Financial Modeling and Valuation Training for Private Equity Teams

Learn the Comprehensive Financial Modeling for PE Professionals

The skill to digest financial information precisely is required in the context of the fast world of private equity where an investment decision can make or break a million-dollar deal. The professionals of the business associated with the field of the private equity should be capable of constructing sound financial models, interpreting the main valuation metrics, and predicting returns in this or that situation. This knowledge enables them to spot investment opportunities that are profitable and have a good management of the performance of the portfolios.

Nevertheless, it takes more than theoretical training to master financial modeling and valuation; it requires practical, hands-on training that is based on the hands-on deal experience. Accompanying the growth of the number of private equity firms in the region, cities such as Phnom Penh are emerging as new financial education centres, with some of these centres providing specific financial education programs that specialize in investment professionals.

This paper discusses the ways in which financial modeling and valuation training programs energize the private equity teams to increase their analytical competence, better in deal structuring and generating long term value to the investors.

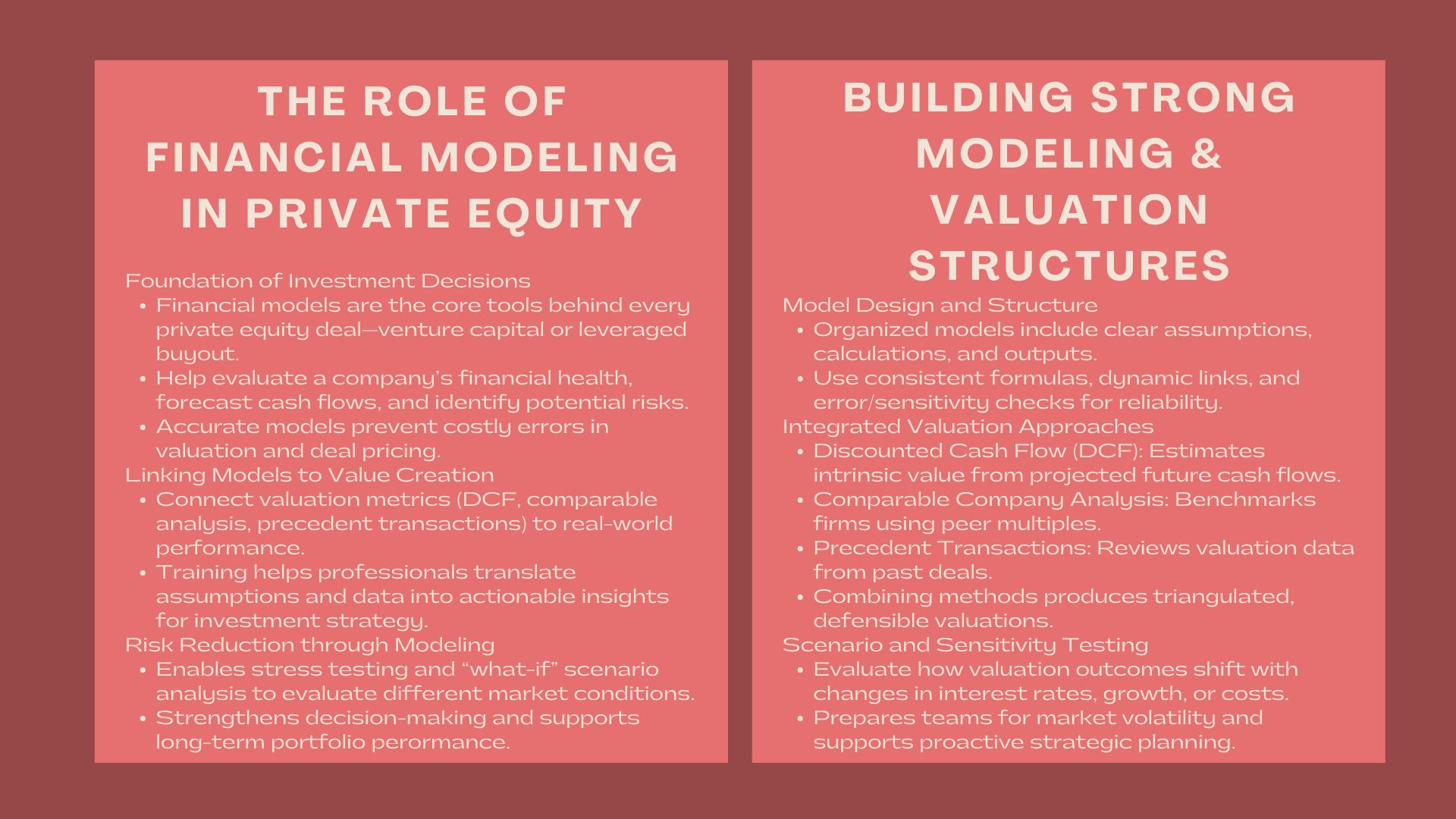

The relevance of Financial Modeling in Private Equity.

The Underpinning of Investment Decision-Making.

All types of financial models are the starting point of every single private equity transaction, whether it is venture capital investment or leveraged buyout. Through these models, analysts can be in a position to assess financial health of target companies, forecast on future cash flows and the likely risks. The model should be well constructed and formed as the basis of valuation, negotiation and strategic decision making.

Devoid of a systematic method of modelling, investors will run a risk of overpricing returns, or underpricing liabilities- errors, which can be quite costly in a high-stakes setting.

Connecting Valuation with Real-World Performance.

In the context of the private equity, valuation is not merely about the application of formula. It entails the knowledge of the effects of market assumptions concerning the state of the market, rates of growth, and the capital structure on actual investment performance. Through programs like the private equity valuation modeling course Phnom Penh, professionals learn to connect theoretical valuation methods—such as discounted cash flow (DCF) analysis, comparable company analysis, and precedent transactions—to practical deal execution.

