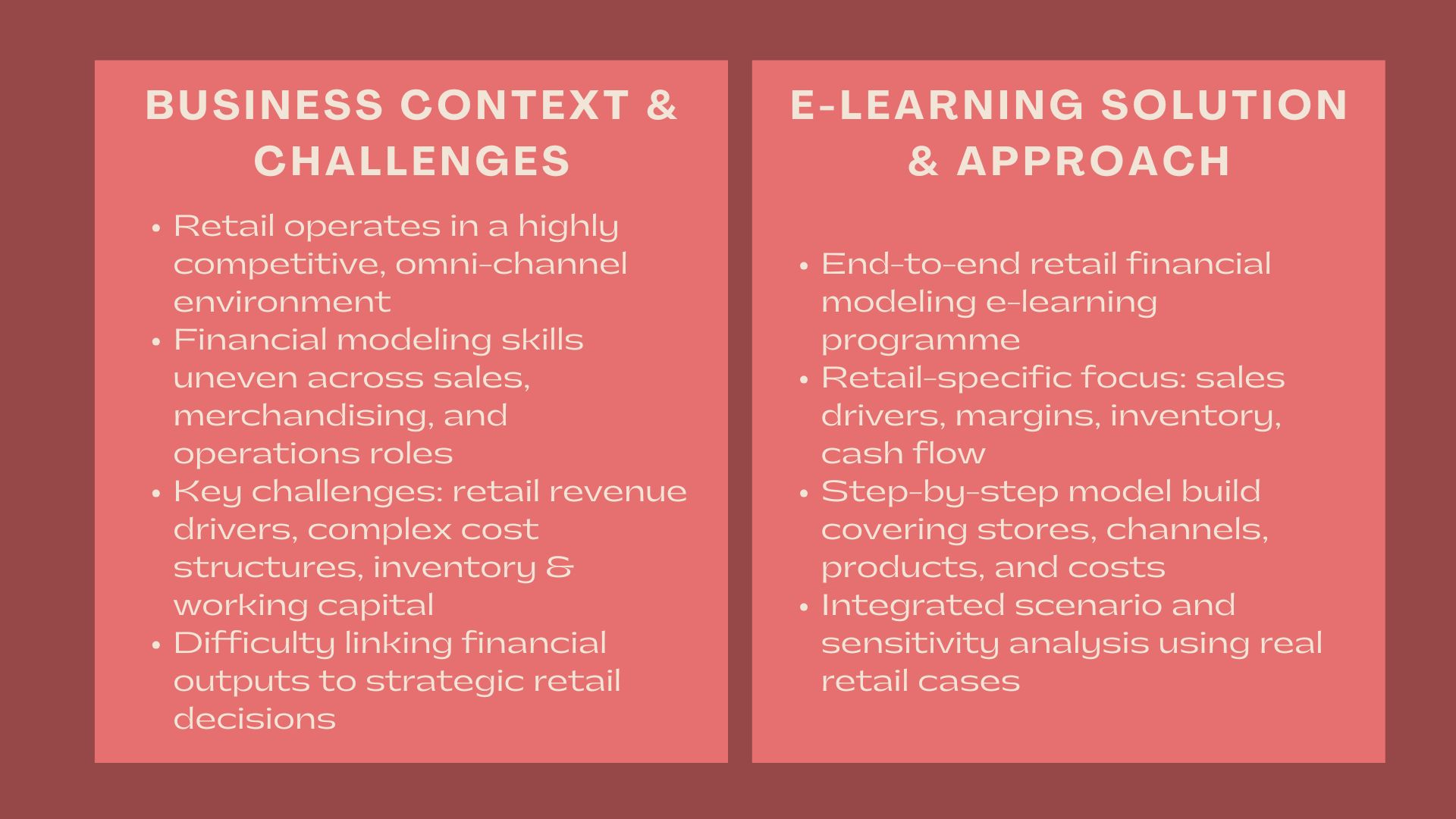

The competitive and dynamic environment in which retail businesses are operating has been characterised by the changing consumer behaviour, digital revolution, price competition and supply chain vulnerability. Financial models are used by retail management teams, investors, and finance professionals to help them in making decisions regarding expansion, store performance assessment, price strategy, inventory decision, and capital expenditure.

