Advanced Real Estate Investment Finance in Singapore – Riverstone Training

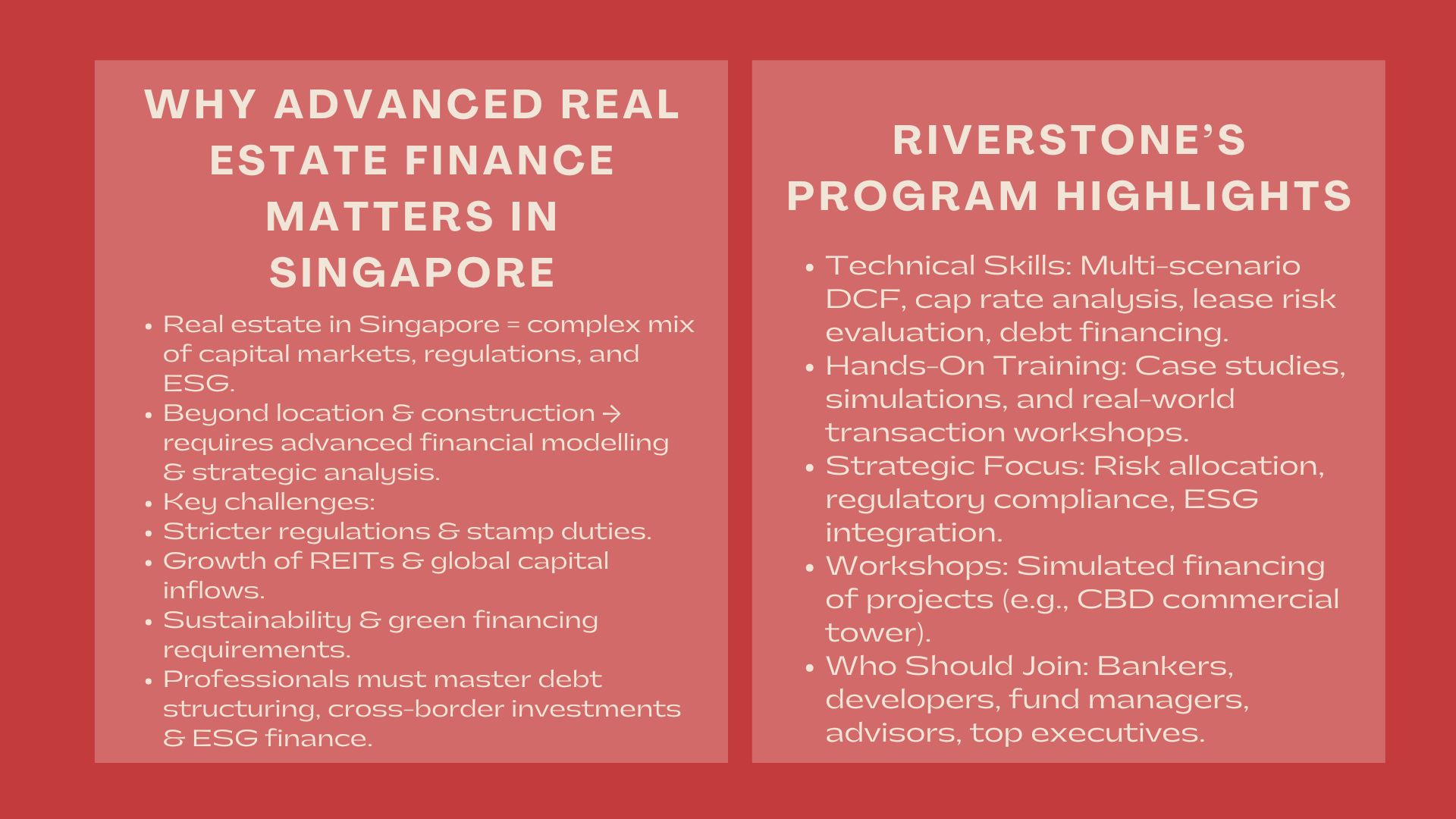

Real estate business in Singapore has become a complex system, where capital market, development policies and sustainability requirements intersect. Previously, property investments have been based mostly on location factors and the cost of construction, but nowadays, they have got sophisticated financing mechanisms and capital flows across the globe, as well as regulation of the activities. Finance professionals should have high-level skills to succeed in such an environment, both in technical valuation processes and in strategic thinking.

The Advanced Real Estate Investment Finance program at Riverstone Training is created in order to provide such a combination of knowledge to program attendees. The program equips managers, analysts and executives to be leaders in a competitive property market that is growing more and more competitive by concentrating on the newest finance instruments, market trends and analysis practices.

Why Real Estate Finance Demands Advanced Knowledge

The Singaporean market is getting more complex.

There is a lot of sophistication in Singapore real estate market, which is known to be stable in the world sphere though it is not obvious at the first sight. Developers and investors are now faced with:

- Stricter control systems, including reduction of cooling on residential properties.

- International funds, which require greater amounts of due diligence, are capital inflows.

- The development of REITs that contains billions of dollars in property related trusts

Sustainability reporting requires, which are in line with ESG requirements.

This implies that the professionals will not be able to depend on simple valuation skills anymore. They need to learn how to do financial modelling, debt structuring and cross-border investment assessment to be competitive.

Through Traditional Deals to Innovative Financing.

Previously, financing of property was highly concerned with bank loans and equity. Credit market in Singapore today consists of joint ventures, mezzanine financing, green bonds and property asset securitization. It takes special training to be able to do deals along this spectrum, which is precisely what the Riverstone program offers.

