Corporate Valuation Training in Manila – Riverstone Training

Manila, the busy centre of the Philippine economy, is a town where business dreams are high and there is a great investment potential. Whether it is startups or well-established conglomerates, the valuation of corporate assets is a daily, vital practice. Mergers, acquisitions, private equity deals, and IPOs are on the rise, and the capability to effectively and capably ascertain the actual worth of a business, is not merely a departmental expertise, but the crown jewel of financial triumph.

To ambitious professionals in Manila who are looking to grow beyond hard-working analysts and join the ranks of influential dealmakers, learning how to calculate the value of companies is the crucial next move in a competitive and dynamic market, which opens up higher earning potential and more strategic power.

Riverstone training, having its established experience in the new markets of Asia, provides the specialized training in Manila itself. We are structured to make you an analytic and cut-throat in the booming investment and corporate finance industry in the Philippines. As it will be seen in this article, gaining knowledge in our programs opens up career opportunities like none before. We will specifically discuss the all-inclusive curriculum, whom it targets, the practical benefits that would accrue and specifically the areas and firms that would be eagerly seeking this high-end knowledge in the Philippine market, and how the direct relevance of our training would solidify your future success.

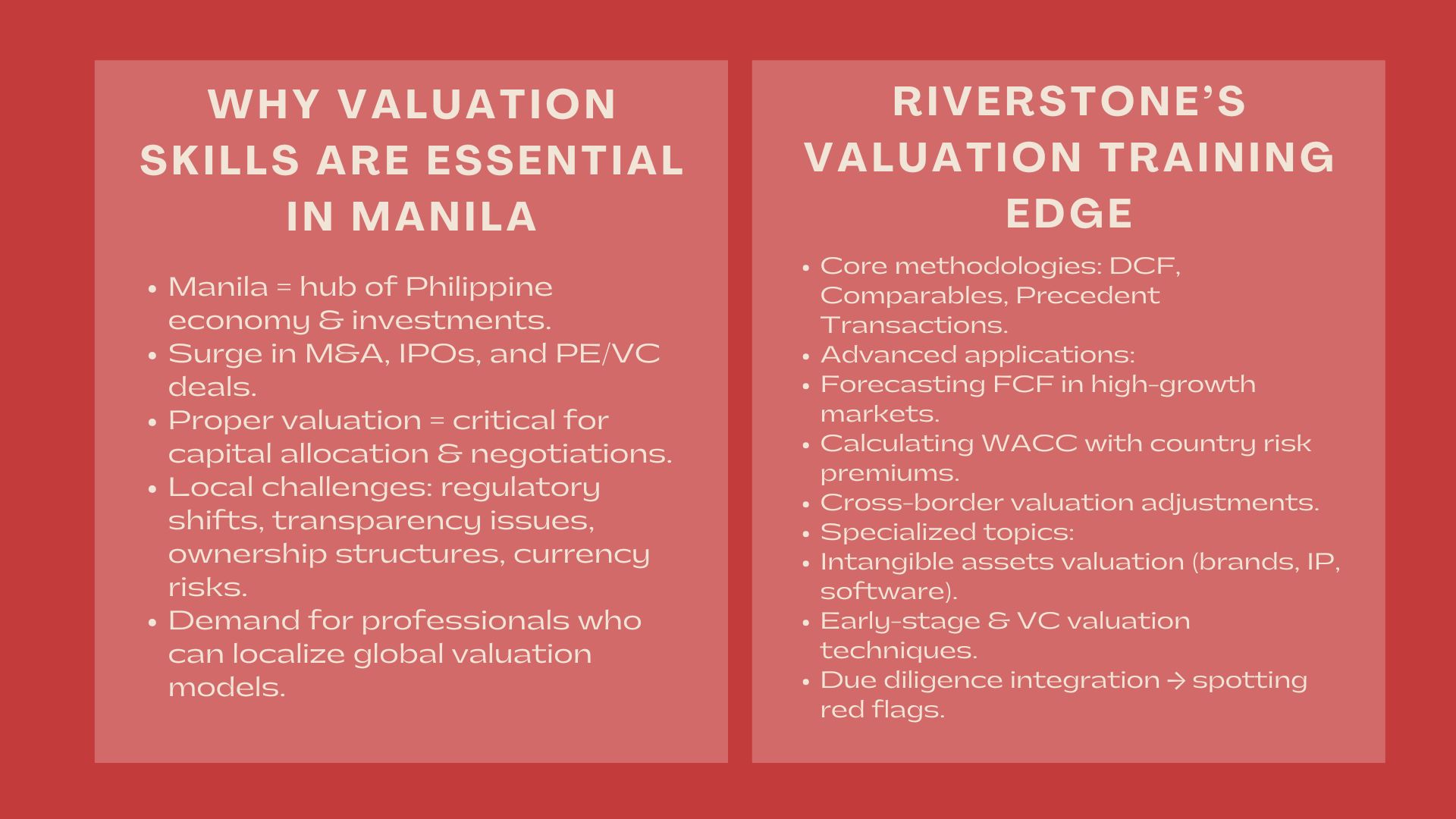

The Dynamic Market in Manila: Why Mastering Valuation is Non-Negotiable.

The Philippine economy is marked by high growth, presence of strong consumer base, and huge foreign investment. This distinct mixture makes the environment complex with traditional valuation models globally needing wide adaptation and localization. The skill of valuing a business properly is the key to making the sound capital allocation and negotiating deals within the market characterized by massive, powerful conglomerates and an expanding startup culture.

