Case Study: CFO In-House Training Services Strengthening Strategic Financial Leadership and Executive Decision-Making

Background on Case Study CFO In-House

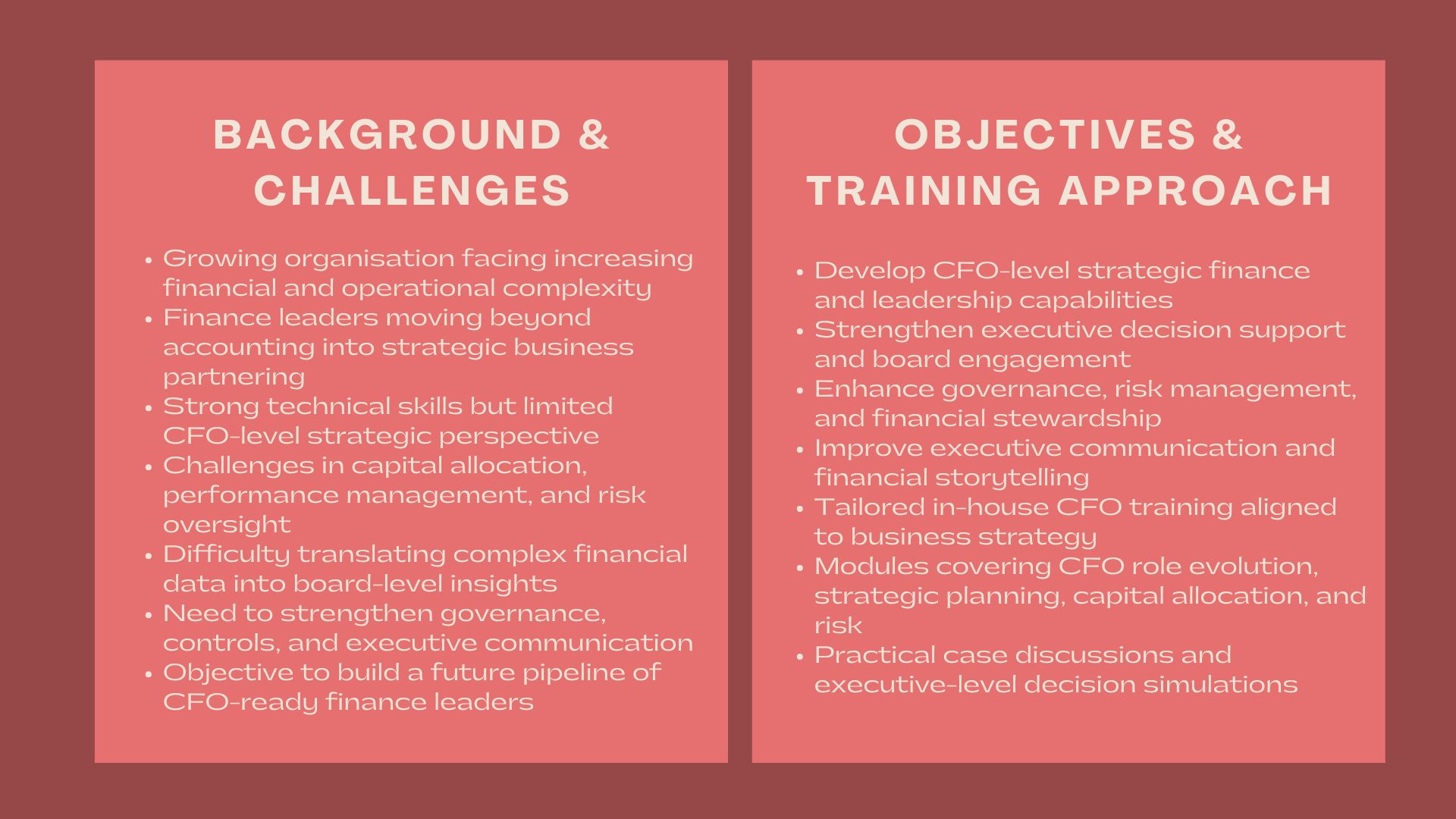

An organisation that was growing in a competitive and dynamic business environment was facing more financial complexity. Since the company became more active in its operations, opened new markets, and was engaged in more complex transactions, the finance function started to perform other functions that were not related to traditional accounting and reporting.

