The Anatomy of Weighted Average Cost.

In finance, the Weighted Average Cost method of inventory assessment customs a weighted average to regulate the volume that goes into inventory and COGS. This approach directly illustrates how inventory valuation affects financial reporting, as it influences both balance sheet valuations and income statement outcomes. The weighted average cost method divides the cost of products available for sale by the number of units available for sale. Mastering such methods is essential, especially for those enrolled in the best financial modeling course for investment banking professionals, where practical applications of inventory accounting are a key component of financial analysis.

Weighted Average Cost Formula

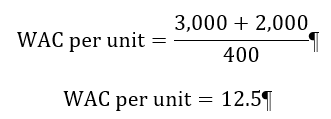

The formula for the weighted average cost is as follows:

The costs of goods available for sale are opening inventory value plus purchases, and units available for sale are the number of units a company can sell to its customer or clients.

Understanding Costs of Goods Available For Sale

The bundling of costs referred to as the cost of goods available for sale. The prices of products available for purchase are either allocated to COGS or ending inventory. Assigning the prices of products available for sale is mentioned as a cost flow statement.

There are numerous cost flow assumptions, such as:

Overview of Weighted Average cost

The weighted average method is castoff to allocate the average cost of production to a product. Weighted average costing is generally used in situations where:

- Inventory items are so intermixed that it is difficult to assign a specific cost to a separate unit.

- The accounting system is not adequately sophisticated to track FIFO or LIFO inventory layers, which can also complicate how to manage petty cash in Singapore businesses, where proper tracking and reconciliation are critical for financial accuracy.

- Inventory items are so commoditized that there is no other way to assign a cost to a separate unit.

The weighted average method divides the product’s value for sale by the number of units available for purchase, which yields the weighted average price per unit. In this calculation, the cost of products available for sale is the totality of launch inventory and total purchases. The then weighted-average figure to assign a value to both finish inventory and the cost of product sold.

Example of the WAC

At the starting of its financial period, Mr. Happy holds 300 units at the cost of $10 per unit. In the first quarter company made these entries:

- purchase of 100 units for $20 in January = $2,000

- purchase of 200 units at the cost of $15 in February = $3,000

Besides, the company made the following sales:

- January sales of 100 units

- March sales of 70 units

Under the inventory system, the company would determine the cost of products for sale and the units for sale at the end of the first quarter:

For the sale of 170 units on the quarterly sale period, allocate that $13.33 per unit sold.

The remaining stock would go to the ending inventory. So:

- 170 x 13.33 = $2,667 are the cost of goods sold

- 8000 – 2,667 = $5,733 is ending inventory

Under the continuous inventory system, we determine the cost before the sale of units.

Therefore, before the sale of 100 units in January, our average would be:

For 100 units sale in January, the costs would be :

- 100 x 12.5 = $1,250 in Cost of goods sold

- 5,000 – 1,250 = $ 3,750 remaining inventory

Before the sale of 70 units in February, the company average will be:

For 70 units sale in March, the costs assigned as follows:

- 70 x $13.5 = $945 in cost of goods sold

- $6,750 – $945 = $5,805 in ending inventory

WACC in Practice: Singaporean Case Studies for Investment Decisions:

Develop in-depth case studies illustrating how the Weighted Average Cost of Capital (WACC) is derived and used by the firms or investors in Singapore to value investment projects or M&A or estimate the value of the whole firm. The following case studies may examine and work out real (anonymized) situations of Singaporean business activity, where the shift in capital structure or the market environment would impact upon WACC, and consequently, on investment decisions. This content will be of practical use to students of finance and financial professionals in Singapore—particularly those enrolled in an accredited business valuation course for professionals in Singapore or a financial modeling course for investment banking professionals Singapore—since it will offer practical examples in respect to their local economic and financial environment.

Choosing Your Inventory Costing Method: WAC, FIFO, or LIFO for Singapore Businesses:

Write a comparative guide consolidated specifically to Singaporean businesses (and in particular SMEs) on the inventory valuation weighted average Cost (WAC) approach and by contrast the FIFO (First-in First-out) and LIFO (last-in First-out) method. This material is expected to explicitly summarize the strengths and weaknesses of both methods in different circumstances (i.e. increase/ decrease in costs, inflation) and how this decision on a method will affect financial statements, profitability, and taxation especially related to the accounting standards of Singapore (SFRS/IFRS). It will clarify the difference between LIFO and FIFO inventory methods Singapore companies must understand to align with compliance and tax reporting needs. It can also be made more valuable with an interactive element; e.g., a simple calculator that compares the COGS using each method and ending inventory using each method with hypothetical numbers—illustrating the inventory valuation methods used by businesses in Singapore to optimize cost tracking and financial clarity.

Conclusion

The Weighted Average Cost method of inventory assessment is the best tool to weighted average and determines COGS and inventory. It is helpful to understand the total yearly inventory and record precisely the amount of stock.