The subtleties of appreciating Philippine Businesses.

When valuing assets in the market in Manila, one has to deal with a number of specific issues: volatile regulatory regime, diverse degrees of transparency, and local market peculiarities associated with complicated ownership patterns. Philippines tends to offer lower liquidity conditions to private companies and to bear in mind special considerations to large-scale infrastructure projects and Public-Private Partnerships (PPPs). Such environment requires financial professionals who can develop sound financial models which properly explain such localized aspects, including currency risk and particular premiums of ownership control.

Local, training on a local basis as well as rigorous training, the financial professionals will misprice deals, and both local investors and foreign capital will end up on very expensive mistakes. Consequently, firms are aggressively seeking candidates who can demonstrate practical competence in these areas, making our Business valuation courses Manila an essential foundation for serious career advancement in the nation’s financial heart.

Elevating Careers: From Analysis to Strategic Influence

The art of valuation is the clear demarcation between unrefined financial information and practical company policy. Once they are capable of explaining and justifying a valuation opinion, professionals become key players in the decision-making models. They are the confidants that inform the C-suite executives on making purchasing, selling, investing, or restructuring decision on their assets. This competence is specialized and it puts individuals in higher levels in terms of technical support to corporate policy and investment strategy in the region.

An example would be an auditor skilled in valuation can move into Transaction Services and a Corporate Finance Analyst can speedily climb the ladder into Corporate Development Manager, with the direct responsibility of assessing merger and acquisition targets and board advice on capital structure. The most effective means of promoting oneself and entering the arena of positions that alter millions, perhaps billions of pesos of capital movement within the economy of Manila is to master the art of valuation.

Riverstone Edge: Sophisticated Technology to support High-Stakes Transactions.

Basic Methodologies Modified to the Philippine situation.

Our workshops go beyond introductory learning to master the three most important pillars of corporate valuation Discounted Cash Flow (DCF), Comparables, and Precedent Transactions and completely incorporate the issues of the Philippine market. The training will further train on such advanced subjects as Advanced Discounted Cash Flow (DCF) and will demand an intensive exploration of forecasting Free Cash Flow (FCF) in high-growth and emerging market businesses and precise calculation of the Terminal Value with sustainable long-term growth rates applicable to the macro-economic prospects in the Philippines.

Moreover, we cover the proper calculation of the Weighted Average Cost of Capital (WACC) complete with the important process of incorporating Country Risk Premiums and correcting the Philippines currency risk and market volatility-which is necessary to any cross-border transaction. This practical instruction is a hallmark of our Advanced corporate valuation Manila programs, giving participants the real-world competence that sets them apart in deal negotiation.

Specialized Scenarios and Due Diligence Mastery

These are the type of significantly specialized valuation problems that need professionals because of the dynamic Philippine economy, which is not generally addressed by general finance degrees. Through our training, we spend a lot of time on these value-added areas and it is the knowledge that will open the doors of an elite career. This incorporates the techniques of Valuing Intangible Assets, including brand names and software, which is essential to technology and media M&A in Manila booming digital economy where intellectual property is more important than the physical.

Our Valuation to Private Equity and Venture Capital also includes methods of valuing early-stage companies, such as the Venture Capital technique of valuation and application of scenario analysis to price equity rounds and estimate valuation of exit. The emphasis in Transaction Due Diligence is incorporated to directly apply the results of valuation to the due diligence process to assess financial red flags and to make certain that the valuation stands during the severe bargaining and legal scrutiny. This robust preparation is a key deliverable of our Professional valuation workshops Manila, ensuring graduates are transaction-ready from day one.

Leading Employers and High-Demand Roles

Philippine economy is dominated by major players, which need special valuation skills to deal with growth and risk, and provide the best compensation and best career advancement opportunities. M&A associates and research analysts are in high demand by Investment Banks and Securities Firms such as BDO Capital, Metrobank Capital and international banks, in their capital raising and transaction advisory services. Valuation analysts play significant roles in screening, pricing and monitoring investments that VC and PE funds have in Philippine firms.

Transaction Services Managers can be recruited to work with the Big Four Consulting Firms (PwC, KPMG, EY, and Deloitte) to handle sophisticated financial reporting and PPA valuation of its huge client base. Lastly, Major Conglomerates such as SM Investments and Ayala Corporation require Corporate Development Executives who will handle the internal M&A and strategic partnerships. Obtaining this new skill set, you not only enhance your technical skill but make a clear statement to your employers that you are ready to transition to strategic management.

Conclusion: Corporate Valuation Training in Manila

The career environment in Manila is also very dynamic and demanding, yet only those who have the specific skills needed can survive in this environment. The most important asset that a finance professional may have in a business world where capital decisions are daily decisions and M & A transactions are a common phenomenon is corporate valuation mastery. Riverstone Training is the ultimate, real-world route to gaining this expertise, as you will be able not only to have the correct pricing but also to reach high stakes deals.

The ultimate action to take now is to invest in progressive corporate valuation training in order to not only be a player, but also a leader in the future of the Philippine dynamic economy. Gain practical valuation expertise through our specialized Corporate Valuation Training in Ho Chi Minh City, tailored for finance professionals. Finance professionals seeking to strengthen their analytical and valuation skills can benefit from programs such as the Corporate Valuation Training in Phnom Penh.