Case Study: Financial Services E-Learning Services Building Scalable Financial Expertise and Regulatory Readiness Through Digital Learning

Background on Case Study Financial Services E-Learning

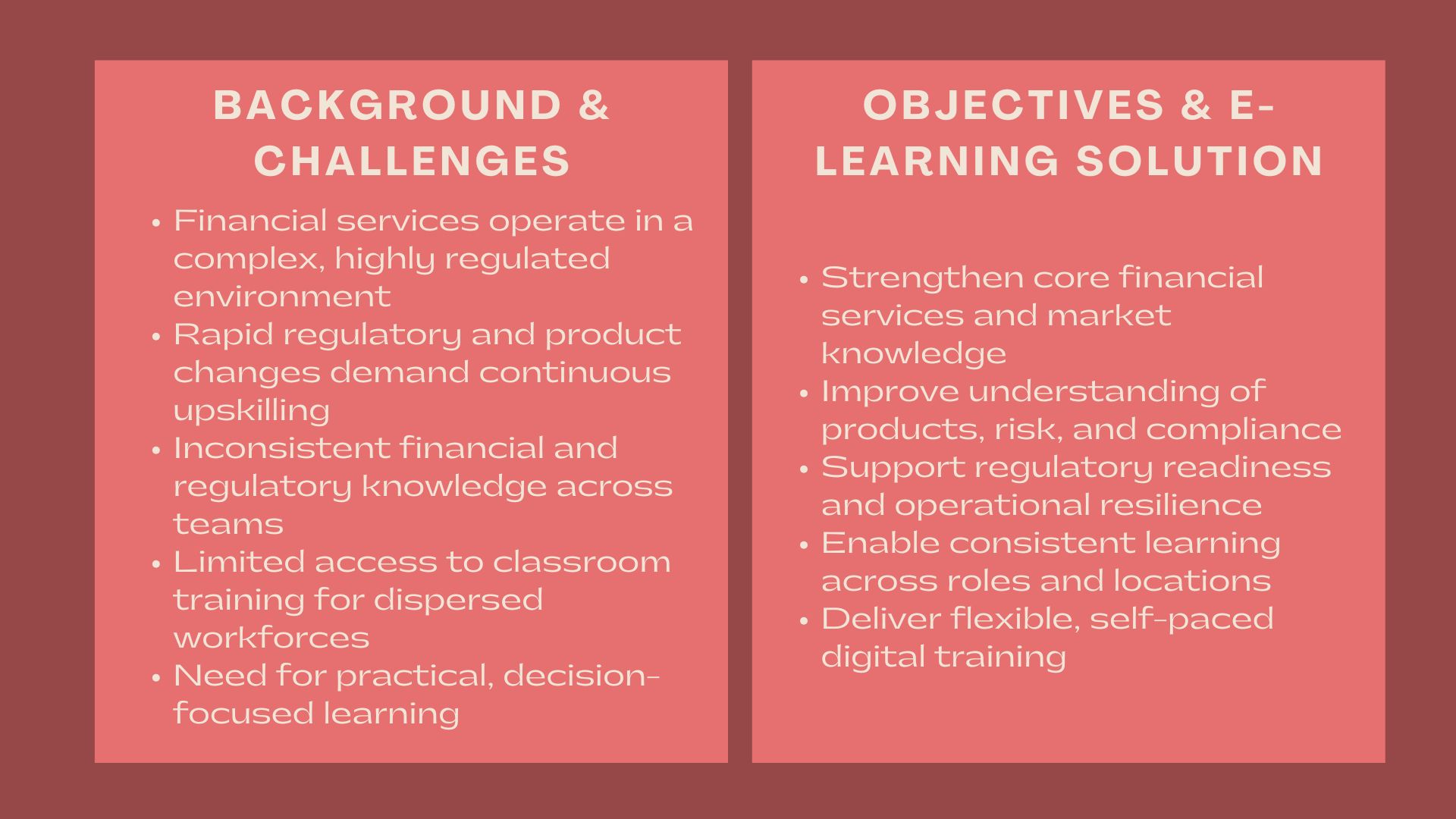

The financial services industry operates in a well regulated, rapidly changing and increasingly complex world. Regulatory change requires banks, asset managers, insurance companies, fintech firms, and advisory institutions to navigate change, accept financial risk, implement new technology, and more, and need to be operationally resilient.