Although financial modeling is crucial, a number of those professionals working in the field of retail operations and retail management have either a merchandising, sales, or operations background and have not been properly trained in the financial modeling of retail business. Conventional classroom training can be hard to implement because of operational requirements, teams that span multiple locations and flexibility of learning.

In order to meet these issues, we were contracted to create and implement a total e-learning programme on Retail Business Financial Modelling where learners could develop practical and retail-focused modeling skills using a scalable, self-paced digital learning platform.

Issues and Challenges

The participants experienced a number of challenges that increased the need of specialised retail financial modeling training.

One of the challenges was to know retail revenue drivers. The retail performance is determined by the number of sales, the price, the product mix, the traffic in the store, the conversion rates, and the same store sales growth, which are not always easy to convert into financial projections.

The other problem was cost structure modeling. The cost profile of retail businesses is complicated and covers the cost of goods sold, cost of holding inventory, store operating costs, logistics costs, and marketing costs.

There were also more challenges in terms of inventory management. Students had difficulty in modeling inventory turnover, markdowns, shrinkage and working capital requirements.

The complexity of multi-store and omni-channel made it even more challenging. A lot of professionals struggled to unify the physical stores with the online platforms with just one model of financial performance.

Lastly, there was no confidence among the learners regarding the interpretation of model output and association of financial outcomes with strategic actions like expansion, store closure, price change, or cost reduction.

Objectives

The main aim of the engagement was to create an e-learning programme in Retail Business Financial Modelling that would help to attain a real world, decision based financial model building.

Key objectives included:

- E2E training in retail financial modeling.

- Powering retail-specific revenue and cost drivers.

- Enhancing working capital and inventory analysis competency.

- Improving the ability to do scenario and sensitivity analysis.

- Delivering self-paced learning that is flexible across the various roles.

The programme had to be realistic, common-sense and easy to implement in the actual retail business decision-making.

How We Helped

We engaged a systematic approach to instructional design in order to create an e-learning programme based on a solid financial modeling of a retail business.

The interaction started with the curriculum development. We designed the learning process to progress in the direction of the retail business foundations to the advanced financial modeling and performance analysis.

Introduction modules covered the business model of retailing, which are brick and mortar, e-commerce, and omni-channel. The most important retailing measures, including gross margin, same-store sales, basket size, and inventory turnover, were put into perspective.

The essence of the programme consisted in the construction of a financial model in the retail industry in phases. Learners were taken through:

- Organising model assumptions and schedules.

- Predicting store, channel, and product sales.

- Gross margins and cost of goods sold modeling.

- Projecting the cost of operation and contribution margin.

- The inclusion of inventory, working capital and cash flow dynamics.

Our next entry was that of profitability and cash flow analysis. At the module level, it was shown how revenue growth and pricing and cost structures affect the liquidity and operating margins.

There was the use of scenario and sensitivity analysis interwoven in the programme. Learners investigated the impact of the sales volume, prices, and markdown rates, inventory turnover and operating costs on the profitability and financial sustainability.

The e-learning experience was based on practical modeling exercises. Students were guided through walks through with the help of real-life business retail scenarios and would be asked to vary assumptions to see the financial effect.

Interpretation and communication were also given priority in this programme. Students were also trained on how to turn financial outputs into comprehensible findings to the management, investors, and operational teams.

Everything was presented in a user-friendly e-learning platform with an explanation of videos, templates to be downloaded and reference materials.

Learning Design and Delivery

The e-learning programme was created with an aim of supporting the learners both in finance and non-finance.

The instruction was presented as modular lessons where concepts were explained, visual learning frameworks and practical modeling activities were performed. This was supported by knowledge checks and practical activities which did not overburden the participants.

The self-managed format enabled the learners to combine the training with the operational tasks which made the programme applicable to the individual professionals and to the corporate retail teams.

The online delivery system allowed standardization of training levels and location and business unit scalability.

Value Delivered

As illustrated in this case study, E-Learning Services in Retail Business Financial Modeling can facilitate commercial acumen and financial decisions making in retail organisations.

The programme allowed the learners to gain a clearer insight into retail economics, financial risks management, and decision-making support with data by blending structured learning with retail-specific modeling exercises.

The e-learning structure is scalable to give a sustainable solution to the continuous development of capabilities as the business model of retailing and consumer behaviour change with time.