Best Financial Modeling Courses

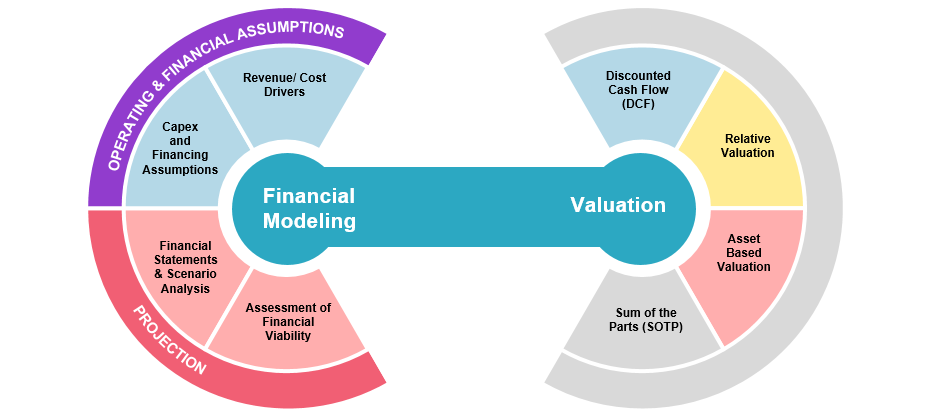

In today’s dynamic business world, financial modeling course is an essential skill for professionals in various fields, including finance, investment banking, corporate finance, and entrepreneurship. Accurate financial modeling courses are crucial for making informed decisions, securing investments, and driving business growth. Riverstone Training is your gateway to mastering financial modeling, providing top-notch courses designed to equip you with the knowledge and skills needed to excel in this critical domain.

Why Choose Riverstone Training?

- Expert Instructors: Riverstone Training’s financial modeling courses are led by industry experts with years of practical experience. Our instructors bring real-world insights into the classroom, ensuring that you receive hands-on, actionable knowledge that you can immediately apply in your career.

- Comprehensive Curriculum: Our courses cover a wide range of financial modeling topics, from the fundamentals to advanced techniques. Whether you’re new to financial modeling course or looking to refine your skills, we have a course tailored to your needs.

- Hands-On Learning: We believe that the best way to learn financial modeling courses is by doing it. That’s why our courses emphasize practical exercises and real-life case studies. You’ll build models, analyze data, and make financial projections, gaining confidence in your abilities along the way.

- Flexible Learning Options: Riverstone Training offers flexible learning options to accommodate your busy schedule. Choose from in-person classes, live online sessions, or on-demand courses that you can access at your convenience. Our goal is to make high-quality financial modeling education accessible to everyone.

- Industry Recognition: Our courses are designed to prepare you for the real-world challenges of financial modeling courses. By completing our programs, you’ll be better prepared to excel in interviews, secure job opportunities, or advance in your current career.

Financial modeling is a crucial skill for professionals in finance, accounting, investment banking, and many other industries. It involves creating mathematical representations of financial data to make informed decisions and projections. In Singapore, Riverstonetraining has emerged as a leading provider of financial modelling courses with a strong focus on Excel training. In this article, we will explore the 15 best financial modeling courses in Singapore offered by Riverstonetraining. These courses cater to individuals seeking to enhance their financial modeling skills, whether they are beginners or experienced professionals.

1. Financial Modeling Fundamentals

– Overview: This foundational course covers essential concepts and techniques required for financial modeling. Participants will learn how to build comprehensive financial models using Excel.

– Who Should Attend: Beginners and professionals looking to strengthen their financial modeling skills.

2. Advanced Financial Modeling

– Overview: Dive deeper into financial modeling with a focus on complex scenarios, valuation, and sensitivity analysis. This course builds on the fundamentals.

– Who Should Attend: Intermediate learners seeking to refine their financial modeling expertise.

3. Real Estate Financial Modeling

– Overview: Explore the intricacies of financial modeling in the real estate sector. Learn how to analyze real estate investments and create detailed property models.

– Who Should Attend: Real estate professionals and investors interested in property analysis.

4. Excel for Finance Professionals

– Overview: Develop strong Excel skills tailored to the finance industry. Learn to use advanced functions and tools to streamline financial analysis and reporting.

– Who Should Attend: Finance professionals aiming to master Excel for financial tasks.

5. Business Valuation Modeling

– Overview: Learn the art of valuing businesses using various methods, including discounted cash flow (DCF) analysis and comparable company analysis (CCA).

– Who Should Attend: Professionals involved in mergers and acquisitions, corporate finance, or investment analysis, who are seeking the best business valuation course in Singapore to enhance their expertise and career prospects.

6. Financial Modeling for Startups

– Overview: Understand the unique financial modeling needs of startups. Create models for business planning, fundraising, and investor communication.

– Who Should Attend: Entrepreneurs, startup founders, and investors interested in startup finance.

7. Project Finance Modeling

– Overview: Focus on financial modeling for large infrastructure and energy projects. Learn to evaluate project feasibility and financing structures. Ideal for professionals looking for the best project finance modeling course in Singapore, it equips you with the technical skills needed to build robust financial models for complex projects.

– Who Should Attend: Project finance professionals and infrastructure developers.

8. Mergers and Acquisitions (M&A) Modeling

– Overview: Master the intricacies of modeling M&A transactions, including accretion/dilution analysis, purchase price allocation, and synergy analysis.

– Who Should Attend: Investment bankers, corporate development professionals, and consultants.

9. Credit Risk Modeling

– Overview: Explore credit risk modeling techniques used in banking and finance. Learn to assess creditworthiness and create credit scoring models.

– Who Should Attend: Risk analysts, credit officers, and banking professionals.

10. Equity Research Modeling

– Overview: Dive into the world of equity research with a focus on financial modeling for stock valuation and investment recommendations.

– Who Should Attend: Equity analysts and investors.

11. Financial Modeling for Non-Finance Professionals

– Overview: Tailored for individuals from non-finance backgrounds, this course provides an introduction to financial modeling concepts and practical applications. As part of a comprehensive finance for non finance professionals course Singapore, it equips participants with the foundational skills to interpret financial data and build basic models with confidence.

– Who Should Attend: Professionals from various fields looking to understand finance better.

12. Credit Analysis and Modeling

– Overview: Develop expertise in credit analysis and modeling, including assessing credit risk, analyzing financial statements, and creating credit reports.

– Who Should Attend: Credit analysts and risk managers.

13. Corporate Budgeting and Forecasting

– Overview: Learn to create dynamic budgets and forecasts for businesses, improving financial planning and decision-making processes.

– Who Should Attend: Finance and accounting professionals involved in budgeting and forecasting.

14. Financial Modeling for Investment Banking

– Overview: Focus on the specific financial modeling skills required in investment banking, including valuation, M&A, and IPO modeling.

– Who Should Attend: Aspiring investment bankers and finance professionals.

15. Excel VBA for Financial Modeling

– Overview: Enhance your financial modeling capabilities by mastering Excel VBA (Visual Basic for Applications) for automation and advanced data analysis.

– Who Should Attend: Excel enthusiasts and professionals seeking to automate financial processes.

Conclusion:

Investing in your financial modeling skills is essential for career growth and informed decision-making. Riverstonetraining offers a diverse range of courses that cater to both beginners and experienced professionals in Singapore. Whether you’re in finance, real estate, startups, or any other industry, these courses can equip you with the knowledge and skills needed to excel in your field. Explore Riverstonetraining’s offerings to embark on your journey to becoming a financial modeling expert with a strong foundation in Excel.