Definition of The profitability index

The profitability index formula can be defined as follows:

The Profitability Index (PI) measures the ratio between the present value of cash flows and the original investment. It is a relationship between the costs and benefits of a project.

The Profitability index is a valuable tool for ranking stock projects and showing the value shaped per unit of the venture. The Profitability Index is also referred to as the Profit Investment Ratio (PIR) or the Value Investment Ratio (VIR) it plays a critical role in evaluating investment decisions—especially when applied in settings like an accredited venture capital course for business professionals. Understanding how to apply the Profitability Index within a broader performance assessment methodology for organizational improvement can greatly enhance strategic financial decision-making and capital allocation in both startup and corporate environments.

The following formula calculates the profitability index:

The profitability index customs the present value of future cash flows and the initial investment to represent the variables mentioned above. A profitability index is rationally the lowest adequate measure on the directory, as any value lower than that amount would designate that the project’s present value (PV) is less than the original investment. As the importance of the profitability index increases, so does the financial attraction of the proposed project. Using financial ratios to improve SME profitability in Singapore becomes essential in this context, as tools like the profitability index help small and medium enterprises make data-driven decisions and prioritize investments that generate the most value.

Understanding the Profitability Index

The profitability index is an evaluation technique applied to future capital expenditures. The method splits the projected capital inflow by the projected capital outflow to regulate the effectiveness of a project. When consuming the profitability index to compare the interest of projects, it’s vital to reflect on how the technique indifferences project size. Therefore, projects with more substantial cash inflows may lower productivity and profitability index calculations because their profit is not as high.

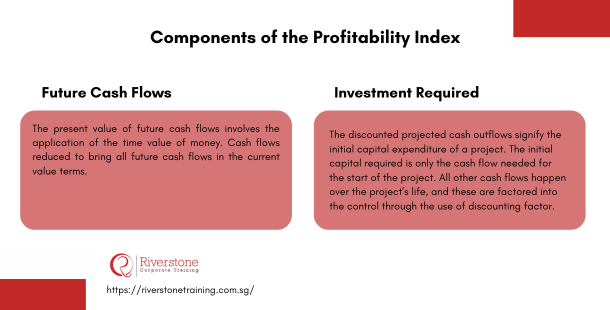

Components of the Profitability Index

- Future Cash Flows :

The present value of future cash flows involves the application of the time value of money. Cash flows reduced to bring all future cash flows in the current value terms.

- Investment Required :

The discounted projected cash outflows signify the initial capital expenditure of a project. The initial capital required is only the cash flow needed for the start of the project. All other cash flows happen over the project’s life, and these are factored into the control through the use of discounting factor.

Calculating and Interpreting the Profitability Index

Profitability index estimates greater than 1.0 indicate the future anticipated discounted cash inflows of the project are more significant than the expected discounted cash outflows. Profitability index less than 1.0 specify the cash inflows lower than cash outflows.

When evaluating the various exclusive projects, the profitability index ranked for all the projects, and projects having higher numbers should be chosen for investment.

Application of Profitability index analysis

The profitability index is principally used as a tool for project selection. The high value of the profitability index means a project is more attractive as compared to the low profitability index.

- For a single project, the profitability index value of 1 or higher is acceptable. If a project has a profitability index (> 1), a company should undertake the project. However, if a project has a profitability index (< 1), a company should reject the plan.

- The profitability index is a comparative measure of an investment’s value, while NPV is a more detailed and logical method.

- The profitability index method can be a valuable analysis to complement the NPV method when choosing a project. It may be beneficial to look at cash flow per dollar of investment using the profitability index when IRR is the same or similar.

Profitability Index Case Studies in Singapore:

Come up with elaborate case studies and examples of how one can tangibly use Profitability Index in assessing various investment projects in Singapore economy. These may involve such situations as a local start-up that may be evaluating a new product line, an old manufacturing company that is evaluating a new technology or an established property developer that may be evaluating various types of constructions. You can offer very practical and relevant insights to business owners in Singapore and financial professionals through provision of substantive examples, the calculation of PI, and how the results can be used to make very important investment decisions. These insights are typically covered in comprehensive finance and investment courses for professionals, or a certified investment course for career development, making them essential learning tools for effective decision-making.

Interactive Capital Budgeting Comparison Tool:

Design an interactive tool on the internet which has an online facility in which a user can enter the data relating to cash flow of a hypothetical project, and comes out with not only the Profitability Index but also the Net Present Value (NPV) as well as the Internal Rate of Return (IRR). The tool must then make a clear comparison of the results of these three capital budgeting methods in how best each of them can be applied, the strengths and the weaknesses of each method and how they can result in the different project decisions particularly in the presence of limited capital (capital rationing). This practical tool would open up advanced financial concepts and would put them to direct use in understanding investments in Singapore. It also complements hands-on learning available through a best short-term finance course with certificate, or a capital project financial modeling course with certification, making the subject matter both interactive and professionally relevant.