With the technical and strategic skills involved in valuation, the professionals in the private equity can make well-informed decisions, which would be in line with the expectations of investors and the realities of the market.

The Investment Risk is what can be reduced by the means of better analysis.

An in-depth financial model enables investors to conduct stress tests and evaluate the response of results to different market environments. This is to reveal the possible risks prior to the capital investment. Through the analysis of the possibilities of what-if scenarios, teams are able to plan contingency solutions and have an optimal exit strategy.

Good modeling and valuation skills are not only useful in making good deals but also in tracking them after investment to make sure that value is created on a long term basis to all the portfolios.

Developing a Strong Financial Modeling Structure.

Structuring the Model

The technical nature of the financial model and its intuitive structure must be in place. It ought to explicitly show assumptions, computation, and results in a way that facilitates reading of results by the decision-makers. The best practices that professional training focuses on include:

- Developing more dynamic structures that have a defined input and output.

- Making the use of consistent formulas and logical cell references.

- Using accuracy controls such as error checks and scenario control.

This methodological technique makes it transparent and reliable- which is vital given that often several stakeholders use the model to make strategic decisions.

The combination of Valuation Techniques.

The framework of any financial model is valuation. Under more advanced training programs, all participants investigate several approaches to valuation, such as:

- Discounted Cash Flow (DCF): The projection of intrinsic value given discounted cash flows and valuation of expected cash flows of a firm.

- Similar Company Analysis: The benchmarking of target companies against publicly traded companies.

- Precedent Transaction Analysis: The evaluation of valuation multiples based on deals close in historical time.

With a blend of these techniques, the analysts will be able to triangulate better value and provide justifications to partners and investors around the investment decision.

Scenario and Sensitivity Analysis.

Markets are not often predicted to behave in a certain way. Scenario and sensitivity analysis are useful to investment teams in the sense that they can see the effects that alterations in assumptions (like interest rates, sales growth, or operating costs) will have on the valuation results.

Training modules are designed so that students learn to construct dynamic models to run through dozens of scenarios concurrently to enable teams react to changes in the market in the shortest time possible and reduce downside risk.

