Case Study: E-Learning Services on Coal Project Financial Modeling Strengthening Energy Project Finance and Risk Assessment Capability

Background on Case Study Coal Project Financial Modeling

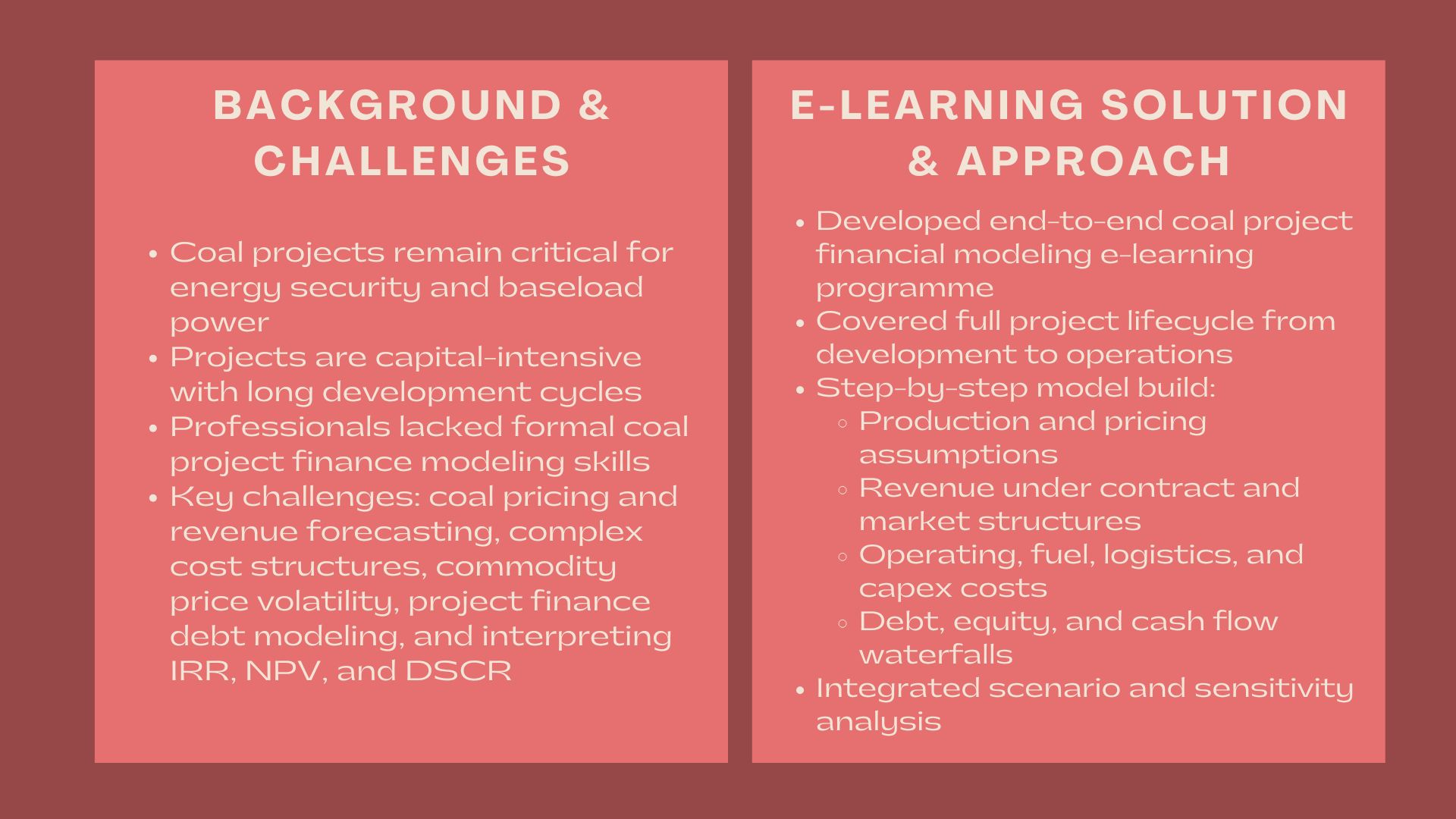

The use of coal-based power and mining projects does not leave the energy mix in a number of markets since energy security, baseload power supply, and the existing infrastructure still play a crucial role in a number of markets. Financial models that are robust are essential to investors, project developers, lenders, and stakeholders of the public sector in order to determine the feasibility, bankability, and the long term performance of coal projects.

