What is the Return On Equity?

Return On Equity (ROE)

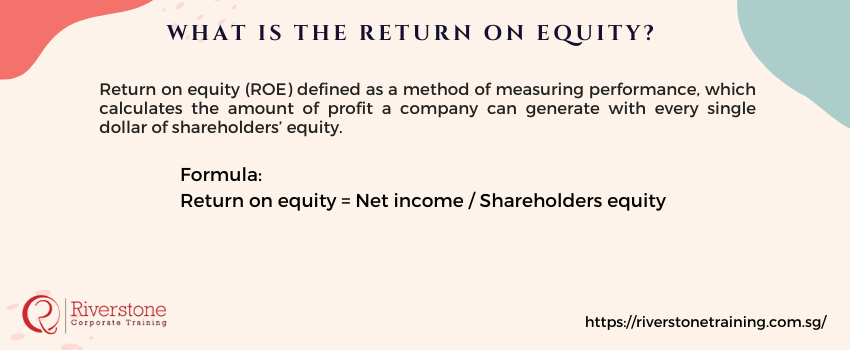

Defined as a method of measuring performance, which calculates the amount of profit a company can generate with every single dollar of shareholders’ equity. ROE can also be termed as “return on net worth.”

Let’s take a look at an example to clarify further.

Example of Return On Equity

Let us assume that a Company ABC generates a certain amount of profit in the current year and has a certain amount of shareholders’ equity. So, a return on equity shows how much profit is generated by the company “ABC” for each dollar of shareholders’ equity.

Return on equity has the formula to make it easy to calculate.

Formula of Return On Equity

Return on equity = Net income / Shareholders equity

It is measured by dividing net income by shareholders’ equity.

ROE is measured for common shareholders most of the time. Therefore, preferred dividends are excluded in this process of calculation because these profits are unavailable to common shareholders. Preferred dividends are drawn out of the net income for this calculation. Besides, average common shareholders’ equity is used usually so an average of both the beginning and ending equity is calculated.

Analysis

Return on equity measures the efficiency of a firm how it can use the money from shareholders to earn profit and enlarge the company. ROE is a profitability ratio from the investor’s perspective, not the company. Investors usually prefer to see a high return on equity ratio because this shows that the company is utilizing the funds of its investors effectively. Higher ratios are much better than lower ratios, but it must be compared to the ratios of the other companies in the industry. Investors and income of every sector differ.

ROE cannot be used to compare companies operating in different sectors. Many investors want to calculate the return on equity at the beginning of a period as well as at the end of a period to see the change impacted in return. In this way, progress can be traced to a specific company. It also helps to maintain a positive trend of earning for a company.

You can also read – What are Qualitative Aspects of Company Analysis