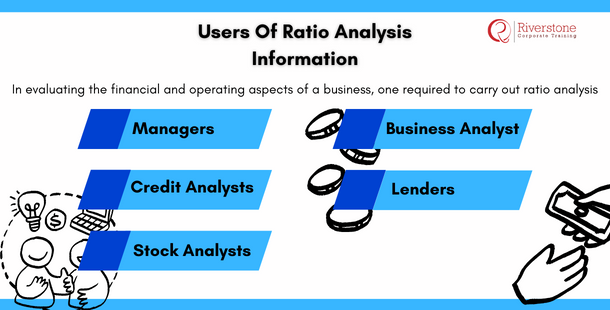

Users Of Ratio Analysis Information

Users of Ratio Analysis Information:

In evaluating the financial and operating aspects of a business, one required to carry out ratio analysis. The liquidity, solvency and profitability ratios in the financial statements offer useful information to investors, creditors and the management.

Managers

The managers of firms find this financial ratio analysis quite handy in analyzing, controlling, and improving the various operations of the firms they manage. Understanding how to perform ratio analysis allows them to determine strengths, weaknesses, and make comparisons with other firms in the industry. Examples of such ratios include Return on Investment (ROI), Return on Assets (ROA), and the debt-to-equity ratio.

Credit Analysts

These are professionals who assess the loan applicant’s worthiness for qualification for a loan. Such professionals rely on ratio analysis to determine to what extent an individual or a firm is able to meet their financial obligations. If a company issues bonds for instance, the credit analyst will use the audited financial statements to determine the creditworthiness of the firm before recommending whether they qualify for the short term or long term loan they are seeking.

Stock Analysts

A stock analyst is a professional who evaluates trading instruments in a bid to predict its future behavior. The analyst will also assess the sector, market or tool using either technical or fundamental analysis. The only way to determine the performance, efficiency, return on equity or growth of a firm is the use of the stock analysis.

Business Analyst

Let’s say that an individual or a firm wants to buy shares of another company. The entities would want to be sure that the stock they are buying or planning to sell would offer the best return in terms of investments. It is the work of the business analyst to provide recommendations on the shares one should buy or sell based on the analysis.

Lenders

If you are a lender to a firm or an entity, you would need assurance that such concerns are in a financial position to meet their debt obligations together with the accrued interests. As such, you will need to scrutinize the ratio analysis in the financial statements—an essential part of the financial data needed for business growth—to determine the extent to which you would commit your finances to the said entities.

Detailed Guides for Specific User Segments

Create dedicated guides or articles that delve deeply into how particular user groups in Singapore leverage ratio analysis. For instance, an article titled “How Singaporean SMEs Use Ratio Analysis for Growth” could detail the most crucial ratios for small businesses, offer specific examples, and discuss common challenges and opportunities in the local market. These resources can also align with the content taught in a professional financial literacy course, helping businesses and individuals build decision-making confidence. Similarly, you could have guides for investors, creditors, or even employees, explaining which ratios matter most to them and why. With the support of interactive employee training solutions, these concepts can be delivered more effectively across teams. This specialized content will cater directly to diverse user needs and establish your site as an authoritative resource for various stakeholders.

Interactive “Which Ratios Matter to You?” Tool

Develop a simple, interactive online tool or quiz that helps users identify which financial ratios are most relevant to their specific role or interest. For example, a user could select “I am an investor considering a local startup” or “I am a manager looking to improve operational efficiency,” and the tool would then present a curated list of key ratios, along with brief explanations of what they indicate for that particular user’s perspective. This personalized approach makes the content highly engaging and immediately valuable, guiding users directly to the most pertinent information for their financial analysis needs in Singapore. By focusing on the role of financial analysis in ratio analysis, users will better understand how to interpret results meaningfully. Additionally, highlighting the importance of benchmark standards in ratio analysis will help them gauge performance against industry norms and best practices.

You can also read – What is the Best Procedure to Understanding Horizontal Analysis?