Coal projects are capital intensive, take long development time and possess intricate cost systems, regulatory factors and face the risk of commodity price fluctuations. Most of the professionals dealing with coal projects have a considerable level of technical or operational knowledge but few have been trained in coal project financial modelling and more so within a formal project finance framework.

Our company was contracted to develop and implement an integrated e-learning programme on Coal Project Financial Modeling to overcome this gap in capabilities as a means of equipping the participants with pragmatic and operative modeling skills through an expansive and scalable e-learning system.

Issues and Challenges

There were a number of challenges faced by the participants that indicated that specialised coal project financial modelling training was necessary.

Among the challenges was to know about coal project revenue drivers. Forecasts of revenues relied on coal pricing mechanism, power purchase agreement, off-take contract and volume assumptions and these had to be well incorporated into financial models.

A second issue was that of cost complexity. Coal projects are associated with large capital outlay, operating costs, fuel acquisition costs, logistics, and long related maintenance needs, which continue to change through the project life cycle.

There were other challenges of commodity price volatility. Students had difficulty in modeling market fluctuations in prices, stress-test assumptions, and how to evaluate downside risks in various market conditions.

There were also hitches in financing structures. Project finance or structured financing arrangements are used to finance many coal projects and the debt service, covenant, and cash flow waterfalls should be modelled accurately.

Lastly, the participants did not feel confident in understanding major financial indicators like IRR, NPV, DSCR, and break-even prices as they relate to coal projects and present the findings to stakeholders.

Objectives

The main aim of the engagement was to create an e-learning programme on Coal Project Financial Modeling which would be able to develop project finance and analytical capability in a structured and scalable fashion.

Key objectives included:

- Financial modelling of end to end coal projects.

- The explanation of coal-related revenue and cost structures.

- Enhancing knowledge on project financing and project investments.

- Improving the skill in scenario and sensitivity analysis.

- Offering learning opportunities that are self-paced and flexible, and can cut across geographies.

The programme had to be neither too technical nor too vague or abstract.

How We Helped

To come up with a complete coal project financial modeling e-learning program, we used an instructional design approach that was structured.

The interaction has started with curriculum design. We charted a learning cycle of a complete project lifecycle of a coal project, including development and construction process, and operating and long-term cash flow analysis.

The initial modules helped the learners get familiar with the basics of coal projects, such as the type of project, value chains, regulations, and the essential risk factors such as price, and cost of running the project.

The essence of the programme was to construct a financial model of a coal project in phases. The learners were oriented in:

- The organisation of model timelines and project phases.

- The prediction of coal production or amount of power production.

- Pricing or contract modeling Revenue modeling: under varying pricing or contract structures.

- Making estimates of operating cost, fuel cost and logistics cost.

- The inclusion of capital expenditure and maintenance expenses.

This was followed by the introduction of project finance principles. Equity and debt structures, terms of financing, and waterfalls of cash flows that are usually employed in coal projects were explained in modules.

The programme was based on scenario as well as sensitivity analysis. Students discussed the effect of coal price changes, changes in the production volume, operating costs and financing conditions on the returns and financial stability of the projects.

The main characteristic of the e-learning experience was practical modeling exercises. Students were subjected to guided walkthroughs involving real-life situations of coal projects and modified assumptions to see the financial effects.

The interpretation and communication were also stressed in the programme. The learners were also taught to be able to analyse financial outputs and be able to present the knowledge in a way that is clear to investors, lenders and internal decision-makers.

Everything was presented in an easy-to-use e-learning platform with the help of instructional videos, downloadable templates, and reference materials.

Learning Design and Delivery

The e-learning programme was a mechanism to suit learners of engineering, finance, investment and policy backgrounds.

The material has been presented in the form of modular lessons which present conceptual explanations, visual frameworks and modeling exercises. Self-assessment and practice of knowledge did not overload the participants but strengthened the knowledge.

The online model enabled the learners to juggle between training and project work and this made the programme applicable to individual workers and corporate energy teams.

The online delivery system guaranteed uniform training quality, scalability and location access.

Value Delivered

In this case study, it is indicated that the E-Learning Services on Coal Project Financial Modeling can enhance the capacity of energy project finance and enhance financial decision-making.

Through the integration of systematic teaching and specific project-based modeling activities, the programme helped the learners to learn more about the economics of coal projects, evaluation of financial risks, and facilitating informed investment and financing choices.

The scalable e-learning system offers a long term solution to sustained capability building as energy markets, regulatory conditions and funding models keep changing.