What Makes Riverstone’s Program Different

Advanced Technical Framework

Unlike generic finance courses, Riverstone’s real estate finance training Singapore is tailored to the realities of property investment. Participants learn how to:

- Construct real-estate multi-scenario DCF frameworks.

- Use cap rate analysis of commercial properties.

- Determine lease structures and tenant risk in determining income generating properties.

- Debt financing project schemes with syndicated loans and equity.

Hands-On Application

Interactive and case study sessions allow participants to be engaged in real-world problem-solving. As an example, they may be asked to assess a mixed use development in new interest rate regimes or test the stability of a REIT portfolio in a recession.

Strategic Focus

The program is not just about numbers as it puts emphasis on the wider decision making. Risk allocation in joint venture, regulatory compliance in Singapore and ESG integration are discussed to enable the participants to create a balanced view.

Who Should Join for Advanced Real Estate Investment Finance in Singapore?

The training of Riverstone has a broad professional group of readers:

- Bankers and lenders that considered property-secured loans.

- Project managers and developers as well as those who intend to enhance feasibility studies.

- Property Funds: Investment analysts and fund managers.

- Advisors and consultants in support of M&A or reorganization of real estate.

- Top management that is required to sign multimillion-dollar real estate deals.

The shared classroom also enables cross-industry networking where members get information on what others in other sectors of the property finance ecosystem are doing.

The Advantage of Specialized Workshops

For professionals aiming to go beyond theory, Riverstone conducts advanced real estate investment workshops Singapore. These exercises are simulated in a real transaction setup where the participants become financiers, developers, and regulators.

One of the exercises is to set up the financing of a hypothetical commercial tower in the CBD, whereby teams need to consider the options of financing, negotiate and offer their advice. This practical nature of the workshops is especially useful in the case of mid-career workers who are finding their way into senior leadership positions.

Regulatory and Policy Dimensions in Singapore

One of the unique aspects of the Singapore market is the influence of government policy. From stamp duties to development charges, regulations shape the financial feasibility of projects. Participants in Riverstone’s property investment courses for professionals Singapore gain a deep understanding of these factors, ensuring they can integrate policy considerations into investment models.

Moreover, the monetary authority of Singapore (MAS) and Urban Redevelopment Authority (URA) have norms that should be maneuvered by investors. When compliance hurdles are not blindsiding the professionals, such training that takes into consideration these realities is necessary.

Global Capital and Cross-Border Relevance

Singapore serves as a real estate investment centre in the Asian region. Most of the transactions are capital by foreign funds, pension funds, or sovereign wealth funds. Experts who have developed within the advanced real estate finance can re-tool to cross-border situations, where currency risk, international ownership regulations and international terms of financing are applied.

Riverstone puts much stress on this international aspect and so its courses are applicable not only in Singapore but also to individuals who may be looking at opportunities in Hong Kong or Sydney or the new markets in ASEAN.

Career Outcomes for Participants

Advanced training in finance of real estate can jumpstart career advancement in important respects.

- To Analysts: The training gives the technical advantage to become a senior associate or manager.

- In the case of Mid-Level Managers: It allows communicating more reasonably with lenders, investors, and boards.

- To the Executives: It instills the courage to negotiate major deals and manage billion-dollar deals.

This demand is evident in the job market of Singapore. Advanced modeling and financing skills are often listed as criteria in positions like the Real Estate Investment Manager, Project Finance Director and REIT Portfolio Analyst. The Riverstone trained professionals are distinguished in this competitive environment.

Building ESG and Sustainability into Real Estate Finance

One of the clear trends that are driving property finance is the incorporation of ESG concepts. Certifications of green building, energy efficiency goals and sustainable financing tools are now taking center stage in investment decisions.

Riverstone implements ESG-linked financing, instructing the participants in the way to:

- Green bond structure property projects.

- Evaluate the sustainability investment financial sustainability.

- Make financial models meet environmental performance standards.

This aspect of ESG is to make sure that not only are the participants technical but also prepared to work in the future.

Participant Benefits Beyond Technical Knowledge

The program by Riverstone has a value that reaches three dimensions:

- Strategic Thinking – The participants learn to think of deals as not only financial formulae but as strategic opportunities.

- Networking – Classrooms help unite professionals working in banks, developers, and consultancies, and create career-related relationships.

- Confidence- During practice, the confidence to address boards, negotiate with lenders and deal with investor expectations is gained.

Why Choose Riverstone?

There are some reasons why Riverstone is a reputable firm in professional finance education:

- Trainers who are well trained in the industry.

- One that has a constantly renewed curriculum that is in touch with the most current market practices.

- Limited size of a classroom to provide individual instruction.

- Established in the Singapore market in the finance and real estate sectors.

This translates to practical implications on the part of the participants; better employability, accelerated career progression and increased credibility in the boardroom.

Conclusion

Singapore property market is one of the most competitive and regulated property markets in the world. Success will not come with just a level superficially, it involves having mastered the many sophisticated concepts of finance, the strategizing, and the insights of global and local dynamics.

The real estate finance training Singapore, property investment courses in Singapore and advanced real estate investment workshops Singapore programs offered by Riverstone Training equip professionals with skills that will see them succeed in such environment. Through controlling technical modeling, regulatory awareness and sustainability oriented finance, participants are sure to be able to make informed choices in one of the most vibrant sectors of the economy.

To career savvy individuals, joining the real estate investment Finance course at Riverstone is not just a course undertaking, but a career long term leadership investment. Many also enhance their skills through practical finance courses for managers non finance Singapore to build a stronger foundation in decision-making.