Due to the changes in financial products and regulations, life long learning has become imperative. Nonetheless, the training model that has been used traditionally in the classroom setting fails to address the demands of contemporary financial institutions. The existence of large and diverse workforces, geographically dispersed teams and the intense operational schedules makes it hard to conduct regular, timely, and cost effective training.

In order to overcome these difficulties, a financial services organisation requested our firm to design and provide an all-inclusive Financial Services E-Learning programme. The aim was to establish a systematic, modular, and viable online learning platform that would empower fiscal expertise, regulatory sensitivity, and professional competence throughout the organisation.

Issues and Challenges

The organisation has a number of workforce development issues that prevailed in the financial services industry before the engagement.

Inequality in the level of knowledge among teams was one of the issues. The employees had diverse backgrounds in terms of their profession and understanding of financial products, concepts of risk and regulatory requirements was inconsistent.

A second issue was the complexity of regulations. The continuous changes in financial regulations meant that training was to be regularly updated, but the conventional training could not easily provide the knowledge dissemination in a timely and consistent manner.

The access to training was also an issue. Workers in various business units and destinations found it difficult to attend physical meetings without interfering with the services or the main operations.

Moreover, it was required to have more applied learning. The current programmes were more theory-based and lacked adequate relatability to financial concepts in the real life scenario of decision making and operations.

Objectives

The purpose of the engagement was to create a Financial Services E-Learning solution that would increase the capability of the workforce as well as assist in regulatory compliance and operational efficiency.

Key objectives included:

- Enhancing the core financial services in knowledge.

- Enhancing financial products and market knowledge.

- Increasing risk management and compliance awareness.

- Encouraging business unit and location-wide learning.

- Providing mobile, self-training, and customized training to a variety of jobs.

The programme had to accommodate not only the entry level professionals but also the experienced practitioners and ensure that there was consistency in the learning levels throughout the organisation.

How We Helped

We have developed a framework of Financial Services E-Learning programme which includes elementary financial concepts, regulatory aspects and practicable learning.

The programme started with an introduction to financial services basics that exposed the learners to financial markets and the institutions as well as the functions of the different players in the market. This guaranteed that there was a common understanding base among teams.

The next modules were on financial products and services such as lending, investment products, insurance solutions and capital market products. The learners were able to understand how these products are organized, priced and handled.

The programme had a major focus on risk management. The modules covered credit risk, market risk, operational risk, and liquidity risk, and how the risks originate and how they are both eliminated in the financial institutions.

The regulatory and compliance issues were integrated into the learning process. The learners were exposed to main principles of regulations and governance structures and standards of conduct regarding financial services activities.

In order to have practical relevance, real-world scenarios and case-based learning were included in the programme. Students implemented the concepts to the following scenarios: client onboarding, risk assessment, and the decision-making of regulations.

Learning Design and Delivery

With the Financial Services E-Learning programme, it was meant to be interactive, convenient and scalable.

The material was presented with minimal and focused training modules that include instructional videos, visual structures, and examples of practice. Technical financial terms were made easy using systematic explanations and practical examples.

The interactive activities like quizzes, scenario-based questions, and knowledge checks were useful in learning and in motivating the learners to participate.

The online training was self-paced and enabled the employees to train even during the course of their working duties without causing much disturbance and at the same time achieving uniform training contents.

The modular nature also enabled the organisation to respond efficiently to changes in regulations, market or business priorities by updating content.

Outcomes and Value Delivered

The case study shows the importance of Financial Services E-Learning Services in developing scalable, consistent and practical financial capability.

The employees gained better insights into financial products, markets and the expectations of the regulatory bodies which helped them to carry out their duties with more confidence and professionalism. Better risk and compliance awareness enhanced good governance and resiliency in operations.

The E-learning solution was cost effective and scalable in terms of training, as seen through an organisational perspective. Uniform learning criteria on all departments minimized the discrepancy of knowledge and enhanced a more integrated professional culture.

Another aspect of the programme was the foundation of continuous professional development and as such the organisation was able to adjust to the changes in regulation, market evolution and future growth.