Tailoring Training for Private Equity Teams

Customized Learning for Deal Professionals

Private equity professionals often come from diverse backgrounds—finance, consulting, law, or operations. An effective program must cater to varying levels of experience while focusing on deal-specific applications. The advanced financial modeling training Phnom Penh program, for instance, emphasizes hands-on exercises tailored to investment professionals who work directly with acquisitions, portfolio management, or fundraising.

The participants get to learn through practical case studies how to model real transactions, be it a startup valuation, leveraged buyout, and improve both technical and commercial judgment.

The use of Real Case Studies.

Probably one of the most useful elements of professional training is exposure to real world examples. Live or historical deal case studies enable the participants to use valuation frameworks to real-life business scenarios. They drill in red flags identification, capital structuring and performance driver evaluation that drive enterprise value.

This practical learning fills the gap between theory and practice so that participants can recreate deal situations in which they could be involved in their respective organizations.

Collaborative Decision-Making Team-Based Learning.

The nature of private equity is collaborative; investment decisions are taken based on many points of view of analysts, managers, and partners. This environment is simulated through team-based exercises that prompt the participants to argue on assumptions, justify valuations, and agree on the final recommendations.

Not only does such interactive learning develop technical skills, but it also develops communication, negotiation, and critical thinking skills-qualities that are required in leadership in the investment management profession.

The important advantages to Financial Modeling and Valuation Training.

Better Deal Structuring and Negotiation.

When professionals are in a position to analyze and interpret financial data confidently, they are in a better position to negotiate terms of deals, leverage structures and the opportunities of value creation.

Improved Portfolio Management.

Proper financial models aid in the post-acquisition monitoring so that the investors can be able to monitor key performance indicators (KPIs) and see the assets that are not performing adequately at the early stages. This is a proactive strategy that assists companies to change strategies before things get out of hand.

Greater Confidence of Investors.

It is transparency and analytical rigor that the investors appreciate. Professionals that are well trained and able to provide data-driven insights are inspiring and lead to building stronger relationships between the private equity firms and the limited partners (LPs).

Competitive Career Advantage.

Professionalism in fiscal modeling and valuation can differentiate individuals in an industry that is competitive. The employers want to find the candidates who are able to merge quantitative analysis with strategic vision-skills which the training programs are developed to develop.

Best Practices of Implementation.

Integrative Theory and Practice.

The programs ought to strike balance between theoretical knowledge and learning based on application utilization. The participants create models on their own, analyze financial statements, and simulate investment situations with the help of Excel.

Embrace new Technology and Applications.

With the development of the field of financial technology, there is also an exposure to expected advanced analytics, automation tools, and visualization software, which are also included in training programs. The process of learning how to combine these tools will result in efficiency and accuracy in modeling.

Promote Ongoing Improvement.

Finance is a dynamic field. A series of refresher workshops, mentorship and availability of new templates will keep the professionals abreast with the market norms and best practices.

Creating Analytical Perfection in Developing Markets.

Due to the development of the financial and investment markets in Cambodia, the need of skilled professionals with high analytical and valuation skills is on the rise. This skills gap is being bridged by regional programs that integrate the best practices in the world with local market understanding.

Financial modeling and valuation training does not only benefit the personal abilities, but also involves development of the entire private equity ecosystem of Phnom Penh and the adjacent markets. The institutions which invest in sustained learning will be in a better place to determine expansion opportunities and risks in a highly dynamic investment environment.

Conclusion

When it comes to the world of the private equity, success is determined by the ability to make informed and data-driven decisions on investment. Financial modelling and valuation training provides professionals with the tools of analysis and the practical knowledge required in the evaluation of opportunities, risk management, as well as creating sustainable value.

With the technical side combined with the strategic side, the private equity teams would be able to turn raw data into a form of actionable intelligence-solving the complex financial issues into quantifiable results. To those professionals who want to raise their knowledge level and have a competitive advantage, organized courses in Phnom Penh can be considered an invaluable way to excellence in investment analysis and decision-making.