Case Study: E-Learning Services on Strategic Ratio Analysis Enhancing Financial Insight and Decision-Making Capability

Background on Case Study Strategic Ratio Analysis

Financial analysis is becoming more and more dominant in supporting the implementation of strategies by organisations in different industries, performance analysis, and investment decisions. Although financial statements are important in giving crucial information, the interpretation of this information through meaningful ratio analysis is important in comprehending the business performance, recognizing the risks and doing a benchmarking against the competition.

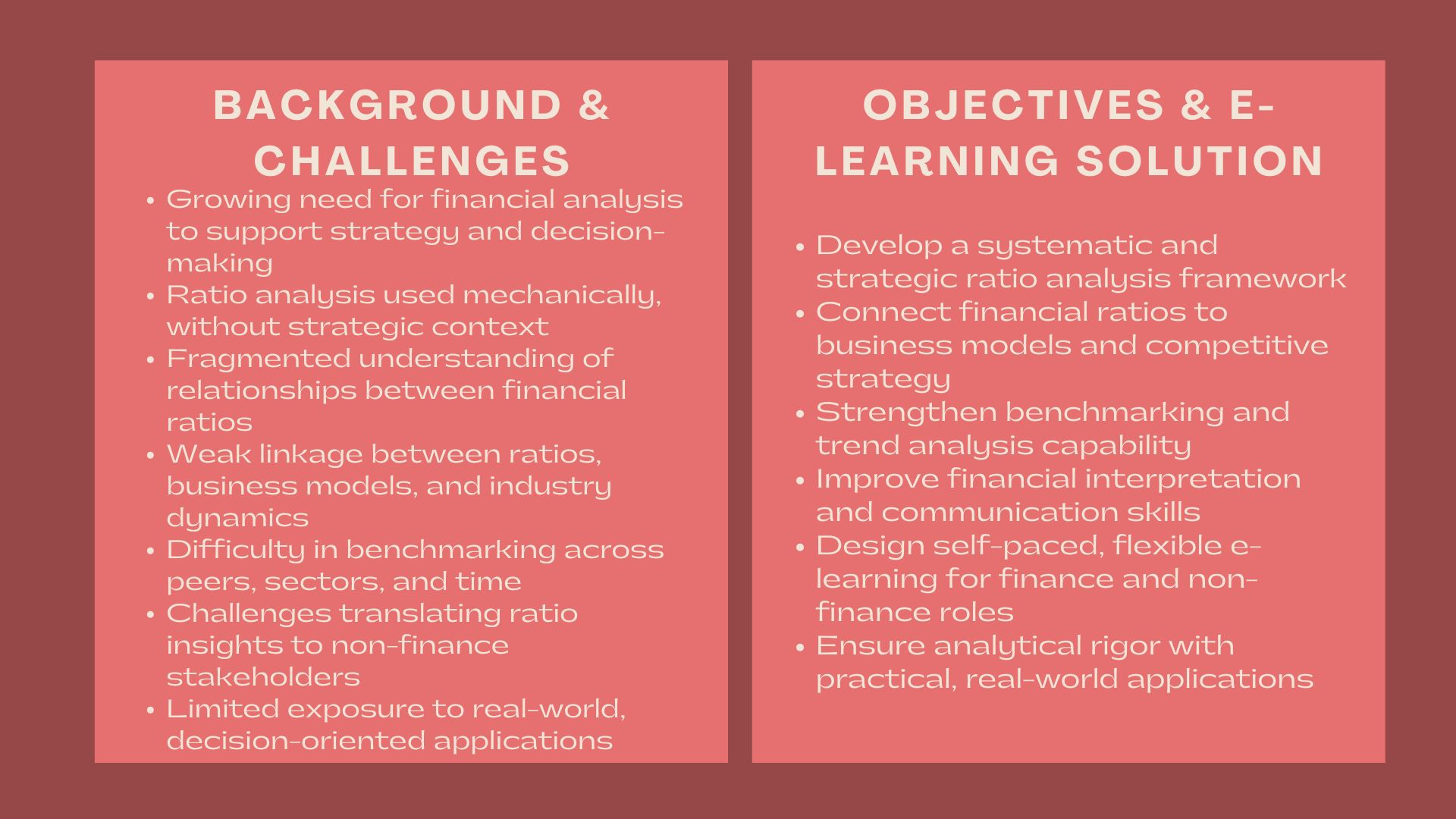

Most of the professionals working in the finance, strategy, operations and management arena commonly analyze the financial ratios but they do not have a systematic method of analyzing these ratios within the strategic framework. Ratio analysis is usually used in a mechanical way without adequate attachment to the business models, industry forces and strategy.

