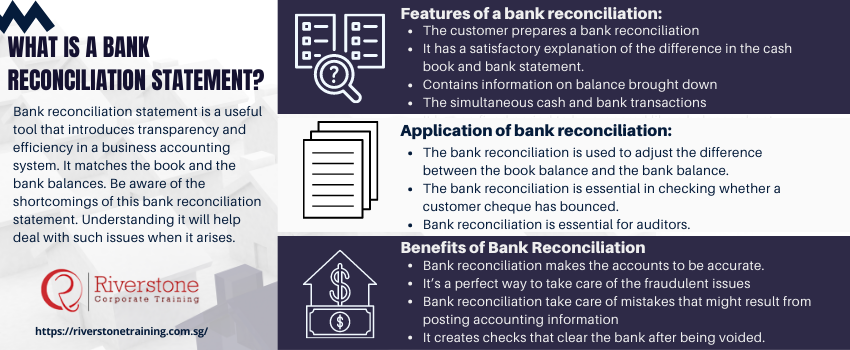

What is a bank reconciliation statement?

Have you ever had issues with the cash balance? Does it not correspond to the bank statement? You need a bank reconciliation statement. It’s a document that matches the cash balance in the balance sheet to the corresponding amount on the bank statement. The bank reconciliation statements are useful in detecting frauds and any cash manipulations. In fact, they are often a key step in how to detect audit fraud, especially when discrepancies in cash records raise red flags. The bank reconciliation statements should be completed regularly to ascertain the cash records. Bank reconciliation statement attempts to explain the difference in the cashbook’s cash and the bank balance.

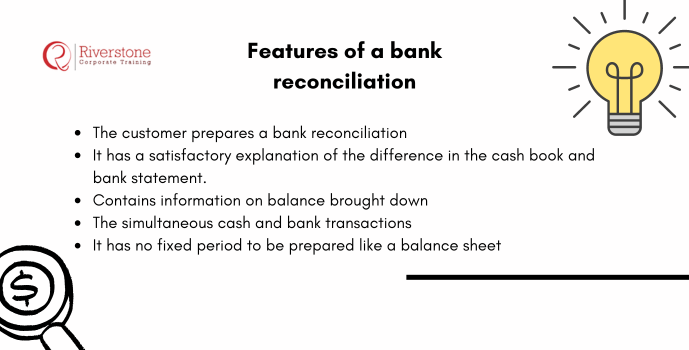

Features of a bank reconciliation:

Here are the critical elements of a bank reconciliation statement;

- The customer prepares a bank reconciliation

- It has a satisfactory explanation of the difference in the cash book and bank statement.

- Contains information on balance brought down

- The simultaneous cash and bank transactions

- It has no fixed period to be prepared like a balance sheet.

Application of bank reconciliation:

- The bank reconciliation is used to adjust the difference between the book balance and the bank balance. It’s useful in correcting the disparities in the amount of cash that you have and the amount that the bank says you have. The bank reconciliation will help gape issues such as the bounced cheques, overdraft, and even the overdrawn bank account issues!

- The bank reconciliation is essential in checking whether a customer cheque has bounced. It is also useful in ascertaining the trustworthiness of the cheques. The bank reconciliation is a key to fraud detection. It is therefore advisable to complete it regularly for earlier detection.

- Bank reconciliation is essential for auditors. The auditors will always examine the company’s ending bank reconciliation while doing their audit, as part of the auditor opinion disclosure requirements.

Pros and cons bank reconciliation statement:

The bank reconciliation statement has merits and demerits. Let’s consider the benefits and the demerits that are associated with the bank reconciliation statement.

Pros:

- Bank reconciliation makes the accounts to be accurate.

- It’s a perfect way to take care of the fraudulent issues

- Bank reconciliation take care of mistakes that might result from posting accounting information which is a crucial concept often introduced in a basic finance course for beginners

- It creates checks that clear the bank after being voided.

- It’s a pathway for accurate balances.

Cons:

Despite the many benefits of bank reconciliation, there are some demerits! The bank statement dates can be altered in a bank reconciliation statement to exclude or include some items. The instance may occur when your company’s customer requests the bank to change the closing date for your bank account hence leading to frauds. The bank reconciliation statement can also create checks that clear the bank from being voided. The bank reconciliation also risks having the missing transactions, especially when the operations are modified while the reconciliation is on.

Mastering Bank Reconciliation for SMEs:

Design a step-by-step guide that is very practical in nature to Small and Medium-sized Enterprises (SMEs) in Singapore. This material is to guide them through the whole bank reconciliation procedure including collection of documents (e.g., bank statements of local banks: DBS, UOB, OCBC and internal cash books), reconciliation of differences and corrections. Add typical business situations found in Singapore like direct deposits by a customer, bank fees and GIRO direct deposits. Such visual aids as a flowchart or a downloadable template of a bank reconciliation statement would make this guide extremely helpful and applicable to the local business community. This type of guide aligns well with practical finance courses for SMEs in Singapore and can be enhanced further through custom e-learning content development Singapore to ensure better engagement and accessibility.

How Smart Bank Reconciliation Drives Business Growth:

Change the tone in which there is only the stress on the very fact of compliance, but it is required to explain how carefully planned and prompt bank reconciliation procedure can turn out to be an effective business tool in Singapore. This content may cover how it aids in the optimization of cash flow in making better investment decisions, fraudulent activities that may affect profitability, better accuracy in budgeting of expansion plans, and streamlining the audit process should there be any requirement of funding or merger. Once making strategic benefits stand out and tying it to growth possibilities in the Singaporean market, you will be able to appeal to business owners and financial managers who are interested in using accounting practices as a form of a competitive advantage, especially those who pursue best finance and investment courses for professionals to enhance strategic decision-making for business.

Conclusion:

To conclude, a bank reconciliation statement is a useful tool that introduces transparency and efficiency in a business accounting system. It matches the book and the bank balances. Be aware of the shortcomings of this bank reconciliation statement. Understanding it will help deal with such issues when it arises.