The senior finance leaders and the finance managers were becoming increasingly set to be strategic partners to the business, assist in executive decision making, financial risk management and report financial insights to the stakeholders. Though the organisation was well endowed with a good finance team, the management realised that the finance leaders needed more CFO-level viewpoints and values to address these emerging expectations.

In a bid to enhance leadership on strategic financial matters and align the top executives of the financial profession to broader responsibilities, the organisation sought our CFO In-House Training Services to develop and provide an executive-level training programme that is aligned with the business strategy and governance structure.

Issues and Challenges

The organisation encountered a number of issues that made it necessary to emphasize training on CFO.

Senior leadership positions shifted away from technical finance was one of the challenges. The finance leaders were technically skilled but still needed additional training in other areas such as strategic thinking, business partnering and business communication.

The other problem was dealing with the growth of financial complexity. The organisation had more developed financial planning, capital allocation processes, performance management and risk considerations, and the financial leaders of the organisation needed to incorporate financial information with more overall business goals.

Communication with the stakeholders was also problematic. The senior financial professionals were supposed to relay financial information to the boards, investors, and senior management but not all of them were assured of their ability to translate the complex financial information into the clear cut decision oriented information.

Other areas included governance and risk oversight. Due to the growth of financial responsibility, finance leaders required a more sophisticated level of learning about governance frameworks, internal control and risk management in CFO perspective.

Lastly, the organisation wanted to ensure that there was a robust pipeline of finance leadership continuity and future CFO and senior finance.

Objectives

The main goal of the engagement was to develop a stronger CFO-level competence by providing CFO-in-house training.

In particular, the organisation was going to:

- Acquire business partnering and strategic finance leadership skills.

- Improve decision support in finance on the executive and board level.

- Enhancements in governance, risk and control responsibilities.

- Enhance executive communication and financial narrations.

- Develop top finance executives into CFOs and leaders.

The training should have been realistic, executive oriented, and in line with the strategic priorities and the operating conditions within the organisation.

How We Helped

Our in-house training of a CFO was structured and collaborative, based on the size of the organisation, industry and overall organisational strategic goals.

We have started by analyzing the training needs of a CFO. We grouped with the senior management, and finance leaders to learn what is the strategic direction of the organisation, its financial problems, and the expectations of the finance leadership roles.

On the basis of this evaluation, we have created tailored training modules on important CFO-level material. These were the changing role of the CFO, strategic financial planning, capital allocation, performance management, cash flow and liquidity management, and financial risk management.

We also added those topics that are related to governance and leadership including board reporting, internal controls, compliance oversight, and stakeholder management. The respondents were led through the discussions of achieving financial stewardship and strategic growth programs by CFOs.

Much value was attached to practical application. The training activities included real-world case scenarios, discussions around executive level cases and decision making activities that emulated the complexity that the CFOs and senior finance leaders have to deal with.

The programme had executive communication and financial storytelling among its aspects. The participants had an exercise of making presentations of financial insight in a succinct and effective manner, to non-financial stakeholders and decision-makers.

The programme was oriented towards senior finance and the managers of finance as well as the high potential leaders who were to assume CFO duties. The level of content and discussions was arranged in a way that indicated the expectation of the executive.

Delivery of the training was flexible including face-to-face executive workshops and specialized virtual retreats as needed. Reflections and sharing of knowledge among the participants was encouraged through interactive discussions, peer learning and facilitated dialogue.

To aid the continuous development, we have given realistic structures, reference materials and executive tools, which the participants could apply in their jobs outside the training sessions.

During the engagement, we collaborated with the participants to solve difficulties, promote strategic thinking, and match learning to the leadership culture of the organisation.

Value Delivered

The case study illustrates that professional CFO In-House Training Services can enhance the strategic financial leadership and capability in making executive decisions.

The interaction through individualised and executive training has contributed to increasing the confidence and performance of the finance leaders, the quality of financial information submitted to the top management, and the effectiveness of governance and risk management.

The in-house training model that was used as a result of this engagement gave a scalable basis to leadership development, succession planning, and further development of the finance function as a strategic business partner.