In order to bridge this gap, our firm was contracted to develop and implement an e-learning program on the Strategic Ratio Analysis, so that learners can stop doing basic calculations and acquire more understanding on financial performance, positioning themselves in the market, and making strategic decisions.

Issues and Challenges

There were a number of challenges that the participants experienced thus bringing the importance of a structured and strategic approach to the ratio analysis.

Lack of coherent knowledge of financial ratios was one of the problems. A lot of learners knew the single ratios but did not have an understanding of the relationship between the various ratios and how they all can tell them about a business.

One more difficulty was related to poor strategic interpretation. The review of ratios was held in isolation and little attention was given to business models, cost structure, and industry characteristics.

There were also other challenges with benchmarking. Students had a hard time putting performance of companies in relative terms among peers, sectors or time.

There was also the financial communication. The ratio analysis could not be translated by professionals into an understandable interpretation to the senior management, investors, or other non-finance stakeholders.

Lastly, the students were not exposed to real-life situations that would help them understand how the ratio analysis can guide a strategic decision-making process in terms of pricing, cost management, capital management and expansion strategy.

Objectives

The overall aim of the engagement was to design an e-learning programme on Strategic Ratio Analysis which would be able to enhance the power of analytical thinking and strategic financial vision.

Key objectives included:

- Constructing a systematic ratio analysis design.

- Connecting business models and strategy to financial ratios.

- Improving benchmarking and trend analysis.

- Enhancing financial insights, interpretation and communication.

- Offering self-paced and flexible learning that can be done at any job level.

The programme had to be applicable to both finance and non-finance learners whilst at the same time ensuring that analytical rigor was present.

How We Helped

To create a holistic Strategic Ratio Analysis e-learning programme, we assume a structured instructional design approach to the development of the programme.

These interactions commenced with curriculum design. We have plotted a rational learning path that passed through the financial statement basics to the high level of strategic analysis of ratios.

Initial modules were geared towards developing a powerful background. Before ratio analysis was introduced, learners were taken through the organization and correlation of the income statement, the balance sheet and the cash flow statement and made sure that it is clear.

We then proposed major groups of financial ratios and these are profitability, liquidity, efficiency, leverage and market based ratios. Instead of being told about the calculations only, every ratio was also described in relation to what it says about business performance and risk.

One of the main characteristics of the programme was strategic interpretation. Students were provided with the framework of relating ratios to business models, cost structure, pricing strategies, and competitive positioning. Examples were used to show how different implications of similar ratios can work in different industries.

The topics of benchmarking and trend analysis were addressed extensively. The modules showed how to make comparisons between ratios of companies, time periods, and industry standards to determine strengths, weaknesses, and emerging risks.

There were practical exercises that involved cases. Students evaluated simplified financial statements of various forms of business and used ratio analysis as a performance measure and strategic issues.

The programme also dealt with constraints of the ratio analysis. It taught learners about pitfalls, accounting manipulations and the significance of qualitative context to understand the financial metrics.

To further improve practical use, e learning material had templates, analysis frameworks, step by step tutorials that students could use in their respective organisations.

Everything was presented via an easy-to-use e-learning platform that enabled the learner to learn at their own speed and revise the topics when necessary.

Learning Design and Delivery

The e-learning programme was structured in a manner to meet the needs of different learning and professional aspects.

The material was organized in the form of the modular lessons involving video explanations, visual structures, worked examples, and exercises. Checks of knowledge ensured that the most important ideas were remembered without bombarding the learners.

The self-paced delivery format enabled the participants to fit learning in their working schedules, and hence the programme is appropriate when it comes to individual learning and also corporate learning programmes.

The programme was available on-site and remote, to assist dispersed geographically distributed teams.

Value Delivered

As shown in this case study, E-Learning Services on Strategic Ratio Analysis can be used to improve financial literacy and strategic thinking throughout an organisation.

The programme allowed learners to gain a better appreciation of financial performance, distinguish between strategic risks and opportunities by focusing on interpretation instead of computation and better communicate to stakeholders.

The dynamic e-learning system is a sustainable solution to developing analytical capacity and facilitating informed and data-based decision-making.